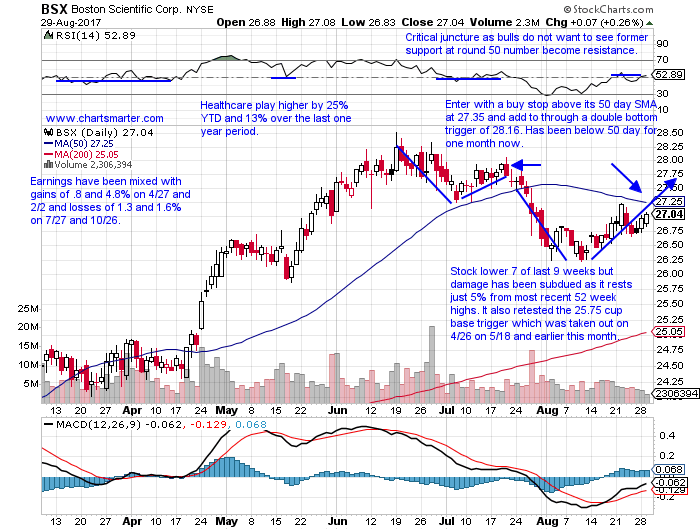

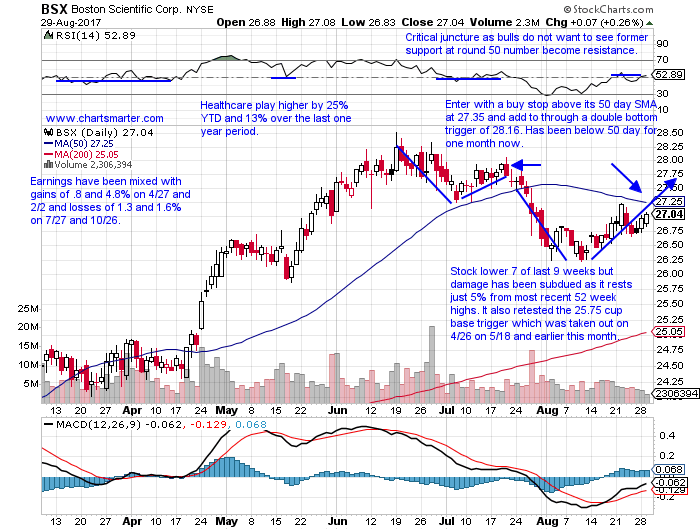

Markets hovered around the UNCH line Thursday with all the major benchmarks finishing near that figure, with the Russell 2000 dropping .25%. The Nasdaq to me has one of the better charts among the indexes as the last 8 sessions have all CLOSED at or in the upper half of their daily ranges. It also is still forming the handle on its cup base, would be complete on Monday, and it is forming above its rising 50 day SMA. On its RSI it held the round 40 numbers where leading names tend to bottom, but it is still making higher lows recently for the fourth time since touching the upper 80s in May. The Nasdaq which we have mentioned to its importance, has outperformed the S&P 500 for three consecutive weeks and this week heading into Friday is lower by .6% and the S&P 500 is off by .5%. While the major averages were mostly flat for the day, under the surface there was some big bifurcation. The financials lagged badly with the XLF falling 1.7% and for the week has declined 3.6% so far and if it ended tomorrow here would be the second worst weekly drop in 2017 (most likely will have its fourth weekly loss Friday in its last 5 and is now 7% off most recent 52 week highs). A falling 10 year note approaching the round 2 number certainly is not helping. On the other end of the spectrum, healthcare shined with the XLV gaining 1.1% and it is now at all time highs and adding to last weeks robust 2.9% jump. Below is a standout in the space BSX and how it appeared in our Wednesday 8/30 Game Plan. It has since recaptured its 50 day SMA and today demonstrated nice follow through after Wednesdays break above a double bottom trigger of 28.16. The stock lost value just 8 times in August and is risen 8 of the last 9 days.

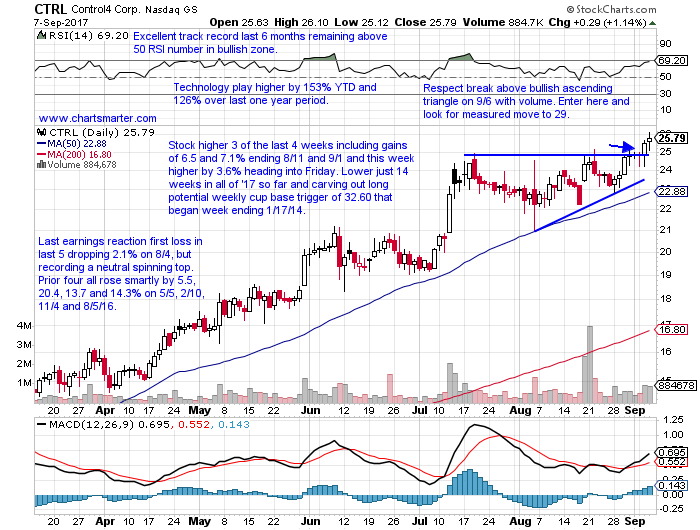

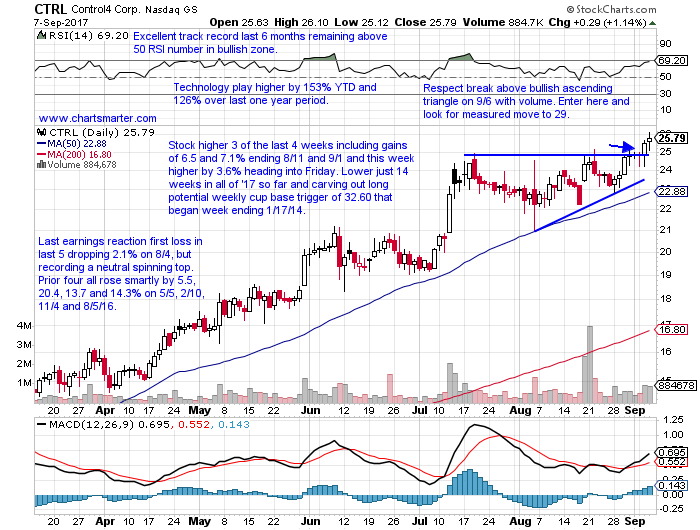

Stocks that can be bought after recent bullish ascending triangle breakouts are CTRL. CTRL is a technology play higher by 153% YTD and 126% over last one year period. Its last earnings reaction was its first loss in last 5 dropping 2.1% on 8/4, but prior four all rose smartly by 5.5, 20.4, 13.7 and 14.3% on 5/5, 2/10, 11/4 and 8/5/16. The stock is higher 3 of the last 4 weeks including gains of 6.5 and 7.1% ending 8/11 and 9/1 and this week higher by 3.6% heading into Friday and is lower just 14 weeks in all of '17 so far and carving out long potential weekly cup base trigger of 32.60 that began week ending 1/17/14. Enter CTRL here after recent break above bullish ascending triangle on 9/6 with volume and look for measured move to 29.

Trigger CTRL here. Stop 24.

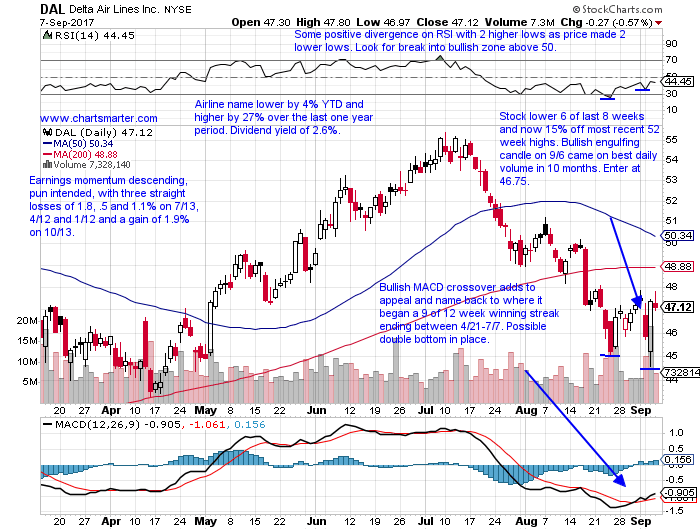

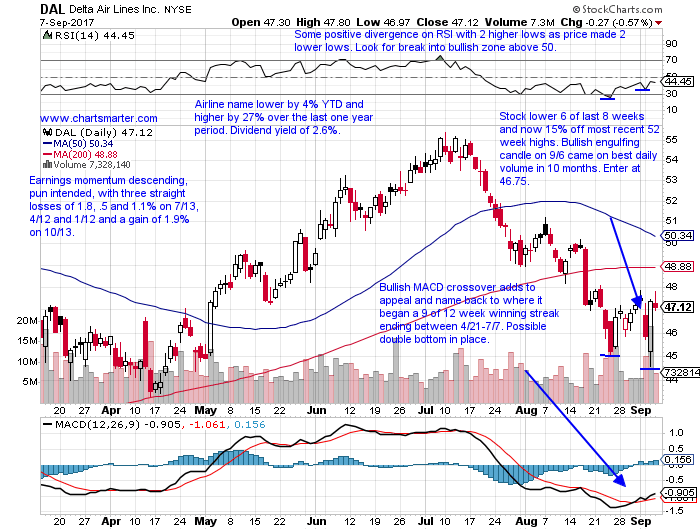

Stocks that can be bought after recent bullish engulfing candles are DAL. DAL is an airline name lower by 4% YTD and higher by 27% over the last one year period and sports a dividend yield of 2.6%. Earnings momentum is descending, pun intended, with three straight losses of 1.8, .5 and 1.1% on 7/13, 4/12 and 1/12 and a gain of 1.9% on 10/13. The stock is lower 6 of last 8 weeks and now 15% off most recent 52 week highs, but name back to where it began a 9 of 12 week winning streak ending between 4/21-7/7 putting a possible double bottom in place. DAL recorded a bullish engulfing candle on 9/6 came on best daily volume in 10 months. Enter on pullback at 46.75.

Trigger DAL 46.75. Stop 44.50.

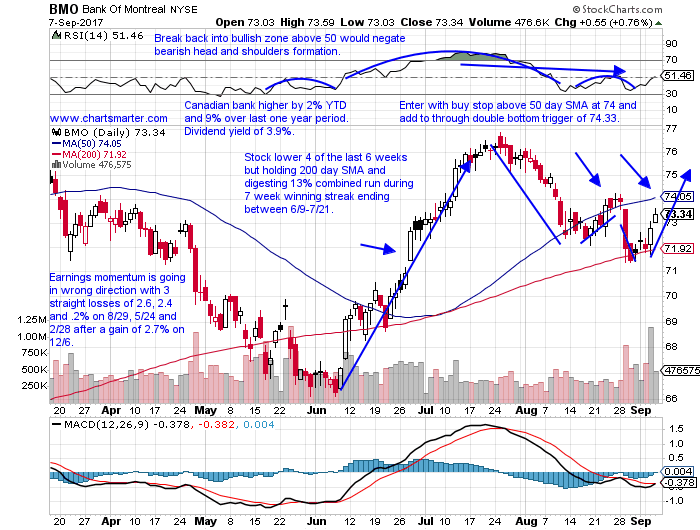

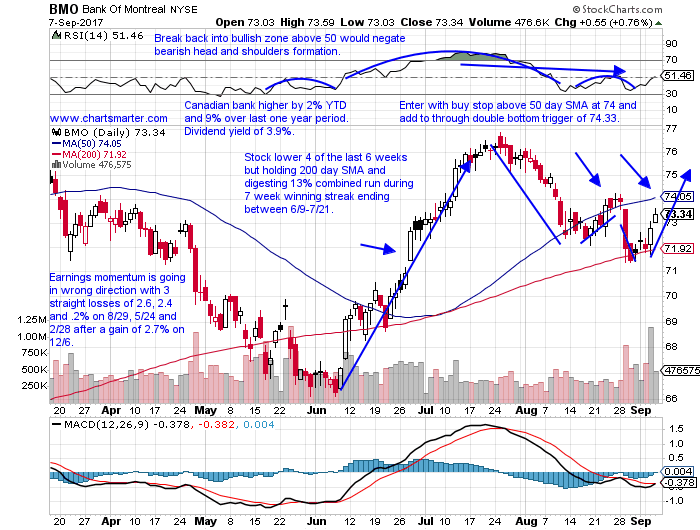

Stocks that can be bought as they take out their upward sloping 50 day SMAs and added to through future valid base structures are BMO. BMO is a Canadian bank (these names are levered to the price of crude) higher by 2% YTD and 9% over last one year period and sports a nice dividend yield of 3.9%. Earnings momentum is going in wrong direction with 3 straight losses of 2.6, 2.4 and .2% on 8/29, 5/24 and 2/28 after a gain of 2.7% on 12/6. The stock is lower 4 of the last 6 weeks but holding its 200 day SMA and digesting 13% combined run during 7 week winning streak ending between 6/9-7/21. Enter BMO with buy stop above 50 day SMA at 74 and add to through double bottom trigger of 74.33.

Trigger BMO 74. Stop 71.75.

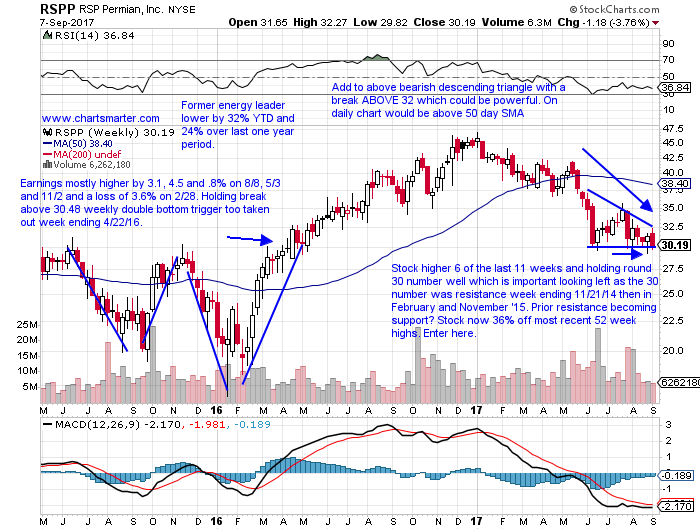

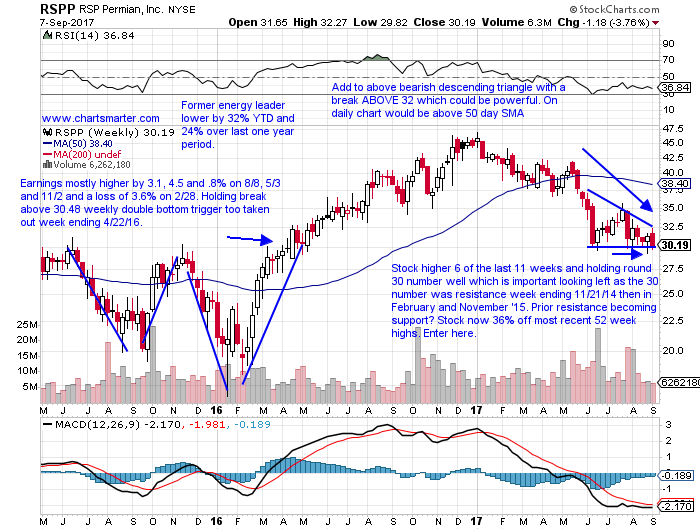

Stocks that can be bought at the round numbers are RSPP. RSPP is a former energy leader lower by 32% YTD and 24% over last one year period. Earnings have been mostly higher by 3.1, 4.5 and .8% on 8/8, 5/3 and 11/2 and a loss of 3.6% on 2/28. The stock is higher 6 of the last 11 weeks and holding round 30 number well, which is important looking left as the 30 number was resistance week ending 11/21/14 then in February and November '15. Prior resistance becoming support? It is now 36% off most recent 52 week highs and a bearish descending triangle has taken shape, but look to enter here and add to with a break ABOVE a descending triangle 32 which could be powerful. On daily chart would be above 50 day SMA.

Trigger RSPP here. Stop 29.55.

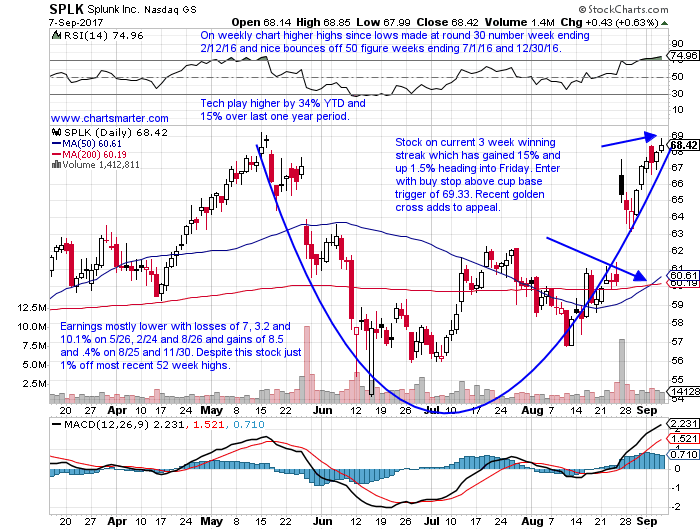

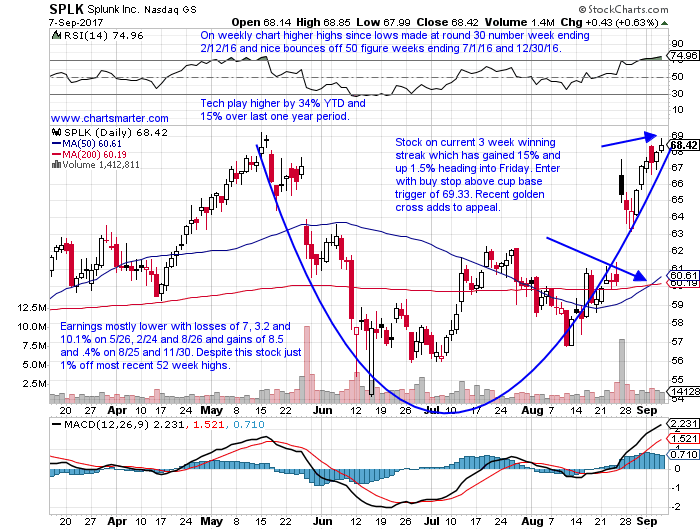

Stocks that can be bought as they take out bullish cup base patterns are SPLK. SPLK is a tech play higher by 34% YTD and 15% over last one year period. Earnings have been mostly lower with losses of 7, 3.2 and 10.1% on 5/26, 2/24 and 8/26 and gains of 8.5 and .4% on 8/25 and 11/30, but despite this stock just 1% off most recent 52 week highs. The stock is on a current 3 week winning streak (on weekly chart higher highs and higher lows since touching round 30 number week ending 2/12/16 and nice bounces off 50 figure weeks ending 7/1/16 and 12/30/16) which has gained 15% and up 1.5% heading into Friday. Enter SPLK with buy stop above cup base trigger of 69.33.

Trigger SPLK 69.33. Stop 66.55.

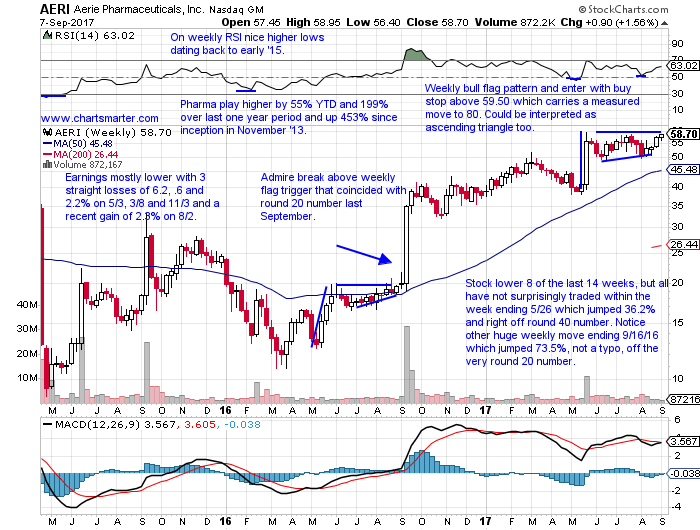

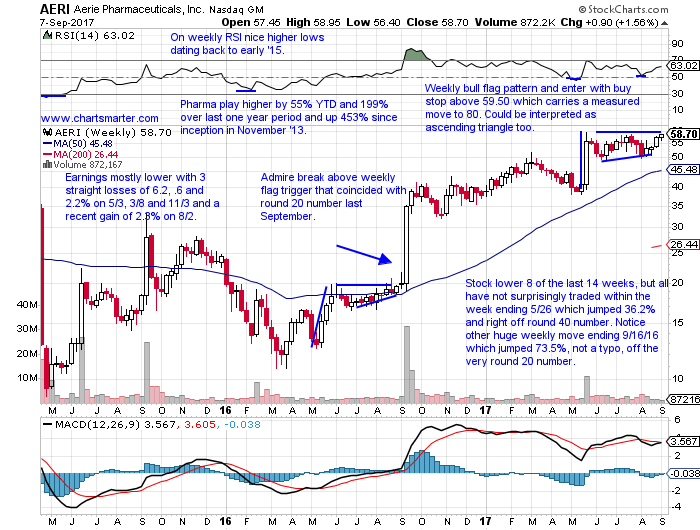

Stocks that can be bought as they take out WEEKLY bull flag triggers are AERI. AERI is a pharma play higher by 55% YTD and 199% over last one year period and up 453% since inception in November '13. Earnings have been mostly lower with 3 straight losses of 6.2, .6 and 2.2% on 5/3, 3/8 and 11/3 and a recent gain of 2.3% on 8/2. The stock is lower 8 of the last 14 weeks, but all have not surprisingly traded within the week ending 5/26 which jumped 36.2% and right off round 40 number (notice other huge weekly move ending 9/16/16 which jumped 73.5%, not a typo, off the very round 20 number). Enter AERI with a buy stop above WEEKLY bull flag pivot of 59.50 which carries a measured move to 80.

Trigger AERI 59.50. Stop 56.25.

The author is flat.

Trigger summaries:

Buy after recent break above bullish ascending triangle CTRL here. Stop 24.

Buy after recent bullish engulfing candle DAL 46.75. Stop 44.50.

Buy stop above upward sloping 50 day SMA BMO 74. Stop 71.75.

Buy at round numbers RSPP here. Stop 29.55.

Buy stop above cup base trigger SPLK 69.33. Stop 66.55.

Buy stop above WEEKLY bull flag trigger AERI 59.50. Stop 56.25.

Markets hovered around the UNCH line Thursday with all the major benchmarks finishing near that figure, with the Russell 2000 dropping .25%. The Nasdaq to me has one of the better charts among the indexes as the last 8 sessions have all CLOSED at or in the upper half of their daily ranges. It also is still forming the handle on its cup base, would be complete on Monday, and it is forming above its rising 50 day SMA. On its RSI it held the round 40 numbers where leading names tend to bottom, but it is still making higher lows recently for the fourth time since touching the upper 80s in May. The Nasdaq which we have mentioned to its importance, has outperformed the S&P 500 for three consecutive weeks and this week heading into Friday is lower by .6% and the S&P 500 is off by .5%. While the major averages were mostly flat for the day, under the surface there was some big bifurcation. The financials lagged badly with the XLF falling 1.7% and for the week has declined 3.6% so far and if it ended tomorrow here would be the second worst weekly drop in 2017 (most likely will have its fourth weekly loss Friday in its last 5 and is now 7% off most recent 52 week highs). A falling 10 year note approaching the round 2 number certainly is not helping. On the other end of the spectrum, healthcare shined with the XLV gaining 1.1% and it is now at all time highs and adding to last weeks robust 2.9% jump. Below is a standout in the space BSX and how it appeared in our Wednesday 8/30 Game Plan. It has since recaptured its 50 day SMA and today demonstrated nice follow through after Wednesdays break above a double bottom trigger of 28.16. The stock lost value just 8 times in August and is risen 8 of the last 9 days.

Stocks that can be bought after recent bullish ascending triangle breakouts are CTRL. CTRL is a technology play higher by 153% YTD and 126% over last one year period. Its last earnings reaction was its first loss in last 5 dropping 2.1% on 8/4, but prior four all rose smartly by 5.5, 20.4, 13.7 and 14.3% on 5/5, 2/10, 11/4 and 8/5/16. The stock is higher 3 of the last 4 weeks including gains of 6.5 and 7.1% ending 8/11 and 9/1 and this week higher by 3.6% heading into Friday and is lower just 14 weeks in all of '17 so far and carving out long potential weekly cup base trigger of 32.60 that began week ending 1/17/14. Enter CTRL here after recent break above bullish ascending triangle on 9/6 with volume and look for measured move to 29.

Trigger CTRL here. Stop 24.

Stocks that can be bought after recent bullish engulfing candles are DAL. DAL is an airline name lower by 4% YTD and higher by 27% over the last one year period and sports a dividend yield of 2.6%. Earnings momentum is descending, pun intended, with three straight losses of 1.8, .5 and 1.1% on 7/13, 4/12 and 1/12 and a gain of 1.9% on 10/13. The stock is lower 6 of last 8 weeks and now 15% off most recent 52 week highs, but name back to where it began a 9 of 12 week winning streak ending between 4/21-7/7 putting a possible double bottom in place. DAL recorded a bullish engulfing candle on 9/6 came on best daily volume in 10 months. Enter on pullback at 46.75.

Trigger DAL 46.75. Stop 44.50.

Stocks that can be bought as they take out their upward sloping 50 day SMAs and added to through future valid base structures are BMO. BMO is a Canadian bank (these names are levered to the price of crude) higher by 2% YTD and 9% over last one year period and sports a nice dividend yield of 3.9%. Earnings momentum is going in wrong direction with 3 straight losses of 2.6, 2.4 and .2% on 8/29, 5/24 and 2/28 after a gain of 2.7% on 12/6. The stock is lower 4 of the last 6 weeks but holding its 200 day SMA and digesting 13% combined run during 7 week winning streak ending between 6/9-7/21. Enter BMO with buy stop above 50 day SMA at 74 and add to through double bottom trigger of 74.33.

Trigger BMO 74. Stop 71.75.

Stocks that can be bought at the round numbers are RSPP. RSPP is a former energy leader lower by 32% YTD and 24% over last one year period. Earnings have been mostly higher by 3.1, 4.5 and .8% on 8/8, 5/3 and 11/2 and a loss of 3.6% on 2/28. The stock is higher 6 of the last 11 weeks and holding round 30 number well, which is important looking left as the 30 number was resistance week ending 11/21/14 then in February and November '15. Prior resistance becoming support? It is now 36% off most recent 52 week highs and a bearish descending triangle has taken shape, but look to enter here and add to with a break ABOVE a descending triangle 32 which could be powerful. On daily chart would be above 50 day SMA.

Trigger RSPP here. Stop 29.55.

Stocks that can be bought as they take out bullish cup base patterns are SPLK. SPLK is a tech play higher by 34% YTD and 15% over last one year period. Earnings have been mostly lower with losses of 7, 3.2 and 10.1% on 5/26, 2/24 and 8/26 and gains of 8.5 and .4% on 8/25 and 11/30, but despite this stock just 1% off most recent 52 week highs. The stock is on a current 3 week winning streak (on weekly chart higher highs and higher lows since touching round 30 number week ending 2/12/16 and nice bounces off 50 figure weeks ending 7/1/16 and 12/30/16) which has gained 15% and up 1.5% heading into Friday. Enter SPLK with buy stop above cup base trigger of 69.33.

Trigger SPLK 69.33. Stop 66.55.

Stocks that can be bought as they take out WEEKLY bull flag triggers are AERI. AERI is a pharma play higher by 55% YTD and 199% over last one year period and up 453% since inception in November '13. Earnings have been mostly lower with 3 straight losses of 6.2, .6 and 2.2% on 5/3, 3/8 and 11/3 and a recent gain of 2.3% on 8/2. The stock is lower 8 of the last 14 weeks, but all have not surprisingly traded within the week ending 5/26 which jumped 36.2% and right off round 40 number (notice other huge weekly move ending 9/16/16 which jumped 73.5%, not a typo, off the very round 20 number). Enter AERI with a buy stop above WEEKLY bull flag pivot of 59.50 which carries a measured move to 80.

Trigger AERI 59.50. Stop 56.25.

The author is flat.

Trigger summaries:

Buy after recent break above bullish ascending triangle CTRL here. Stop 24.

Buy after recent bullish engulfing candle DAL 46.75. Stop 44.50.

Buy stop above upward sloping 50 day SMA BMO 74. Stop 71.75.

Buy at round numbers RSPP here. Stop 29.55.

Buy stop above cup base trigger SPLK 69.33. Stop 66.55.

Buy stop above WEEKLY bull flag trigger AERI 59.50. Stop 56.25.