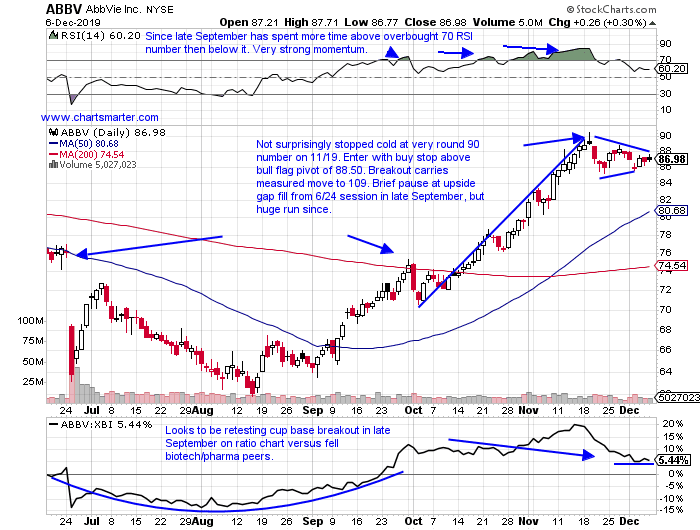

It is no secret healthcare ended 2019 on a strong note. Trends in motion tend to stay that way. Below we have a look at the chart of ABBV, and how it appeared in our 12/9 Healthcare Note. This name could potentially be a big mover in 2020.

- Pharma play lower by 6% YTD and 4% over last one year period. Dividend yield of 5.4%.

- Higher 10 of last 14 weeks, and 3 of 4 decliners lost less than 1.5%. Could potentially be building right side of WEEKLY cup base that began back in January '18.

- Three straight mild positive earnings reactions, for pharma/biotech play, up 2.8, 1.6 and .8% on 11/1, 7/26 and 4/25.

- Enter with buy stop above bull flag. Breakout carries measured move to 109.

- Entry ABBV 88.50. Stop 85.75.

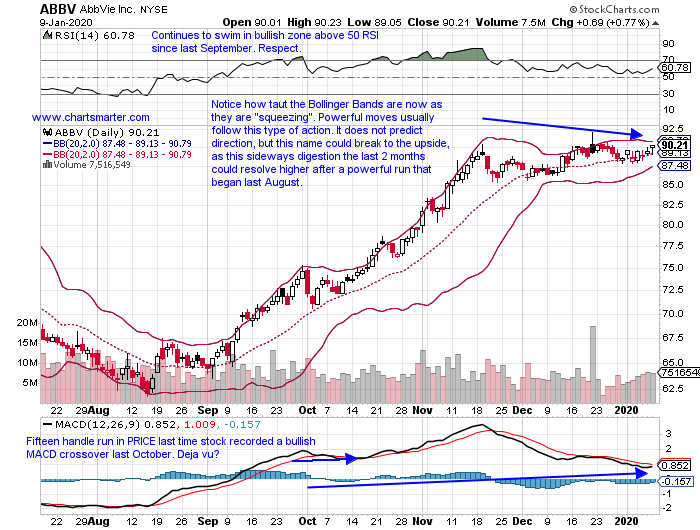

- Here is a present look at the stock, which has moved higher modestly since the chart above. Thursday was just the third CLOSE above the very round 90 number, although eleven were above intraday since 11/19/19. The last 3 weeks CLOSED very taut within just .59 of each other, and this tends to lead to explosive moves IF a breakout occurs (hence the Bollinger Band Squeeze). It is looking for its first WEEKLY CLOSE above 90 since the week ending 12/28/18. Stay long and add above 92.

If you enjoyed what you read why not visit www.chartsmarter.com.

This article requires a Chartsmarter membership. Please click here to join.

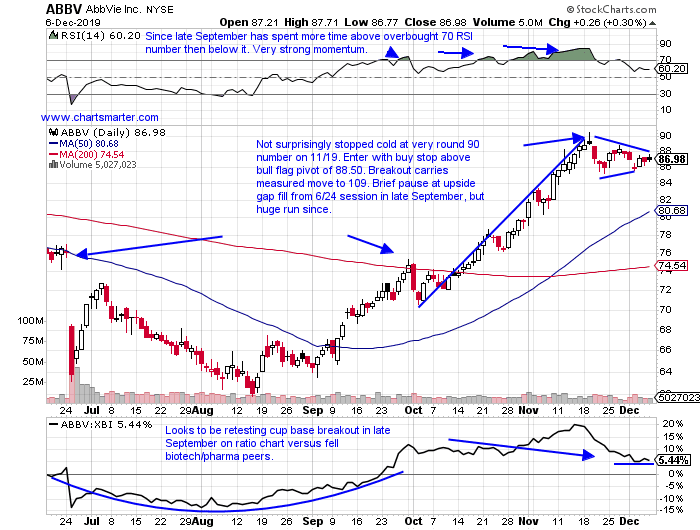

It is no secret healthcare ended 2019 on a strong note. Trends in motion tend to stay that way. Below we have a look at the chart of ABBV, and how it appeared in our 12/9 Healthcare Note. This name could potentially be a big mover in 2020.

- Pharma play lower by 6% YTD and 4% over last one year period. Dividend yield of 5.4%.

- Higher 10 of last 14 weeks, and 3 of 4 decliners lost less than 1.5%. Could potentially be building right side of WEEKLY cup base that began back in January '18.

- Three straight mild positive earnings reactions, for pharma/biotech play, up 2.8, 1.6 and .8% on 11/1, 7/26 and 4/25.

- Enter with buy stop above bull flag. Breakout carries measured move to 109.

- Entry ABBV 88.50. Stop 85.75.

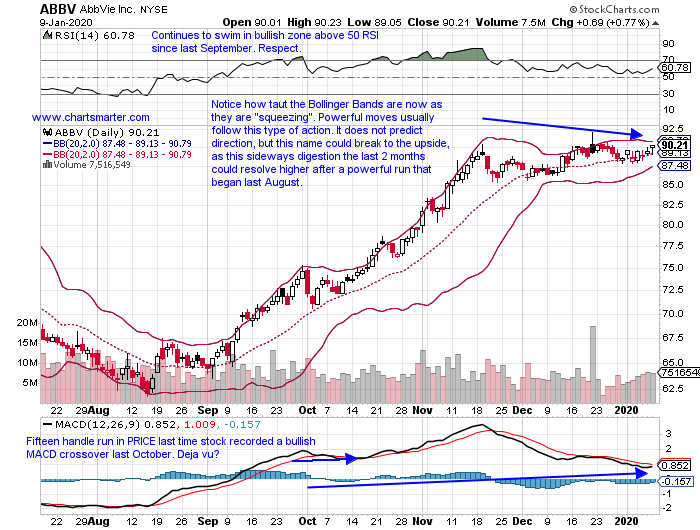

- Here is a present look at the stock, which has moved higher modestly since the chart above. Thursday was just the third CLOSE above the very round 90 number, although eleven were above intraday since 11/19/19. The last 3 weeks CLOSED very taut within just .59 of each other, and this tends to lead to explosive moves IF a breakout occurs (hence the Bollinger Band Squeeze). It is looking for its first WEEKLY CLOSE above 90 since the week ending 12/28/18. Stay long and add above 92.

If you enjoyed what you read why not visit www.chartsmarter.com.