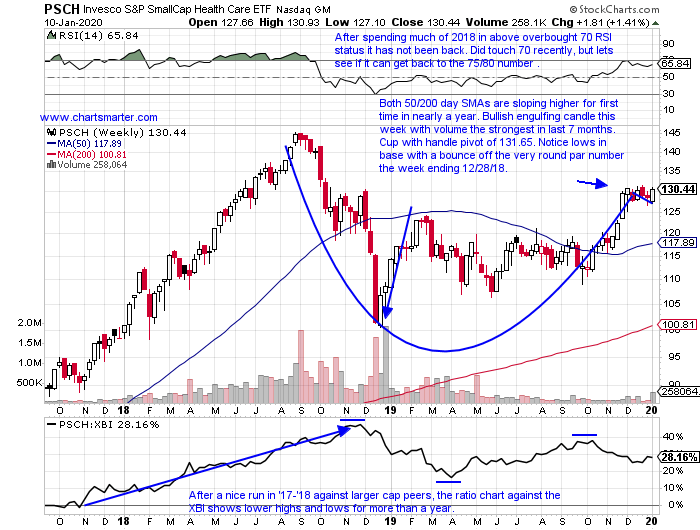

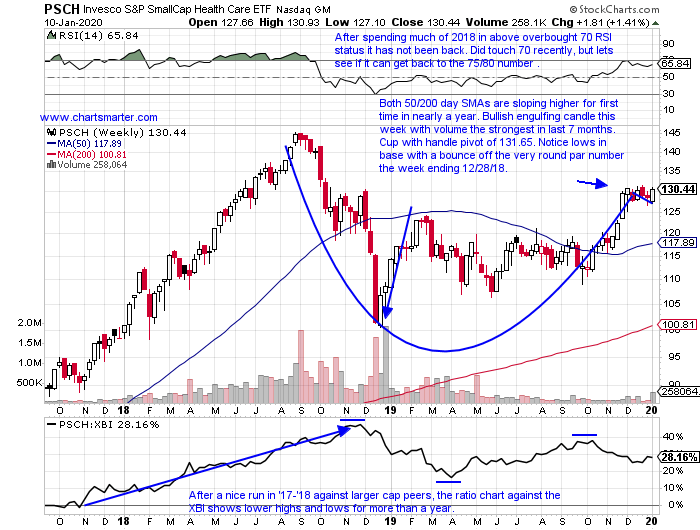

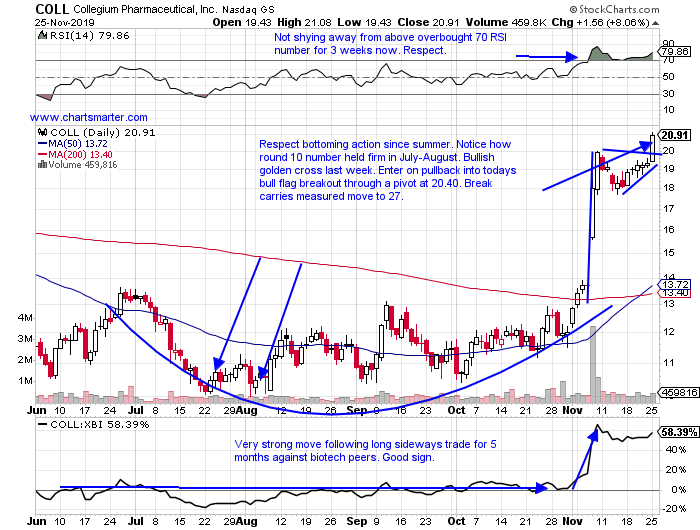

The small cap biotech names are trying to keep pace with their larger peers. The PSCH is less than 1% from a good looking WEEKLY cup with handle pivot of 131.65 in a base that began in August '18. There are plenty of examples of strong stocks within the group, and today we take a look at Collegium Pharmaceuticals. In this post we will look at how one can buy, and add to a leader on the way UP, in both the past and present.

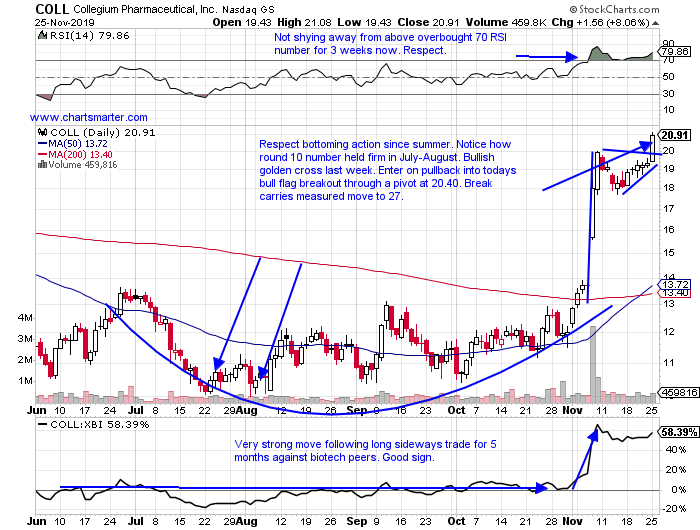

- Biotech play higher by 22% YTD and 14% over last one year period.

- Just 1% off most recent 52 week highs, and digesting a doubling since early August as it trades between very round 10-20 numbers. Todays break above 2o which was resistance last December could be powerful.

- FOUR consecutive positive earnings reactions, higher by 31.4, 5, 5 and 21.7% on 11/7, 8/8, 5/9 and 2/28 inspire confidence.

- Enter on pullback into breakout above bull flag. Break carries measured move to 27.

- Entry COLL 20.40. Stop 18.

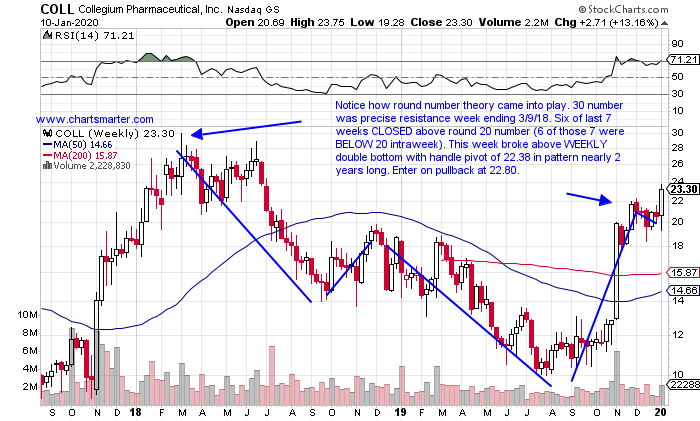

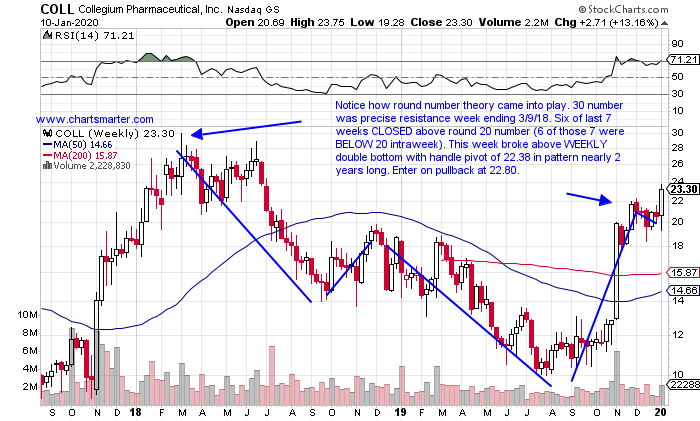

- Taking a present look at COLL in its WEEKLY chart, one can see the excellent relative strength jumping more than 13%. It is the stocks THIRD double digit weekly advance since last November, including the 55% explosion higher the week ending 11/8/19 in the strongest weekly volume in 18 months. The round 20 number has held very firm recently, and volume trends are very bullish with the last week of distribution coming the week ending 1/11/19, exactly one year ago. The round 30 number which was resistance not only in March '18, but dating back also to December '15 is the target going forward in the near term.

If you liked what you read why not visit www.chartsmarter.com

The small cap biotech names are trying to keep pace with their larger peers. The PSCH is less than 1% from a good looking WEEKLY cup with handle pivot of 131.65 in a base that began in August '18. There are plenty of examples of strong stocks within the group, and today we take a look at Collegium Pharmaceuticals. In this post we will look at how one can buy, and add to a leader on the way UP, in both the past and present.

- Biotech play higher by 22% YTD and 14% over last one year period.

- Just 1% off most recent 52 week highs, and digesting a doubling since early August as it trades between very round 10-20 numbers. Todays break above 2o which was resistance last December could be powerful.

- FOUR consecutive positive earnings reactions, higher by 31.4, 5, 5 and 21.7% on 11/7, 8/8, 5/9 and 2/28 inspire confidence.

- Enter on pullback into breakout above bull flag. Break carries measured move to 27.

- Entry COLL 20.40. Stop 18.

- Taking a present look at COLL in its WEEKLY chart, one can see the excellent relative strength jumping more than 13%. It is the stocks THIRD double digit weekly advance since last November, including the 55% explosion higher the week ending 11/8/19 in the strongest weekly volume in 18 months. The round 20 number has held very firm recently, and volume trends are very bullish with the last week of distribution coming the week ending 1/11/19, exactly one year ago. The round 30 number which was resistance not only in March '18, but dating back also to December '15 is the target going forward in the near term.

If you liked what you read why not visit www.chartsmarter.com