Relative Performance:

- Not surprising to see weakness on ratio chart against S&P 500 for the staples. It is the "worst" actor among the 11 major S&P sector groups up just better than 7%. The XLP is now 4% off most recent 52 week highs, and top component in PG could have ETF feeling heavy as chart is sporting bearish top pattern.

Individual Names:

- Leader just 1% off most recent all-time highs and on current 7 session winning streak, and has advanced 23 of last 33 weeks. Last week rose 6.5% its best WEEKLY gain in almost 7 months. Peer BJ cleared round 60 number in short cup base and is up more than a double YTD compared to COST's 28%.

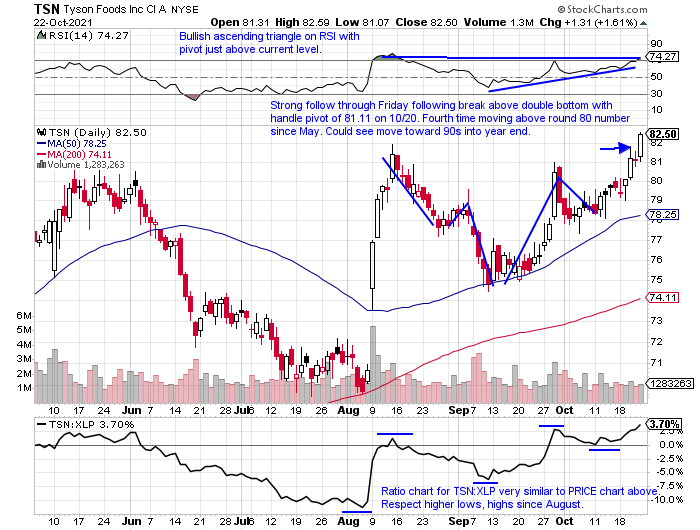

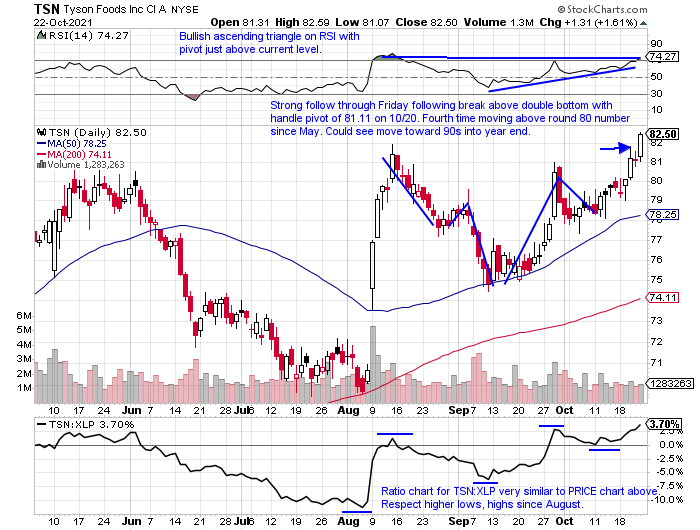

- Name on a current 6 week winning streak and has had issues with CLOSING consistently above round 80 number on WEEKLY basis. Last CLOSED above week ending 8/15, then dropped next 4 weeks. And the 2 weeks ending 5/14-21 CLOSED above 80, then saw stock fall 9 of next 11 weeks. Crucial this time around has better showing.

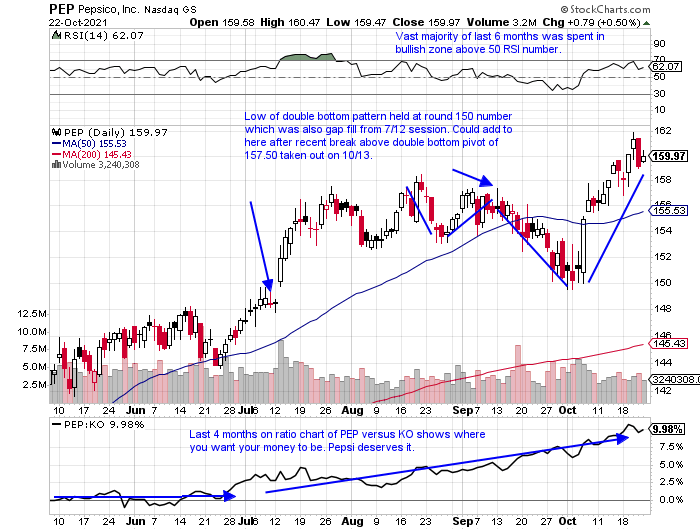

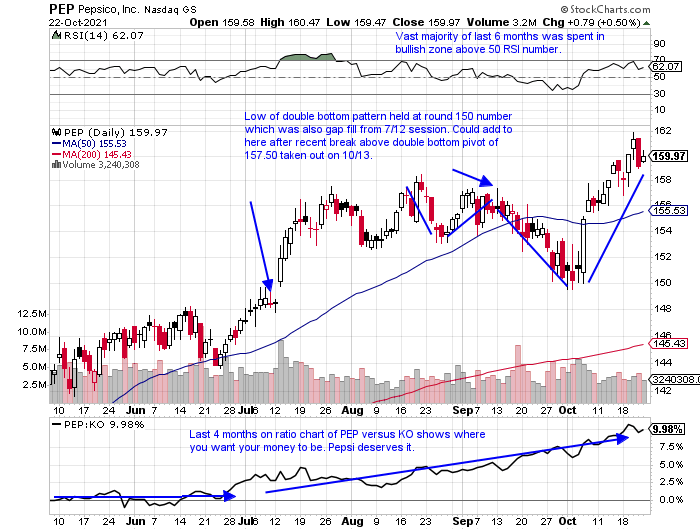

Alternatives:

- Just superior to rival KO in many different ways. PEP is up 8% YTD while KO is lower by 1% in 2021 thus far. Last 3 weeks PEP is up 6%, more than double that of KO which has risen less than 3%, and lastly PEP is just 1% off most recent 52 week highs, whereas KO is 5% off its own annual peak.

This article requires a Chartsmarter membership. Please click here to join.

Relative Performance:

- Not surprising to see weakness on ratio chart against S&P 500 for the staples. It is the "worst" actor among the 11 major S&P sector groups up just better than 7%. The XLP is now 4% off most recent 52 week highs, and top component in PG could have ETF feeling heavy as chart is sporting bearish top pattern.

Individual Names:

- Leader just 1% off most recent all-time highs and on current 7 session winning streak, and has advanced 23 of last 33 weeks. Last week rose 6.5% its best WEEKLY gain in almost 7 months. Peer BJ cleared round 60 number in short cup base and is up more than a double YTD compared to COST's 28%.

- Name on a current 6 week winning streak and has had issues with CLOSING consistently above round 80 number on WEEKLY basis. Last CLOSED above week ending 8/15, then dropped next 4 weeks. And the 2 weeks ending 5/14-21 CLOSED above 80, then saw stock fall 9 of next 11 weeks. Crucial this time around has better showing.

Alternatives:

- Just superior to rival KO in many different ways. PEP is up 8% YTD while KO is lower by 1% in 2021 thus far. Last 3 weeks PEP is up 6%, more than double that of KO which has risen less than 3%, and lastly PEP is just 1% off most recent 52 week highs, whereas KO is 5% off its own annual peak.