Is 2022 Year Energy Breaks The Curse?

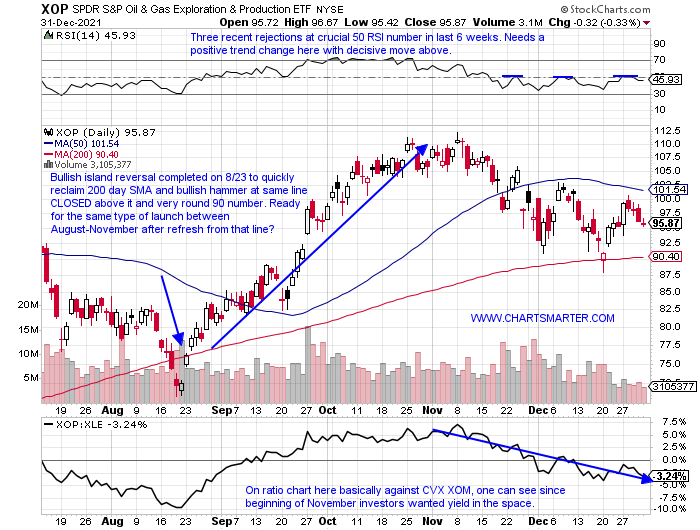

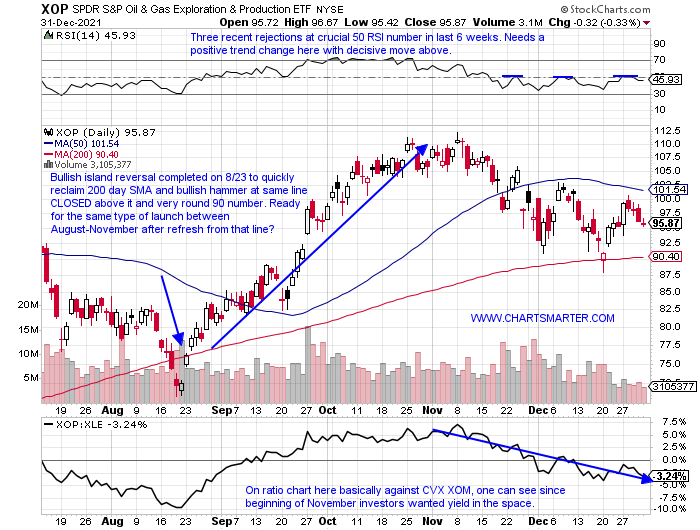

- We frequently mention the pic here of how energy has a tendency to lag other major S&P sector peers, after a year that it was the best actor of 11. In 2007 and 2016 it was the best behaved, and notice the following year it was negative as 2008 fell 35% and 2017 lost 1%. Of course, 2021 was a stellar year for the group with the XLE jumping 46%. Will this be the year where it can back it up with another solid performance in consecutive years? Perhaps as many may not be positioned for that, and the space is still hated by many (political pressures and bank lending to energy names is seen as politically risky too, thanks Will), and it still represents a very small fraction of the S&P. Below is the chart of the XOP and since late November has been reluctant to remain above the very round par number. I think the trend is your friend and energy will surprise and continue its upward ascent. Look for CVX to dominate XOM as well, as it currently trades just 2% off most recent 52 week highs, as XOM is now 8% below its own. On its WEEKLY chart, it has the look of a bull flag with a move above 120 carrying a measured move of nearly 30 handles. That will have a dramatic impact on the entire space, and many will be lifted by that possible rising tide.

Equipment Check:

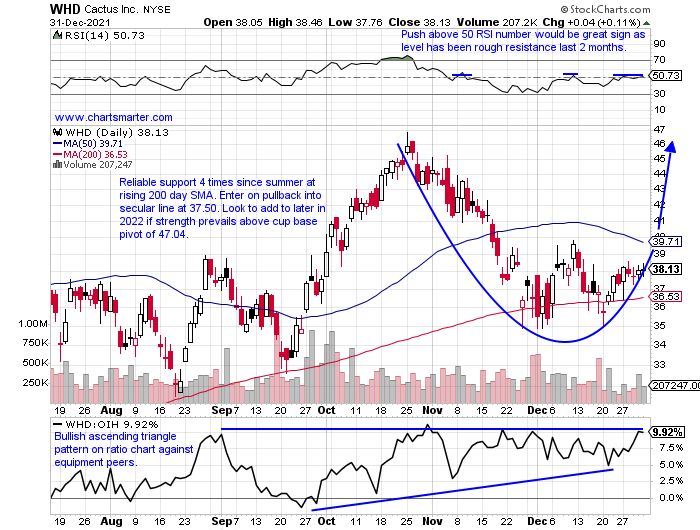

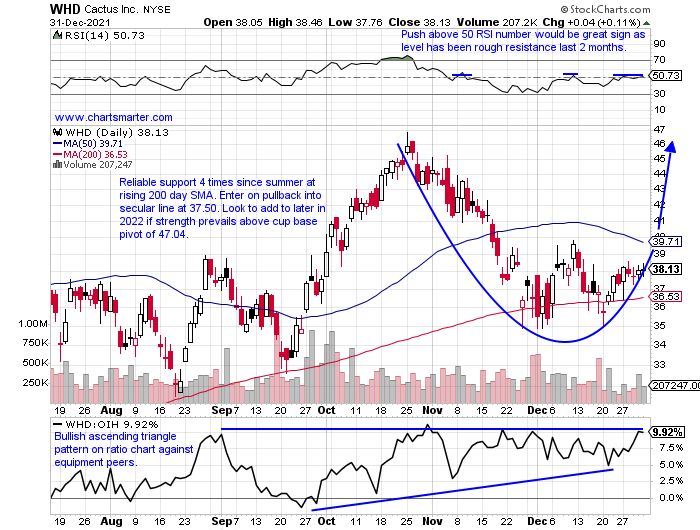

- The equipment space in 2021 drastically underperformed exploration as the OIH advanced 20% (XOP rose 64%). The ETF trades 26% off most recent 52 week highs compared to the XOP which resides 15% off its own yearly peak. The OIH did record a bearish death cross last week, but those indicators are unreliable as it recorded one in early September, and a few sessions later it went on to register a 50 handle rise. The fund is top-heavy like many with HAL and SLB making up one-third of the ETF. SLB has gained 7 of the last 8 sessions, after the completion of a bullish morning star on 12/27, and above 30 looks attractive. Others in the space have underperformed like HP which is now 35% off most recent 52 week highs and is weakening again after filling in an upside gap fill from the 11/24 session. Below is the chart of a name I like in WHD, with good risk/reward scenario here in the neighborhood of its rising 200 day SMA which has been comforting in the second half of 2021. Last week it displayed nice relative strength up 2.2% as the OIH fell by 1.3%.

Recent Examples:

- Coal names are so abhorred that the old KOL ETF was disbanded about one year ago. It does not mean there is still not a way to be exposed to the space as there have been some winners within. AMR which traded with a one handle, not a typo, in March of 2020 to a high near 70 in Q4 '21. It trades just 12% off most recent 52 week highs and is enjoying a current 5-week winning streak. It is building the right side of a cup-base above 60, but it does trade in light volume. Below is a name in CEIX and how it appeared in our 12/9 Energy Note. It too has a very nice 2021, until 10/19 that slumped 12.6%, recording a bearish engulfing candle in the process. Now it trades 37% off that ascent and could be in a good risk/reward scenario in 2022. The stock managed to bounce nicely off the very round 20 number on both 12/3 and 12/15 and went on to advance almost 30% before a rejection at its downward sloping 50 day SMA. If that 20 number continues to hold, which now doubles as 200 day SMA support, the stock could have a very strong 2022.

Special Situations:

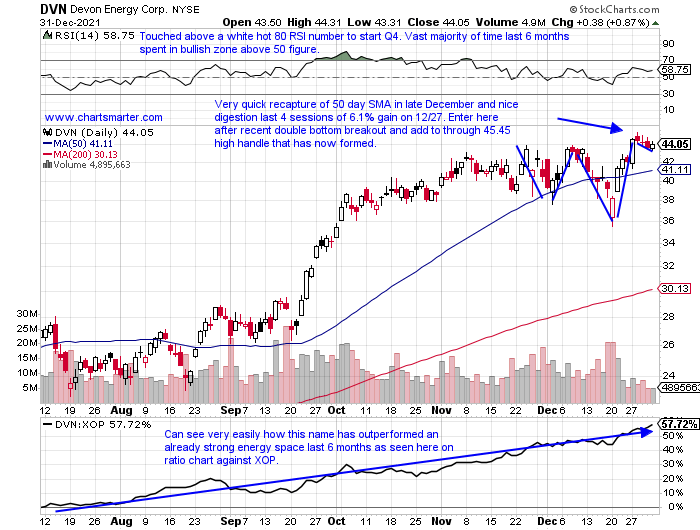

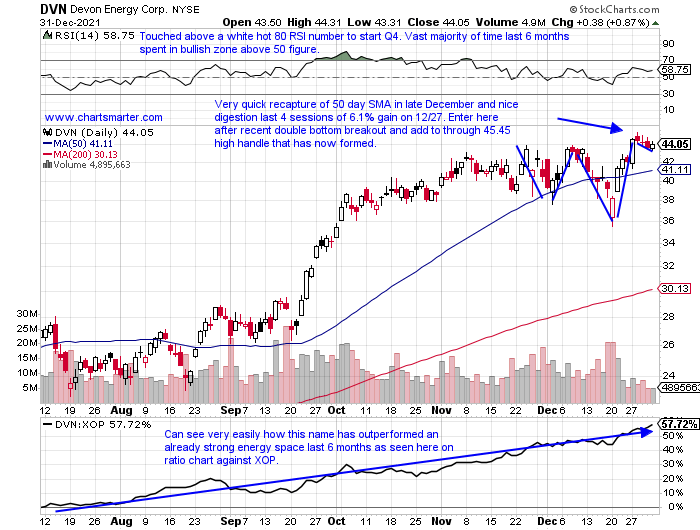

- Exploration leader higher by 179% over last one year period. Dividend yield of 1%.

- Name just 3% off most recent 52-week highs and good relative strength last week up 4.7% (XOP rose just .4 % last week), nice follow through as week prior rose 7.3%.

- Earnings mostly higher with 3 straight positive reactions up 7.6, 4.1, and 5.7% on 5/5, 2/17, and 10/30/20 (was UNCH on 11/3 and down 3.5% on 8/4).

- Enter after recent double bottom breakout.

- Entry DVN here. Stop 41.

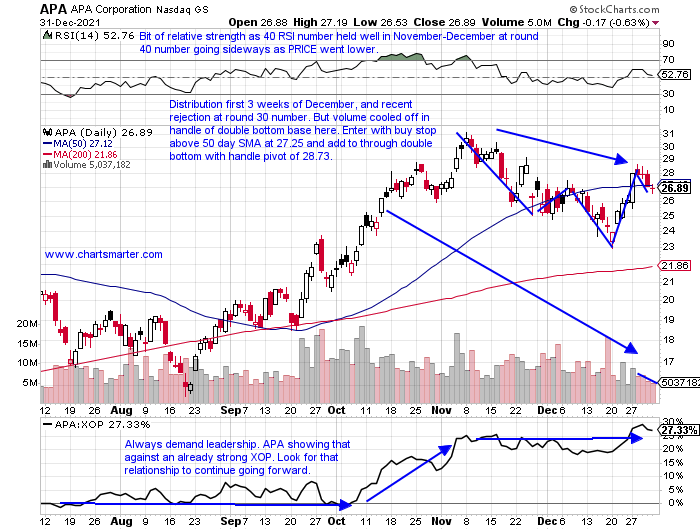

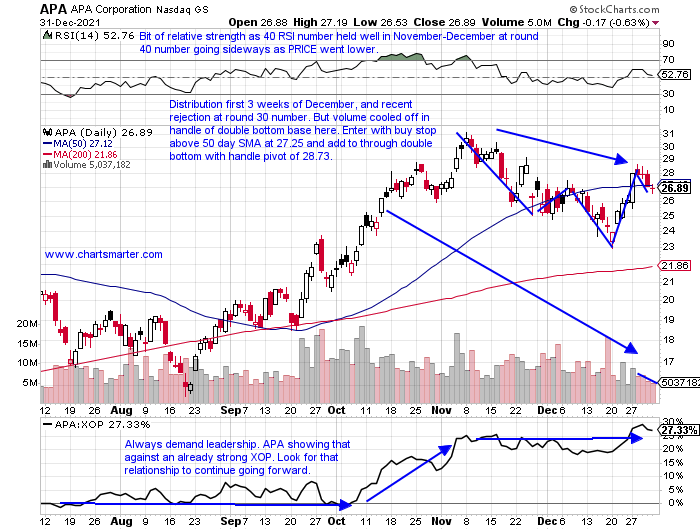

- Exploration play rose 89% in last one year period. Dividend yield of 1.9%.

- Name 14% off most recent 52-week highs and week ending 12/24 rose almost 7% and bounced in 23-24 area which was resistance in both March and June 2020. Former resistance becomes current support.

- Three straight positive earnings reactions up 5.2, 1.7, and 2.2% on 11/4, 8/5, and 5/6 (fell 3.3% on 2/25).

- Enter with buy stop back above 50 day SMA.

- Entry APA 27.25. Stop 26.

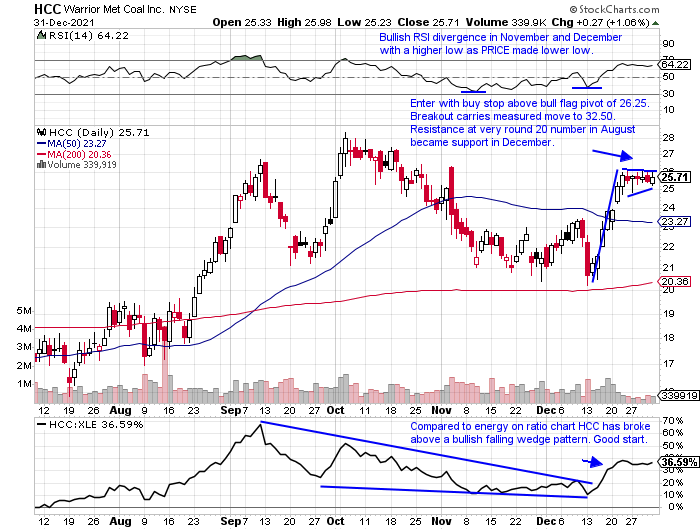

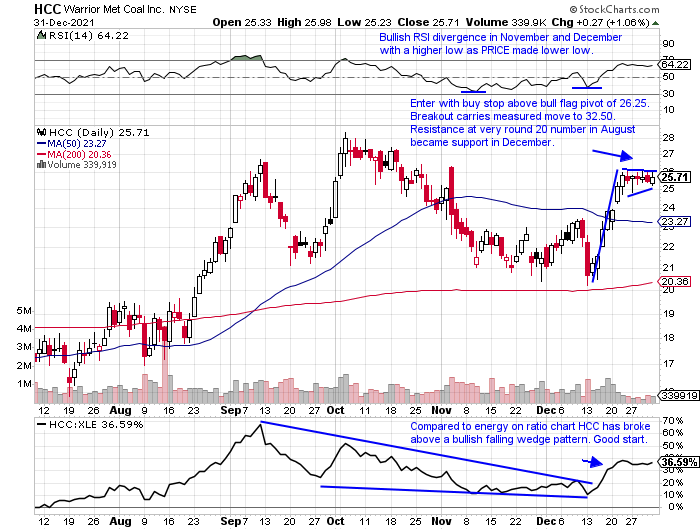

- Coal name higher by 21% over last one year period. Dividend yield of .8%.

- Name now 9% off most recent 52-week highs. Current 6 week winning streak with most impressive week ending 12/17 that rose almost 6% powerfully off the very round 20 number.

- Earnings mostly lower with losses of 5.5, 5.3, and 22.5% on 11/3, 5/6, and 2/25 (rose 3.2% on 8/5).

- Enter with buy stop above bull flag pivot.

- Entry HCC 26.25. Stop 24.75.

Good luck.

Entry summaries:

Buy after recent break above double bottom pattern DVN here. Stop 41.

Buy stop back above 50 day SMA APA 27.25. Stop 26.

Buy stop above bull flag pivot HCC 26.25. Stop 24.75.

This article requires a Chartsmarter membership. Please click here to join.

Is 2022 Year Energy Breaks The Curse?

- We frequently mention the pic here of how energy has a tendency to lag other major S&P sector peers, after a year that it was the best actor of 11. In 2007 and 2016 it was the best behaved, and notice the following year it was negative as 2008 fell 35% and 2017 lost 1%. Of course, 2021 was a stellar year for the group with the XLE jumping 46%. Will this be the year where it can back it up with another solid performance in consecutive years? Perhaps as many may not be positioned for that, and the space is still hated by many (political pressures and bank lending to energy names is seen as politically risky too, thanks Will), and it still represents a very small fraction of the S&P. Below is the chart of the XOP and since late November has been reluctant to remain above the very round par number. I think the trend is your friend and energy will surprise and continue its upward ascent. Look for CVX to dominate XOM as well, as it currently trades just 2% off most recent 52 week highs, as XOM is now 8% below its own. On its WEEKLY chart, it has the look of a bull flag with a move above 120 carrying a measured move of nearly 30 handles. That will have a dramatic impact on the entire space, and many will be lifted by that possible rising tide.

Equipment Check:

- The equipment space in 2021 drastically underperformed exploration as the OIH advanced 20% (XOP rose 64%). The ETF trades 26% off most recent 52 week highs compared to the XOP which resides 15% off its own yearly peak. The OIH did record a bearish death cross last week, but those indicators are unreliable as it recorded one in early September, and a few sessions later it went on to register a 50 handle rise. The fund is top-heavy like many with HAL and SLB making up one-third of the ETF. SLB has gained 7 of the last 8 sessions, after the completion of a bullish morning star on 12/27, and above 30 looks attractive. Others in the space have underperformed like HP which is now 35% off most recent 52 week highs and is weakening again after filling in an upside gap fill from the 11/24 session. Below is the chart of a name I like in WHD, with good risk/reward scenario here in the neighborhood of its rising 200 day SMA which has been comforting in the second half of 2021. Last week it displayed nice relative strength up 2.2% as the OIH fell by 1.3%.

Recent Examples:

- Coal names are so abhorred that the old KOL ETF was disbanded about one year ago. It does not mean there is still not a way to be exposed to the space as there have been some winners within. AMR which traded with a one handle, not a typo, in March of 2020 to a high near 70 in Q4 '21. It trades just 12% off most recent 52 week highs and is enjoying a current 5-week winning streak. It is building the right side of a cup-base above 60, but it does trade in light volume. Below is a name in CEIX and how it appeared in our 12/9 Energy Note. It too has a very nice 2021, until 10/19 that slumped 12.6%, recording a bearish engulfing candle in the process. Now it trades 37% off that ascent and could be in a good risk/reward scenario in 2022. The stock managed to bounce nicely off the very round 20 number on both 12/3 and 12/15 and went on to advance almost 30% before a rejection at its downward sloping 50 day SMA. If that 20 number continues to hold, which now doubles as 200 day SMA support, the stock could have a very strong 2022.

Special Situations:

- Exploration leader higher by 179% over last one year period. Dividend yield of 1%.

- Name just 3% off most recent 52-week highs and good relative strength last week up 4.7% (XOP rose just .4 % last week), nice follow through as week prior rose 7.3%.

- Earnings mostly higher with 3 straight positive reactions up 7.6, 4.1, and 5.7% on 5/5, 2/17, and 10/30/20 (was UNCH on 11/3 and down 3.5% on 8/4).

- Enter after recent double bottom breakout.

- Entry DVN here. Stop 41.

- Exploration play rose 89% in last one year period. Dividend yield of 1.9%.

- Name 14% off most recent 52-week highs and week ending 12/24 rose almost 7% and bounced in 23-24 area which was resistance in both March and June 2020. Former resistance becomes current support.

- Three straight positive earnings reactions up 5.2, 1.7, and 2.2% on 11/4, 8/5, and 5/6 (fell 3.3% on 2/25).

- Enter with buy stop back above 50 day SMA.

- Entry APA 27.25. Stop 26.

- Coal name higher by 21% over last one year period. Dividend yield of .8%.

- Name now 9% off most recent 52-week highs. Current 6 week winning streak with most impressive week ending 12/17 that rose almost 6% powerfully off the very round 20 number.

- Earnings mostly lower with losses of 5.5, 5.3, and 22.5% on 11/3, 5/6, and 2/25 (rose 3.2% on 8/5).

- Enter with buy stop above bull flag pivot.

- Entry HCC 26.25. Stop 24.75.

Good luck.

Entry summaries:

Buy after recent break above double bottom pattern DVN here. Stop 41.

Buy stop back above 50 day SMA APA 27.25. Stop 26.

Buy stop above bull flag pivot HCC 26.25. Stop 24.75.