Dog No Longer?

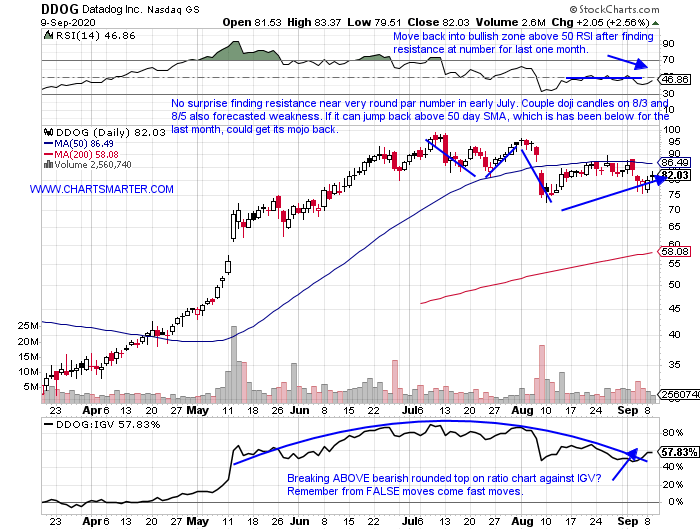

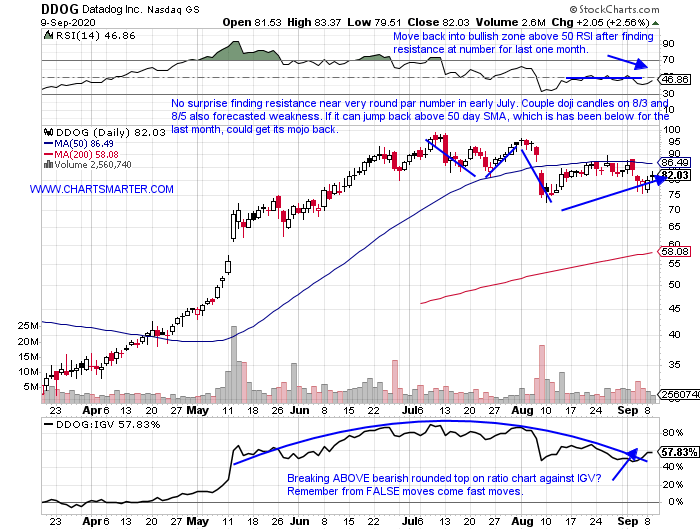

- The software group has been a very robust performer within a very dominant technology group in 2020. The IGV has advanced more than 30% YTD as the ETF attempts to keep its altitude above the very round 300 number. Within the fund there has been some gems, and some that failed to keep pace with the white hot group (software is being bested by just computer hardware inside technology with strong showings from AAPL ROKU and DELL, yes that last symbol is not a typo). Below is the chart of a prior best in breed name, trying to recapture that status in DDOG. It has been struggling since it reacted in poor fashion after its latest earnings report. It trades 17% off most recent 52 week highs, and I am a buyer of strength, but if this name can gather some steam and CLOSE above the 50 day SMA a nice double bottom pattern comes into focus. The last 4 days have CLOSED in the upper half of its daily range, and Monday recorded a bullish engulfing candle that traded into the bullish harami from 8/10. This name warrants a long look.

New Software Darling?

- The have been no shortage of new issues in the software space as investment banks take advantage and try and shove supply down potential shareholders throats. Some examples that have come public somewhat recently, in the last 2 years, include ESTC which as of today is back above a 99.26 double bottom breakout pivot originally taken out on 8/10 (notice nice recent support at rising 50 day SMA for the first time since the breakout, often an ideal entry point). SAIL trades just 7% off most recent highs, as it was recently rebutted at the round 40 number. FVRR is just 6% off its most recent yearly peak, and displayed good support near the very round par number, which was also in the vicinity of a gap fill from the 8/4 session. Below is another name that could soon be spoken about in possible best of breed terms, in KC. It still trades 26% off most recent highs, but is digesting a powerful 7 week winning streak weeks ending between 5/29-7/10 which traveled from the high teens to low 40s. Keep this name on your watch list.

Recent Examples:

- Around important moving averages many stops will be placed, and trading can become hectic when the line is tested. If a leader can maintain a close distance from the line, and do so in somewhat muted fashion it could provide a good buying opportunity. Below could be a good example of that with the chart of FSLY, and how it appeared in our 9/8 Technology Note. The stock is still trading 29% off most recent 52 week highs, but on 9/4 it recorded a strong reversal, the last day on the chart below, registering a doji candle in the process. They are adept at forecasting changes in the prevailing trend, and with FSLY it was a 50 handle decline from the 8/5 session alone. One can also see how round number theory came into play with a roadblock at the very round par figure in late August. The stock is now about 4% below that 50 day SMA, and a move above would be very bullish for the former leader.

Special Situations:

- Semiconductor play higher by 28% YTD and 16% over last one year period.

- Since March lows to recent highs climbed 187.6% top to bottom of range. Has not recorded back to back WEEKLY losses in 6 months. Decent risk/reward trading 12% off most recent 52 week highs.

- Last earnings reaction strong up 13.1% on 8/7, but prior three all fell by 1.1, 14.7 and 5.8% on 5/8, 2/21 and 10/25/19.

- Enter on recent successful retest of rising 50 day SMA for first time since recent breakout.

- Entry FSLR here. Stop 67.

- Social media play higher by 45% YTD and 55% over last one year period.

- Still 11% off most recent 52 week highs, but looking for 3 week winning streak. Most impressive is this weeks strength up 5.4%, after prior 2 rose by a combined 4%.

- Earnings mostly lower with losses of 6.2, 14.7 and 5.9% on 7/22, 2/5 and 10/23/19 (rose 36.7% on 4/22).

- Enter after recent break back above 50 day SMA.

- Entry SNAP here. Stop 22.25.

- Computer hardware play lower by 4% YTD and up 4% over last one year period. Dividend yield of 3.6%.

- Good relative strength this week up 2.4% already, while the Nasdaq is lower by just more than 1.5% so far. Digesting strong WEEKLY gain of 8.9% week ending 8/28.

- Earnings reactions mostly lower down 12.3, 1.3 and 5.9% on 5/28, 11/27 and 8/23/19 (gained 5.7, 6.1% on 8/28 and 2/25).

- Enter with break above very round number.

- Entry HPQ 20.25. Stop 19.

Good luck.

Entry summaries:

Buy initial retest of rising 50 day SMA following recent breakout FSLR here. Stop 67.

Buy after recent break above 50 day SMA SNAP here. Stop 22.25.

Buy break above very round number/bull flag HPQ 20.25. Stop 19.

This article requires a Chartsmarter membership. Please click here to join.

Dog No Longer?

- The software group has been a very robust performer within a very dominant technology group in 2020. The IGV has advanced more than 30% YTD as the ETF attempts to keep its altitude above the very round 300 number. Within the fund there has been some gems, and some that failed to keep pace with the white hot group (software is being bested by just computer hardware inside technology with strong showings from AAPL ROKU and DELL, yes that last symbol is not a typo). Below is the chart of a prior best in breed name, trying to recapture that status in DDOG. It has been struggling since it reacted in poor fashion after its latest earnings report. It trades 17% off most recent 52 week highs, and I am a buyer of strength, but if this name can gather some steam and CLOSE above the 50 day SMA a nice double bottom pattern comes into focus. The last 4 days have CLOSED in the upper half of its daily range, and Monday recorded a bullish engulfing candle that traded into the bullish harami from 8/10. This name warrants a long look.

New Software Darling?

- The have been no shortage of new issues in the software space as investment banks take advantage and try and shove supply down potential shareholders throats. Some examples that have come public somewhat recently, in the last 2 years, include ESTC which as of today is back above a 99.26 double bottom breakout pivot originally taken out on 8/10 (notice nice recent support at rising 50 day SMA for the first time since the breakout, often an ideal entry point). SAIL trades just 7% off most recent highs, as it was recently rebutted at the round 40 number. FVRR is just 6% off its most recent yearly peak, and displayed good support near the very round par number, which was also in the vicinity of a gap fill from the 8/4 session. Below is another name that could soon be spoken about in possible best of breed terms, in KC. It still trades 26% off most recent highs, but is digesting a powerful 7 week winning streak weeks ending between 5/29-7/10 which traveled from the high teens to low 40s. Keep this name on your watch list.

Recent Examples:

- Around important moving averages many stops will be placed, and trading can become hectic when the line is tested. If a leader can maintain a close distance from the line, and do so in somewhat muted fashion it could provide a good buying opportunity. Below could be a good example of that with the chart of FSLY, and how it appeared in our 9/8 Technology Note. The stock is still trading 29% off most recent 52 week highs, but on 9/4 it recorded a strong reversal, the last day on the chart below, registering a doji candle in the process. They are adept at forecasting changes in the prevailing trend, and with FSLY it was a 50 handle decline from the 8/5 session alone. One can also see how round number theory came into play with a roadblock at the very round par figure in late August. The stock is now about 4% below that 50 day SMA, and a move above would be very bullish for the former leader.

Special Situations:

- Semiconductor play higher by 28% YTD and 16% over last one year period.

- Since March lows to recent highs climbed 187.6% top to bottom of range. Has not recorded back to back WEEKLY losses in 6 months. Decent risk/reward trading 12% off most recent 52 week highs.

- Last earnings reaction strong up 13.1% on 8/7, but prior three all fell by 1.1, 14.7 and 5.8% on 5/8, 2/21 and 10/25/19.

- Enter on recent successful retest of rising 50 day SMA for first time since recent breakout.

- Entry FSLR here. Stop 67.

- Social media play higher by 45% YTD and 55% over last one year period.

- Still 11% off most recent 52 week highs, but looking for 3 week winning streak. Most impressive is this weeks strength up 5.4%, after prior 2 rose by a combined 4%.

- Earnings mostly lower with losses of 6.2, 14.7 and 5.9% on 7/22, 2/5 and 10/23/19 (rose 36.7% on 4/22).

- Enter after recent break back above 50 day SMA.

- Entry SNAP here. Stop 22.25.

- Computer hardware play lower by 4% YTD and up 4% over last one year period. Dividend yield of 3.6%.

- Good relative strength this week up 2.4% already, while the Nasdaq is lower by just more than 1.5% so far. Digesting strong WEEKLY gain of 8.9% week ending 8/28.

- Earnings reactions mostly lower down 12.3, 1.3 and 5.9% on 5/28, 11/27 and 8/23/19 (gained 5.7, 6.1% on 8/28 and 2/25).

- Enter with break above very round number.

- Entry HPQ 20.25. Stop 19.

Good luck.

Entry summaries:

Buy initial retest of rising 50 day SMA following recent breakout FSLR here. Stop 67.

Buy after recent break above 50 day SMA SNAP here. Stop 22.25.

Buy break above very round number/bull flag HPQ 20.25. Stop 19.