Farmers Helper:

- Spending a lot of time out on the North Fork of Long Island, we are privy to just how hard farmers work. They are often up before sunrise and do not finish until after sunset. Anything that could benefit them and make life somewhat easier is much appreciated. John Deere comes to mind, and its chart is a bit weak at the moment as it trades between the round 350-400 numbers this month as a bear flag below the 50 day SMA takes shape. AGCO is another name in the niche space that also now trades in correction mode lower by 11% from most recent 52 week highs. Below is the chart of TSCO, and in my opinion is the best of the triumvirate. Wednesday it registered a bullish engulfing candle right at its 50 day SMA (the other two names mentioned here are both underneath it), a line that has given the name some comfort in 2021. Decent risk/reward scenario exists right here with a possible move back to all-time highs. The last 3 times touching the 50 day SMA this year witnessed subsequent spurts higher of 23, 33, and 26 handles higher.

You Got To Know When To Hold Them....

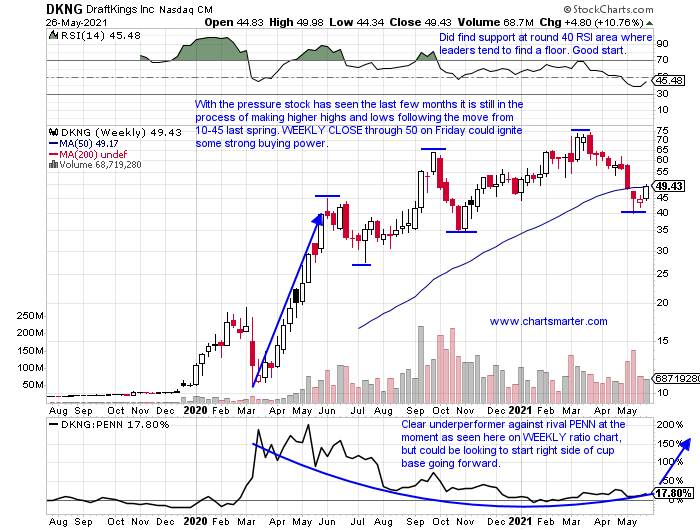

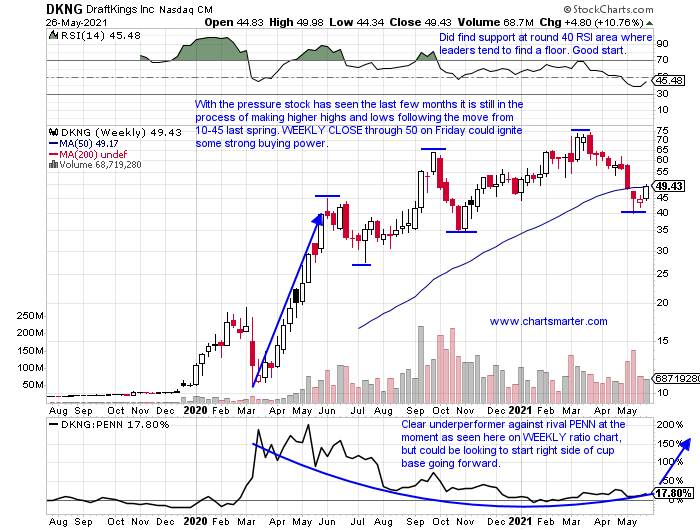

- Know when to fold them. A classic song that Kenny Rogers sang that could have easily applied to the stock market. Could say that it was a reminder to have good risk management. Below is the chart of DKNG, a name that still sits one-third away from its highs made back just 2 months ago. It is on a current 8 of 9 week losing streak, but this week is higher by nearly 11%, and depending on Fridays CLOSE could be the third consecutive WEEKLY CLOSE in the upper half of the range. Similar circumstances occurred back the week ending 11/6/20 that jumped almost 20%, after recording a 4-week losing streak immediately prior that shed half its value the weeks ending between 10/9-30/20. On its daily chart it has traded between the round 40-50 numbers, and it will have t contend with 200 day SMA resistance. Below however is the WEEKLY chart of DKNG, and a CLOSE here above the 50 day SMA looks like it could potentially go a long way into later 2021 and make another higher high.

Personal Note:

- This is the first, and last, time I have ever written a personal note in my 8 years doing ChartSmarter. Tuesday afternoon I lost my brother Bryan at 37 years old to a brain tumor (pictured on right). We can write all the cliches we want, but it does seem true that "only the good die young". He was the architect that developed my whole website almost a decade ago, and he was my biggest cheerleader. Finance was his profession working his whole career at Alliance Bernstein, and we enjoyed chatting markets all the time. In fact, just a few days ago we were discussing which way the 10-year yield was headed. To say he will be missed is a gigantic understatement. He never complained about the rotten situation he was given, and he was a warrior given 6 months to live 8 years ago. We were similar in a lot of ways. We kept things simple and enjoyed the small things in life. Tomorrow is never promised. Go out and celebrate life today. Bryan would have done anything to spend just one more minute with his young twin boys. You will never be far from my thoughts for the rest of my life brother. Rest in peace.

Special Situations:

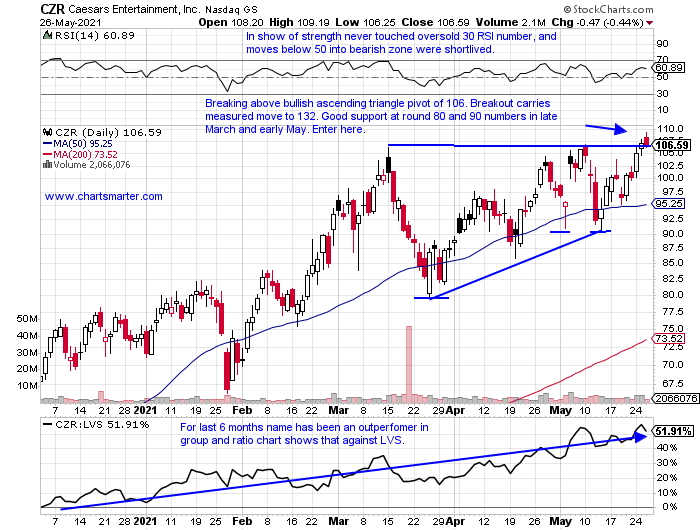

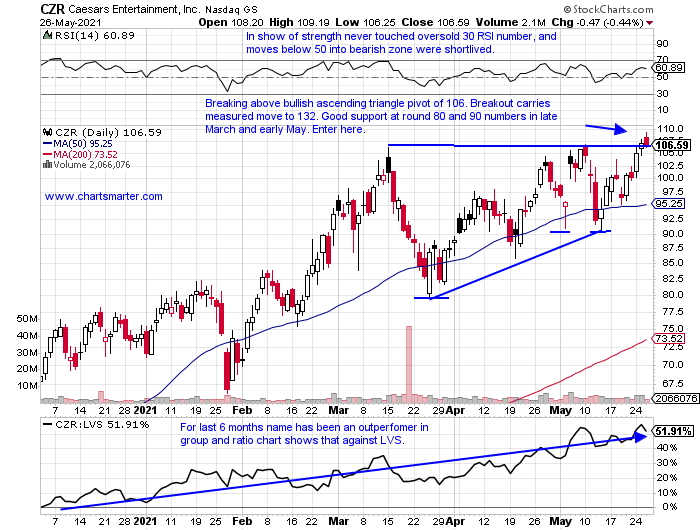

- Gaming play higher by 44% YTD and 203% over last one-year period.

- Just 3% off most recent 52-week highs, and has not recorded a WEEKLY losing streak of more than 2 weeks in 10 months. Good relative strength as peers WYNN and LVS are 8 and 12% off their yearly peaks respectively.

- Three straight positive earnings reactions up 7.8, 9.7, and 1.3% on 5/5, 2/26, and 11/6/20 (fell 1.8% on 8/7/20).

- Enter after break above bullish ascending triangle.

- Entry CZR here. Stop 98.

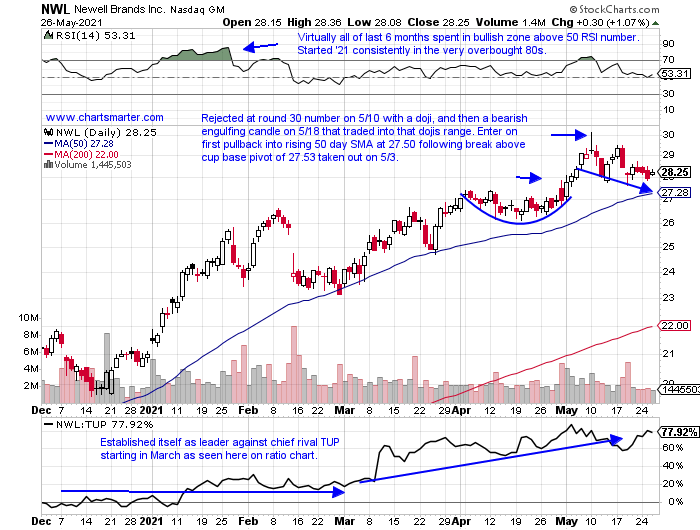

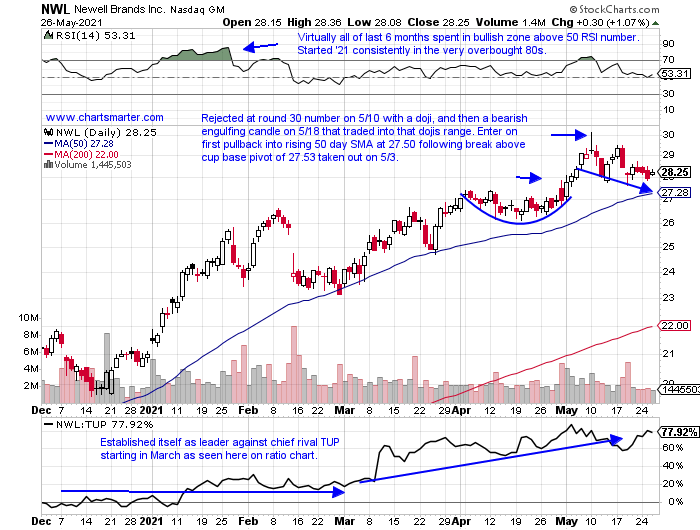

- Household products play up 33% YTD and 108% over last one-year period. Dividend yield of 3.3%.

- Lower 5 of the last 7 weeks, but 4 of the decliners lost 1% or less. Good relative strength now just 6% off most recent 52 week highs while TUP is 34% lower from its own yearly peak.

- Earnings mostly lower off .1, 7.1, 7.4 and 11.5% on 4/30, 2/12, 7/31 and 5/1/20 (rose 5% on 10/30/20).

- Enter on initial touch of rising 50 day SMA following breakout.

- Entry NWL 27.50. Stop 26.

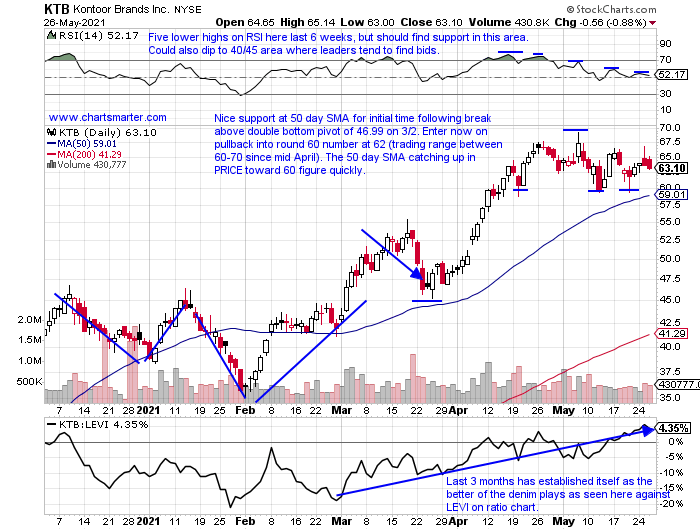

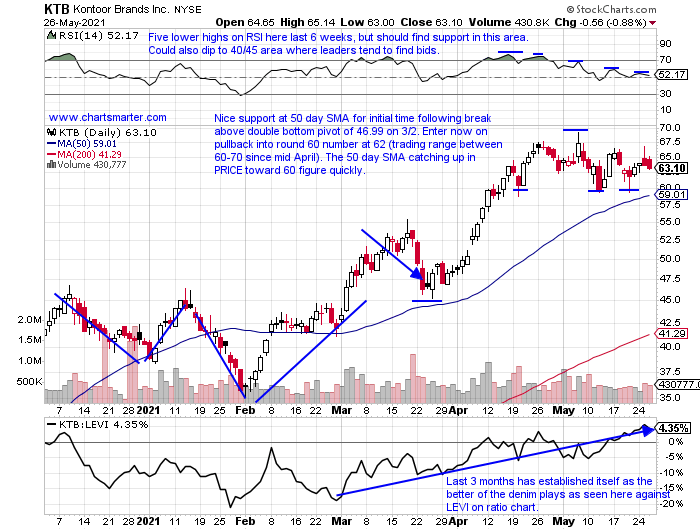

- Apparel retailer higher by 55% YTD and 320% over last one year period. Dividend yield of 2.5%.

- Now 9% off most recent 52 week highs (peer LEVI now 12% off its highs made earlier this month at round 30 number). Last 4 weeks bullishly digesting big 3 week winning streak weeks ending 4/9-23 that rose by a combined 32%.

- Three straight positive earnings reactions up 5.1, 7.6, and 11.2% on 5/6, 3/2, and 10/29/20 (fell 5.3% on 8/6/20).

- Enter on pullback into round number.

- Entry KTB 62. Stop 57.25.

Good luck.

Entry summaries:

Buy after break above bullish ascending triangle CZR here. Stop 98.

Buy initial touch of rising 50 day SMA following recent breakout NWL 27.50. Stop 26.

Buy pullback into round number KTB 62. Stop 57.25.

This article requires a Chartsmarter membership. Please click here to join.

Farmers Helper:

- Spending a lot of time out on the North Fork of Long Island, we are privy to just how hard farmers work. They are often up before sunrise and do not finish until after sunset. Anything that could benefit them and make life somewhat easier is much appreciated. John Deere comes to mind, and its chart is a bit weak at the moment as it trades between the round 350-400 numbers this month as a bear flag below the 50 day SMA takes shape. AGCO is another name in the niche space that also now trades in correction mode lower by 11% from most recent 52 week highs. Below is the chart of TSCO, and in my opinion is the best of the triumvirate. Wednesday it registered a bullish engulfing candle right at its 50 day SMA (the other two names mentioned here are both underneath it), a line that has given the name some comfort in 2021. Decent risk/reward scenario exists right here with a possible move back to all-time highs. The last 3 times touching the 50 day SMA this year witnessed subsequent spurts higher of 23, 33, and 26 handles higher.

You Got To Know When To Hold Them....

- Know when to fold them. A classic song that Kenny Rogers sang that could have easily applied to the stock market. Could say that it was a reminder to have good risk management. Below is the chart of DKNG, a name that still sits one-third away from its highs made back just 2 months ago. It is on a current 8 of 9 week losing streak, but this week is higher by nearly 11%, and depending on Fridays CLOSE could be the third consecutive WEEKLY CLOSE in the upper half of the range. Similar circumstances occurred back the week ending 11/6/20 that jumped almost 20%, after recording a 4-week losing streak immediately prior that shed half its value the weeks ending between 10/9-30/20. On its daily chart it has traded between the round 40-50 numbers, and it will have t contend with 200 day SMA resistance. Below however is the WEEKLY chart of DKNG, and a CLOSE here above the 50 day SMA looks like it could potentially go a long way into later 2021 and make another higher high.

Personal Note:

- This is the first, and last, time I have ever written a personal note in my 8 years doing ChartSmarter. Tuesday afternoon I lost my brother Bryan at 37 years old to a brain tumor (pictured on right). We can write all the cliches we want, but it does seem true that "only the good die young". He was the architect that developed my whole website almost a decade ago, and he was my biggest cheerleader. Finance was his profession working his whole career at Alliance Bernstein, and we enjoyed chatting markets all the time. In fact, just a few days ago we were discussing which way the 10-year yield was headed. To say he will be missed is a gigantic understatement. He never complained about the rotten situation he was given, and he was a warrior given 6 months to live 8 years ago. We were similar in a lot of ways. We kept things simple and enjoyed the small things in life. Tomorrow is never promised. Go out and celebrate life today. Bryan would have done anything to spend just one more minute with his young twin boys. You will never be far from my thoughts for the rest of my life brother. Rest in peace.

Special Situations:

- Gaming play higher by 44% YTD and 203% over last one-year period.

- Just 3% off most recent 52-week highs, and has not recorded a WEEKLY losing streak of more than 2 weeks in 10 months. Good relative strength as peers WYNN and LVS are 8 and 12% off their yearly peaks respectively.

- Three straight positive earnings reactions up 7.8, 9.7, and 1.3% on 5/5, 2/26, and 11/6/20 (fell 1.8% on 8/7/20).

- Enter after break above bullish ascending triangle.

- Entry CZR here. Stop 98.

- Household products play up 33% YTD and 108% over last one-year period. Dividend yield of 3.3%.

- Lower 5 of the last 7 weeks, but 4 of the decliners lost 1% or less. Good relative strength now just 6% off most recent 52 week highs while TUP is 34% lower from its own yearly peak.

- Earnings mostly lower off .1, 7.1, 7.4 and 11.5% on 4/30, 2/12, 7/31 and 5/1/20 (rose 5% on 10/30/20).

- Enter on initial touch of rising 50 day SMA following breakout.

- Entry NWL 27.50. Stop 26.

- Apparel retailer higher by 55% YTD and 320% over last one year period. Dividend yield of 2.5%.

- Now 9% off most recent 52 week highs (peer LEVI now 12% off its highs made earlier this month at round 30 number). Last 4 weeks bullishly digesting big 3 week winning streak weeks ending 4/9-23 that rose by a combined 32%.

- Three straight positive earnings reactions up 5.1, 7.6, and 11.2% on 5/6, 3/2, and 10/29/20 (fell 5.3% on 8/6/20).

- Enter on pullback into round number.

- Entry KTB 62. Stop 57.25.

Good luck.

Entry summaries:

Buy after break above bullish ascending triangle CZR here. Stop 98.

Buy initial touch of rising 50 day SMA following recent breakout NWL 27.50. Stop 26.

Buy pullback into round number KTB 62. Stop 57.25.