Opportunity Or Omen?

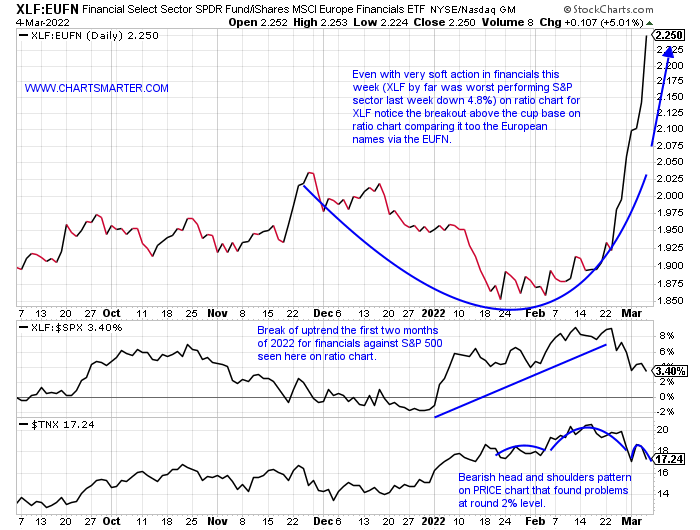

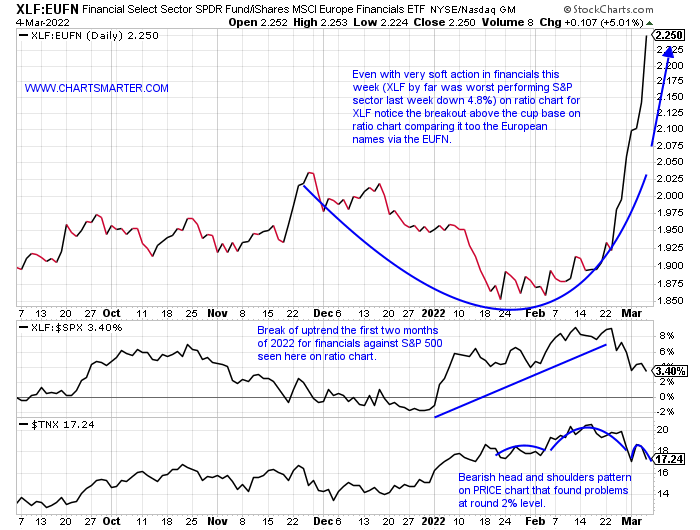

- The disaster that occurred within the finance group recently here was pale in comparison to what happened with their European counterparts. The EUFN plummeted more than 15% this week in the largest WEEKLY volume in at least 5 years. One name I do think provides a decent opportunity is DB which Friday CLOSED right at the very round 10 number. Just one month ago it recorded a very powerful breakout above a WEEKLY cup base pivot of 15.44 the week ending 2/4 that screamed higher by 17% in a pattern nine months in duration. Getting back to our domestic names BAC is trading between the very round 40-50 figures. The big question is if the huge drawdown across the ocean is creating good long-term entries into some of the best in breed banks here? Is the weakness in the ten-year yield putting a bid under the home construction ETF in the ITB? The fund is on a 7-week losing streak although it did record a huge bullish hammer WEEKLY candle the week ending off the round 60 number, and the last 5 weeks have CLOSED taut finishing with a 66 or 67 handle. In my opinion, some of the better plays in the XLF is BRKB which trades 1% off all-time highs and has defended the very round 300 number on 1/24-25 and 2/24. Another top ten holding in the fund SCHW looks solid with a CLOSING stop below 76.

Former Leader Attractive?

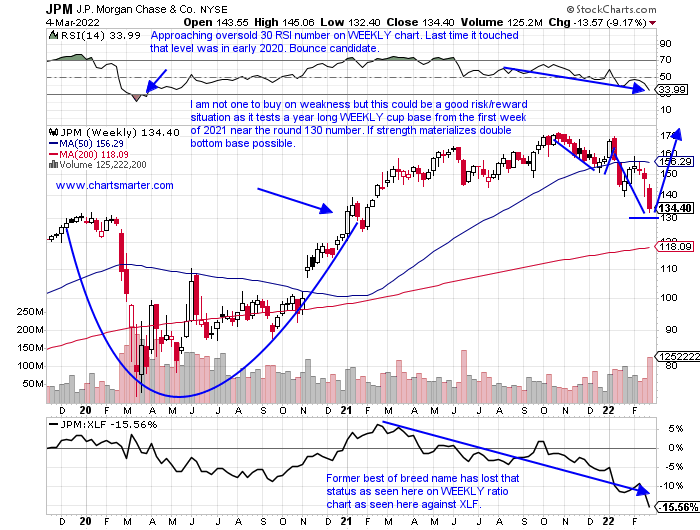

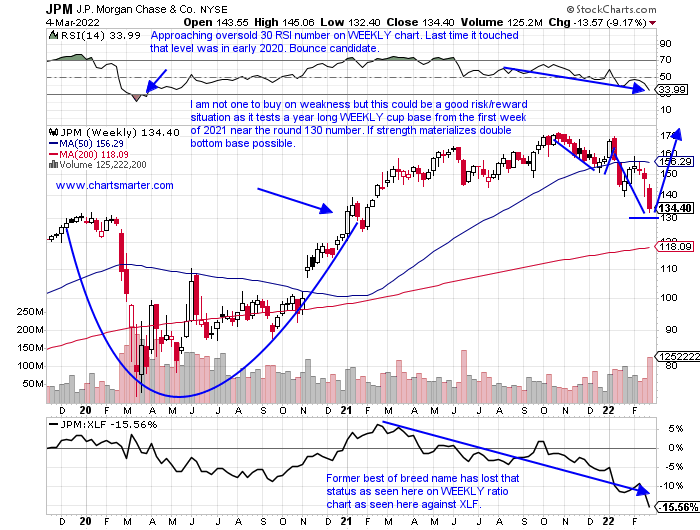

- We know the saying that in fresh bull markets new leaders emerge at the forefront. In the banking group, there is not an abundance of names to make that leap. The disruptors in names like SOFI and UPST are not fulfilling their end of the bargain. SOFI looked as if it was going to make a charge higher after the CLOSE last Tuesday up more than 20% after earnings, but the 3/2 session recorded a bearish filled-in black candlestick at the downward sloping 50 day SMA. It followed through to end the week lower by 6.3% and CLOSING at the very round 10 number, a familiar level with SPACs. UPST is now 68% off highs achieved at the very round 400 number last October and a move back below 120 could see par relatively quickly. It has recorded two bearish dark cloud covers candles on 2/17 and 3/1. JPM sits 22% off most recent 52 week highs and it could see a reversal higher at this level here explained below. Enter at 132 and use a stop of 123.

Recent Examples:

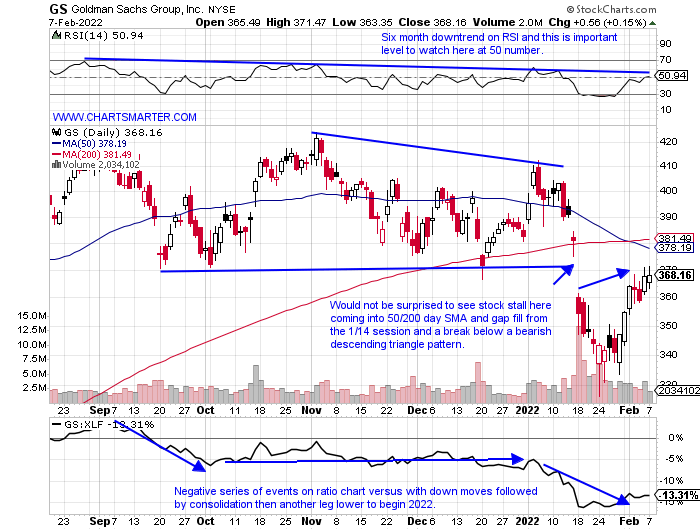

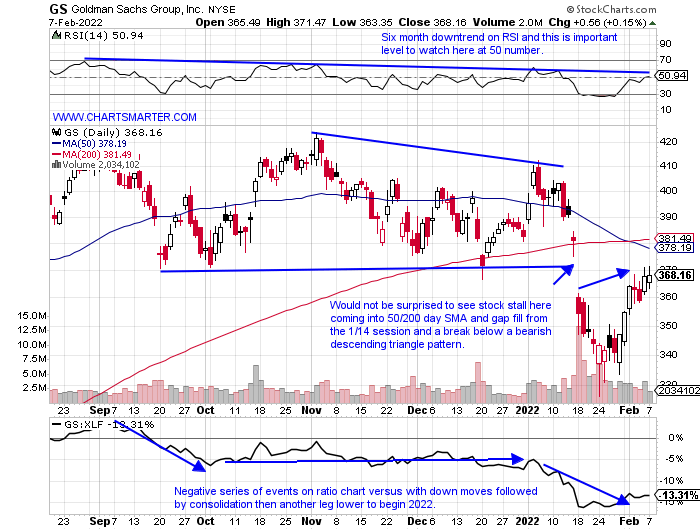

- There is no question the banks have come under pressure recently, but one wants to monitor which ones act better than others in the current environment. Citigroup for example has been a laggard and will most likely continue to do so as it is nearly off by one-third from its highs achieved last June with a bearish WEEKLY doji candle the week ending 6/4/21. MS is now 21% off highs made just one month ago as its break above a WEEKLY cup base pivot just above the very round par number failed miserably. Below is the chart of GS and how it appeared in our 2/9 Financial Note. The stock is now 23% off most recent 52 week highs and on its WEEKLY chart has the look of a long bearish rounded top pattern that began almost one year ago. The stock has declined 5 of the last 8 weeks, with all 5 down weeks CLOSING right at the bottom of the WEEKLY range, obviously a bearish trait. Included in that weakness was the week ending that lost nearly 10%, its largest WEEKLY loss since the throws of the February-March implosion of 2020.

Special Situations:

- Best in breed bank up 2% YTD and 31% over last one year period. Dividend yield of 2%.

- Name now 19% off most recent 52-week highs and on current 3-week losing streak down a combined 17%. Since the lows of November 2020 have recorded just 2 other three-week drops and both achieved near-term lows.

- Earnings mostly higher up 3.7, 4, and 5.5% on 1/14, 7/14, and 4/14 (fell 1.6% on 10/14/21).

- Enter on pullback into 200 day SMA.

- Entry WFC here. Stop 46.

- Consumer finance leader higher by 6% YTD and 21% over last one year period. Dividend yield of 1%.

- Name now 13% off most recent 52-week highs compared to peers MA V and COF down 18, 21, and 25% from their yearly peaks. Down 10.7% last week, its largest WEEKLY loss since week ending 4/3/20. Stock has recorded just one 3-week losing streak since the start of 2021.

- Three straight positive earnings reactions up 8.9, 5.4, and 1.3% on 1/25, 10/22, and 7/23 (fell 1.9% on 4/23/21).

- Enter on pullback into 200 day SMA.

- Entry AXP 170.25. Stop 160.

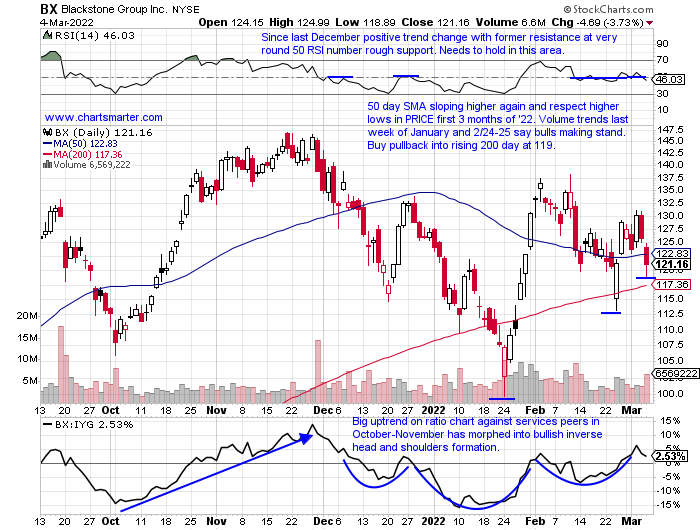

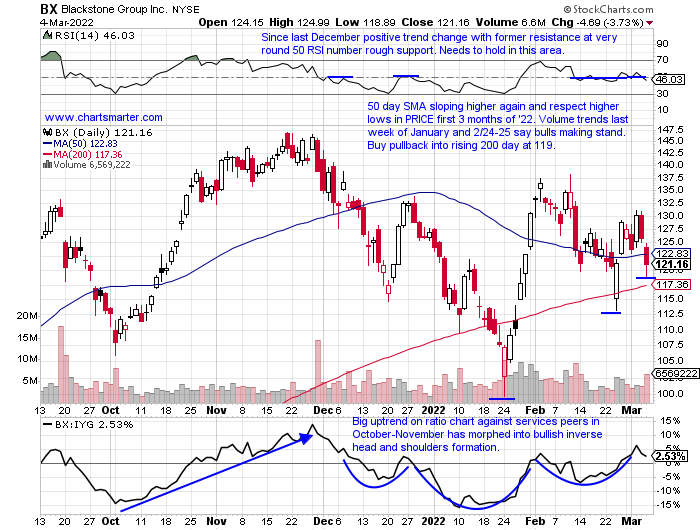

- Asset manager lower by 6% YTD and higher by 81% over last one-year period. Dividend yield of 3.3%.

- Last few months have been digesting massive move from very round 50 number in November 2020 to 150 figure in Q4 '21. Advanced 4 of last 6 weeks with the week ending 1/28 jumping 13.2%, its second-largest WEEKLY gain in 23 months.

- FIVE straight positive earnings reactions up 6.8, 3, 4.1, 3.3 and .4% on 1/27, 10/21, 7/22, 4/22 and 1/27/21.

- Enter on pullback into 200 day SMA.

- Entry BX 119. Stop 114.

Good luck.

Entry summaries:

Buy pullback into 200 day SMA WFC here. Stop 46.

Buy pullback into 200 day SMA AXP 170.25. Stop 160.

Buy pullback into 200 day SMA BX 119. Stop 114.

This article requires a Chartsmarter membership. Please click here to join.

Opportunity Or Omen?

- The disaster that occurred within the finance group recently here was pale in comparison to what happened with their European counterparts. The EUFN plummeted more than 15% this week in the largest WEEKLY volume in at least 5 years. One name I do think provides a decent opportunity is DB which Friday CLOSED right at the very round 10 number. Just one month ago it recorded a very powerful breakout above a WEEKLY cup base pivot of 15.44 the week ending 2/4 that screamed higher by 17% in a pattern nine months in duration. Getting back to our domestic names BAC is trading between the very round 40-50 figures. The big question is if the huge drawdown across the ocean is creating good long-term entries into some of the best in breed banks here? Is the weakness in the ten-year yield putting a bid under the home construction ETF in the ITB? The fund is on a 7-week losing streak although it did record a huge bullish hammer WEEKLY candle the week ending off the round 60 number, and the last 5 weeks have CLOSED taut finishing with a 66 or 67 handle. In my opinion, some of the better plays in the XLF is BRKB which trades 1% off all-time highs and has defended the very round 300 number on 1/24-25 and 2/24. Another top ten holding in the fund SCHW looks solid with a CLOSING stop below 76.

Former Leader Attractive?

- We know the saying that in fresh bull markets new leaders emerge at the forefront. In the banking group, there is not an abundance of names to make that leap. The disruptors in names like SOFI and UPST are not fulfilling their end of the bargain. SOFI looked as if it was going to make a charge higher after the CLOSE last Tuesday up more than 20% after earnings, but the 3/2 session recorded a bearish filled-in black candlestick at the downward sloping 50 day SMA. It followed through to end the week lower by 6.3% and CLOSING at the very round 10 number, a familiar level with SPACs. UPST is now 68% off highs achieved at the very round 400 number last October and a move back below 120 could see par relatively quickly. It has recorded two bearish dark cloud covers candles on 2/17 and 3/1. JPM sits 22% off most recent 52 week highs and it could see a reversal higher at this level here explained below. Enter at 132 and use a stop of 123.

Recent Examples:

- There is no question the banks have come under pressure recently, but one wants to monitor which ones act better than others in the current environment. Citigroup for example has been a laggard and will most likely continue to do so as it is nearly off by one-third from its highs achieved last June with a bearish WEEKLY doji candle the week ending 6/4/21. MS is now 21% off highs made just one month ago as its break above a WEEKLY cup base pivot just above the very round par number failed miserably. Below is the chart of GS and how it appeared in our 2/9 Financial Note. The stock is now 23% off most recent 52 week highs and on its WEEKLY chart has the look of a long bearish rounded top pattern that began almost one year ago. The stock has declined 5 of the last 8 weeks, with all 5 down weeks CLOSING right at the bottom of the WEEKLY range, obviously a bearish trait. Included in that weakness was the week ending that lost nearly 10%, its largest WEEKLY loss since the throws of the February-March implosion of 2020.

Special Situations:

- Best in breed bank up 2% YTD and 31% over last one year period. Dividend yield of 2%.

- Name now 19% off most recent 52-week highs and on current 3-week losing streak down a combined 17%. Since the lows of November 2020 have recorded just 2 other three-week drops and both achieved near-term lows.

- Earnings mostly higher up 3.7, 4, and 5.5% on 1/14, 7/14, and 4/14 (fell 1.6% on 10/14/21).

- Enter on pullback into 200 day SMA.

- Entry WFC here. Stop 46.

- Consumer finance leader higher by 6% YTD and 21% over last one year period. Dividend yield of 1%.

- Name now 13% off most recent 52-week highs compared to peers MA V and COF down 18, 21, and 25% from their yearly peaks. Down 10.7% last week, its largest WEEKLY loss since week ending 4/3/20. Stock has recorded just one 3-week losing streak since the start of 2021.

- Three straight positive earnings reactions up 8.9, 5.4, and 1.3% on 1/25, 10/22, and 7/23 (fell 1.9% on 4/23/21).

- Enter on pullback into 200 day SMA.

- Entry AXP 170.25. Stop 160.

- Asset manager lower by 6% YTD and higher by 81% over last one-year period. Dividend yield of 3.3%.

- Last few months have been digesting massive move from very round 50 number in November 2020 to 150 figure in Q4 '21. Advanced 4 of last 6 weeks with the week ending 1/28 jumping 13.2%, its second-largest WEEKLY gain in 23 months.

- FIVE straight positive earnings reactions up 6.8, 3, 4.1, 3.3 and .4% on 1/27, 10/21, 7/22, 4/22 and 1/27/21.

- Enter on pullback into 200 day SMA.

- Entry BX 119. Stop 114.

Good luck.

Entry summaries:

Buy pullback into 200 day SMA WFC here. Stop 46.

Buy pullback into 200 day SMA AXP 170.25. Stop 160.

Buy pullback into 200 day SMA BX 119. Stop 114.