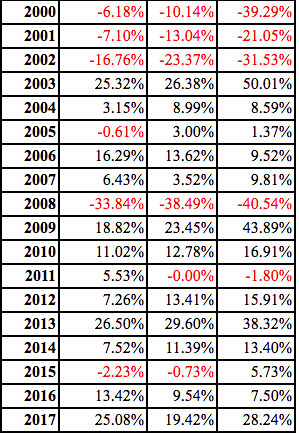

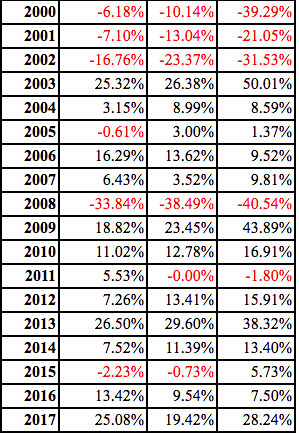

Sentiment seemed to be running high after Tuesday's decent rebound, and it may be premature as there is still plenty of technical damage thats needs to be taken care of. Give credit for the bounces off the round numbers for the S&P 500 and Russell 2000, with reversals witnessed at 2700 and 1500 respectively. That being said all the major averages are still swimming underneath their 200 day SMAs and have the look of bear flag formations. With so many looking for a bottom so quickly after a sharp pullback, many participants have never seen a bear market. The Nasdaq for one is looking for a seventh consecutive yearly gain, and it looks likely higher by 7.7% YTD so far. Now I are not pounding the table for a prolonged downturn, but many were never active in the 2000-2002 period. Look at the 2008 return too, and if not for the paltry 1.8% loss in 2011 the Nasdaq would be higher 14 of the last 15 years. One can make the case that some real softness is possible, or even prudent. That being said one has to be openminded and we could have yet another V shaped recovery, although I am not in that camp. Today we highlight 3 names that I think are interesting here.

Filled in gap on 10/12 from 6/20 to add to bullish narrative. KR is a defensive food play higher by 4% YTD and 33% over the last one year period and sports a dividend yield of 2%. Earnings have been anything but conservative with gains of 9.7 and 6.1% on 6/21 and 11/30/17 and losses of 9.9, 12.4 and 7.5% on 9/13, 3/8 and 9/8/17. The stock has been making higher lows and higher highs since touching the very round 20 number and displayed good relative strength last week gaining 2.4%, while the S&P 500 was flat. Follow through is taking place this week as it is higher by 3.2% so far and the S&P 500 is off 1%. Enter KR here after a smart, rapid reclaim of its 200 day SMA. Respect the 5 session winning streak amid a tough tape.

Trigger KR here. Stop 27.

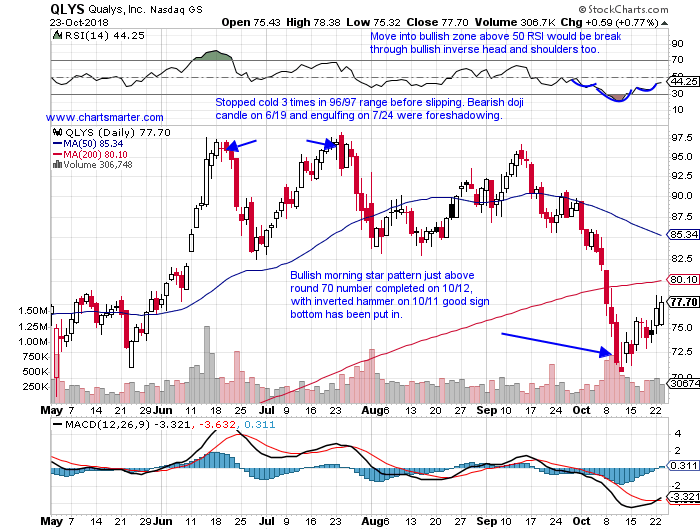

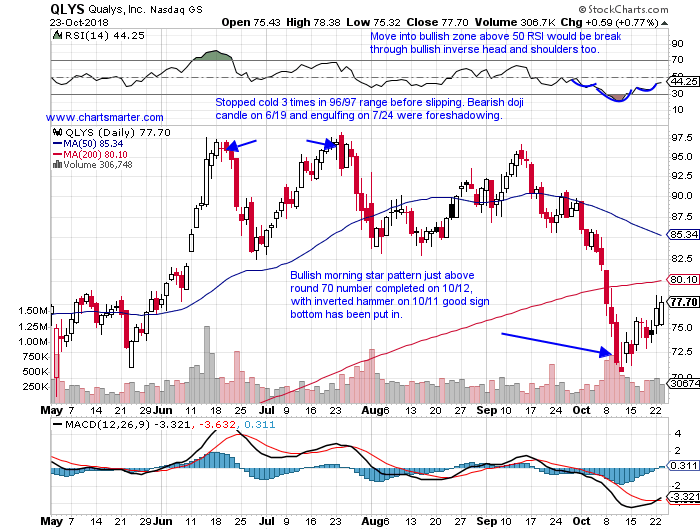

Positive software security theme not going away anytime soon. QLYS is a software play higher by 31% YTD and 51% over the last one year period and now sits in bear market mode lower by 21% from most recent 52 week highs. Earnings momentum has cooled a bit with back to back pedestrian losses of 2.3 and 2.9% on 8/1 and 5/2 after nice gains of 7.5, 5.4 and 13.6% on 2/13, 11/17 and 8/3/17 (REPORTS 10/30 after close). The stock is down 3 of the last 5 weeks, but so far this week is putting in a fight up 4.4%. There was a tell this morning when the Nasdaq was down well over 2% and this name was green. Enter QLYS on slight pullback at 77.

Trigger QLYS 77. Stop 74.

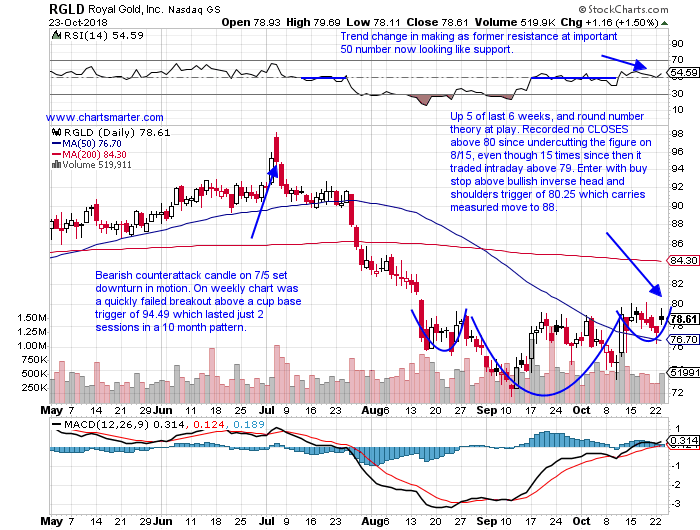

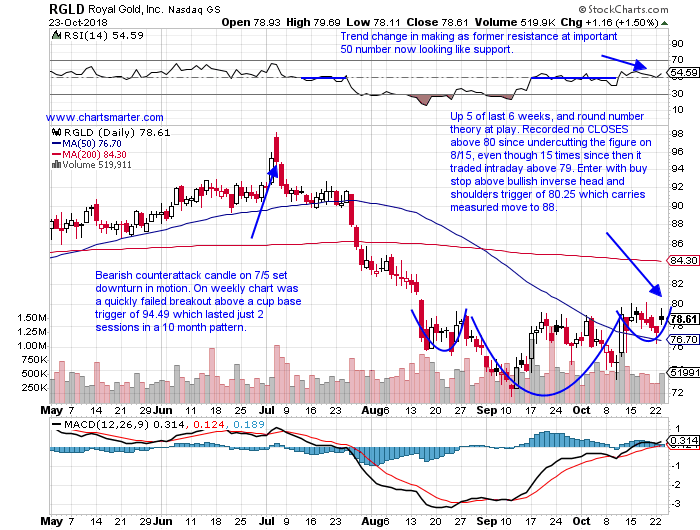

NEM reporting Thursday morning could be the long catalyst. RGLD is a gold play lower by 4% YTD and 9% over the last one year period and sports a dividend yield of 1.3%. Earnings have been mostly lower with three straight losses of .3, .2 and 1.4% on 8/9, 5/3 and 2/9 after a gain of 3.9% on 11/2/17 (REPORTS 10/31 after the close). The stock is higher 5 of the last 6 weeks, and is having issues with the round 80 number. It recorded no CLOSES above 80 since undercutting the figure on 8/15, even though 15 times since then it traded intraday above 79. Enter RGLD with a buy stop above a bullish inverse head and shoulders trigger of 80.25 which carries a measured move to 88.

Trigger RGLD 80.25. Stop 77.40.

Good luck.

Trigger summaries:

Buy after recent reclaim off 200 day SMA KR here. Stop 27.

Buy pullback into recent bullish morning star pattern QLYS 77. Stop 74.

Buy stop above bullish inverse head and shoulders RGLD 80.25. Stop 77.40.

Sentiment seemed to be running high after Tuesday's decent rebound, and it may be premature as there is still plenty of technical damage thats needs to be taken care of. Give credit for the bounces off the round numbers for the S&P 500 and Russell 2000, with reversals witnessed at 2700 and 1500 respectively. That being said all the major averages are still swimming underneath their 200 day SMAs and have the look of bear flag formations. With so many looking for a bottom so quickly after a sharp pullback, many participants have never seen a bear market. The Nasdaq for one is looking for a seventh consecutive yearly gain, and it looks likely higher by 7.7% YTD so far. Now I are not pounding the table for a prolonged downturn, but many were never active in the 2000-2002 period. Look at the 2008 return too, and if not for the paltry 1.8% loss in 2011 the Nasdaq would be higher 14 of the last 15 years. One can make the case that some real softness is possible, or even prudent. That being said one has to be openminded and we could have yet another V shaped recovery, although I am not in that camp. Today we highlight 3 names that I think are interesting here.

Filled in gap on 10/12 from 6/20 to add to bullish narrative. KR is a defensive food play higher by 4% YTD and 33% over the last one year period and sports a dividend yield of 2%. Earnings have been anything but conservative with gains of 9.7 and 6.1% on 6/21 and 11/30/17 and losses of 9.9, 12.4 and 7.5% on 9/13, 3/8 and 9/8/17. The stock has been making higher lows and higher highs since touching the very round 20 number and displayed good relative strength last week gaining 2.4%, while the S&P 500 was flat. Follow through is taking place this week as it is higher by 3.2% so far and the S&P 500 is off 1%. Enter KR here after a smart, rapid reclaim of its 200 day SMA. Respect the 5 session winning streak amid a tough tape.

Trigger KR here. Stop 27.

Positive software security theme not going away anytime soon. QLYS is a software play higher by 31% YTD and 51% over the last one year period and now sits in bear market mode lower by 21% from most recent 52 week highs. Earnings momentum has cooled a bit with back to back pedestrian losses of 2.3 and 2.9% on 8/1 and 5/2 after nice gains of 7.5, 5.4 and 13.6% on 2/13, 11/17 and 8/3/17 (REPORTS 10/30 after close). The stock is down 3 of the last 5 weeks, but so far this week is putting in a fight up 4.4%. There was a tell this morning when the Nasdaq was down well over 2% and this name was green. Enter QLYS on slight pullback at 77.

Trigger QLYS 77. Stop 74.

NEM reporting Thursday morning could be the long catalyst. RGLD is a gold play lower by 4% YTD and 9% over the last one year period and sports a dividend yield of 1.3%. Earnings have been mostly lower with three straight losses of .3, .2 and 1.4% on 8/9, 5/3 and 2/9 after a gain of 3.9% on 11/2/17 (REPORTS 10/31 after the close). The stock is higher 5 of the last 6 weeks, and is having issues with the round 80 number. It recorded no CLOSES above 80 since undercutting the figure on 8/15, even though 15 times since then it traded intraday above 79. Enter RGLD with a buy stop above a bullish inverse head and shoulders trigger of 80.25 which carries a measured move to 88.

Trigger RGLD 80.25. Stop 77.40.

Good luck.

Trigger summaries:

Buy after recent reclaim off 200 day SMA KR here. Stop 27.

Buy pullback into recent bullish morning star pattern QLYS 77. Stop 74.

Buy stop above bullish inverse head and shoulders RGLD 80.25. Stop 77.40.