Earnings Hangover:

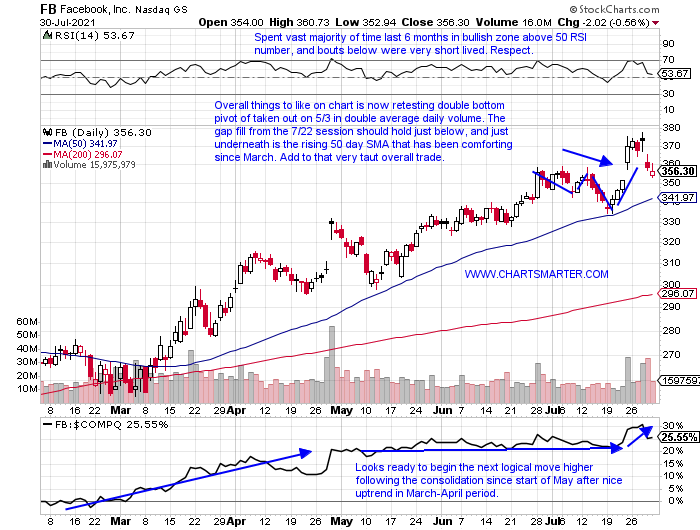

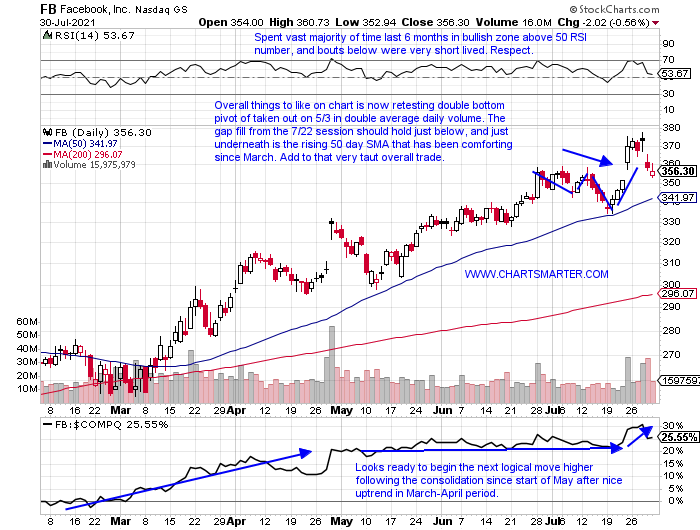

- With the largest week of earnings reports behind us, let us take a look back at some that impressed this week, and others that fell flat. Below is the chart of FB that slipped 4% on Thursday, but still looks attractive. It is just 6% off all-time highs and this week lost 3.6%, giving back less than half of the prior week's advance. The ones most highlighted are often the biggest losers and they were delivered by AMZN and PINS this week. SHOP lost 9% this week following a bearish engulfing candle on Monday and fell every day last week. It did meet a measured move to 1600 from a bullish ascending triangle break above 1300 (pattern began at very round 1000 number on 3/26). Others worth mentioning are AAPL, which could not penetrate the round 150 number to the upside on 7/15 or 7/26, but above that carries a measured move to 175 through a bull flag. Less heralded moves last week were LOGI which looks good on a risk/reward basis near its 200 day (I was WRONG about this name recently), and AMKR among a strong semi group just above a 24.10 double bottom pivot, and has added 12% alone the last 2 weeks. Finally, one to watch this coming week is CGNX which broke firmly above the very round 90 number and double bottom pivot of 88.96 (it REPORTS Thursday after the close). The stock showed solid relative strength up 5% last week as the Nasdaq fell 1.1%.

Hardware General:

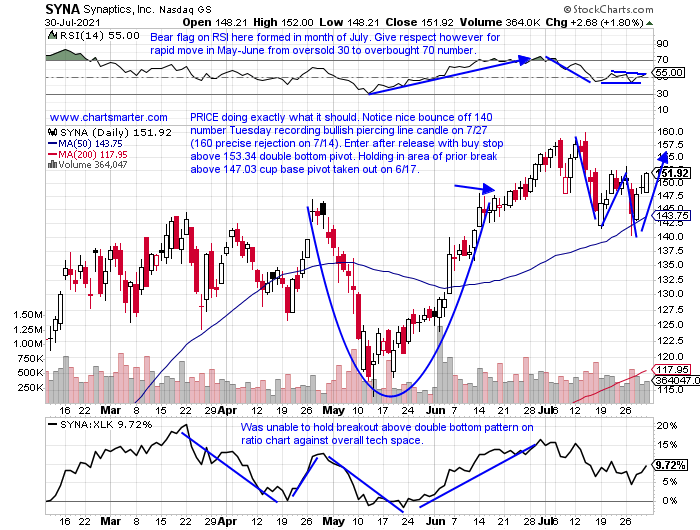

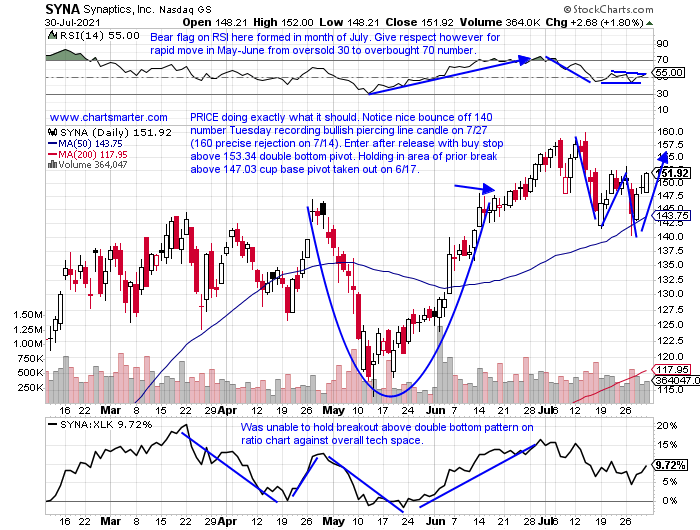

- I often state that I would not open a position just prior to earnings. Unless I had an existing position and had a very comfortable basis. Even then most times I would shave around the holding. Below is a computer hardware play in SYNA that is REPORTING next Thursday after the close. Its chart is intriguing, and it has advanced 3 of the last 4 times after releasing numbers including 3 in a row higher by 11.4, .4, and 8.4% on 2/5, 11/6, and 8/6/20. The stock trades just 6% off most recent all-time highs and is lower 3 of the last 4 weeks, but 2 of the decliners CLOSED in the upper half of the WEEKLY range. And prior to that, it recorded a solid 6-week winning streak the weeks ending between 5/28-7/2 jumping by a combined 27%. Keep an eye on peer STX which has now recorded back-to-back WEEKLY bullish hammer candles after a nice run from 40 last March to 106 in May.

Recent Examples:

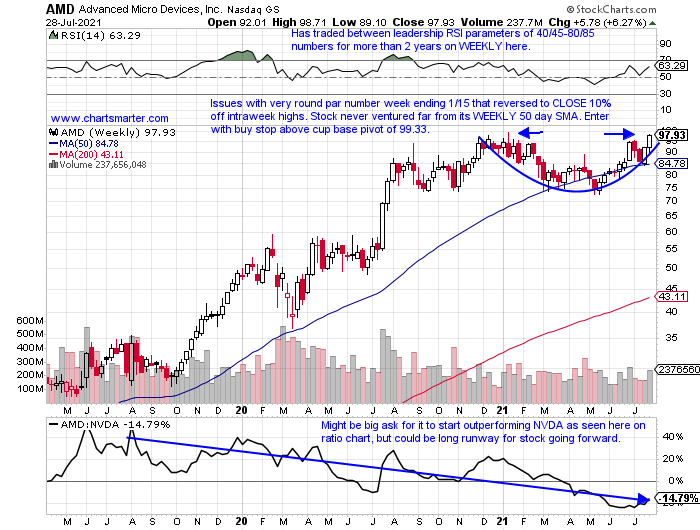

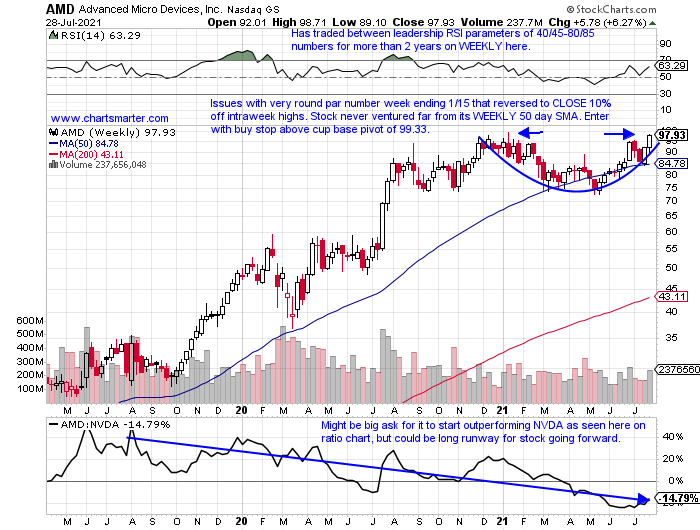

- With the bulk of earnings season now behind us after this week, one can really do some homework this weekend to witness where the dust settled and where to go from here. One of, if not THE MVP, of the past week, has to be AMD. Below is the WEEKLY chart and how it appeared in our 7/29 Technology Note. WEEKLY volume was gigantic most likely alluding to many investors who were "offside" and had to cover. Combined that with the real generic buying and one had a potent combination. This week's move of 15.2% was accompanied by the strongest WEEKLY volume in one year, and that was strong follow-through considering the advance the prior week was better than 7%. Before its recent gain of 7.6% on 7/28 it recorded three straight negative earnings reactions of 1.4, 6.2, and 4.1% on 4/28, 1/27, and 10/27/20. Peculiarly enough we noticed that the July number in 2020 was well received and acted robustly thereafter, and that's what appears to be happening now. Any move back toward the round par number should be considered a gift.

Special Situations:

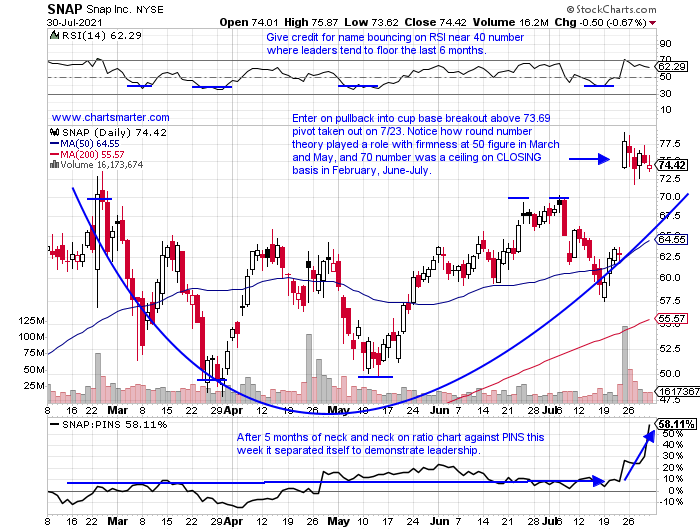

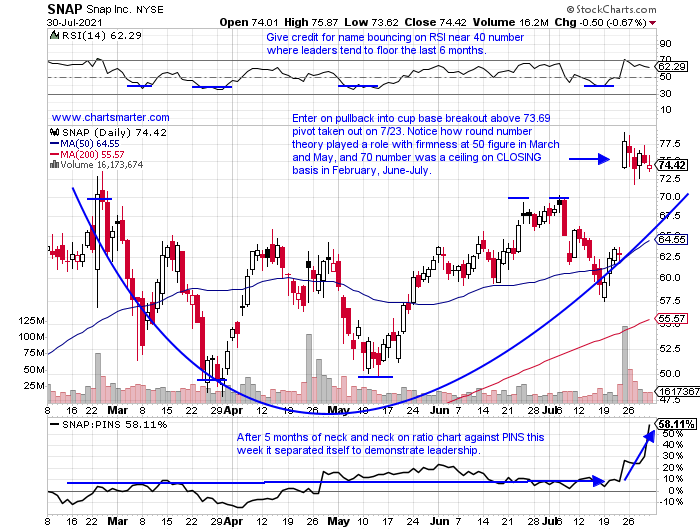

- Communication services name higher by 49% YTD and 232% over last one-year period.

- Name now 6% off most recent all-time highs and this week fell by 4.5%, giving back little of prior weeks jump of 31.6%. Encouraging on WEEKLY chart is action during last WEEKLY firm push higher the week ending 10/23/20 that advanced 55%. It formed a bull flag the next 4 weeks after that before another solid push higher to 73 this February.

- FOUR straight positive earnings reactions up 23.8, 7.4, 9.1, and 28.3% on 7/23, 4/23, 2/5, and 10/21/20.

- Enter on pullback into cup base breakout.

- Entry SNAP here. Stop 68 (full disclosure am long name).

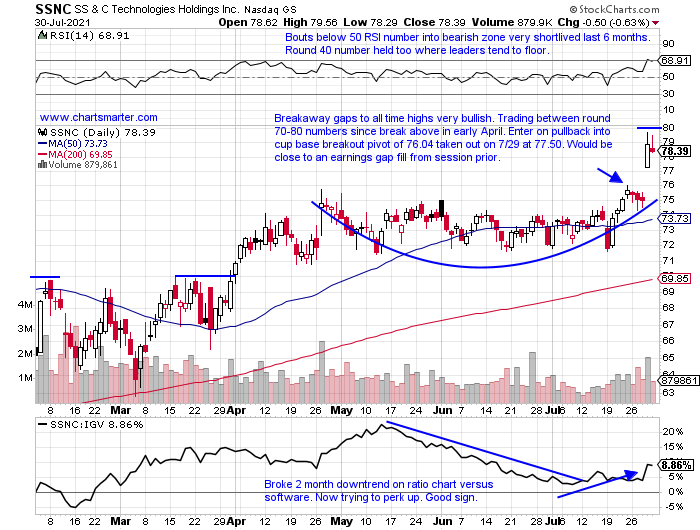

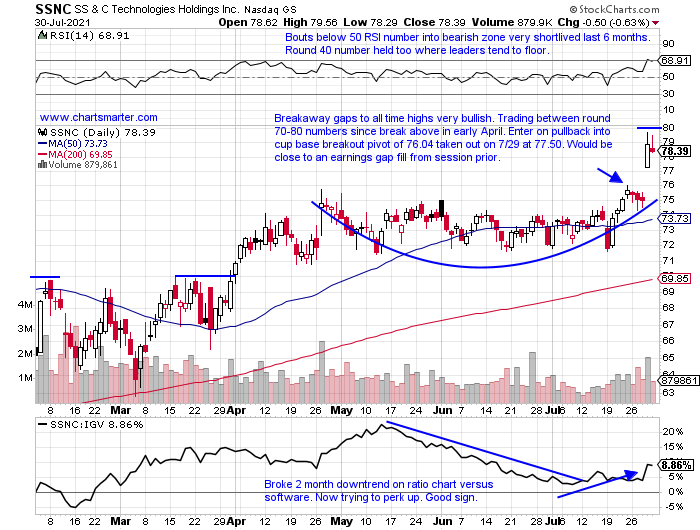

- Software play higher by 8% YTD and 36% over last one-year period. Dividend yield of .8%.

- Name trading 2% off most recent all-time highs, and rose 3.6% this week after prior week rose by 2.7%. Was immediately preceded by a 4 week period weeks ending between 6/25-7/16 that all CLOSED very taut within just .16 of each other.

- Back to back earnings-related gains of 5.2 and 4.1% on 7/29 and 4/27, after losses of 2.4 and .1% on 2/11 and 10/29/20.

- Enter on pullback into cup base breakout.

- Entry SSNC 77.50. Stop 74.

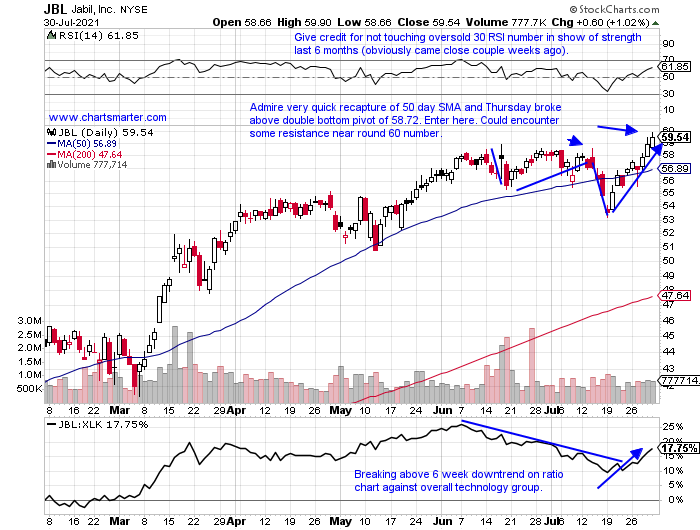

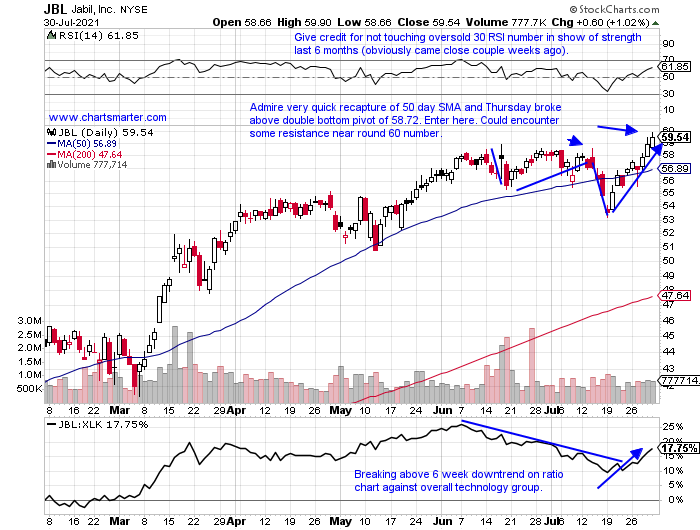

- "Old tech" play higher by 40% YTD and 74% over last one-year period. Dividend yield of .5%.

- Just 1% off all-time highs, which was recently eclipsed from its peak made back in 2000. Big run as it was at 17 last March, now approaching round 60 number. Only one three-week losing streak since week ending 3/20/20 to show how firm name has acted.

- FIVE straight positive earnings reactions up 2.2, 3.3, 7.4, 9/24 and 2.2% on 6/17, 3/16, 12/17, 9/24 and 6/19/20.

- Enter after break above double bottom pattern.

- Entry JBL here. Stop 56.

Good luck.

Entry summaries:

Buy pullback into cup base breakout SNAP here. Stop 68.

Buy pullback into cup base breakout SSNC 77.50. Stop 74.

Buy after recent double bottom breakout JBL here. Stop 56.

This article requires a Chartsmarter membership. Please click here to join.

Earnings Hangover:

- With the largest week of earnings reports behind us, let us take a look back at some that impressed this week, and others that fell flat. Below is the chart of FB that slipped 4% on Thursday, but still looks attractive. It is just 6% off all-time highs and this week lost 3.6%, giving back less than half of the prior week's advance. The ones most highlighted are often the biggest losers and they were delivered by AMZN and PINS this week. SHOP lost 9% this week following a bearish engulfing candle on Monday and fell every day last week. It did meet a measured move to 1600 from a bullish ascending triangle break above 1300 (pattern began at very round 1000 number on 3/26). Others worth mentioning are AAPL, which could not penetrate the round 150 number to the upside on 7/15 or 7/26, but above that carries a measured move to 175 through a bull flag. Less heralded moves last week were LOGI which looks good on a risk/reward basis near its 200 day (I was WRONG about this name recently), and AMKR among a strong semi group just above a 24.10 double bottom pivot, and has added 12% alone the last 2 weeks. Finally, one to watch this coming week is CGNX which broke firmly above the very round 90 number and double bottom pivot of 88.96 (it REPORTS Thursday after the close). The stock showed solid relative strength up 5% last week as the Nasdaq fell 1.1%.

Hardware General:

- I often state that I would not open a position just prior to earnings. Unless I had an existing position and had a very comfortable basis. Even then most times I would shave around the holding. Below is a computer hardware play in SYNA that is REPORTING next Thursday after the close. Its chart is intriguing, and it has advanced 3 of the last 4 times after releasing numbers including 3 in a row higher by 11.4, .4, and 8.4% on 2/5, 11/6, and 8/6/20. The stock trades just 6% off most recent all-time highs and is lower 3 of the last 4 weeks, but 2 of the decliners CLOSED in the upper half of the WEEKLY range. And prior to that, it recorded a solid 6-week winning streak the weeks ending between 5/28-7/2 jumping by a combined 27%. Keep an eye on peer STX which has now recorded back-to-back WEEKLY bullish hammer candles after a nice run from 40 last March to 106 in May.

Recent Examples:

- With the bulk of earnings season now behind us after this week, one can really do some homework this weekend to witness where the dust settled and where to go from here. One of, if not THE MVP, of the past week, has to be AMD. Below is the WEEKLY chart and how it appeared in our 7/29 Technology Note. WEEKLY volume was gigantic most likely alluding to many investors who were "offside" and had to cover. Combined that with the real generic buying and one had a potent combination. This week's move of 15.2% was accompanied by the strongest WEEKLY volume in one year, and that was strong follow-through considering the advance the prior week was better than 7%. Before its recent gain of 7.6% on 7/28 it recorded three straight negative earnings reactions of 1.4, 6.2, and 4.1% on 4/28, 1/27, and 10/27/20. Peculiarly enough we noticed that the July number in 2020 was well received and acted robustly thereafter, and that's what appears to be happening now. Any move back toward the round par number should be considered a gift.

Special Situations:

- Communication services name higher by 49% YTD and 232% over last one-year period.

- Name now 6% off most recent all-time highs and this week fell by 4.5%, giving back little of prior weeks jump of 31.6%. Encouraging on WEEKLY chart is action during last WEEKLY firm push higher the week ending 10/23/20 that advanced 55%. It formed a bull flag the next 4 weeks after that before another solid push higher to 73 this February.

- FOUR straight positive earnings reactions up 23.8, 7.4, 9.1, and 28.3% on 7/23, 4/23, 2/5, and 10/21/20.

- Enter on pullback into cup base breakout.

- Entry SNAP here. Stop 68 (full disclosure am long name).

- Software play higher by 8% YTD and 36% over last one-year period. Dividend yield of .8%.

- Name trading 2% off most recent all-time highs, and rose 3.6% this week after prior week rose by 2.7%. Was immediately preceded by a 4 week period weeks ending between 6/25-7/16 that all CLOSED very taut within just .16 of each other.

- Back to back earnings-related gains of 5.2 and 4.1% on 7/29 and 4/27, after losses of 2.4 and .1% on 2/11 and 10/29/20.

- Enter on pullback into cup base breakout.

- Entry SSNC 77.50. Stop 74.

- "Old tech" play higher by 40% YTD and 74% over last one-year period. Dividend yield of .5%.

- Just 1% off all-time highs, which was recently eclipsed from its peak made back in 2000. Big run as it was at 17 last March, now approaching round 60 number. Only one three-week losing streak since week ending 3/20/20 to show how firm name has acted.

- FIVE straight positive earnings reactions up 2.2, 3.3, 7.4, 9/24 and 2.2% on 6/17, 3/16, 12/17, 9/24 and 6/19/20.

- Enter after break above double bottom pattern.

- Entry JBL here. Stop 56.

Good luck.

Entry summaries:

Buy pullback into cup base breakout SNAP here. Stop 68.

Buy pullback into cup base breakout SSNC 77.50. Stop 74.

Buy after recent double bottom breakout JBL here. Stop 56.