Select retail names have been acting very well shrugging off overall market weakness. One should not ignore names displaying this type of action. TPR, the former COH, is a prime example with the stock on a current 6 week winning streak up by a combined 14% and this week adding another .8% so far. LULU, DECK and BURL are others to watch closely. Today we take a peek at PRTY on both a daily and weekly timeframe. Its complexion has become much better since last November, and looks nothing like its ugly start after emerging as a public company once again falling 29 of 39 weeks ending between 5/22/15-2/12/16. Below is how one can initiate and add to a position on strength.

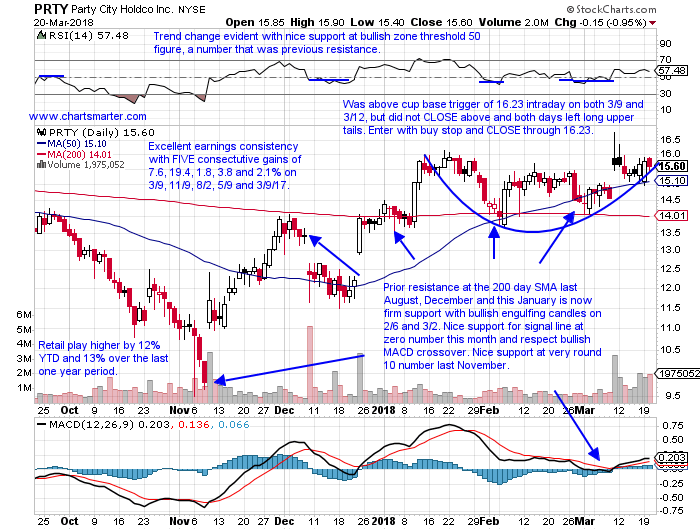

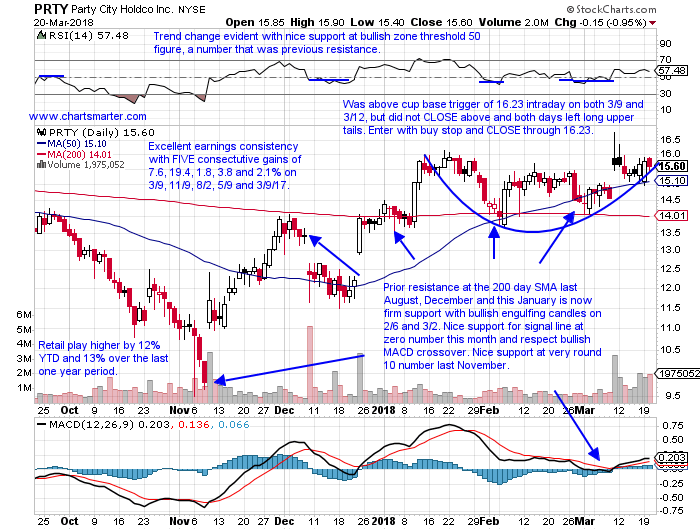

PRTY is a retail play higher by 12% YTD and 13% over the last one year period. It has excellent earnings consistency with FIVE consecutive gains of 7.6, 19.4, 1.8, 3.8 and 2.1% on 3/9, 11/9, 8/2, 5/9 and 3/9/17. The stock has found nice support at the 200 day SMA this February and March, after being resistance last August, December and this January. Notice it bounced nicely off the very round 10 number last November. PRTY was above a cup base trigger of 16.23 intraday on both 3/9 and 3/12, but did not CLOSE above and both days left long upper tails. Enter with buy stop and CLOSE through 16.23.

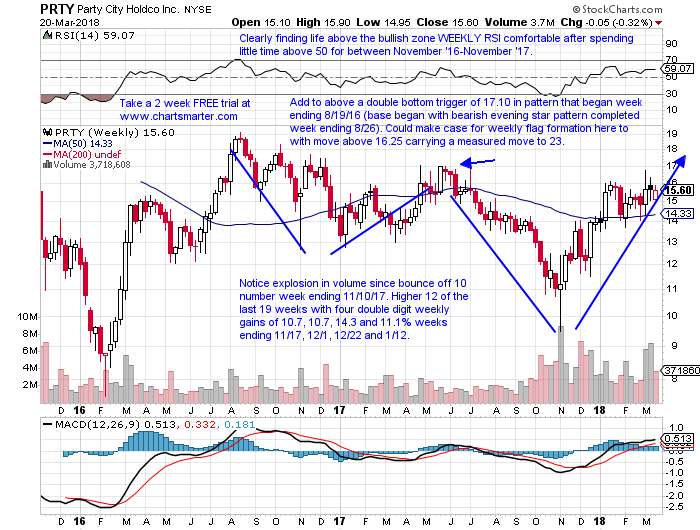

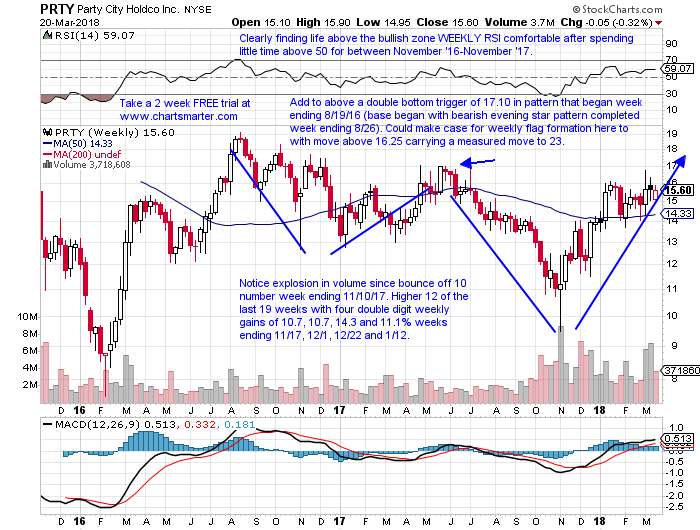

Looking at PRTY on a weekly basis it is higher 12 of the last 19 weeks, with four double digit weekly gains of 10.7, 10.7, 14.3 and 11.1% the weeks ending 11/17, 12/1, 12/22 and 1/12. Volume trends are very bullish during the timeframe as well. One could add to above a double bottom trigger of 17.10, in pattern that began week ending 8/19/16 (base began with bearish evening star pattern completed week ending 8/26). It also has the look of a weekly flag formation here to with move above 16.25 carrying a measured move to 23.

If you like what you read why not visit www.chartsmarter.com.

Select retail names have been acting very well shrugging off overall market weakness. One should not ignore names displaying this type of action. TPR, the former COH, is a prime example with the stock on a current 6 week winning streak up by a combined 14% and this week adding another .8% so far. LULU, DECK and BURL are others to watch closely. Today we take a peek at PRTY on both a daily and weekly timeframe. Its complexion has become much better since last November, and looks nothing like its ugly start after emerging as a public company once again falling 29 of 39 weeks ending between 5/22/15-2/12/16. Below is how one can initiate and add to a position on strength.

PRTY is a retail play higher by 12% YTD and 13% over the last one year period. It has excellent earnings consistency with FIVE consecutive gains of 7.6, 19.4, 1.8, 3.8 and 2.1% on 3/9, 11/9, 8/2, 5/9 and 3/9/17. The stock has found nice support at the 200 day SMA this February and March, after being resistance last August, December and this January. Notice it bounced nicely off the very round 10 number last November. PRTY was above a cup base trigger of 16.23 intraday on both 3/9 and 3/12, but did not CLOSE above and both days left long upper tails. Enter with buy stop and CLOSE through 16.23.

Looking at PRTY on a weekly basis it is higher 12 of the last 19 weeks, with four double digit weekly gains of 10.7, 10.7, 14.3 and 11.1% the weeks ending 11/17, 12/1, 12/22 and 1/12. Volume trends are very bullish during the timeframe as well. One could add to above a double bottom trigger of 17.10, in pattern that began week ending 8/19/16 (base began with bearish evening star pattern completed week ending 8/26). It also has the look of a weekly flag formation here to with move above 16.25 carrying a measured move to 23.

If you like what you read why not visit www.chartsmarter.com.