Generals Retreat:

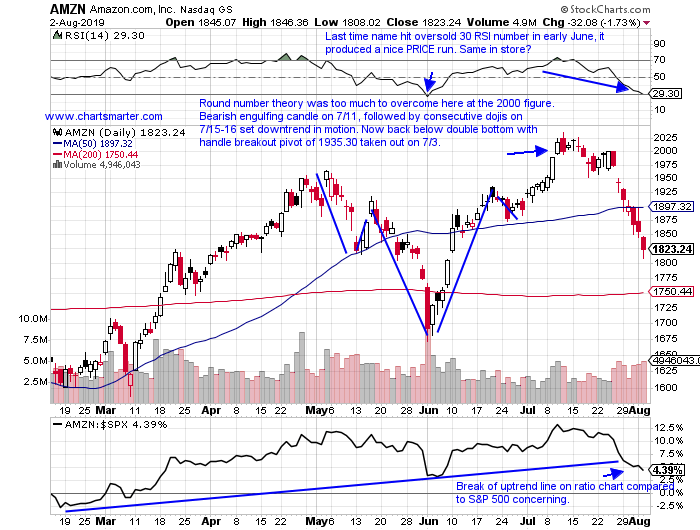

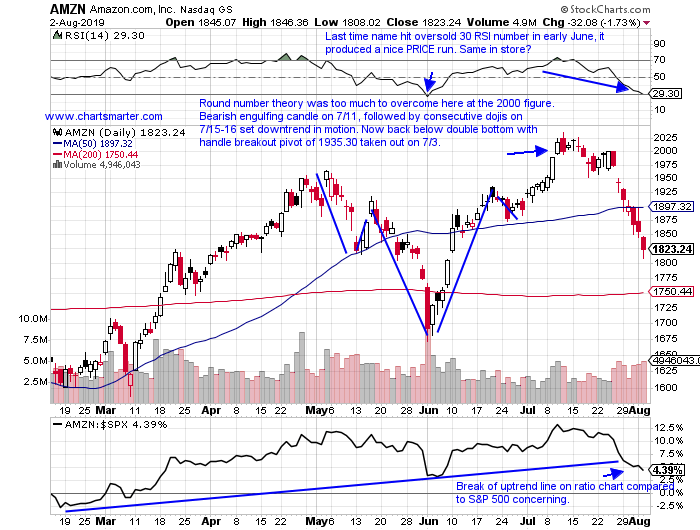

- The discretionary group recorded the worst weekly return this week of the 11 major S&P sectors, falling 4.4%, and easily the XLY's worst weekly loss of 2019 thus far. Of course the 800lb gorilla in the ETF AMZN, at more than 22% of the fund, extended its weekly losing streak to three, with all 3 CLOSING right at the lows for the weekly range. It is on a 7 session losing streak, and volume has been elevated during the 200 handle downturn. Many other names experienced tough weeks, most notably UAA, which fell more than 20%. ETSY slumped almost 16%, and former leaders BBY and FIVE dropped 11.9 and 10.1% respectively. When the retail generals expose weakness, that is a poor sign going forward. TGT undercut its 50 day SMA on 8/1 in bulging volume, and the bullseye is on this space. Keep in mind the consumer makes up 2/3rds of the economy, so perhaps we will look back at this week as a canary in the coal mine.

Nothing Casual About These Diners:

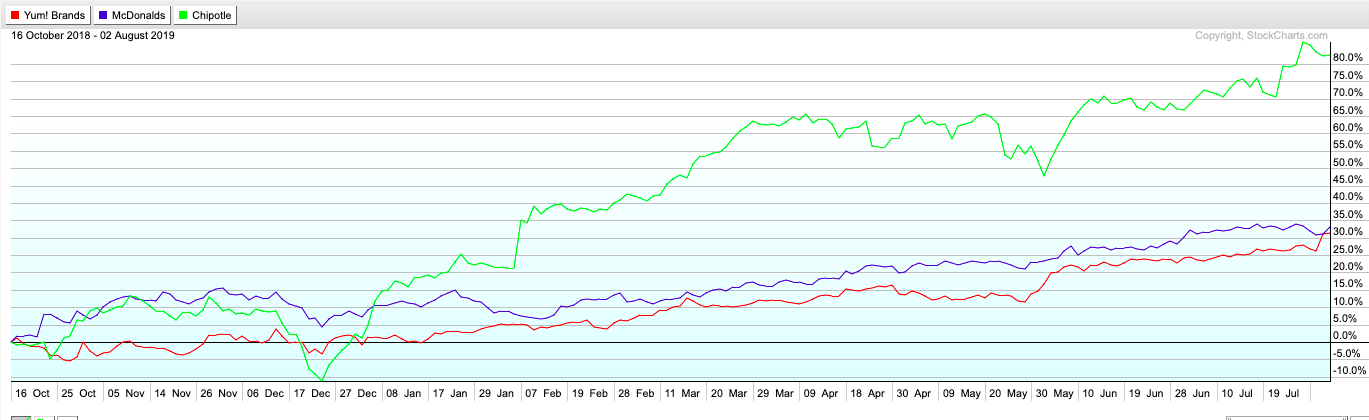

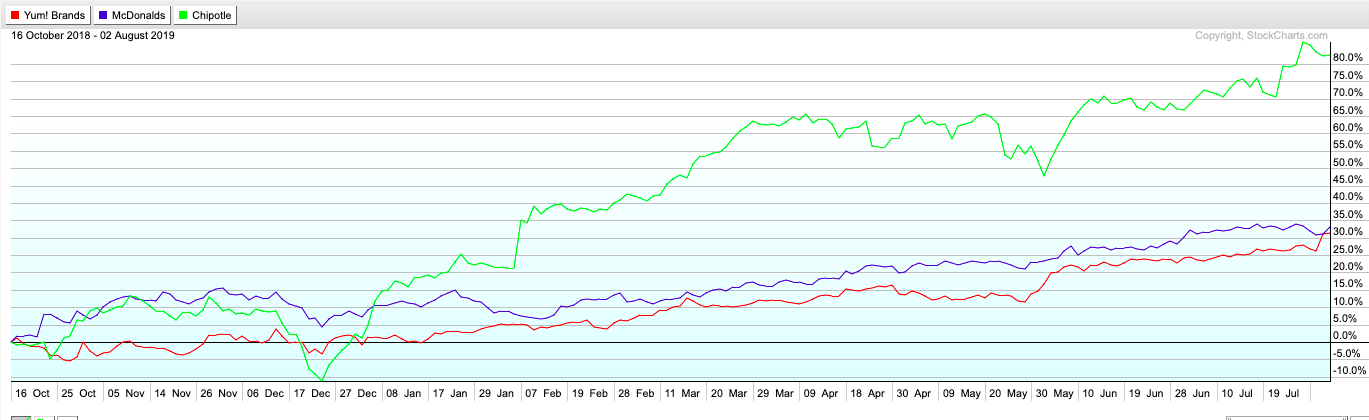

- There were few places to hide this week, but investors were not reluctant to put money to work in safe, casual diners. At least MCD and YUM, are considered more stable, mature names, but CMG has seen a very robust run doubling since the late December lows. MCD has traveled on a much different path grinding gradually higher advancing 20 of the last 25 weeks, and the last three CLOSED very taut all within just 1.71 of each other (that type of coiling action usually resolves itself in powerful moves, continuing in the prevailing direction). YUM has risen 9 of the last 10 weeks, and this week produced a strong 2.9% after a well received earnings report. Appetizing action for sure, pun intended.

Examples:

- If markets will take a more defensive posture, investors may look to deploy capital to more conservative names. Staple names that have displayed nice earnings reactions include PG which jumped 3.8% this past Tuesday (and has now filled in that earnings gap). Below is the chart of another name CPB, and how it appeared in our 7/31 Consumer Note. This week as the benchmarks were rattled, the stock put up a respectable 3.4% weekly gain up 4 of the 5 sessions this week. It has been trading taut and is now a few percentage points away from an add on 43.76 cup base pivot.

Special Situations:

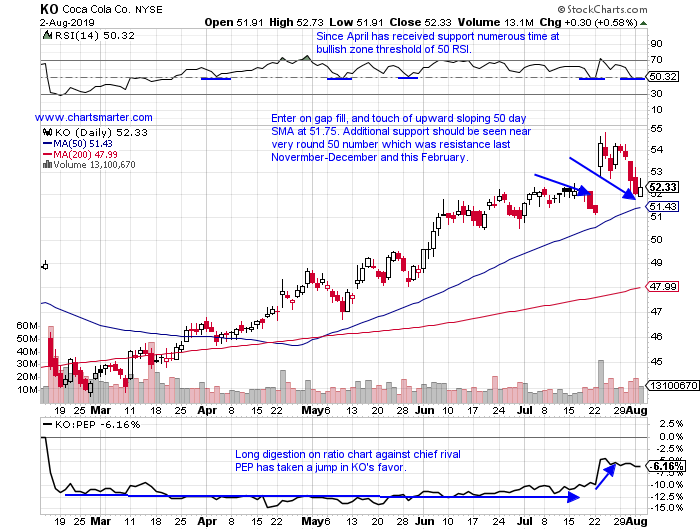

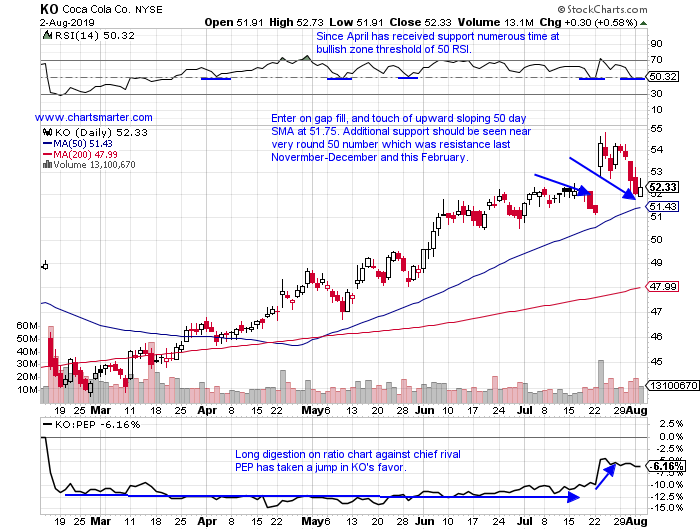

- Soft drink play higher by 11% YTD and 13% over last one year period. Dividend yield of 3.1%.

- Higher 16 of the last 24 weeks (7 of losing weeks fell less than 1.5%). Fell 3.4% this week in less volume, that the prior week which jumped 5.4%.

- Four of last five earnings reactions higher by 6.1, 1.7, 2.5 and 1.8% on 7/23, 4/23, 10/30 and 7/25/18.

- Enter on gap fill, and touch of upward sloping 50 day SMA at 51.75.

- Entry KO 51.75. Stop 49.50.

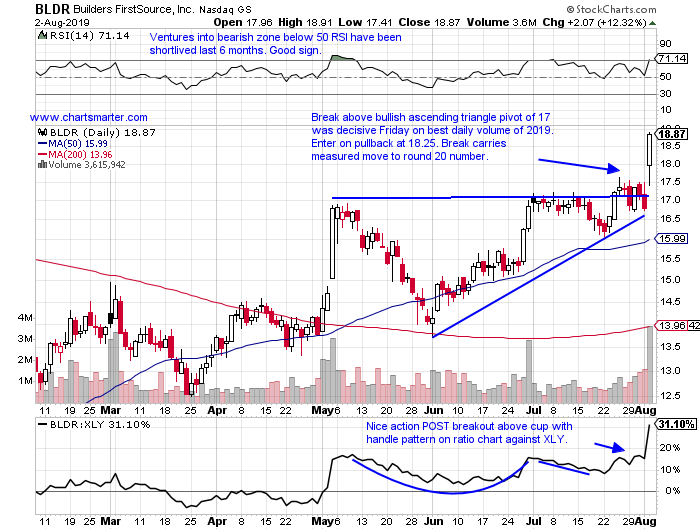

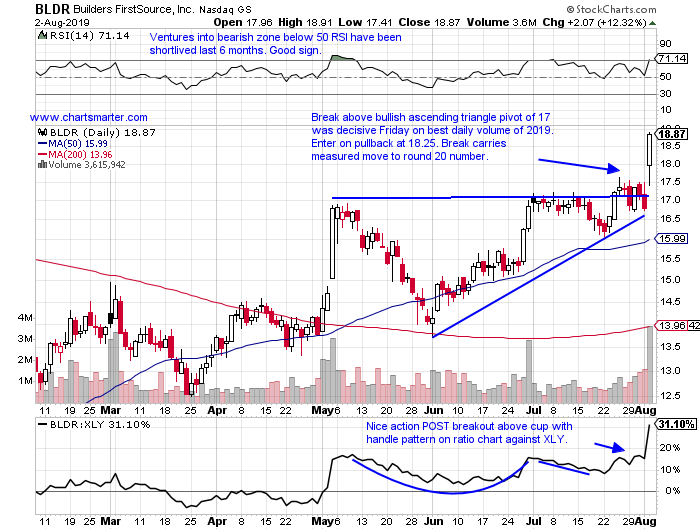

- Building and fixtures leader higher by 73% YTD and 7% over last one year period.

- Rose 8.8% this week, and higher 19 of the last 32 since bouncing off round 10 number week ending 12/28/18.

- FOUR consecutive positive earnings reactions higher by 12.3, 14.1, .7 and 11.5% on 8/2, 5/3, 3/1 and 11/2/18.

- Enter on pullback into bullish ascending triangle breakout at 18.25. Break carries measured move to 20.

- Entry BLDR 18.25. Stop 16.75.

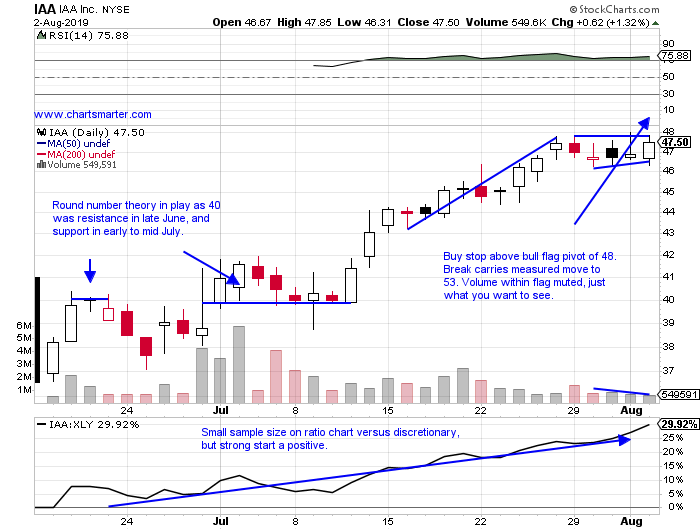

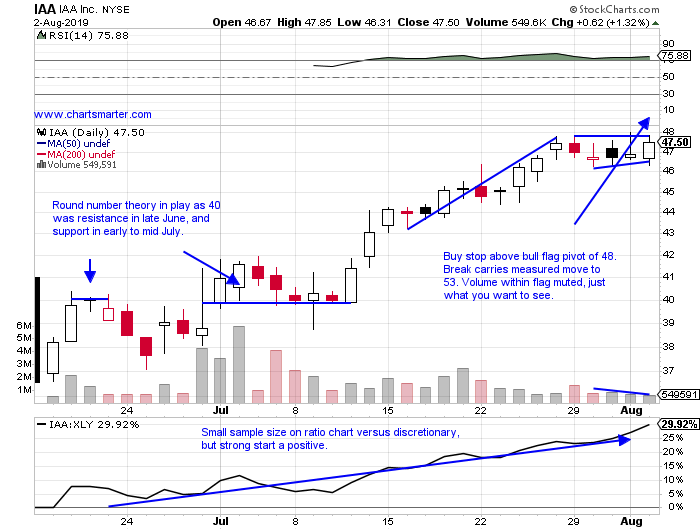

- Recent spinoff from KAR trading remarkably tight for a name that just started trading. Just 1% off recent highs.

- Current 6 week winning streak, including strong combined run of 16.5% during 3 weeks ending between 7/12-26.

- Gained a fractional .1% this week, demonstrating great relative strength as XLY FELL 4.4%.

- Enter with buy stop above bull flag pivot of 48. Break carries measured move to 53.

- Entry IAA 48. Stop 46.50.

Good luck.

Entry summaries:

Buy on gap fill KO 51.75. Stop 49.50.

Buy pullback into bullish ascending triangle breakout BLDR 18.25. Stop 16.75.

Buy stop above bull flag IAA 48. Stop 46.50.

This article requires a Chartsmarter membership. Please click here to join.

Generals Retreat:

- The discretionary group recorded the worst weekly return this week of the 11 major S&P sectors, falling 4.4%, and easily the XLY's worst weekly loss of 2019 thus far. Of course the 800lb gorilla in the ETF AMZN, at more than 22% of the fund, extended its weekly losing streak to three, with all 3 CLOSING right at the lows for the weekly range. It is on a 7 session losing streak, and volume has been elevated during the 200 handle downturn. Many other names experienced tough weeks, most notably UAA, which fell more than 20%. ETSY slumped almost 16%, and former leaders BBY and FIVE dropped 11.9 and 10.1% respectively. When the retail generals expose weakness, that is a poor sign going forward. TGT undercut its 50 day SMA on 8/1 in bulging volume, and the bullseye is on this space. Keep in mind the consumer makes up 2/3rds of the economy, so perhaps we will look back at this week as a canary in the coal mine.

Nothing Casual About These Diners:

- There were few places to hide this week, but investors were not reluctant to put money to work in safe, casual diners. At least MCD and YUM, are considered more stable, mature names, but CMG has seen a very robust run doubling since the late December lows. MCD has traveled on a much different path grinding gradually higher advancing 20 of the last 25 weeks, and the last three CLOSED very taut all within just 1.71 of each other (that type of coiling action usually resolves itself in powerful moves, continuing in the prevailing direction). YUM has risen 9 of the last 10 weeks, and this week produced a strong 2.9% after a well received earnings report. Appetizing action for sure, pun intended.

Examples:

- If markets will take a more defensive posture, investors may look to deploy capital to more conservative names. Staple names that have displayed nice earnings reactions include PG which jumped 3.8% this past Tuesday (and has now filled in that earnings gap). Below is the chart of another name CPB, and how it appeared in our 7/31 Consumer Note. This week as the benchmarks were rattled, the stock put up a respectable 3.4% weekly gain up 4 of the 5 sessions this week. It has been trading taut and is now a few percentage points away from an add on 43.76 cup base pivot.

Special Situations:

- Soft drink play higher by 11% YTD and 13% over last one year period. Dividend yield of 3.1%.

- Higher 16 of the last 24 weeks (7 of losing weeks fell less than 1.5%). Fell 3.4% this week in less volume, that the prior week which jumped 5.4%.

- Four of last five earnings reactions higher by 6.1, 1.7, 2.5 and 1.8% on 7/23, 4/23, 10/30 and 7/25/18.

- Enter on gap fill, and touch of upward sloping 50 day SMA at 51.75.

- Entry KO 51.75. Stop 49.50.

- Building and fixtures leader higher by 73% YTD and 7% over last one year period.

- Rose 8.8% this week, and higher 19 of the last 32 since bouncing off round 10 number week ending 12/28/18.

- FOUR consecutive positive earnings reactions higher by 12.3, 14.1, .7 and 11.5% on 8/2, 5/3, 3/1 and 11/2/18.

- Enter on pullback into bullish ascending triangle breakout at 18.25. Break carries measured move to 20.

- Entry BLDR 18.25. Stop 16.75.

- Recent spinoff from KAR trading remarkably tight for a name that just started trading. Just 1% off recent highs.

- Current 6 week winning streak, including strong combined run of 16.5% during 3 weeks ending between 7/12-26.

- Gained a fractional .1% this week, demonstrating great relative strength as XLY FELL 4.4%.

- Enter with buy stop above bull flag pivot of 48. Break carries measured move to 53.

- Entry IAA 48. Stop 46.50.

Good luck.

Entry summaries:

Buy on gap fill KO 51.75. Stop 49.50.

Buy pullback into bullish ascending triangle breakout BLDR 18.25. Stop 16.75.

Buy stop above bull flag IAA 48. Stop 46.50.