Tops Form Briskly:

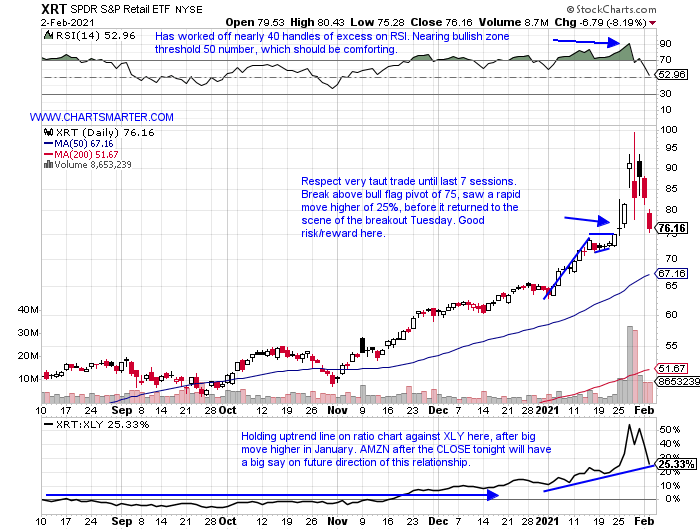

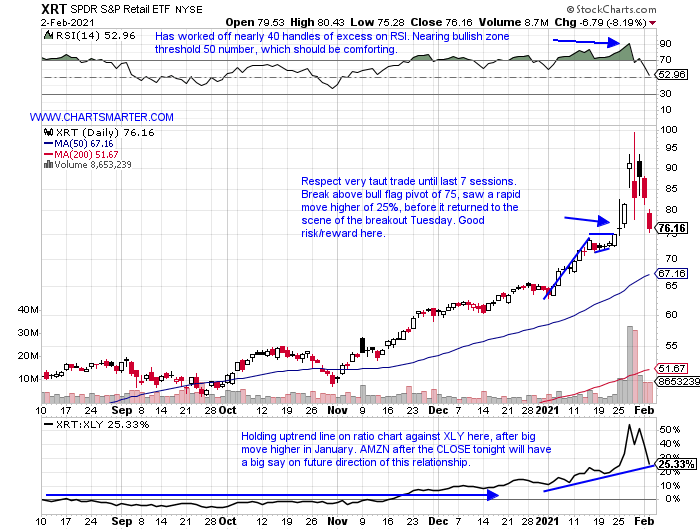

- I am not making an outlandish prediction here, but the old saying that bottoms take time and tops form in unsettled fashion, is often accurate. Case in point with the chart of XRT below. Now PRICE action supersedes all else and one has to be very impressed with the vault of 25% between the 4 sessions of 1/25-28. Round number theory did come into play here with a strong rejection at the very round par number on 1/28, CLOSING 18% off intraday highs. There is probably some decent opportunity here, to the long side, with the ETF as it retested the bull flag breakout at 75 almost precisely Tuesday, and it is now 23% off most recent 52 week highs. Looking at the top holdings in the XRT, GME as of today was near the 20% threshold, and is the reason the ETF PRICE action has been skewed. So if one believes that that fiasco is in the rear view window, instead of through the windshield, there should be some good opportunities within. Top ten holding BOOT looks good, if it can get its foot in the door above the round 60 number, pun intended.

Online Education Scenario:

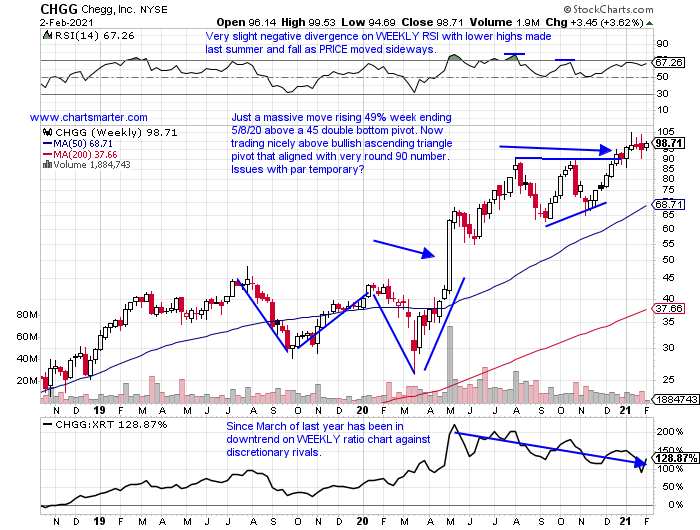

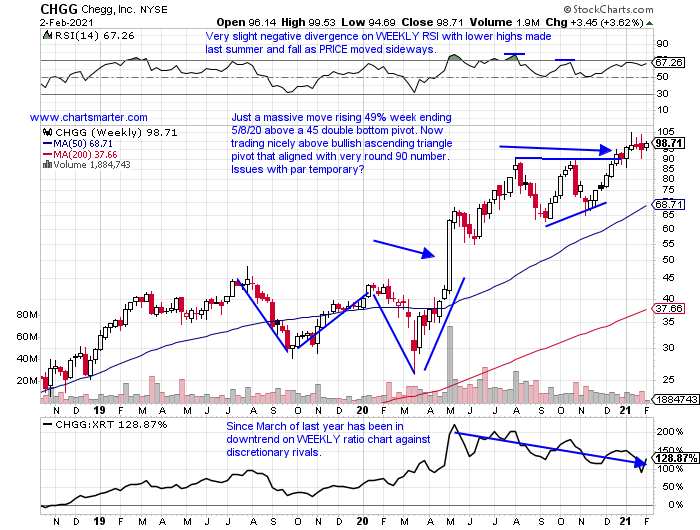

- If there was ever a play made for remote learning, perhaps it could be the chart of CHGG below. Truth be told it was behaving powerfully before the pandemic, and this best of breed name has to be given credit for its performance against its own specific peers too. Chegg has advanced well more than 100% over the last one year period, while LOPE has risen by just 12% over the same time frame (other rivals in STRA and LRN are in the 50% lower from their most recent 52 week highs neighborhood). The argument that CHGG could fall once things "return to normal" could be short sighted as it has demonstrated its ability to thrive in different environments. PRICE action, which is paramount to us, is trading in a tight range between the very round 90 and par figures. The last 3 weeks all traded intraweek well above 100, but finished with 97, 96 and 95 handles, and in the lower half of the WEEKLY range. Its longer term direction, through 100 or below 90, should be cleared up, after it REPORTS earnings next Monday after the close.

Recent Examples:

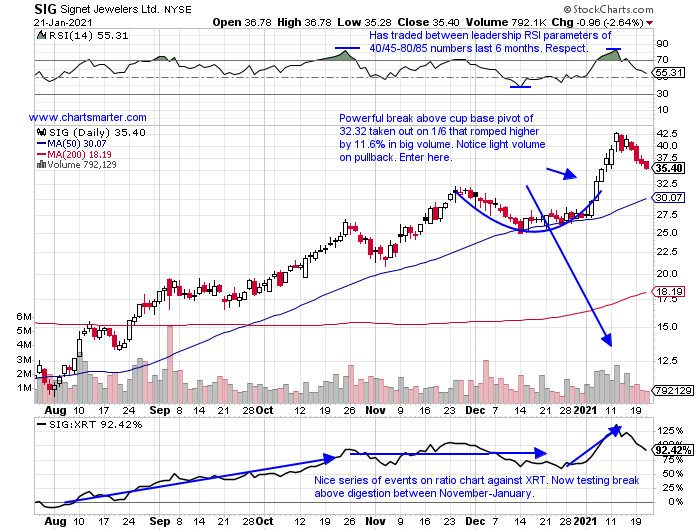

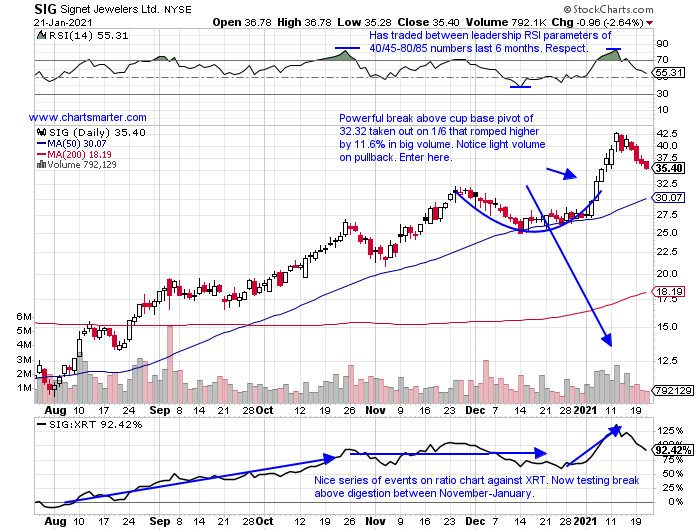

- Some consumer names have really excelled this year so far. Some just do their things, grinding higher gradually, in my opinion the "right way", as opposed to wild, volatile trade. For example M is higher by 20% YTD, although it is now 39% amount off that peak made on just 1/27. And of course the big elephants in the room in GME and AMC have reached the stratosphere, and have returned to earth. Below is a chart that just put its head down, and ignored the noise, and proceeded to make gains the old fashioned way. It is SIG, and how it appeared in our 1/22 Consumer Note. Now do not get me wrong, this name traded with a 5 handle late last spring, but for some time now has traded bullishly taut, and like most leaders often do, is giving one the chance to add on the way UP. It is not sporting a bull flag formation, and a break above 43, carries a measured move to 59.

Special Situations:

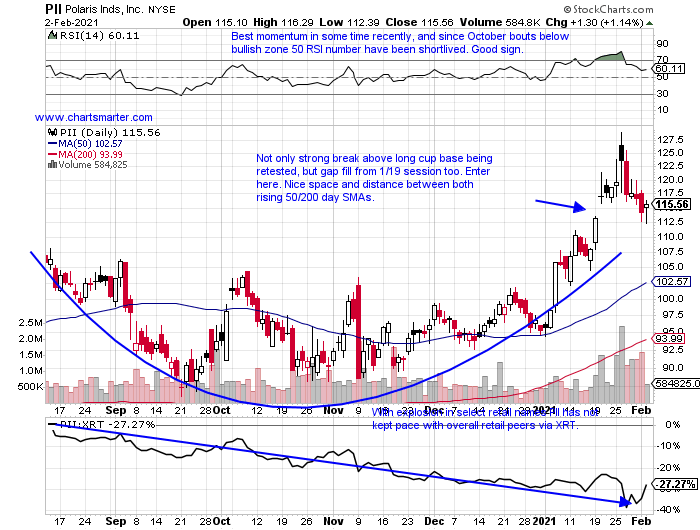

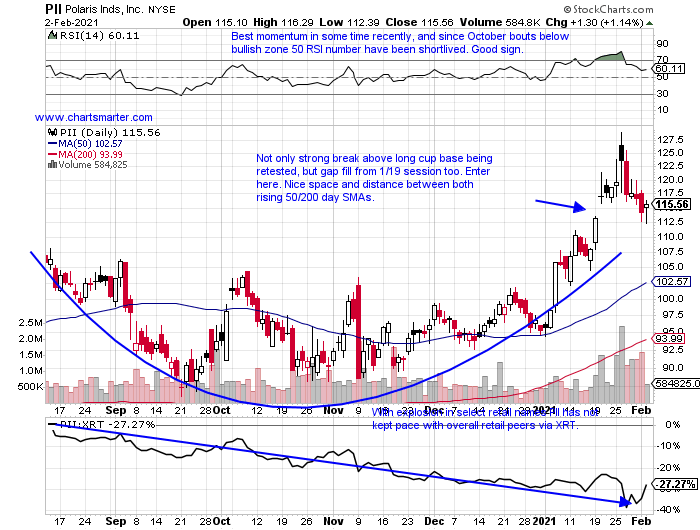

- Recreational vehicle play higher by 20% YTD and 24% over last one year period. Dividend yield of 2.2%.

- Name still 10% off most recent 52 week highs, and broke above 5 month WEEKLY cup base pivot of 110.40 the week ending 1/22 that rose 10%. Respect.

- FIVE straight positive earnings reactions up 3.5, .5, 7.4, 3.7 and 5.7% on 1/26, 10/27, 7/28, 4/28 and 1/28/20.

- Enter after recent gap fill.

- Entry PII here. Stop 107.

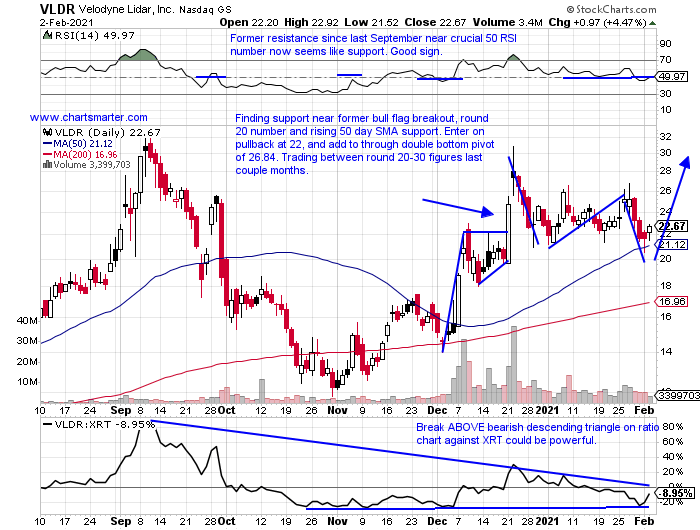

- Auto parts play down 3% YTD and higher by 122% over last one year period.

- Now 30% off most recent 52 week highs, and last 6 weeks have been attempting to digest prior 3 week winning streak weeks ending 12/11-25 (AAPL car excitement) between that rose by a combined 54%.

- Latest earnings reaction on 11/6 fell 7.2%.

- Enter on pullback into very round number.

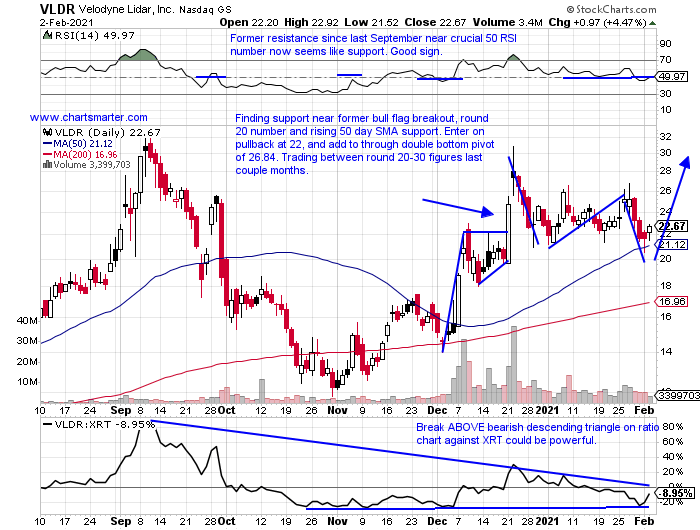

- Entry VLDR 22. Stop 20.25.

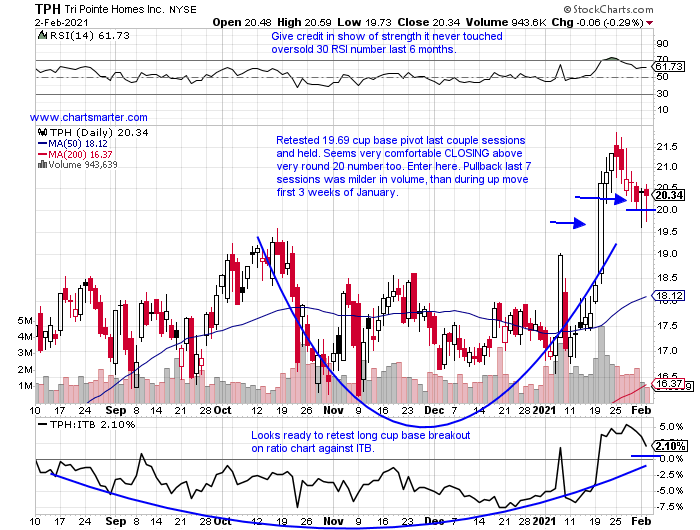

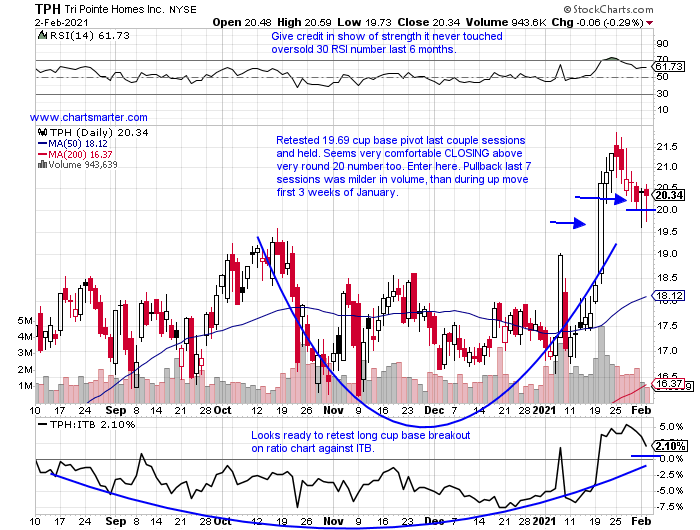

- Homebuilder play up 18% YTD and 25% over last one year period.

- Now 7% off most recent 52 week highs, and looking for third straight WEEKLY CLOSE above very round 20 number, which has been resistant dating back to 2013-14 and 2018.

- Back to back negative earnings reactions down 7.3 and 4.5% on 10/22 and 7/24, after 3 straight gains of 6.2, 4.7 and 1.1% on 4/24, 2/19 and 10/31/19.

- Enter after successful cup base breakout retest.

- Entry TPH here. Stop 18.75.

Good luck.

Entry summaries:

Buy after recent gap fill PII here. Stop 107.

Buy pullback into very round number VLDR 22. Stop 20.25.

Buy successful cup base breakout retest TPH here. Stop 18.75.

This article requires a Chartsmarter membership. Please click here to join.

Tops Form Briskly:

- I am not making an outlandish prediction here, but the old saying that bottoms take time and tops form in unsettled fashion, is often accurate. Case in point with the chart of XRT below. Now PRICE action supersedes all else and one has to be very impressed with the vault of 25% between the 4 sessions of 1/25-28. Round number theory did come into play here with a strong rejection at the very round par number on 1/28, CLOSING 18% off intraday highs. There is probably some decent opportunity here, to the long side, with the ETF as it retested the bull flag breakout at 75 almost precisely Tuesday, and it is now 23% off most recent 52 week highs. Looking at the top holdings in the XRT, GME as of today was near the 20% threshold, and is the reason the ETF PRICE action has been skewed. So if one believes that that fiasco is in the rear view window, instead of through the windshield, there should be some good opportunities within. Top ten holding BOOT looks good, if it can get its foot in the door above the round 60 number, pun intended.

Online Education Scenario:

- If there was ever a play made for remote learning, perhaps it could be the chart of CHGG below. Truth be told it was behaving powerfully before the pandemic, and this best of breed name has to be given credit for its performance against its own specific peers too. Chegg has advanced well more than 100% over the last one year period, while LOPE has risen by just 12% over the same time frame (other rivals in STRA and LRN are in the 50% lower from their most recent 52 week highs neighborhood). The argument that CHGG could fall once things "return to normal" could be short sighted as it has demonstrated its ability to thrive in different environments. PRICE action, which is paramount to us, is trading in a tight range between the very round 90 and par figures. The last 3 weeks all traded intraweek well above 100, but finished with 97, 96 and 95 handles, and in the lower half of the WEEKLY range. Its longer term direction, through 100 or below 90, should be cleared up, after it REPORTS earnings next Monday after the close.

Recent Examples:

- Some consumer names have really excelled this year so far. Some just do their things, grinding higher gradually, in my opinion the "right way", as opposed to wild, volatile trade. For example M is higher by 20% YTD, although it is now 39% amount off that peak made on just 1/27. And of course the big elephants in the room in GME and AMC have reached the stratosphere, and have returned to earth. Below is a chart that just put its head down, and ignored the noise, and proceeded to make gains the old fashioned way. It is SIG, and how it appeared in our 1/22 Consumer Note. Now do not get me wrong, this name traded with a 5 handle late last spring, but for some time now has traded bullishly taut, and like most leaders often do, is giving one the chance to add on the way UP. It is not sporting a bull flag formation, and a break above 43, carries a measured move to 59.

Special Situations:

- Recreational vehicle play higher by 20% YTD and 24% over last one year period. Dividend yield of 2.2%.

- Name still 10% off most recent 52 week highs, and broke above 5 month WEEKLY cup base pivot of 110.40 the week ending 1/22 that rose 10%. Respect.

- FIVE straight positive earnings reactions up 3.5, .5, 7.4, 3.7 and 5.7% on 1/26, 10/27, 7/28, 4/28 and 1/28/20.

- Enter after recent gap fill.

- Entry PII here. Stop 107.

- Auto parts play down 3% YTD and higher by 122% over last one year period.

- Now 30% off most recent 52 week highs, and last 6 weeks have been attempting to digest prior 3 week winning streak weeks ending 12/11-25 (AAPL car excitement) between that rose by a combined 54%.

- Latest earnings reaction on 11/6 fell 7.2%.

- Enter on pullback into very round number.

- Entry VLDR 22. Stop 20.25.

- Homebuilder play up 18% YTD and 25% over last one year period.

- Now 7% off most recent 52 week highs, and looking for third straight WEEKLY CLOSE above very round 20 number, which has been resistant dating back to 2013-14 and 2018.

- Back to back negative earnings reactions down 7.3 and 4.5% on 10/22 and 7/24, after 3 straight gains of 6.2, 4.7 and 1.1% on 4/24, 2/19 and 10/31/19.

- Enter after successful cup base breakout retest.

- Entry TPH here. Stop 18.75.

Good luck.

Entry summaries:

Buy after recent gap fill PII here. Stop 107.

Buy pullback into very round number VLDR 22. Stop 20.25.

Buy successful cup base breakout retest TPH here. Stop 18.75.