Size Matters:

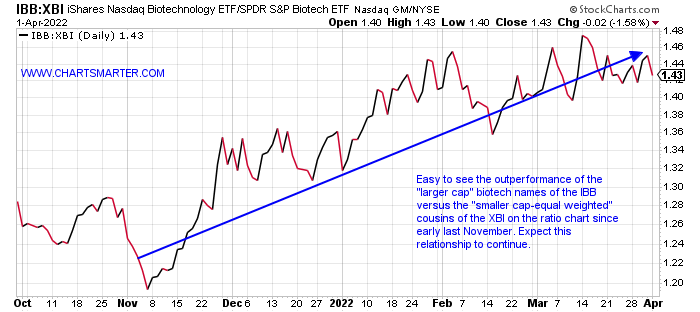

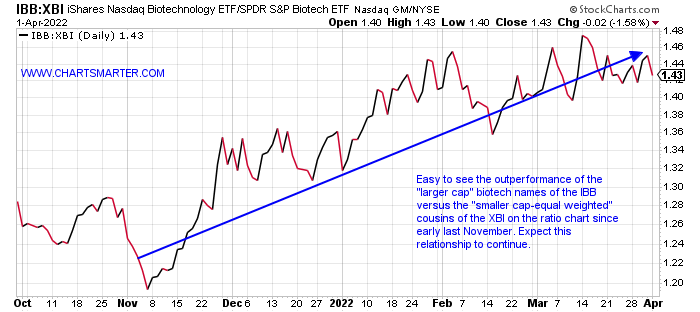

- In times of caution, investors crave more mature, defensive names. The ratio chart comparing the IBB to the XBI demonstrates this well. This past week the 2 ETFs traded inline up nearly 4%. In 2022 the IBB is lower by 13% "outperforming" the XBI which has declined by 17%. Looking at their descents from their most recent 52-week highs IBB is faring a bit better 25% off last August's peak, whereas the XBI is down 34% from its ascent last July. The top-heavy IBB is being aided by top 5 holding REGN which has been trading between the very round 600 and 700 figures since late last December. A CLOSE above 700, the last 3 days of last week were all above intraday but zero CLOSES above could be considered a bull flag breakout with a measured move to 800. VRTX, another top 5 holding, fell just five days in all of March is above a 255.03 cup base pivot. I think one can buy a mix of the best in breed names in both of these funds and we will delve into that below.

Barbell Approach:

- In the diverse healthcare sector, I think one can utilize a "barbell approach", meaning one can include both conservative and more "risky" smaller cap plays. The large-cap pharma names can be considered magnets for those searching for yield, even in an environment with rates going up (even TSLA is looking to issue a dividend). Within the traditional mega-cap pharma plays, if one seeks they shall find some have witnessed nice appreciation and a nice dividend yield. BMY is up 18% YTD and sports a 3.3% dividend yield as has advanced 15 of the last 17 weeks. LLY trades just 1% off all-time highs and is riding a 7-week winning streak and has a mild 1.3% yield, and a move above a bull flag pivot of 295 carries a measured move to 355. Below is MRK which has gained 9% in 2022 thus far and sports a dividend yield of 3.3%. This should in the near term gravitate toward the very round 90 number which was a rough area of a possible upside gap-fill last November, and remember if that occurs names that travel above 90 overwhelmingly go on to par and above.

Recent Examples:

- The biotechs are starting to show mild strength but they are still 19% below its 200 day SMA which is still sloping lower. One wants to search for names within that have shown strength or are above those long-term moving averages. A small-cap play that could fit the bill which has been trading between the round 40-60 numbers thus far in 2022 is KROS. Today had the look of a break above a bullish ascending triangle pivot of 56. Below is another name in the space that is repairing prior technical damage by the session with the chart of NBIX and how it appeared in our 3/15 Healthcare Note. On its WEEKLY chart, it is still making lower highs dating back to July 2020, but it has gained ground 9 of the last 12 weeks, and since breaking above its 200 day SMA on 3/16 it seems to be feeling more comfortable by the day there. Still think this one fills in the upside gap in the near term of the 11/1/21 session. It has the look of breaking above a 95 bull flag pivot Friday.

Special Situations:

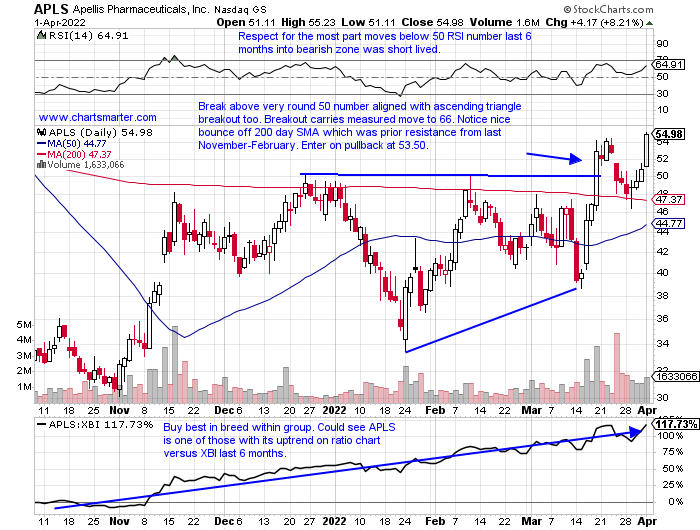

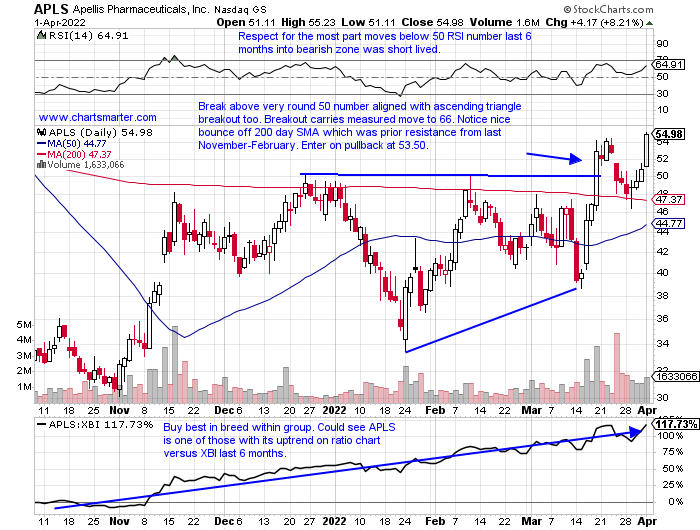

- Biotech play higher by 16% YTD and 28% over last one-year period.

- Name 25% off most recent 52-week highs and has advanced just 5 of the 9 weeks, but two jumped more than double digits and good relative strength this week up 11.6% while XBI rose 4.2%.

- Earnings mostly higher with gains of 5.2, 10.8, and 6.5% on 3/1, 11/9, and 4/29/21 (fell 3.5% on 8/10).

- Enter on pullback into bullish ascending triangle breakout.

- Entry APLS 53.50. Stop 47.75.

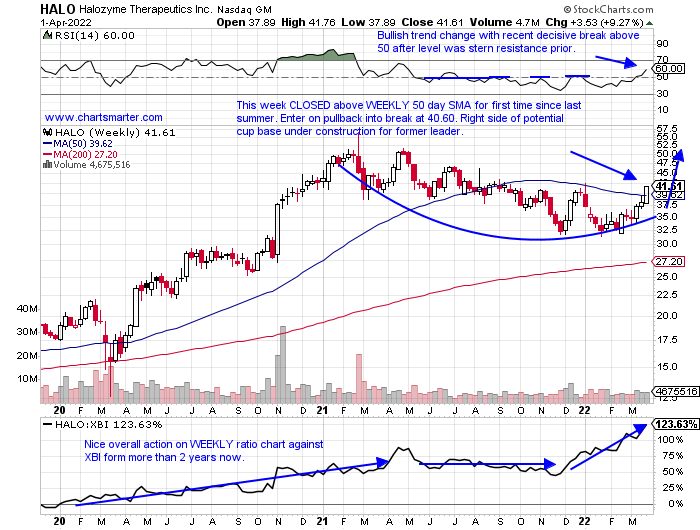

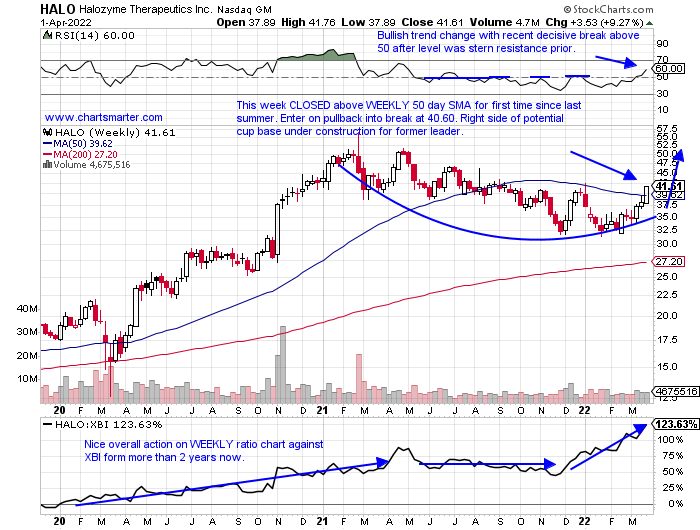

- Biotech name higher by 3% YTD and lower by 2% over last one year period.

- Name 19% off most recent 52-week highs but nice relative strength this week up 9.3% well outpacing XBI. On current 3-week winning streak (just second such run in last 11 months) up a combined 19%.

- Three straight positive earnings reactions up 2.9, 1.4, and 2% on 2/23, 11/3, and 8/10/21 (fell 7.4% on 5/11/21).

- Enter on pullback into break above WEEKLY 50 day SMA.

- Entry HALO 40.60. Stop 38.

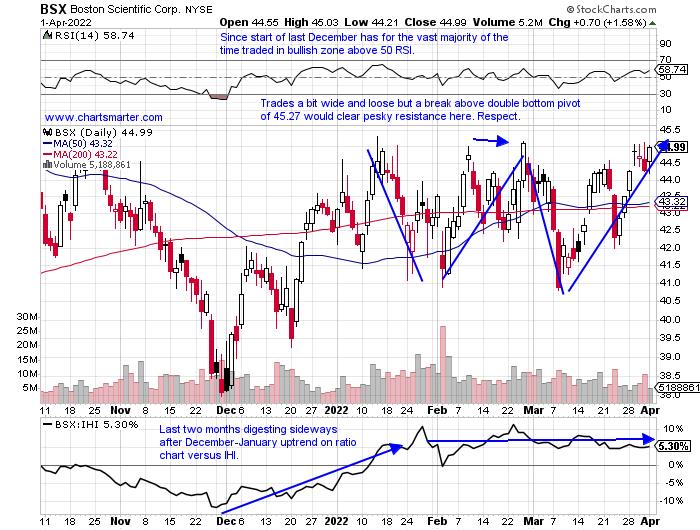

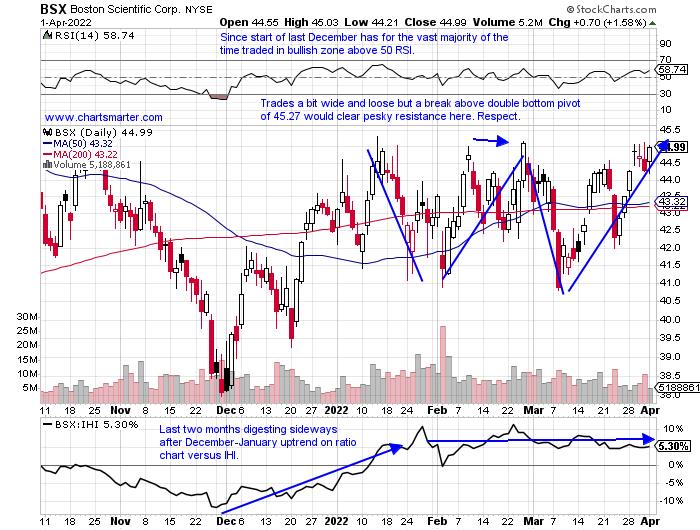

- Medical equipment play higher by 6% YTD and 16% over last one-year period.

- Name just 3% off most recent 52-week highs, good relative strength as IHI is 8% off its own annual peak. Consistent resistance in the 45-46 area and WEEKLY chart has look of bullish inverse head and shoulders that began last summer.

- Back to back negative earnings reactions down 4.7 and 1.3% on 2/2 and 10/27/21 after 3 straight gains of 3.5, 4.3, and 2.2% on 7/27, 4/28, and 2/3/21.

- Enter with buy stop above double bottom pivot.

- Entry BSX 45.27. Stop 43.

Good luck.

Entry summaries:

Buy pullback into bullish ascending triangle breakout APLS 53.50. Stop 47.75.

Buy pullback into break above WEEKLY 50 day SMA HALO 40.60. Stop 38.

Buy stop above double bottom pivot BSX 45.27. Stop 43.

This article requires a Chartsmarter membership. Please click here to join.

Size Matters:

- In times of caution, investors crave more mature, defensive names. The ratio chart comparing the IBB to the XBI demonstrates this well. This past week the 2 ETFs traded inline up nearly 4%. In 2022 the IBB is lower by 13% "outperforming" the XBI which has declined by 17%. Looking at their descents from their most recent 52-week highs IBB is faring a bit better 25% off last August's peak, whereas the XBI is down 34% from its ascent last July. The top-heavy IBB is being aided by top 5 holding REGN which has been trading between the very round 600 and 700 figures since late last December. A CLOSE above 700, the last 3 days of last week were all above intraday but zero CLOSES above could be considered a bull flag breakout with a measured move to 800. VRTX, another top 5 holding, fell just five days in all of March is above a 255.03 cup base pivot. I think one can buy a mix of the best in breed names in both of these funds and we will delve into that below.

Barbell Approach:

- In the diverse healthcare sector, I think one can utilize a "barbell approach", meaning one can include both conservative and more "risky" smaller cap plays. The large-cap pharma names can be considered magnets for those searching for yield, even in an environment with rates going up (even TSLA is looking to issue a dividend). Within the traditional mega-cap pharma plays, if one seeks they shall find some have witnessed nice appreciation and a nice dividend yield. BMY is up 18% YTD and sports a 3.3% dividend yield as has advanced 15 of the last 17 weeks. LLY trades just 1% off all-time highs and is riding a 7-week winning streak and has a mild 1.3% yield, and a move above a bull flag pivot of 295 carries a measured move to 355. Below is MRK which has gained 9% in 2022 thus far and sports a dividend yield of 3.3%. This should in the near term gravitate toward the very round 90 number which was a rough area of a possible upside gap-fill last November, and remember if that occurs names that travel above 90 overwhelmingly go on to par and above.

Recent Examples:

- The biotechs are starting to show mild strength but they are still 19% below its 200 day SMA which is still sloping lower. One wants to search for names within that have shown strength or are above those long-term moving averages. A small-cap play that could fit the bill which has been trading between the round 40-60 numbers thus far in 2022 is KROS. Today had the look of a break above a bullish ascending triangle pivot of 56. Below is another name in the space that is repairing prior technical damage by the session with the chart of NBIX and how it appeared in our 3/15 Healthcare Note. On its WEEKLY chart, it is still making lower highs dating back to July 2020, but it has gained ground 9 of the last 12 weeks, and since breaking above its 200 day SMA on 3/16 it seems to be feeling more comfortable by the day there. Still think this one fills in the upside gap in the near term of the 11/1/21 session. It has the look of breaking above a 95 bull flag pivot Friday.

Special Situations:

- Biotech play higher by 16% YTD and 28% over last one-year period.

- Name 25% off most recent 52-week highs and has advanced just 5 of the 9 weeks, but two jumped more than double digits and good relative strength this week up 11.6% while XBI rose 4.2%.

- Earnings mostly higher with gains of 5.2, 10.8, and 6.5% on 3/1, 11/9, and 4/29/21 (fell 3.5% on 8/10).

- Enter on pullback into bullish ascending triangle breakout.

- Entry APLS 53.50. Stop 47.75.

- Biotech name higher by 3% YTD and lower by 2% over last one year period.

- Name 19% off most recent 52-week highs but nice relative strength this week up 9.3% well outpacing XBI. On current 3-week winning streak (just second such run in last 11 months) up a combined 19%.

- Three straight positive earnings reactions up 2.9, 1.4, and 2% on 2/23, 11/3, and 8/10/21 (fell 7.4% on 5/11/21).

- Enter on pullback into break above WEEKLY 50 day SMA.

- Entry HALO 40.60. Stop 38.

- Medical equipment play higher by 6% YTD and 16% over last one-year period.

- Name just 3% off most recent 52-week highs, good relative strength as IHI is 8% off its own annual peak. Consistent resistance in the 45-46 area and WEEKLY chart has look of bullish inverse head and shoulders that began last summer.

- Back to back negative earnings reactions down 4.7 and 1.3% on 2/2 and 10/27/21 after 3 straight gains of 3.5, 4.3, and 2.2% on 7/27, 4/28, and 2/3/21.

- Enter with buy stop above double bottom pivot.

- Entry BSX 45.27. Stop 43.

Good luck.

Entry summaries:

Buy pullback into bullish ascending triangle breakout APLS 53.50. Stop 47.75.

Buy pullback into break above WEEKLY 50 day SMA HALO 40.60. Stop 38.

Buy stop above double bottom pivot BSX 45.27. Stop 43.