David Versus Goliath:

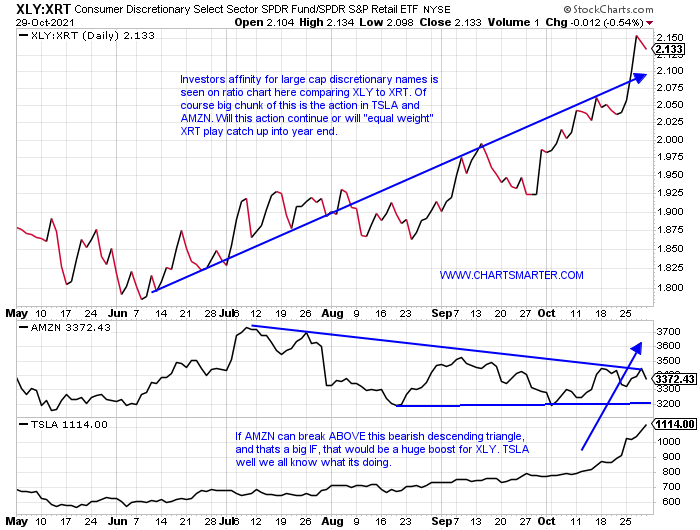

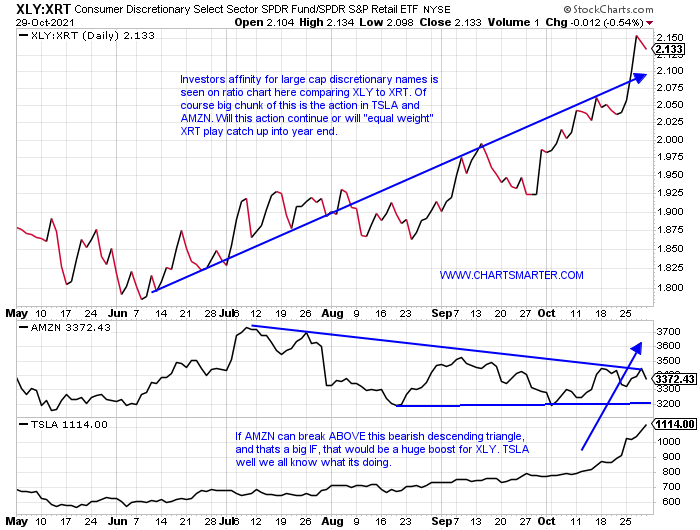

- An abundance of chatter has been made about the consolidation within the small-cap arena. On a very general basis, the IWM has gone virtually sideways since February. In the consumer discretionary arena, there is some divergence occurring in regards to the larger cap, more top-heavy, XLY to the "smaller cap", more equal weight XRT. While the XLY is right at all-time highs and on a very impressive 4 week winning streak, the XRT trades 5% off its 2021 peak, and this week the difference was glaring with the XLY higher by 4.3%, and the XRT falling fractionally. TSLA, on a current 10 week winning streak, recently joined the exclusive trillion market dollar cap club (just 5 others including MSFT GOOGL AMZN AAPL and Aramco) by jumping 22.5% this week, it's second-best WEEKLY gain behind the 24.7% gain the week ending 1/5. Expect the psychological very round 1000 figure to be supportive going forward, if retested. AMZN recorded a 100 handle reversal intraday to CLOSE at highs for the session Friday after an ill-received earnings release. While the two aforementioned names dictate the vast majority of the action in the XLY do not discount how HD is doing, falling just 4 sessions in all of October. NKE and TGT, other top 10 holdings are quickly building the right side of their cup bases. The latter completed a handle Friday. Advantage large caps.

Discount Dazzle In Store?

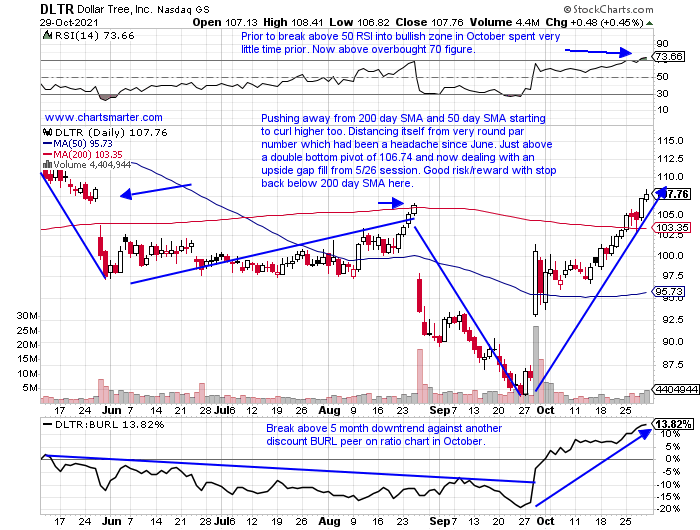

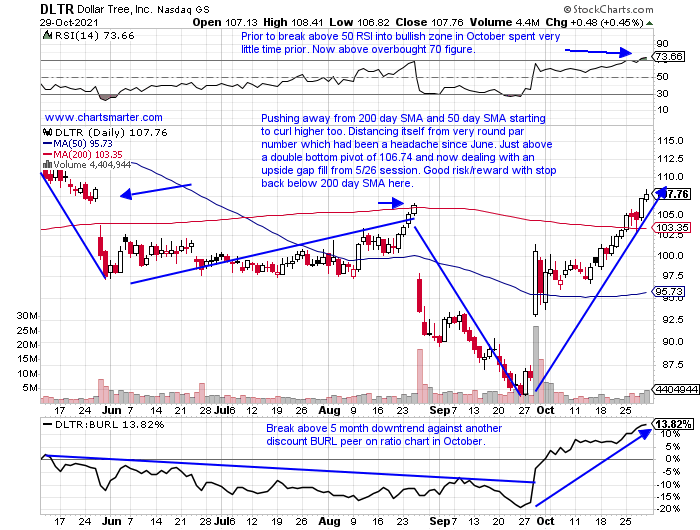

- The discount retail plays are trying to mount a comeback after some tough sledding in 2021. FIVE is still 17% off highs made in August and doing battle with the very round 200 number here. It is now back above both its 50 and 200 day SMAs. DG is trying to build the right side of a cup base. Others like TJX and ROST stores are still well into correction mode, and OLLI is currently 45% off a peak made in late January and it recently recorded a 9 week losing streak between weeks ending 8/6-10/1, with all nine CLOSING at their lows for the WEEKLY range. One chart in the group that is taking on a better look is the one below of DLTR. This past Monday it broke above its 200 day SMA, retested it Wednesday then followed through higher by more than 3% on Thursday and Friday. It was the first peek above that important line since slicing beneath it on 5/27. It has recorded back to back negative earnings reactions, but has been holding the 9/29 surge that rose 16.5% after announcing it would be raising PRICES. Looks like there is a good risk/reward scenario here.

Recent Examples:

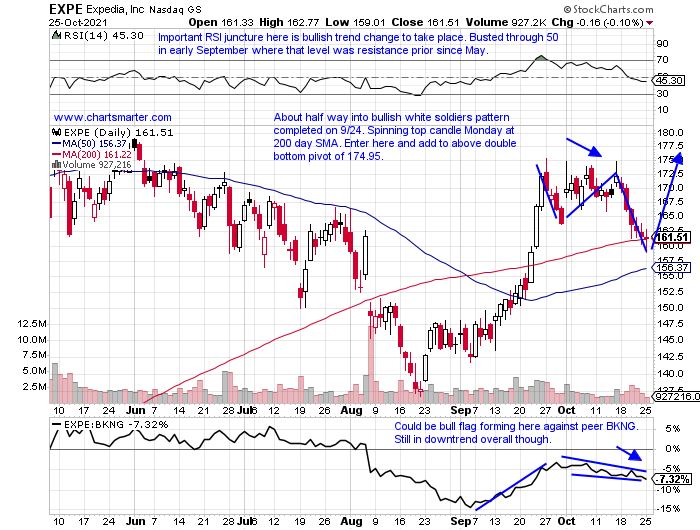

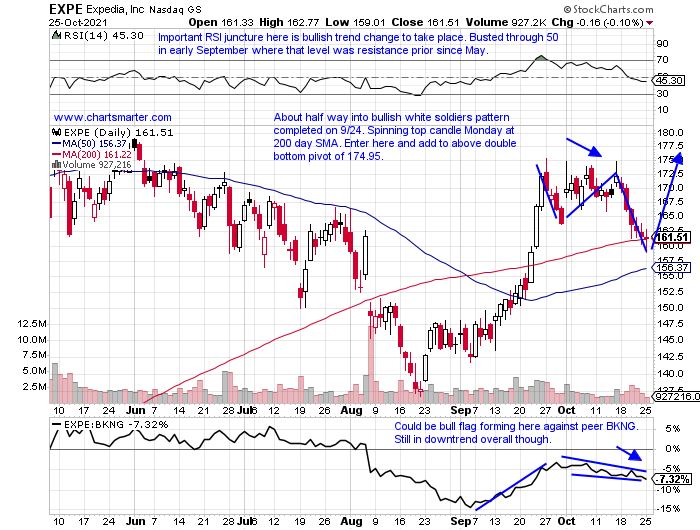

- The online travel group has some real bifurcation. Let's get the bad news out of the way first. SABR is now 39% off its annual peak and has fallen 9 of the last 10 session (it has declined 3 of the last 4 weeks including two by double digits). BKNG is just 5% off most recent 52 week highs, and trades in a wide and loose manner, but is building a high handle in its cup base in a pattern 6 months long. Below is the chart of EXPE and how it appeared in our 10/26 Consumer Note. This name is 13% off its peak made back in March and is trading in the middle of the range of the big WEEKLY gain ending 9/24 that rose by 13%. It is spooning its 200 day SMA for the last couple of weeks, and to be frank it needs to push off that secular line sooner rather than later if that potential double bottom pattern is to take shape.

Special Situations:

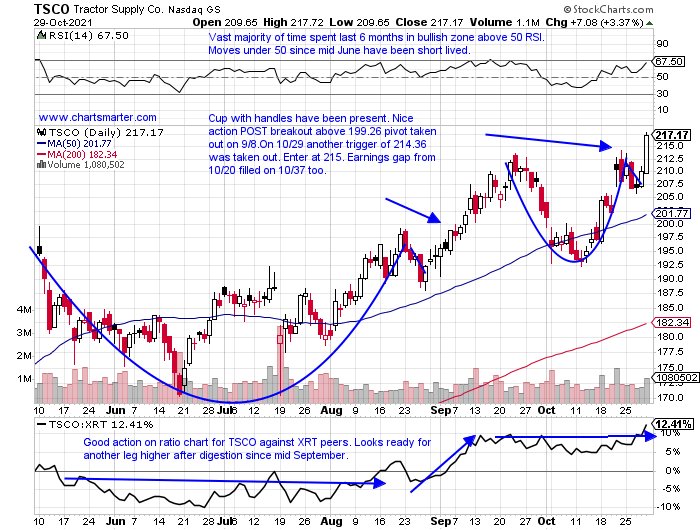

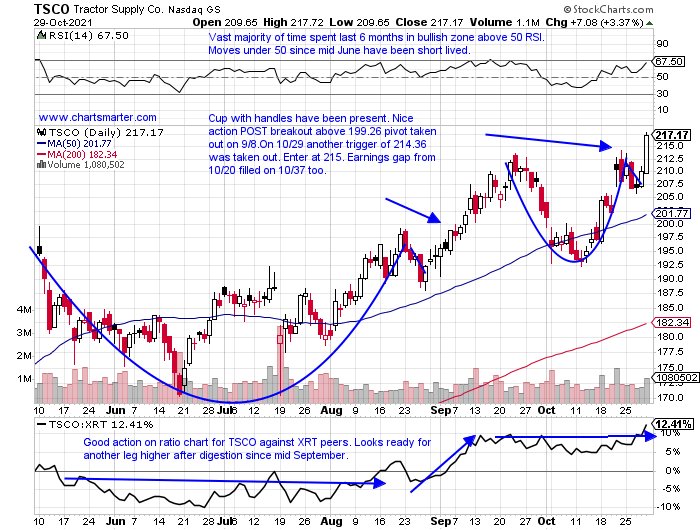

- Specialty retail play up 54% YTD and 63% over last one-year period. Dividend yield of 1%.

- Name at all-time highs and advanced 12 of last 19 weeks. Current 3-week winning streak has gained a combined 11%. Very round 200 number was resistance in May and August now looks like a floor going forward.

- Earnings mixed with gains of 4 and 4.4% on 10/21 and 4/22 and losses of 4.3 and 2.8% on 7/19 and 1/28.

- Enter after break above cup with handle.

- Entry TSCO 215. Stop 206.50.

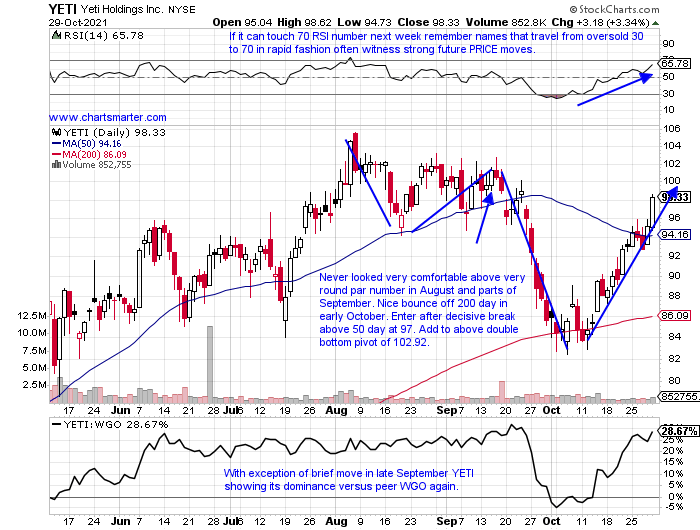

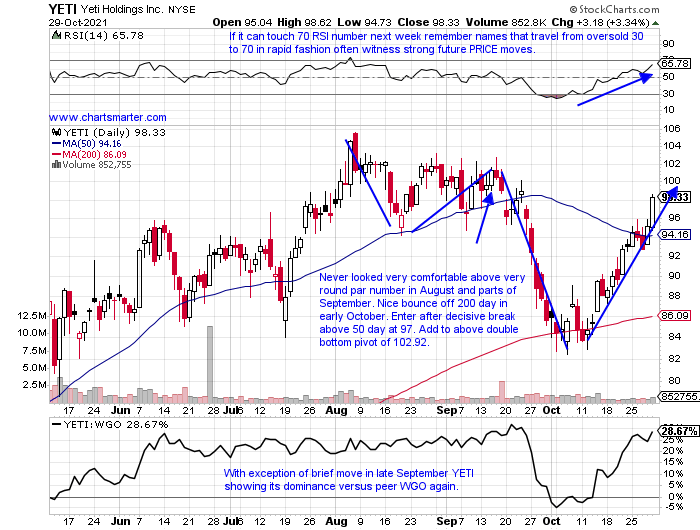

- Recreational products play higher by 44% YTD and 88% over last one year period.

- Name still 7% off recent 52-week highs, but a nice change in character with 15% gain during current 3-week losing streak. Was preceded by 6-week losing streak.

- Earnings mostly higher with gains of 4.9, 5.4, and 16.5% on 8/5, 5/13, and 11/5/20 (fell 8% on 2/11).

- Enter on pullback after break above 50 day SMA.

- Entry YETI 97. Stop 94.

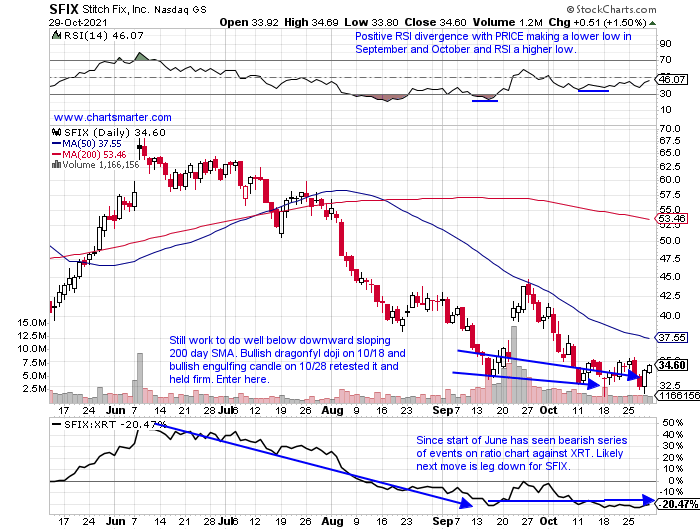

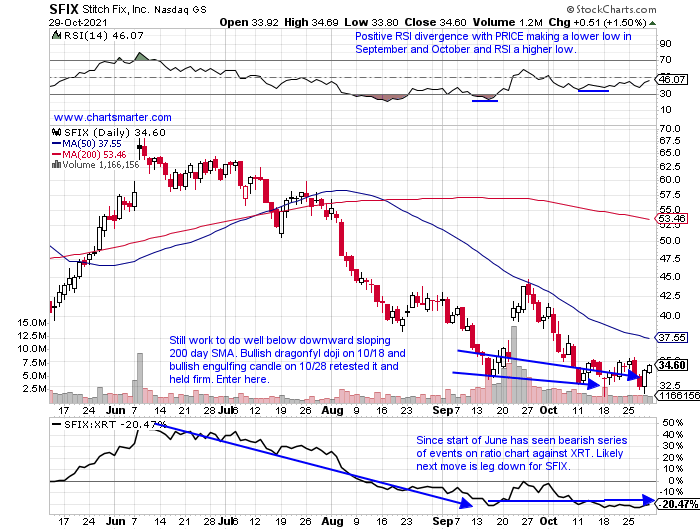

- Specialty retail play down 41% YTD and 9% over last one-year period.

- Name still 70% off most recent 52-week highs and first consecutive WEEKLY advances since late June and early July.

- Back-to-back positive earnings reactions up 15.6 and 14.1% on 6/8 and 9/22 (rose 39.2% on 12/8/20 fell 21.8% on 3/9).

- Enter after dragonfly doji/bullish engulfing candle.

- Entry SFIX here. Stop 32.50.

Good luck.

Entry summaries:

Buy after break above cup with handle TSCO 215. Stop 206.50.

Buy decisive break above 50 day SMA YETI 97. Stop 94.

Buy after dragonfly doji/bullish engulfing candle SFIX here. Stop 32.50.

This article requires a Chartsmarter membership. Please click here to join.

David Versus Goliath:

- An abundance of chatter has been made about the consolidation within the small-cap arena. On a very general basis, the IWM has gone virtually sideways since February. In the consumer discretionary arena, there is some divergence occurring in regards to the larger cap, more top-heavy, XLY to the "smaller cap", more equal weight XRT. While the XLY is right at all-time highs and on a very impressive 4 week winning streak, the XRT trades 5% off its 2021 peak, and this week the difference was glaring with the XLY higher by 4.3%, and the XRT falling fractionally. TSLA, on a current 10 week winning streak, recently joined the exclusive trillion market dollar cap club (just 5 others including MSFT GOOGL AMZN AAPL and Aramco) by jumping 22.5% this week, it's second-best WEEKLY gain behind the 24.7% gain the week ending 1/5. Expect the psychological very round 1000 figure to be supportive going forward, if retested. AMZN recorded a 100 handle reversal intraday to CLOSE at highs for the session Friday after an ill-received earnings release. While the two aforementioned names dictate the vast majority of the action in the XLY do not discount how HD is doing, falling just 4 sessions in all of October. NKE and TGT, other top 10 holdings are quickly building the right side of their cup bases. The latter completed a handle Friday. Advantage large caps.

Discount Dazzle In Store?

- The discount retail plays are trying to mount a comeback after some tough sledding in 2021. FIVE is still 17% off highs made in August and doing battle with the very round 200 number here. It is now back above both its 50 and 200 day SMAs. DG is trying to build the right side of a cup base. Others like TJX and ROST stores are still well into correction mode, and OLLI is currently 45% off a peak made in late January and it recently recorded a 9 week losing streak between weeks ending 8/6-10/1, with all nine CLOSING at their lows for the WEEKLY range. One chart in the group that is taking on a better look is the one below of DLTR. This past Monday it broke above its 200 day SMA, retested it Wednesday then followed through higher by more than 3% on Thursday and Friday. It was the first peek above that important line since slicing beneath it on 5/27. It has recorded back to back negative earnings reactions, but has been holding the 9/29 surge that rose 16.5% after announcing it would be raising PRICES. Looks like there is a good risk/reward scenario here.

Recent Examples:

- The online travel group has some real bifurcation. Let's get the bad news out of the way first. SABR is now 39% off its annual peak and has fallen 9 of the last 10 session (it has declined 3 of the last 4 weeks including two by double digits). BKNG is just 5% off most recent 52 week highs, and trades in a wide and loose manner, but is building a high handle in its cup base in a pattern 6 months long. Below is the chart of EXPE and how it appeared in our 10/26 Consumer Note. This name is 13% off its peak made back in March and is trading in the middle of the range of the big WEEKLY gain ending 9/24 that rose by 13%. It is spooning its 200 day SMA for the last couple of weeks, and to be frank it needs to push off that secular line sooner rather than later if that potential double bottom pattern is to take shape.

Special Situations:

- Specialty retail play up 54% YTD and 63% over last one-year period. Dividend yield of 1%.

- Name at all-time highs and advanced 12 of last 19 weeks. Current 3-week winning streak has gained a combined 11%. Very round 200 number was resistance in May and August now looks like a floor going forward.

- Earnings mixed with gains of 4 and 4.4% on 10/21 and 4/22 and losses of 4.3 and 2.8% on 7/19 and 1/28.

- Enter after break above cup with handle.

- Entry TSCO 215. Stop 206.50.

- Recreational products play higher by 44% YTD and 88% over last one year period.

- Name still 7% off recent 52-week highs, but a nice change in character with 15% gain during current 3-week losing streak. Was preceded by 6-week losing streak.

- Earnings mostly higher with gains of 4.9, 5.4, and 16.5% on 8/5, 5/13, and 11/5/20 (fell 8% on 2/11).

- Enter on pullback after break above 50 day SMA.

- Entry YETI 97. Stop 94.

- Specialty retail play down 41% YTD and 9% over last one-year period.

- Name still 70% off most recent 52-week highs and first consecutive WEEKLY advances since late June and early July.

- Back-to-back positive earnings reactions up 15.6 and 14.1% on 6/8 and 9/22 (rose 39.2% on 12/8/20 fell 21.8% on 3/9).

- Enter after dragonfly doji/bullish engulfing candle.

- Entry SFIX here. Stop 32.50.

Good luck.

Entry summaries:

Buy after break above cup with handle TSCO 215. Stop 206.50.

Buy decisive break above 50 day SMA YETI 97. Stop 94.

Buy after dragonfly doji/bullish engulfing candle SFIX here. Stop 32.50.