Speed Bump?

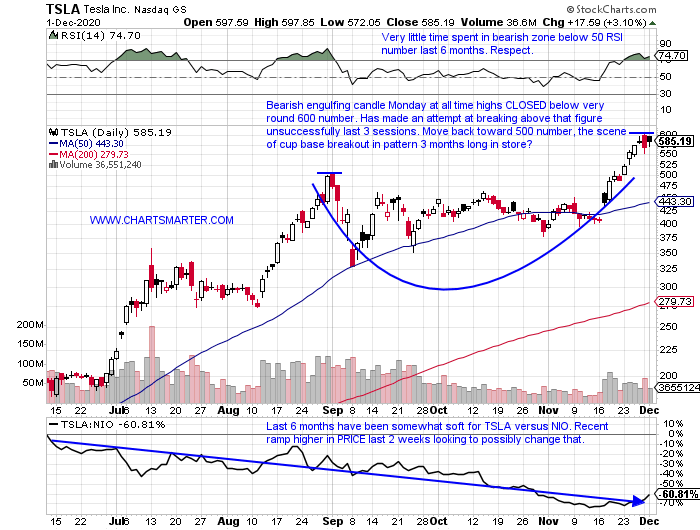

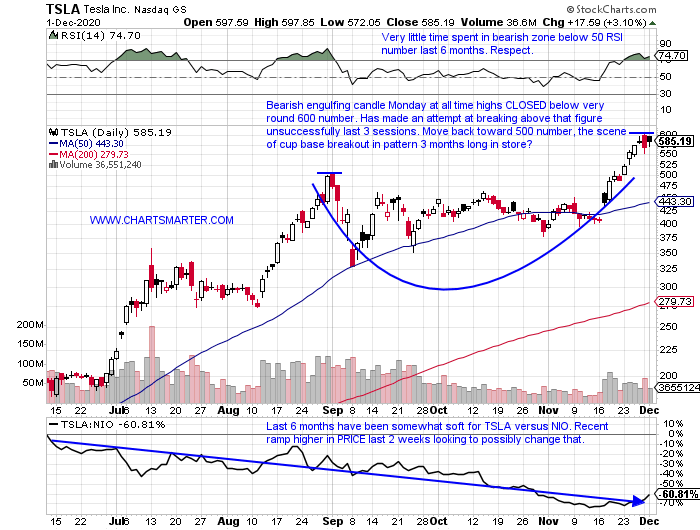

- I am well aware that the Tesla cult, thinks the company is much more deserving of being put in the automobile group, but it is what it is. That puts it in the consumer discretionary space too, and the automobiles to be honest have become a bit sexy again, with the exception of NKLA. GM is firing on all cylinders, F is approaching the very round 10 number, TTM has acted well POST breakout from a cup with handle pivot of 10.49 taken out on 11/19. In Japan TM and HMC are holding their own, and RACE and FCAU in Europe are on the ascent. But TSLA is without question the big daddy of them all, and the question is, will the very round 600 number be a temporary roadblock? Or will it be a nemesis in the short term? There has been a lot of anticipation of its inclusion into the S&P 500 later this month, which has undoubtedly assisted its rise. Will the last 2 WEEKLY gains of 20%, need a responsible pause, or is the stock idling before yet another powerful jump? A couple consecutive CLOSES above 600 would give the bulls all the ammunition it needs.

Consumer Thirst:

- The energy drink and carbonated group is a very large one, with plenty of room for multiple adversaries to prosper. There is Monster which trades just 2% from all time highs. KDP is on a four week winning streak up by a combined 14%, as it battles with the round 30 number which has hampered in a bit in recent years. SAM in the alcohol space which has seltzer, made a rare move below its 50 day SMA recently, and todays move back above the important line can be bought. A smaller player in the arena, and perhaps an opportunity as it is under followed, is the chart below of FIZZ. It is higher by more than 90% YTD, and is setting up a bull flag right in conjunction with the very round par figure. Before a recent fall after an earnings release on 9/10, it produced three straight gains of .9, 6.9 and 12.1% on 7/2, 3/6 and 12/6/19. This name could get very bubbly with a move and CLOSE above 100, pun intended.

Recent Examples:

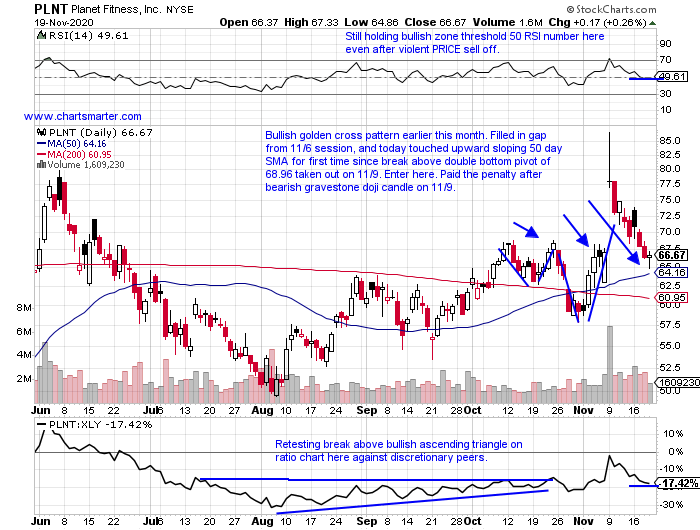

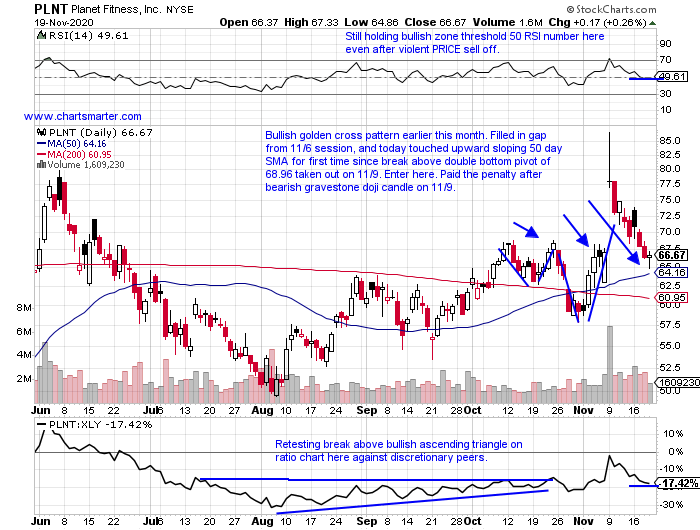

- The reopening trade has been acting well with vaccine news that comes now on a WEEKLY basis. For example 2 of the last 3 weeks NCLH has recorded 18% advances. The JETS ETF is looking for a 5 week winning streak, which if it occurs would be its first in 13 months. Below is that chart of another leisure play with PLNT, and how it appeared in our 11/20 Consumer Note. We admired the name after it filled in a gap fill from the 11/6 session, found support at its rising 50 day SMA, and recorded a bullish harami on 11/19. Last week it gained 9%, and this week is following through modestly adding almost another 4% thus far. Its last earnings reaction on 11/9 rose 16%, but CLOSED 10% off intraday highs recording a bearish gravestone doji candle. Currently it trades 16% off most recent 52 week highs, and investors who are long can move up there stop with a CLOSE below the round 70 figure.

Special Situations:

- Specialized consumer services play higher by 250% YTD and 257% over last one year period.

- Now 6% off most recent 52 week highs, and higher 3 of the last 5 weeks, ALL 5 with double digit returns. Last 2 alone advanced by a combined 27%.

- Earnings mostly lower with losses of 5.2, 3.6, 2.1 and 15.7% on 10/29, 8/6, 5/7 and 10/31/19 (rose 14.3% on 2/27).

- Enter on pullback into recent break above double bottom pattern.

- Entry ETSY 151. Stop 144.

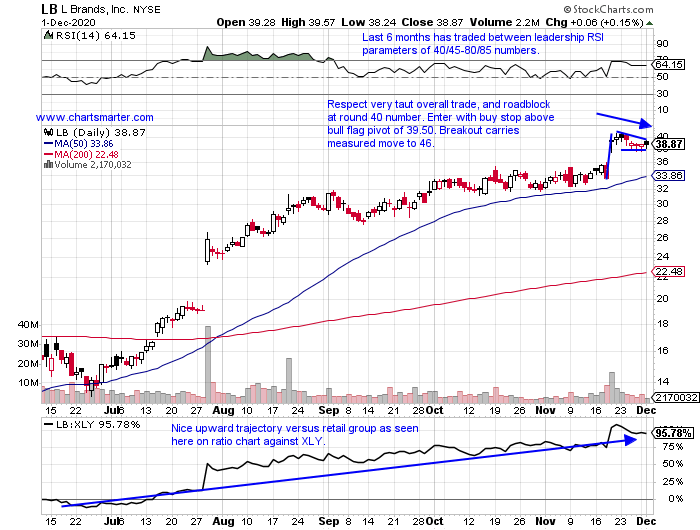

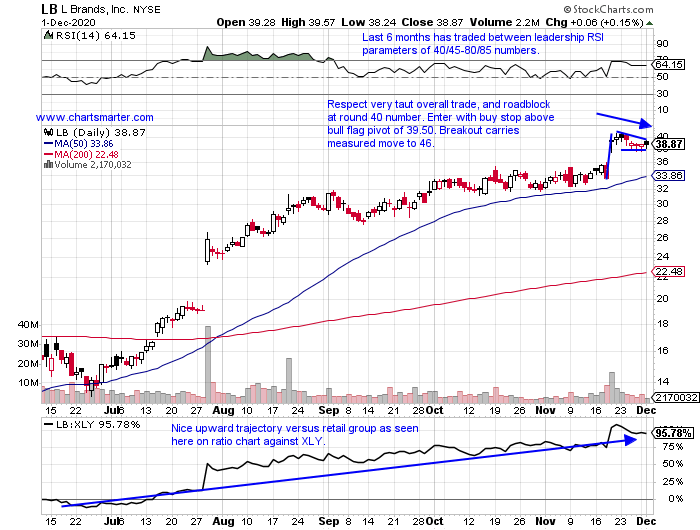

- Apparel retail play higher by 114% YTD and 103% over last one year period.

- Now 6% off most recent 52 week highs, and last week fell 2.8%, acceptable as the prior three rose by a combined 23%. Traded with an 8 handle this spring.

- FOUR straight positive earnings reactions up 17.7, 3.9, 18.2 and 1.2% on 11/19, 8/20, 5/21 and 2/27.

- Enter with buy stop above bull flag formation.

- Entry LB 39.50. Stop 37.50.

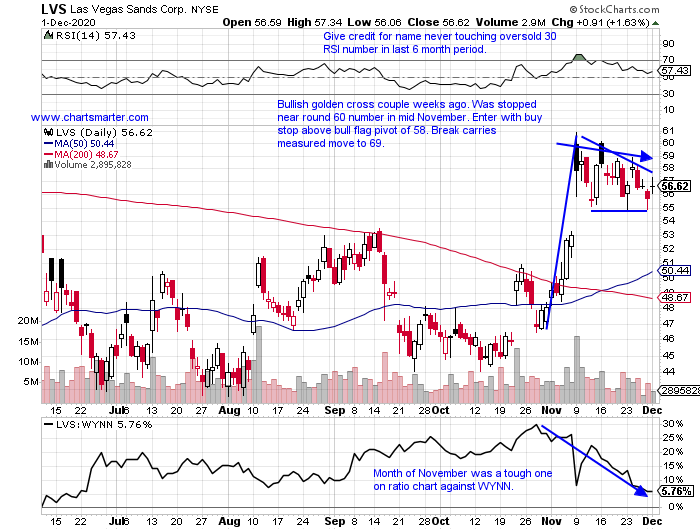

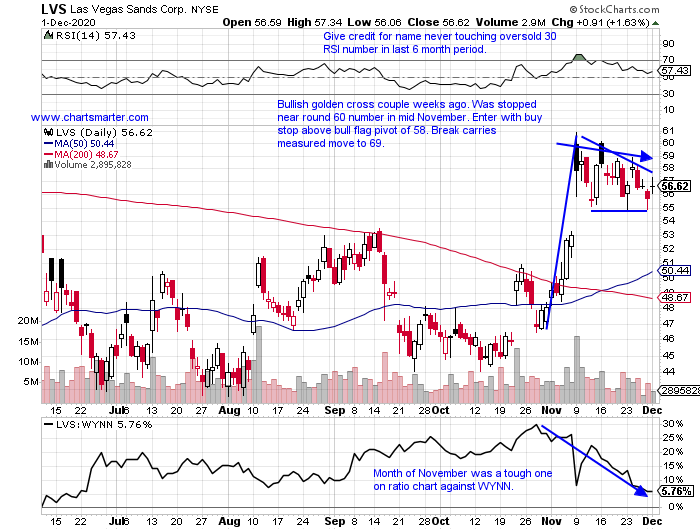

- Gaming play lower. by 18% YTD and 9% over last one year period.

- Still 24% off most recent 52 week highs, even with back to back 10% WEEKLY gainers the weeks ending 11/6 and 11/13 (rose 11.7% too week ending 10/23).

- Earnings mostly higher with gains of 8.4, 12, 2.3 and 3.3% on 10/22, 4/23, 1/30 and 10/24/19 (fell 4.2% on 7/23).

- Enter with buy stop above bull flag formation.

- Entry LVS 58. Stop 55.

Good luck.

Entry summaries:

Buy pullback into recent double bottom breakout ETSY 151. Stop 144.

Buy stop above bull flag LB 39.50. Stop 37.50.

Buy stop above bull flag LVS 58. Stop 55.

This article requires a Chartsmarter membership. Please click here to join.

Speed Bump?

- I am well aware that the Tesla cult, thinks the company is much more deserving of being put in the automobile group, but it is what it is. That puts it in the consumer discretionary space too, and the automobiles to be honest have become a bit sexy again, with the exception of NKLA. GM is firing on all cylinders, F is approaching the very round 10 number, TTM has acted well POST breakout from a cup with handle pivot of 10.49 taken out on 11/19. In Japan TM and HMC are holding their own, and RACE and FCAU in Europe are on the ascent. But TSLA is without question the big daddy of them all, and the question is, will the very round 600 number be a temporary roadblock? Or will it be a nemesis in the short term? There has been a lot of anticipation of its inclusion into the S&P 500 later this month, which has undoubtedly assisted its rise. Will the last 2 WEEKLY gains of 20%, need a responsible pause, or is the stock idling before yet another powerful jump? A couple consecutive CLOSES above 600 would give the bulls all the ammunition it needs.

Consumer Thirst:

- The energy drink and carbonated group is a very large one, with plenty of room for multiple adversaries to prosper. There is Monster which trades just 2% from all time highs. KDP is on a four week winning streak up by a combined 14%, as it battles with the round 30 number which has hampered in a bit in recent years. SAM in the alcohol space which has seltzer, made a rare move below its 50 day SMA recently, and todays move back above the important line can be bought. A smaller player in the arena, and perhaps an opportunity as it is under followed, is the chart below of FIZZ. It is higher by more than 90% YTD, and is setting up a bull flag right in conjunction with the very round par figure. Before a recent fall after an earnings release on 9/10, it produced three straight gains of .9, 6.9 and 12.1% on 7/2, 3/6 and 12/6/19. This name could get very bubbly with a move and CLOSE above 100, pun intended.

Recent Examples:

- The reopening trade has been acting well with vaccine news that comes now on a WEEKLY basis. For example 2 of the last 3 weeks NCLH has recorded 18% advances. The JETS ETF is looking for a 5 week winning streak, which if it occurs would be its first in 13 months. Below is that chart of another leisure play with PLNT, and how it appeared in our 11/20 Consumer Note. We admired the name after it filled in a gap fill from the 11/6 session, found support at its rising 50 day SMA, and recorded a bullish harami on 11/19. Last week it gained 9%, and this week is following through modestly adding almost another 4% thus far. Its last earnings reaction on 11/9 rose 16%, but CLOSED 10% off intraday highs recording a bearish gravestone doji candle. Currently it trades 16% off most recent 52 week highs, and investors who are long can move up there stop with a CLOSE below the round 70 figure.

Special Situations:

- Specialized consumer services play higher by 250% YTD and 257% over last one year period.

- Now 6% off most recent 52 week highs, and higher 3 of the last 5 weeks, ALL 5 with double digit returns. Last 2 alone advanced by a combined 27%.

- Earnings mostly lower with losses of 5.2, 3.6, 2.1 and 15.7% on 10/29, 8/6, 5/7 and 10/31/19 (rose 14.3% on 2/27).

- Enter on pullback into recent break above double bottom pattern.

- Entry ETSY 151. Stop 144.

- Apparel retail play higher by 114% YTD and 103% over last one year period.

- Now 6% off most recent 52 week highs, and last week fell 2.8%, acceptable as the prior three rose by a combined 23%. Traded with an 8 handle this spring.

- FOUR straight positive earnings reactions up 17.7, 3.9, 18.2 and 1.2% on 11/19, 8/20, 5/21 and 2/27.

- Enter with buy stop above bull flag formation.

- Entry LB 39.50. Stop 37.50.

- Gaming play lower. by 18% YTD and 9% over last one year period.

- Still 24% off most recent 52 week highs, even with back to back 10% WEEKLY gainers the weeks ending 11/6 and 11/13 (rose 11.7% too week ending 10/23).

- Earnings mostly higher with gains of 8.4, 12, 2.3 and 3.3% on 10/22, 4/23, 1/30 and 10/24/19 (fell 4.2% on 7/23).

- Enter with buy stop above bull flag formation.

- Entry LVS 58. Stop 55.

Good luck.

Entry summaries:

Buy pullback into recent double bottom breakout ETSY 151. Stop 144.

Buy stop above bull flag LB 39.50. Stop 37.50.

Buy stop above bull flag LVS 58. Stop 55.