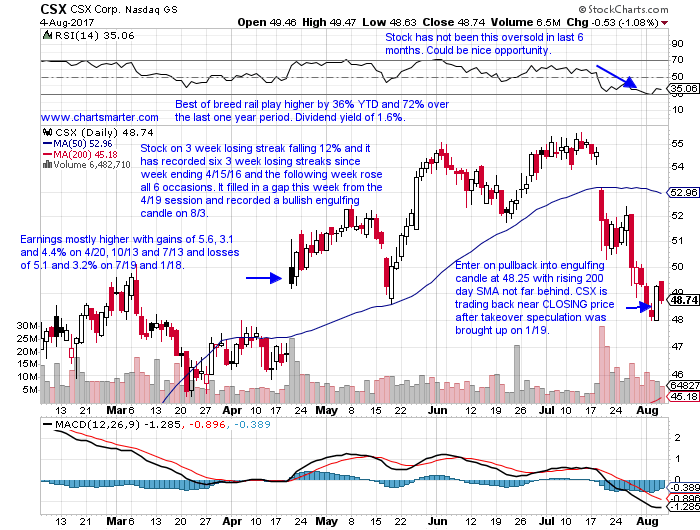

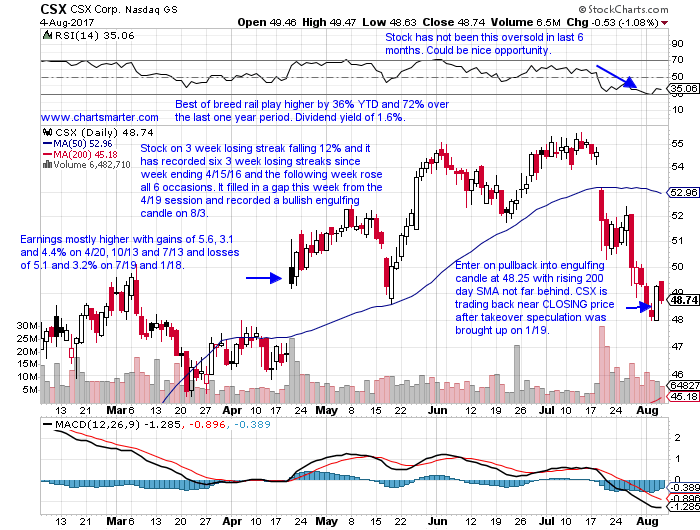

Markets remained in the red all day Wednesday but managed to finish off lows with the S&P 500 ending fractionally lower. The Nasdaq was the weakest of the big three but it did cut a morning deficit of .9% into .3% by 4pm. As we spoke of the Dow's respectable 10 session winning streak coming to a halt Tuesday, the Russell 2000 has done nearly the opposite FALLING 7 of the last 10 days and it is looking at a potential 3 week losing streak after consecutive bearish shooting weekly candle stars ending 7/21-28. Today the index was a clear laggard falling .9% and slicing the round 1400 number which was ample support in June and July and it is decisively below its 50 day SMA but is still making higher highs and lows. Looking at individual groups today winners were hard to come by with the defensive staples group outperforming and utilities and cyclicals lagging. The energy sector seems to be garnering a lot of attention and I do not have much of an opinion on the direction of the space as the XLE still is battling within a strong ongoing downtrend 17% off most recent 52 week highs. There does seem to be a slew of things working against it with the emergence of the solar group as millennials demand alternative sources, companies such as Volvo declaring an all electric fleet in the years ahead and word came out recently the energy legend Andy Hall closing his flag ship hedge fund due to severe negative returns. These events are washing out sentiment in a contrarian fashion for the bulls, but for me as a technician I would need to see some PRICE confirmation before I became an interested long participant. Some transports are perking back up as they have been soft recently and below is the chart of CSX, it was higher by 1.1% on a somewhat soft tape and completed a three white soldiers pattern, and how it appeared in our Monday Game Plan. To be clear the trigger was NOT hit but could be a bright spot for the overall market if these space and get its act together and continue its climb upward. The bulls are singing the old song The Little Engine, I think I can, I think I can, I think I can.

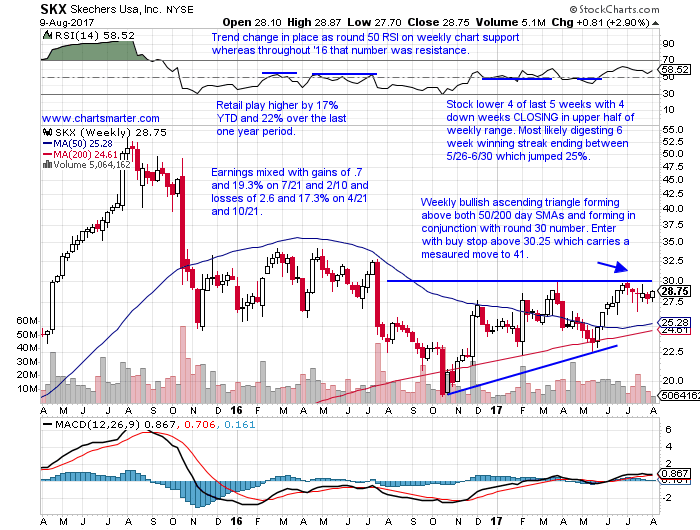

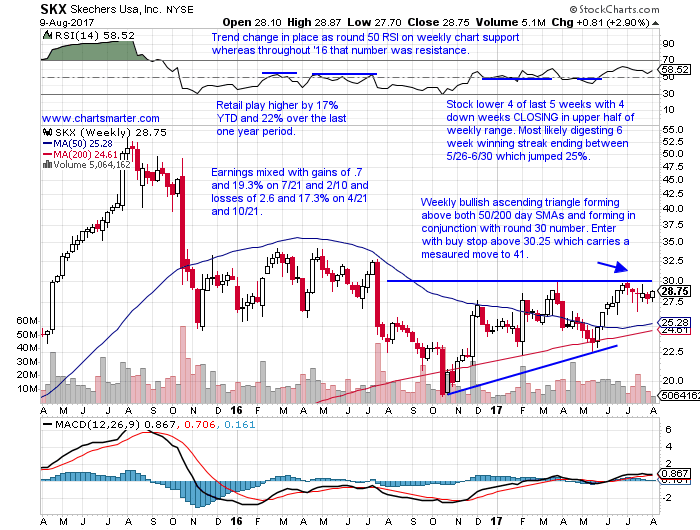

Stocks that can be bought as they take out weekly bullish ascending triangles are SKX. SKX is a retail play higher by 17% YTD and 22% over the last one year period. Earnings have been mixed with gains of .7 and 19.3% on 7/21 and 2/10 and losses of 2.6 and 17.3% on 4/21 and 10/21. The stock is lower 4 of last 5 weeks with 4 down weeks CLOSING in upper half of weekly range and is most likely digesting 6 week winning streak ending between 5/26-6/30 which jumped 25% (stock may be getting its mojo back as it recorded a 25 of 29 week winning streak ending between 1/23/15-8/7/15). Enter SKX with a buy stop above 30.25 which carries a measured move to 41 (weeks ending 3/31 and 7/7 were stopped cold at 30 figure).

Trigger SKX 30.25. Stop 27.40.

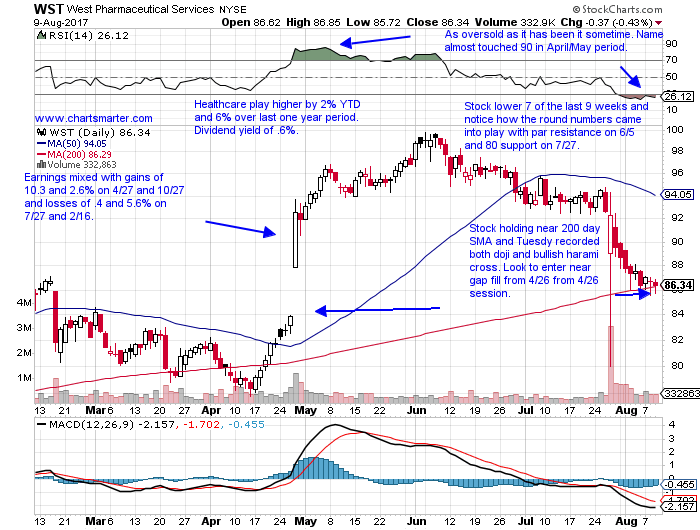

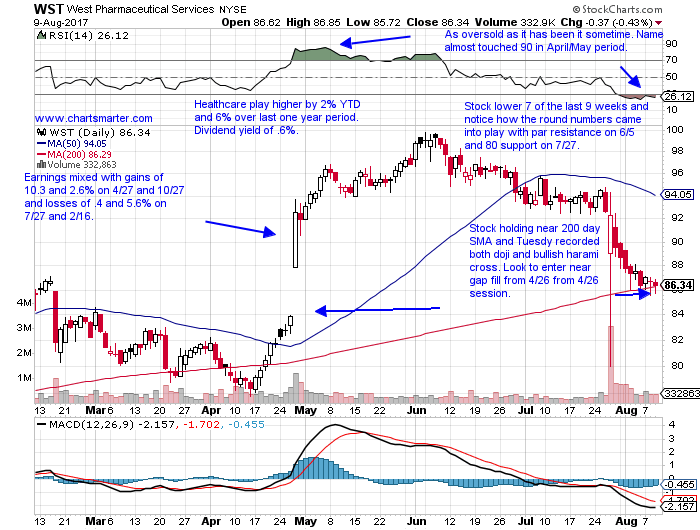

Stocks that can be bought as they fill in gaps are WST. WST is a healthcare play higher by 2% YTD and 6% over last one year period and sports a small dividend yield of .6%. Earnings have been mixed with gains of 10.3 and 2.6% on 4/27 and 10/27 and losses of .4 and 5.6% on 7/27 and 2/16. The stock is lower 7 of the last 9 weeks and now 14% off most recent 52 week highs, and notice how the round numbers came into play with par resistance on 6/5 and 80 support on 7/27. WST is holding near 200 day SMA and Tuesday recorded both doji and bullish harami cross and today recorded a hammer to CLOSE above the 200 day. Look to enter near gap fill from 4/26 session at 85.

Trigger WST 85. Stop 82.75.

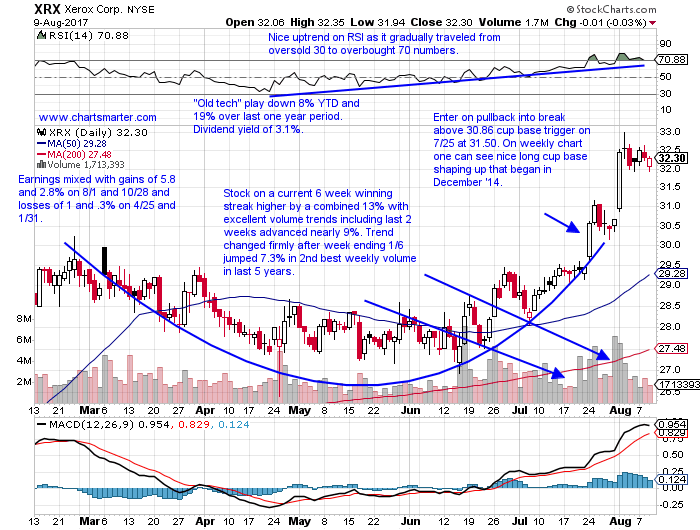

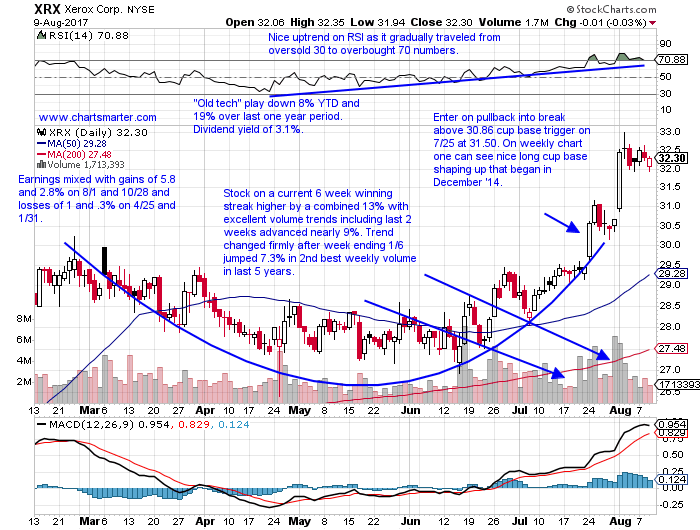

Stocks that can be bought as they pullback into recent cup base breakouts are XRX. XRX is an "Old tech" play down 8% YTD and 19% over last one year period and sports a nice dividend yield of 3.1%. Earnings have been mixed with gains of 5.8 and 2.8% on 8/1 and 10/28 and losses of 1 and .3% on 4/25 and 1/31. The stock is on a current 6 week winning streak higher by a combined 13% with excellent volume trends including last 2 weeks advanced nearly 9%. The trend changed firmly after week ending 1/6 jumped 7.3% in 2nd best weekly volume in last 5 years. Enter XRX on pullback into break above 30.86 cup base trigger on 7/25 at 31.50. On weekly chart one can see nice long cup base shaping up that began in December '14.

Trigger XRX 31.50. Stop 29.05.

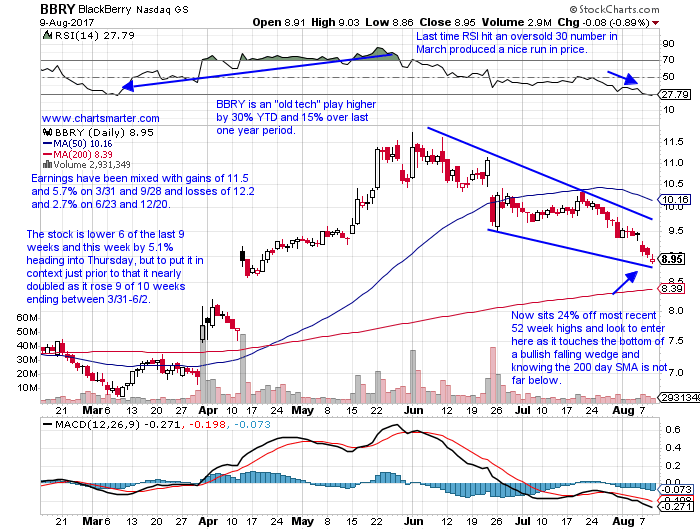

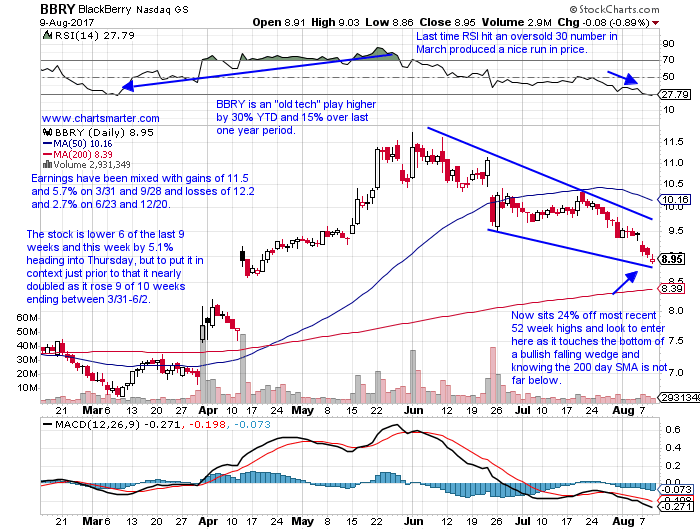

Stocks that can be bought at support within bullish falling wedges are BBRY. BBRY is an "old tech" play higher by 30% YTD and 15% over last one year period. Earnings have been mixed with gains of 11.5 and 5.7% on 3/31 and 9/28 and losses of 12.2 and 2.7% on 6/23 and 12/20. The stock is lower 6 of the last 9 weeks and this week by 5.1% heading into Thursday, but to put it in context just prior to that it nearly doubled as it rose 9 of 10 weeks ending between 3/31-6/2. It now sits 24% off most recent 52 week highs and look to enter here as it touches the bottom of a bullish falling wedge and knowing the 200 day SMA is not far below.

Trigger BBRY here. Stop 7.85.

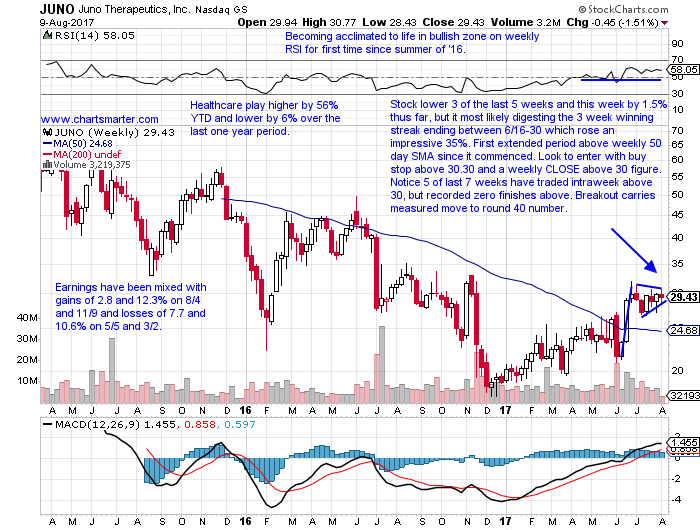

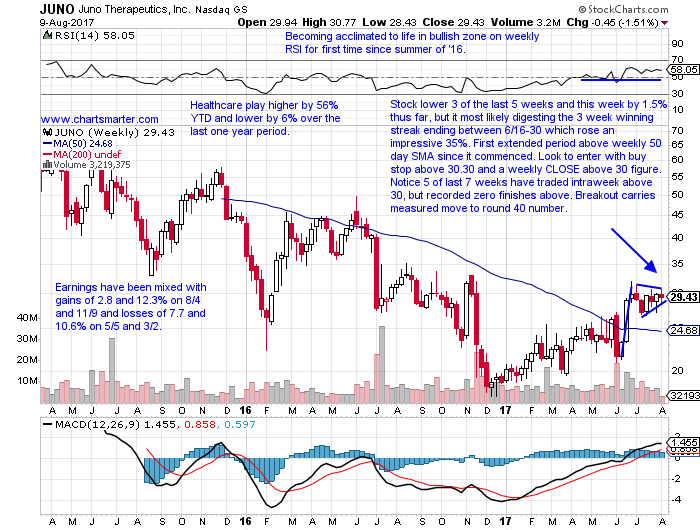

Stocks that can be bought as they take out weekly bull flag patterns are JUNO. JUNO is a healthcare play higher by 56% YTD and lower by 6% over the last one year period. Earnings have been mixed with gains of 2.8 and 12.3% on 8/4 and 11/9 and losses of 7.7 and 10.6% on 5/5 and 3/2. The stock is lower 3 of the last 5 weeks and this week by 1.6% thus far, but it most likely digesting the 3 week winning streak ending between 6/16-30 which rose an impressive 35%. Look to enter JUNO with buy stop above 30.30 and a weekly CLOSE above 30 figure. Notice 5 of last 7 weeks have traded intraweek above 30, but recorded zero finishes above. A breakout carries measured move to round 40 number.

Trigger JUNO 30.30. Stop 28.55.

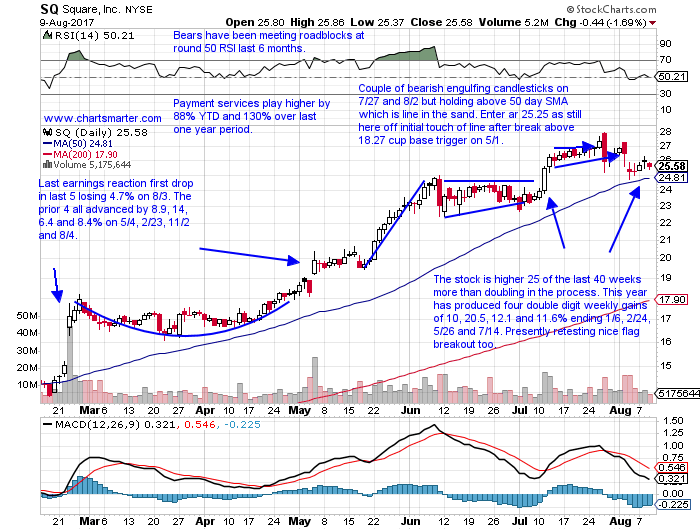

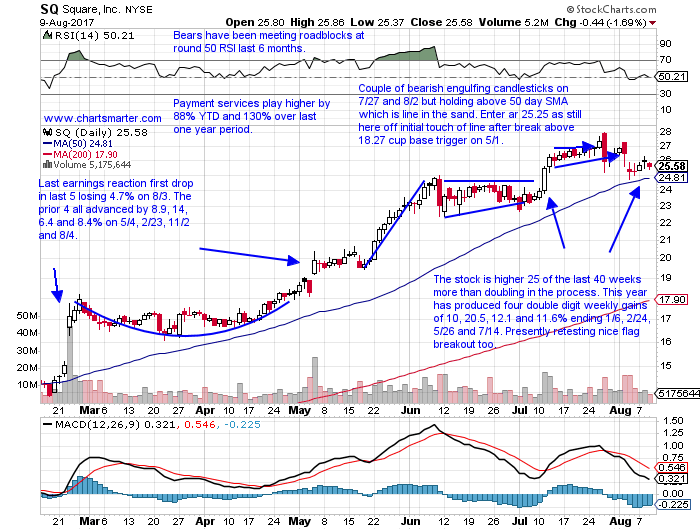

Stocks that can be bought as they initially touch their 50 day SMAs after recent breakouts are SQ. SQ is a payment services play higher by 88% YTD and 130% over last one year period. Its last earnings reaction was first drop in last 5 losing 4.7% on 8/3. The prior 4 all advanced by 8.9, 14, 6.4 and 8.4% on 5/4, 2/23, 11/2 and 8/4. The stock is higher 25 of the last 40 weeks more than doubling in the process and this year has produced four double digit weekly gains of 10, 20.5, 12.1 and 11.6% ending 1/6, 2/24, 5/26 and 7/14. Enter SQ at 25.25 as still here off initial touch of line after break above 18.27 cup base trigger on 5/1, and it is also retesting a good looking flag breakout trigger taken out on 7/11.

Trigger SQ 25.25. Stop 24.35.

Good luck.

The author is flat.

Trigger summaries:

Buy stop above weekly ascending triangle SKX 30.25. Stop 27.40.

Buy gap fill WST 85. Stop 82.75.

Buy pullback into recent cup base breakout XRX 31.50. Stop 29.05.

Buy at support in bullish falling wedge BBRY here. Stop 7.85.

Buy stop above weekly bull flag JUNO 30.30. Stop 28.55.

Buy initial touch of rising 50 day SMA after recent breakout SQ 25.25. Stop 24.35.

Markets remained in the red all day Wednesday but managed to finish off lows with the S&P 500 ending fractionally lower. The Nasdaq was the weakest of the big three but it did cut a morning deficit of .9% into .3% by 4pm. As we spoke of the Dow's respectable 10 session winning streak coming to a halt Tuesday, the Russell 2000 has done nearly the opposite FALLING 7 of the last 10 days and it is looking at a potential 3 week losing streak after consecutive bearish shooting weekly candle stars ending 7/21-28. Today the index was a clear laggard falling .9% and slicing the round 1400 number which was ample support in June and July and it is decisively below its 50 day SMA but is still making higher highs and lows. Looking at individual groups today winners were hard to come by with the defensive staples group outperforming and utilities and cyclicals lagging. The energy sector seems to be garnering a lot of attention and I do not have much of an opinion on the direction of the space as the XLE still is battling within a strong ongoing downtrend 17% off most recent 52 week highs. There does seem to be a slew of things working against it with the emergence of the solar group as millennials demand alternative sources, companies such as Volvo declaring an all electric fleet in the years ahead and word came out recently the energy legend Andy Hall closing his flag ship hedge fund due to severe negative returns. These events are washing out sentiment in a contrarian fashion for the bulls, but for me as a technician I would need to see some PRICE confirmation before I became an interested long participant. Some transports are perking back up as they have been soft recently and below is the chart of CSX, it was higher by 1.1% on a somewhat soft tape and completed a three white soldiers pattern, and how it appeared in our Monday Game Plan. To be clear the trigger was NOT hit but could be a bright spot for the overall market if these space and get its act together and continue its climb upward. The bulls are singing the old song The Little Engine, I think I can, I think I can, I think I can.

Stocks that can be bought as they take out weekly bullish ascending triangles are SKX. SKX is a retail play higher by 17% YTD and 22% over the last one year period. Earnings have been mixed with gains of .7 and 19.3% on 7/21 and 2/10 and losses of 2.6 and 17.3% on 4/21 and 10/21. The stock is lower 4 of last 5 weeks with 4 down weeks CLOSING in upper half of weekly range and is most likely digesting 6 week winning streak ending between 5/26-6/30 which jumped 25% (stock may be getting its mojo back as it recorded a 25 of 29 week winning streak ending between 1/23/15-8/7/15). Enter SKX with a buy stop above 30.25 which carries a measured move to 41 (weeks ending 3/31 and 7/7 were stopped cold at 30 figure).

Trigger SKX 30.25. Stop 27.40.

Stocks that can be bought as they fill in gaps are WST. WST is a healthcare play higher by 2% YTD and 6% over last one year period and sports a small dividend yield of .6%. Earnings have been mixed with gains of 10.3 and 2.6% on 4/27 and 10/27 and losses of .4 and 5.6% on 7/27 and 2/16. The stock is lower 7 of the last 9 weeks and now 14% off most recent 52 week highs, and notice how the round numbers came into play with par resistance on 6/5 and 80 support on 7/27. WST is holding near 200 day SMA and Tuesday recorded both doji and bullish harami cross and today recorded a hammer to CLOSE above the 200 day. Look to enter near gap fill from 4/26 session at 85.

Trigger WST 85. Stop 82.75.

Stocks that can be bought as they pullback into recent cup base breakouts are XRX. XRX is an "Old tech" play down 8% YTD and 19% over last one year period and sports a nice dividend yield of 3.1%. Earnings have been mixed with gains of 5.8 and 2.8% on 8/1 and 10/28 and losses of 1 and .3% on 4/25 and 1/31. The stock is on a current 6 week winning streak higher by a combined 13% with excellent volume trends including last 2 weeks advanced nearly 9%. The trend changed firmly after week ending 1/6 jumped 7.3% in 2nd best weekly volume in last 5 years. Enter XRX on pullback into break above 30.86 cup base trigger on 7/25 at 31.50. On weekly chart one can see nice long cup base shaping up that began in December '14.

Trigger XRX 31.50. Stop 29.05.

Stocks that can be bought at support within bullish falling wedges are BBRY. BBRY is an "old tech" play higher by 30% YTD and 15% over last one year period. Earnings have been mixed with gains of 11.5 and 5.7% on 3/31 and 9/28 and losses of 12.2 and 2.7% on 6/23 and 12/20. The stock is lower 6 of the last 9 weeks and this week by 5.1% heading into Thursday, but to put it in context just prior to that it nearly doubled as it rose 9 of 10 weeks ending between 3/31-6/2. It now sits 24% off most recent 52 week highs and look to enter here as it touches the bottom of a bullish falling wedge and knowing the 200 day SMA is not far below.

Trigger BBRY here. Stop 7.85.

Stocks that can be bought as they take out weekly bull flag patterns are JUNO. JUNO is a healthcare play higher by 56% YTD and lower by 6% over the last one year period. Earnings have been mixed with gains of 2.8 and 12.3% on 8/4 and 11/9 and losses of 7.7 and 10.6% on 5/5 and 3/2. The stock is lower 3 of the last 5 weeks and this week by 1.6% thus far, but it most likely digesting the 3 week winning streak ending between 6/16-30 which rose an impressive 35%. Look to enter JUNO with buy stop above 30.30 and a weekly CLOSE above 30 figure. Notice 5 of last 7 weeks have traded intraweek above 30, but recorded zero finishes above. A breakout carries measured move to round 40 number.

Trigger JUNO 30.30. Stop 28.55.

Stocks that can be bought as they initially touch their 50 day SMAs after recent breakouts are SQ. SQ is a payment services play higher by 88% YTD and 130% over last one year period. Its last earnings reaction was first drop in last 5 losing 4.7% on 8/3. The prior 4 all advanced by 8.9, 14, 6.4 and 8.4% on 5/4, 2/23, 11/2 and 8/4. The stock is higher 25 of the last 40 weeks more than doubling in the process and this year has produced four double digit weekly gains of 10, 20.5, 12.1 and 11.6% ending 1/6, 2/24, 5/26 and 7/14. Enter SQ at 25.25 as still here off initial touch of line after break above 18.27 cup base trigger on 5/1, and it is also retesting a good looking flag breakout trigger taken out on 7/11.

Trigger SQ 25.25. Stop 24.35.

Good luck.

The author is flat.

Trigger summaries:

Buy stop above weekly ascending triangle SKX 30.25. Stop 27.40.

Buy gap fill WST 85. Stop 82.75.

Buy pullback into recent cup base breakout XRX 31.50. Stop 29.05.

Buy at support in bullish falling wedge BBRY here. Stop 7.85.

Buy stop above weekly bull flag JUNO 30.30. Stop 28.55.

Buy initial touch of rising 50 day SMA after recent breakout SQ 25.25. Stop 24.35.