Trigger summaries:

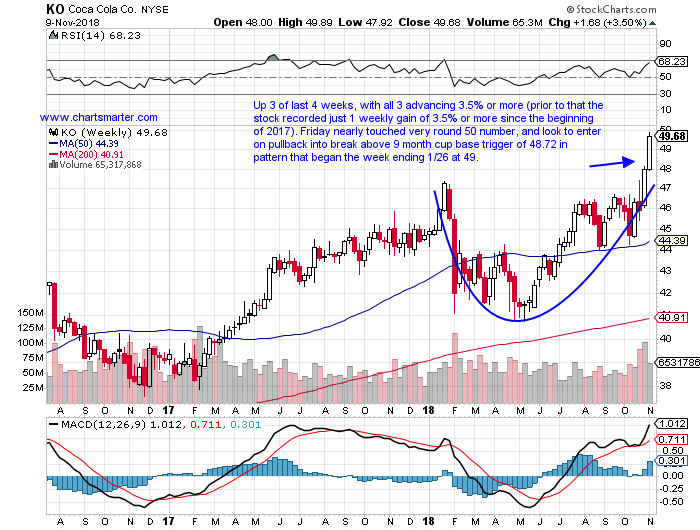

Buy pullback into long cup base breakout KO 49. Stop 46.

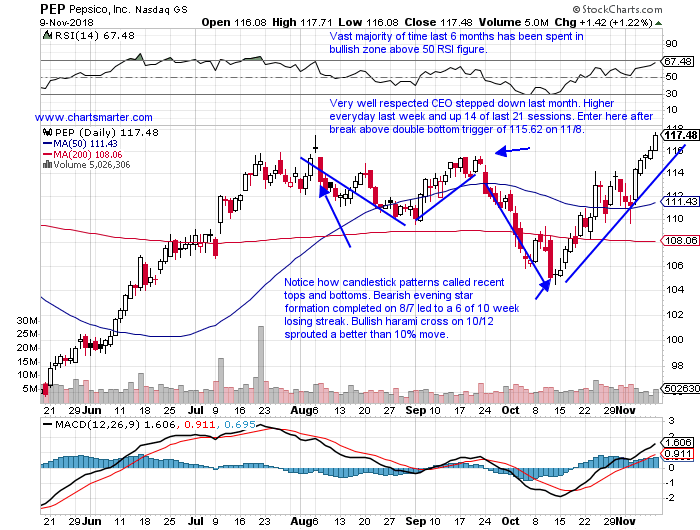

Buy after recent double bottom breakout PEP here. Stop 111.25.

Buy stop above long WEEKLY cup base trigger ULTA 314.96. Stop 288.

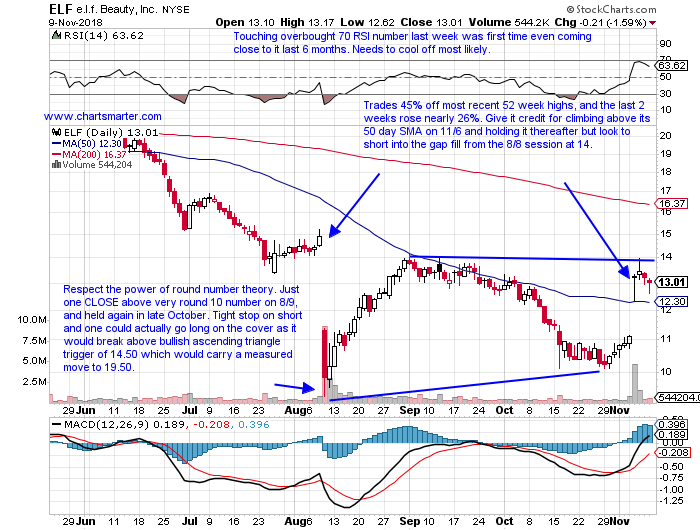

Short into upside gap fill ELF 13.75. Buy stop 14.50.

Group Overview:

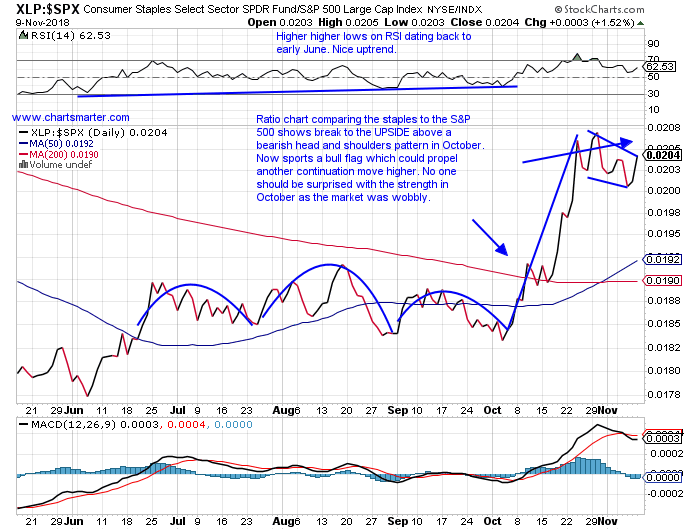

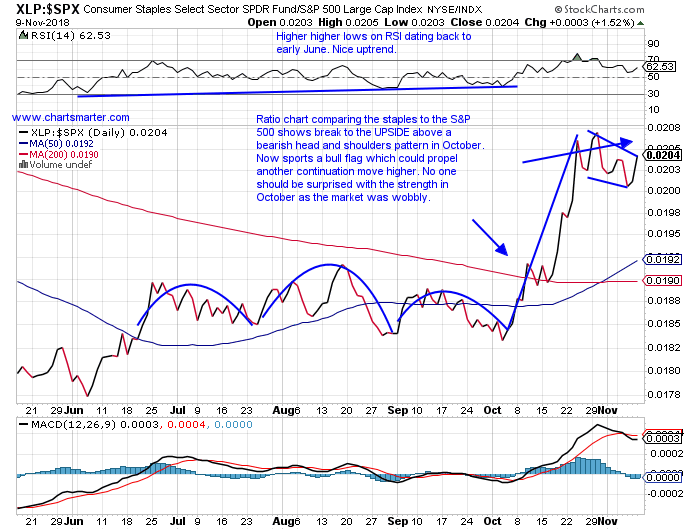

- The staples have been proving many wrong in 2018, and the Barrons Roundtable at the beginning of the year had almost every panelist preaching for investors to avoid the group. Their leadership should make bulls anything but sanguine. They were the best performer Friday, anything but a large sample, but the XLP is the best acting major S&P sector over the last one, three and six month period. Any give them credit for shrugging off a different competitor each time. On a one month time frame the XLP has advanced 5.1%, doubling its second closest peer the XLRE which rose 2.6%. On a three month look back period the XLP is up 7.1%, besting the second strongest XLU that gained 4%, and over the last 6 months the XLP added 17.1%, edging out healthcare with the XLV up 16%. Notice the second best group on each occasion hails from a very defensive group being real estate, utilities and healthcare. Below is a ratio chart comparing the staples to the S&P 500.

Special Situations:

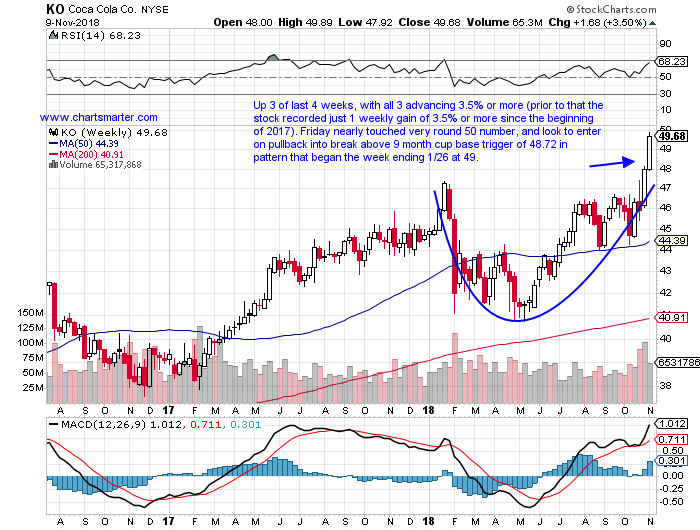

Lets take a look at some names that should continue to benefit from a rising tide within the space. KO is a beverage play higher by 11% YTD and over the last one year period and sports a dividend yield of 3.1%. Earnings have been mostly higher with gains of 2.5, 1.8 and .4% on 10/30, 7/25 and 2/16 and a loss of 2.1% on 4/24. The stock is higher 3 of the last 4 weeks, with all 3 advancing 3.5% or more (prior to that the stock recorded just 1 weekly gain of 3.5% or more since the beginning of 2017). On Friday it came into close contact with the very round 50 number, and look to enter on a pullback into the break above a 9 month cup base trigger of 48.72 in a pattern that began the week ending 1/26 at 49.

Trigger KO 49. Stop 46.

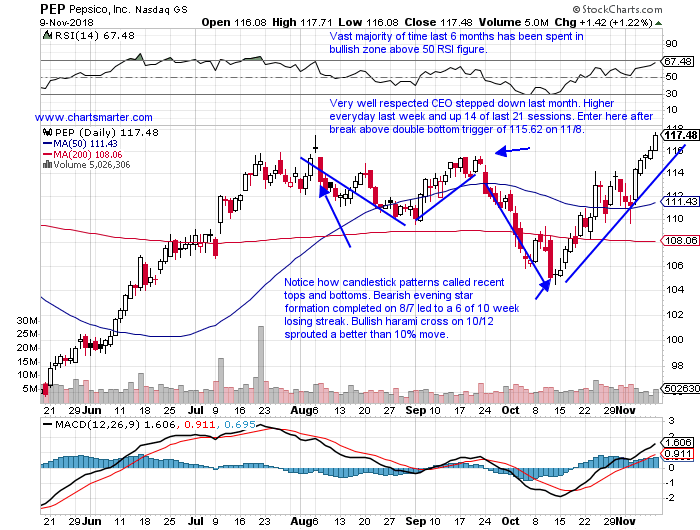

Who is old enough to remember the Pepsi Challenge? Well fast forward to today and both of their charts are palatable. Below is the chart of PEP which is UNCH YTD and higher by 8% over the last one year period and sports a dividend yield of 3.2%. Earnings have been mixed with gains of 4.8 and 2.1% on 7/10 and 4/26 and losses of 1.8 and 2.7% on 10/2 and 2/14. The stock is on a 4 week winning streak rising more than a combined 11%. Earlier this year the "boring" stock recorded an 8 week winning streak that rose 15% between the weeks ending 6/8-7/20. Enter PEP here after a break above a double bottom trigger of 115.62 taken out on 11/8 (contrast the previous beverage leaders with BUD, lower 13 of the last 16 weeks and by 37% off most recent 52 week highs after a dividend cut).

Trigger PEP here. Stop 111.25.

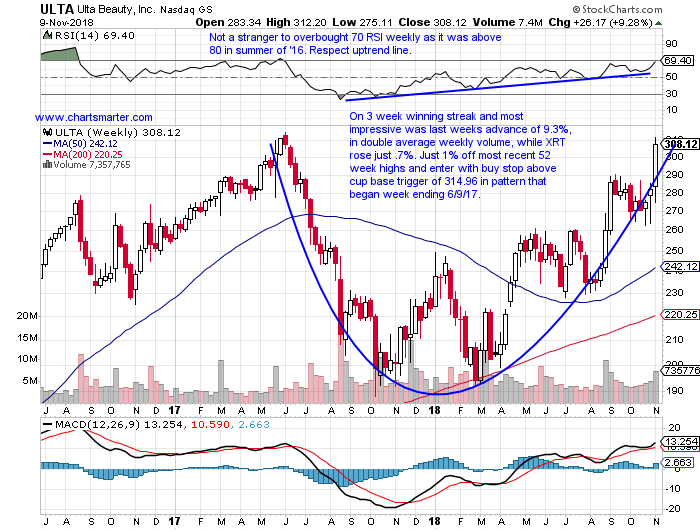

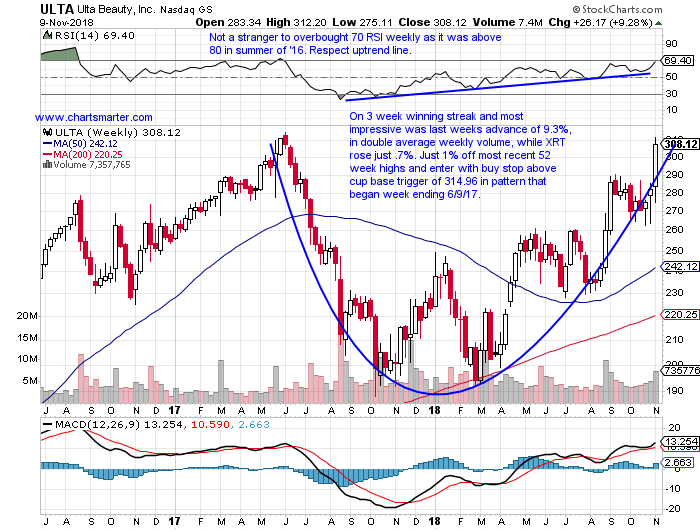

Excellent chart action as name in October barely undercut its 50 day SMA, when many, many others undercut their 200 day SMAs. ULTA is a beauty leader higher by 38% YTD and 57% over the last one year period. Earnings have been mixed with nice gains of 6.4 and 7.6% on 8/31 and 3/16 and losses of .7 and 4.1% on 6/1 and 12/1/17. The stock is on a 3 week winning streak and most impressive was last weeks advance of 9.3%, in double average weekly volume, while the XRT rose just .7%. It sits just 1% off most recent 52 week highs and enter ULTA with a buy stop above a cup base trigger of 314.96 in a pattern that began the week ending 6/9/17. This name can be looked at as a pair trade with the floundering ELF.

Trigger ULTA 314.96. Stop 288.

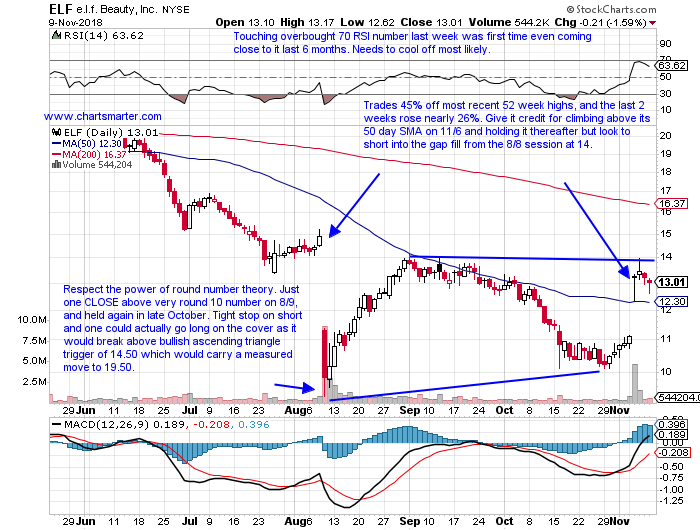

Conversely if a name has not been able to keep pace within a powerful space, there is often a reason why and should be a good tell. Below is the chart of ELF, a beauty laggard and its chart is anything but. It is lower 42% YTD and 32% over the last one year period. Its most recent earnings reaction rose handsomely, pun intended, by 19.2% on 11/6. However the prior FIVE all fell losing 33.9, 3.6, 9.3, 6.9 and 1.6% on 8/9, 5/10, 2/28, 11/8/17 and 8/10/17. It now trades 45% off most recent 52 week highs, and the last 2 weeks rose nearly 26% with some short covering bolstering that gain. Give it credit for climbing above its 50 day SMA on 11/6 and holding it thereafter but look to short ELF into the gap fill from the 8/8 session at 14. Peer COTY is another example of another straggler down 61% from most recent 52 week highs.

Trigger ELF 13.75. Buy stop 14.50.

Good luck.

Trigger summaries:

Buy pullback into long cup base breakout KO 49. Stop 46.

Buy after recent double bottom breakout PEP here. Stop 111.25.

Buy stop above long WEEKLY cup base trigger ULTA 314.96. Stop 288.

Short into upside gap fill ELF 13.75. Buy stop 14.50.

Group Overview:

- The staples have been proving many wrong in 2018, and the Barrons Roundtable at the beginning of the year had almost every panelist preaching for investors to avoid the group. Their leadership should make bulls anything but sanguine. They were the best performer Friday, anything but a large sample, but the XLP is the best acting major S&P sector over the last one, three and six month period. Any give them credit for shrugging off a different competitor each time. On a one month time frame the XLP has advanced 5.1%, doubling its second closest peer the XLRE which rose 2.6%. On a three month look back period the XLP is up 7.1%, besting the second strongest XLU that gained 4%, and over the last 6 months the XLP added 17.1%, edging out healthcare with the XLV up 16%. Notice the second best group on each occasion hails from a very defensive group being real estate, utilities and healthcare. Below is a ratio chart comparing the staples to the S&P 500.

Special Situations:

Lets take a look at some names that should continue to benefit from a rising tide within the space. KO is a beverage play higher by 11% YTD and over the last one year period and sports a dividend yield of 3.1%. Earnings have been mostly higher with gains of 2.5, 1.8 and .4% on 10/30, 7/25 and 2/16 and a loss of 2.1% on 4/24. The stock is higher 3 of the last 4 weeks, with all 3 advancing 3.5% or more (prior to that the stock recorded just 1 weekly gain of 3.5% or more since the beginning of 2017). On Friday it came into close contact with the very round 50 number, and look to enter on a pullback into the break above a 9 month cup base trigger of 48.72 in a pattern that began the week ending 1/26 at 49.

Trigger KO 49. Stop 46.

Who is old enough to remember the Pepsi Challenge? Well fast forward to today and both of their charts are palatable. Below is the chart of PEP which is UNCH YTD and higher by 8% over the last one year period and sports a dividend yield of 3.2%. Earnings have been mixed with gains of 4.8 and 2.1% on 7/10 and 4/26 and losses of 1.8 and 2.7% on 10/2 and 2/14. The stock is on a 4 week winning streak rising more than a combined 11%. Earlier this year the "boring" stock recorded an 8 week winning streak that rose 15% between the weeks ending 6/8-7/20. Enter PEP here after a break above a double bottom trigger of 115.62 taken out on 11/8 (contrast the previous beverage leaders with BUD, lower 13 of the last 16 weeks and by 37% off most recent 52 week highs after a dividend cut).

Trigger PEP here. Stop 111.25.

Excellent chart action as name in October barely undercut its 50 day SMA, when many, many others undercut their 200 day SMAs. ULTA is a beauty leader higher by 38% YTD and 57% over the last one year period. Earnings have been mixed with nice gains of 6.4 and 7.6% on 8/31 and 3/16 and losses of .7 and 4.1% on 6/1 and 12/1/17. The stock is on a 3 week winning streak and most impressive was last weeks advance of 9.3%, in double average weekly volume, while the XRT rose just .7%. It sits just 1% off most recent 52 week highs and enter ULTA with a buy stop above a cup base trigger of 314.96 in a pattern that began the week ending 6/9/17. This name can be looked at as a pair trade with the floundering ELF.

Trigger ULTA 314.96. Stop 288.

Conversely if a name has not been able to keep pace within a powerful space, there is often a reason why and should be a good tell. Below is the chart of ELF, a beauty laggard and its chart is anything but. It is lower 42% YTD and 32% over the last one year period. Its most recent earnings reaction rose handsomely, pun intended, by 19.2% on 11/6. However the prior FIVE all fell losing 33.9, 3.6, 9.3, 6.9 and 1.6% on 8/9, 5/10, 2/28, 11/8/17 and 8/10/17. It now trades 45% off most recent 52 week highs, and the last 2 weeks rose nearly 26% with some short covering bolstering that gain. Give it credit for climbing above its 50 day SMA on 11/6 and holding it thereafter but look to short ELF into the gap fill from the 8/8 session at 14. Peer COTY is another example of another straggler down 61% from most recent 52 week highs.

Trigger ELF 13.75. Buy stop 14.50.

Good luck.