- Healthcare has been quietly making a comeback, which has gained steam recently capturing investors attention. On a one month timeframe the XLV is the second best major S&P sector performer higher by 6.5%, and on a 3 month span it is also the second best actor advancing 8.5%, bested only slightly by technology which added 8.7%. Tonight we take a peek at an overlooked name, that looks attractive from both a fundamental and technical perspective Ocular Therapeutix.

Biotech Observation:

- Ocular Thx: (OCUL) price 8/1: $5.58: the company is looking for AB/Steriods application, Dextenza (hydrogel soluble technology whereby punctal plugs are placed in the canaliculus that release the drugs resulting in less pain and absence of anterior chamber cells), in a user friendly way for especially the forgetful elderly after cataract surgery treatment, Ocular is also developing treatments for glaucoma (OTX-TP, OTX-TIC) and wet AMD (OTX-TKI and OTX-IVT). Dextenza although cleared for it efficacy by the FDA still has to clear some CRL/GMP issues that arose under the old management. The PDUFA (Presecription Drug User Fee Act) date which is the deadline for the FDA to approve Dextenza is December 28, 2018. Management is confident that the manufacturing issues will be solved to the satisfaction of the FDA. This should clear the path to marketing Dextenza !Q19. Ocular estimates the market to be 2m Med Part B surgeries x $500 (per unit) = $1bn annually. Quick market acceptance is expected since the product is a clear improvement to drop therapy and should be associated with a procedure code that will provide a new income stream for doctors and surgery centers. Considering that many manufacturing changes have been implemented and can be altered if needed, it will be just a matter of time before Dextenza will come to the market. With many more applications for this technology a market cap of$205m (and estimated Enterprise Value of $205m-$60m=$145m) Ocular looks very attractive!!! 8/1 Market cap: $205m, Shares O/S: 37m, adv: 384k, Cash 31/3: $62.9m, High 2015: $43. Gijsbert Groenewegen

Analyst Coverage:

- Cantor Fitzgerald set a $22.00 price target on Ocular Therapeutix and gave the stock a buy rating in a research report on Tuesday, May 8th.

- HC Wainwright set a $10.00 price target on Ocular Therapeutix and gave the stock a buy rating in a research report on Wednesday, May 9th.

- ValuEngine upgraded Ocular Therapeutix from a strong sell rating to a sell rating in a research report on Wednesday, June 13th.

Institutional Investors:

- BlackRock Inc. boosted its stake in Ocular Therapeutix by 0.8% in the fourth quarter. BlackRock Inc. now owns 1,418,577 shares of the biopharmaceutical company’s stock valued at $6,312,000.

Technical Take:

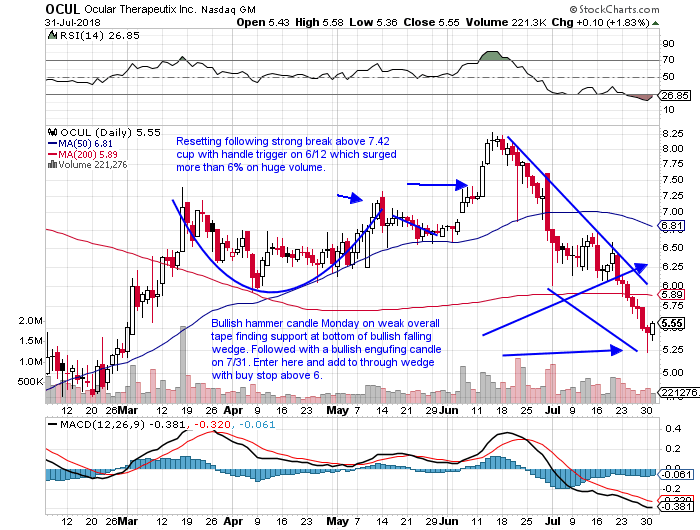

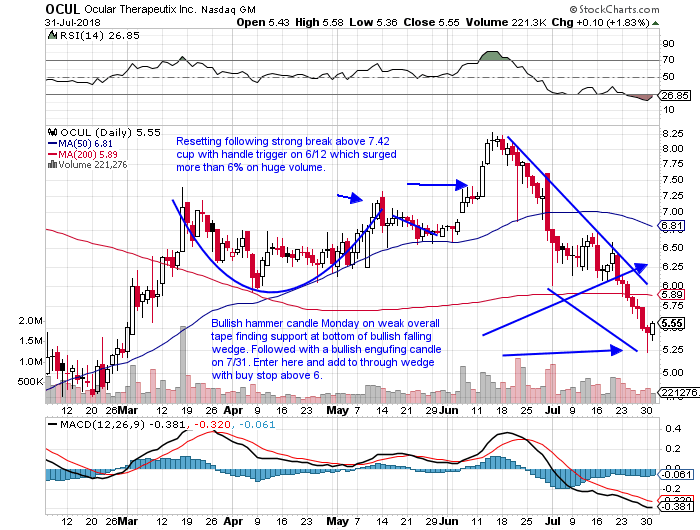

- Here we take a look at the technical story of the chart on both a daily and monthly basis. On the daily chart below the stock has not been this oversold in 6 months, below the 30 RSI number. Tuesday ended a 7 session losing streak, and the first two days of the week recorded bullish candle. Notice the short term top at just above 8 registered a doji candle on 6/14, which correctly warned of potential weakness.

- On a monthly interval the chart looks even better. It has built its bottom in a slow and steady fashion, and looks poised to travel toward the very round 10 number where it was met with stubborn resistance between November '16-July '17. Notice nearly every one of those months traded above 10 intramonth, but only one month mustered a CLOSE above 10 in May '17.

This article requires a Chartsmarter membership. Please click here to join.

- Healthcare has been quietly making a comeback, which has gained steam recently capturing investors attention. On a one month timeframe the XLV is the second best major S&P sector performer higher by 6.5%, and on a 3 month span it is also the second best actor advancing 8.5%, bested only slightly by technology which added 8.7%. Tonight we take a peek at an overlooked name, that looks attractive from both a fundamental and technical perspective Ocular Therapeutix.

Biotech Observation:

- Ocular Thx: (OCUL) price 8/1: $5.58: the company is looking for AB/Steriods application, Dextenza (hydrogel soluble technology whereby punctal plugs are placed in the canaliculus that release the drugs resulting in less pain and absence of anterior chamber cells), in a user friendly way for especially the forgetful elderly after cataract surgery treatment, Ocular is also developing treatments for glaucoma (OTX-TP, OTX-TIC) and wet AMD (OTX-TKI and OTX-IVT). Dextenza although cleared for it efficacy by the FDA still has to clear some CRL/GMP issues that arose under the old management. The PDUFA (Presecription Drug User Fee Act) date which is the deadline for the FDA to approve Dextenza is December 28, 2018. Management is confident that the manufacturing issues will be solved to the satisfaction of the FDA. This should clear the path to marketing Dextenza !Q19. Ocular estimates the market to be 2m Med Part B surgeries x $500 (per unit) = $1bn annually. Quick market acceptance is expected since the product is a clear improvement to drop therapy and should be associated with a procedure code that will provide a new income stream for doctors and surgery centers. Considering that many manufacturing changes have been implemented and can be altered if needed, it will be just a matter of time before Dextenza will come to the market. With many more applications for this technology a market cap of$205m (and estimated Enterprise Value of $205m-$60m=$145m) Ocular looks very attractive!!! 8/1 Market cap: $205m, Shares O/S: 37m, adv: 384k, Cash 31/3: $62.9m, High 2015: $43. Gijsbert Groenewegen

Analyst Coverage:

- Cantor Fitzgerald set a $22.00 price target on Ocular Therapeutix and gave the stock a buy rating in a research report on Tuesday, May 8th.

- HC Wainwright set a $10.00 price target on Ocular Therapeutix and gave the stock a buy rating in a research report on Wednesday, May 9th.

- ValuEngine upgraded Ocular Therapeutix from a strong sell rating to a sell rating in a research report on Wednesday, June 13th.

Institutional Investors:

- BlackRock Inc. boosted its stake in Ocular Therapeutix by 0.8% in the fourth quarter. BlackRock Inc. now owns 1,418,577 shares of the biopharmaceutical company’s stock valued at $6,312,000.

Technical Take:

- Here we take a look at the technical story of the chart on both a daily and monthly basis. On the daily chart below the stock has not been this oversold in 6 months, below the 30 RSI number. Tuesday ended a 7 session losing streak, and the first two days of the week recorded bullish candle. Notice the short term top at just above 8 registered a doji candle on 6/14, which correctly warned of potential weakness.

- On a monthly interval the chart looks even better. It has built its bottom in a slow and steady fashion, and looks poised to travel toward the very round 10 number where it was met with stubborn resistance between November '16-July '17. Notice nearly every one of those months traded above 10 intramonth, but only one month mustered a CLOSE above 10 in May '17.