Most Breakouts Are Retested To Determine Their Validity:

- My belief is that going forward into the short term, perhaps until the end of summer, the bullish narrative flows through technology. The nascent growth outperforming value needs to persist here. Friday most likely caught many bulls offside but on the chart below of the QQQ one can see a line being drawn in the sand with an impending retest of the bullish ascending triangle just below the very round 300 number. Round number theory is coming into play a lot here overall with the Nasdaq trading roughly between the very round 11000-12000 figures in July (S&P 500 playing footsies with the 4000 figure and the SOXX being rejected at the 400 level Thursday). Nothing goes up in a straight line, but give the Nasdaq credit for still making higher lows since mid-June. The whole sanguine tech thesis will be put to the test next week as 4 of the top 7 holdings REPORT earnings next week including AAPL GOOGL MSFT META and AMZN.

What Recession?

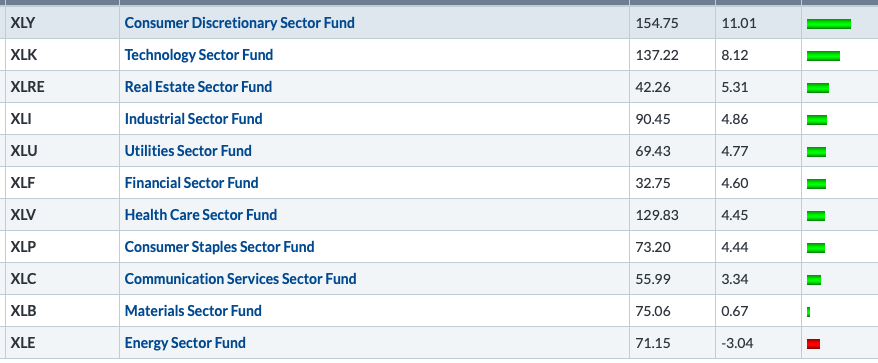

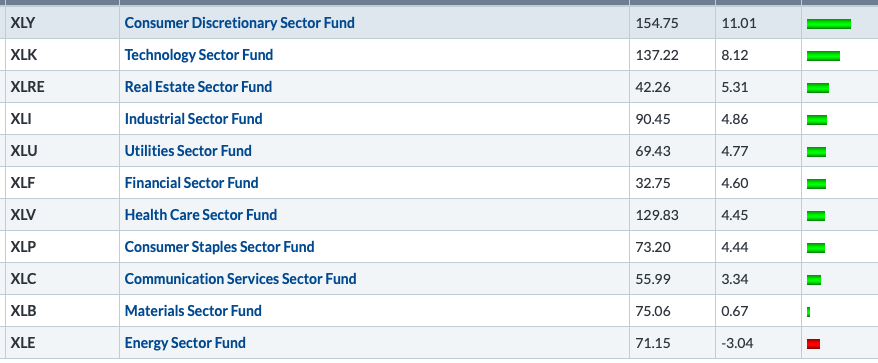

- The definition of a recession is 2 consecutive quarters of negative GDP readings. Two-thirds of gross domestic product comes from consumer spending. Now one can look at employment figures and wages, etc but we prefer that the genuine data is reflected in PRICE. Below is the table of the 11 major S&P sectors and their performance over the last one-month period. It demonstrates growth has come back into play (tech second best). At the top of the leaderboard sits consumer discretionary with an 11% advance. Last week it was the best actor of 11 as well with a gain of nearly 7%. We are all aware of the top-heavy presence in the XLY from TSLA and AMZN, with the former on an 8 session winning streak. The latter recorded a bearish engulfing candle Friday after a spirited run of 20 handles, a much bigger percentage gain after its 20/1 split last month.

Deeper Dive:

- Take a look at what has contributed to the positive action over the last one-month period it has been the homebuilders (below are the top ten subsectors within XLY). Interestingly the group started going higher last month before rates "peaked", anticipating lower 10-year yields. The ITB is now on a 5-week winning streak with all 5 weeks CLOSING near highs for the WEEKLY range and rising by more than a combined 20%. BZH has recorded the best percentage gain of the group rising by 50% over the last five weeks from the very round 10 number. Within automobiles, TSLA added 15%, but other noteworthy double-digit moves came from F and GM, the former reclaiming its 50-day SMA. Notable relative strength within foreign car names, RACE was one of the only names to advance over the last one month as it grapples with the very round 200 number here. Ferrari rose 9.1% during the time period whereas STLA (Dutch), DDAIF BMWYY (German), NSANY (Japan), and BYDDF (China) fell between 2.2 and 15.6%.

You've Got To Know When To Hold Them:

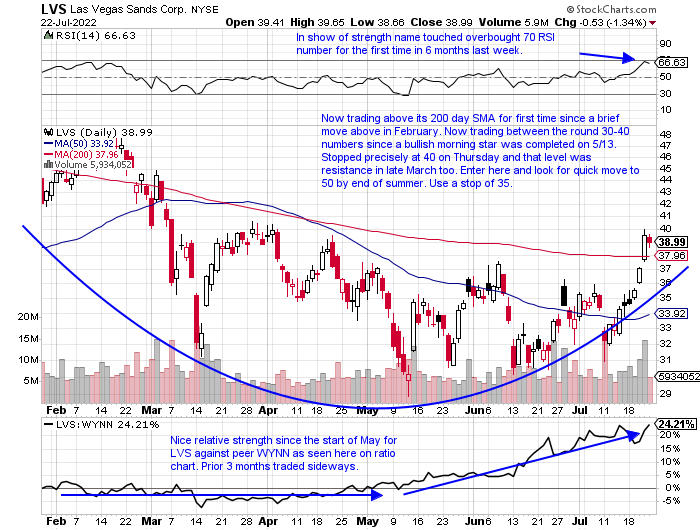

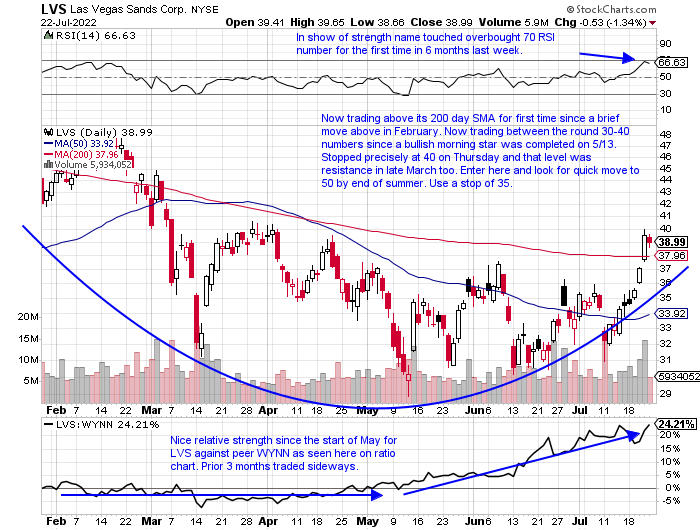

- Know when to Fold them. Maybe Kenny Rogers was an analyst he would have put a "hold" rating on LVS here. Referencing the gaming strength in the table in the last paragraph, we are seeing an early winner emerge. And remember stocks that jump out of the gate first are often ones that we lead further once the group catches some love. LVS recorded its second straight positive earnings reaction last Thursday up 6.6% (rose 2.4% on 4/28) after the prior 4 reports all fell. More importantly, it has now recaptured both its 50 and 200-day SMAs. Last week it rose almost 13% and Friday on a soft overall tape fell 1.4% recording a bullish inside day, losing less than half of what peers WYNN and CZR fell by. Do not sleep on fellow gaming peer CHDN which has gained more than 20% over the last one-month period. If that can clear 222 it would put a WEEKLY double bottom add-on pivot of 249.43 into focus.

Cash Is King?

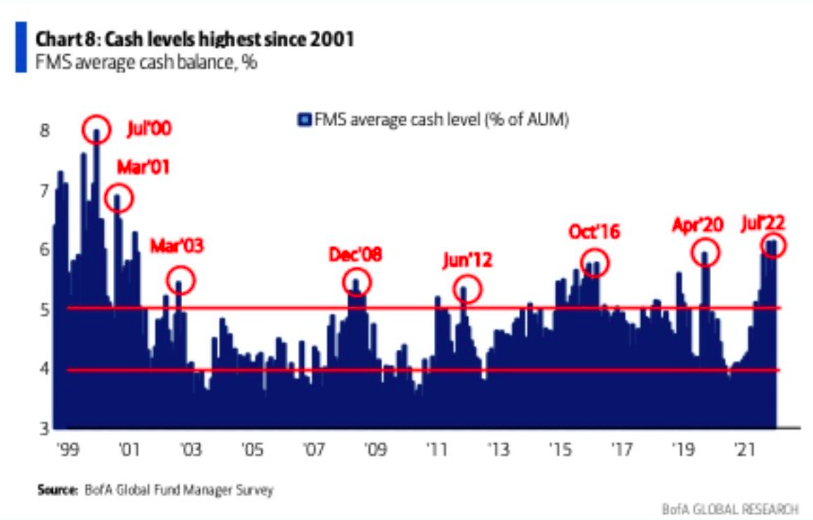

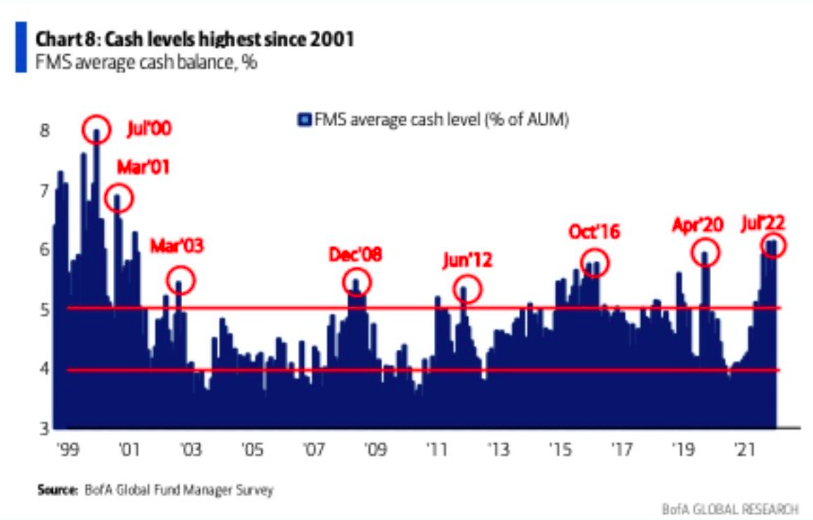

- While cash has been a prudent position for most of 2022, from a tactical standpoint it could be a good time to deploy some now. Based on the chart below from Bank Of America, showing the largest levels since 2001, perhaps too much is on the sidelines. If the benchmarks can solidify their recent gains that can lure those who have been patient to wade back in and create a FOMO-like experience. That is an unlikely scenario but one has to be open-minded too. The markets continue to do what they do best in confounding the most. Keep in mind that this week not only brings a bevy of earnings announcements but the Fed meeting on Wednesday. Either one or surprises from both could have a dramatic impact on cash levels.

Volume Puzzlement?

- For those who believe that volume needs to accompany market rallies, I am one of them, the chart below from Bespoke proves otherwise. Volume to me is the footprint of institutional purchasing and perhaps now I can change my view that it is welcomed, but not actually necessary. For the Nasdaq, just two sessions since the recent low (not yet calling it a bottom) have come in well above average trade on 6/17 and 6/24. Those were both Fridays, and in fact, I was surprised to see the last 5 Fridays before 7/22 all advanced. Keep in mind the indexes do not usually see huge volume sessions, perhaps with the exception of witching, and it is different with individual stocks that would be very bullish when examining breakouts. Also when potential rallies start lack of belief is the reason and it will kick once the move starts to gain credence. Either way, it will not shake my belief in PRICE being omnipotent will never change.

Banking Outlier:

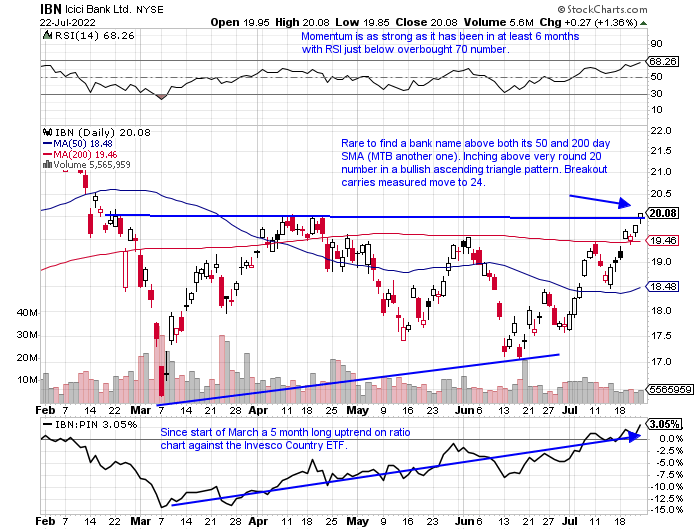

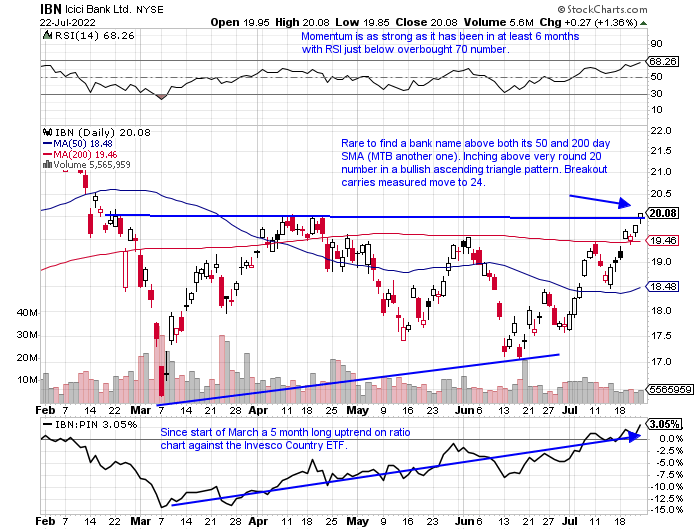

- Looking at bank plays from around the globe it is interesting to see if there are any names that are demonstrating exceptional strength. Of course here at home, many have already recorded earnings results and this week the best actors were GS MS and WFC up 10.4, 5.5, and 5%. In Latin/South America big Brazilian banks ITUB and BBD are trading in the low single digits and are 31 and 43% respectively off their most recent 52-week highs. CIB, in Colombia, looked very promising after a brief break above a cup base pivot of 44.43 but fell 23 of 28 sessions between 6/3-7/14 after election results. Peering broadly at Europe the EUFN is 31% from its peak this January. Below is the chart of an Indian name up 1% YTD and 14% over the last one-year period. It is 10% off the most recent 52-week highs, with good relative strength against PIN down 19% from the annual peak. The stock has recorded SEVEN straight positive earnings reactions and I believe its next reaction will be Monday. It has conquered the very round 20 number Friday on a CLOSING basis for the first time since 2/22. Enter here and use a stop of 18.50.

Good luck.

This article requires a Chartsmarter membership. Please click here to join.

Most Breakouts Are Retested To Determine Their Validity:

- My belief is that going forward into the short term, perhaps until the end of summer, the bullish narrative flows through technology. The nascent growth outperforming value needs to persist here. Friday most likely caught many bulls offside but on the chart below of the QQQ one can see a line being drawn in the sand with an impending retest of the bullish ascending triangle just below the very round 300 number. Round number theory is coming into play a lot here overall with the Nasdaq trading roughly between the very round 11000-12000 figures in July (S&P 500 playing footsies with the 4000 figure and the SOXX being rejected at the 400 level Thursday). Nothing goes up in a straight line, but give the Nasdaq credit for still making higher lows since mid-June. The whole sanguine tech thesis will be put to the test next week as 4 of the top 7 holdings REPORT earnings next week including AAPL GOOGL MSFT META and AMZN.

What Recession?

- The definition of a recession is 2 consecutive quarters of negative GDP readings. Two-thirds of gross domestic product comes from consumer spending. Now one can look at employment figures and wages, etc but we prefer that the genuine data is reflected in PRICE. Below is the table of the 11 major S&P sectors and their performance over the last one-month period. It demonstrates growth has come back into play (tech second best). At the top of the leaderboard sits consumer discretionary with an 11% advance. Last week it was the best actor of 11 as well with a gain of nearly 7%. We are all aware of the top-heavy presence in the XLY from TSLA and AMZN, with the former on an 8 session winning streak. The latter recorded a bearish engulfing candle Friday after a spirited run of 20 handles, a much bigger percentage gain after its 20/1 split last month.

Deeper Dive:

- Take a look at what has contributed to the positive action over the last one-month period it has been the homebuilders (below are the top ten subsectors within XLY). Interestingly the group started going higher last month before rates "peaked", anticipating lower 10-year yields. The ITB is now on a 5-week winning streak with all 5 weeks CLOSING near highs for the WEEKLY range and rising by more than a combined 20%. BZH has recorded the best percentage gain of the group rising by 50% over the last five weeks from the very round 10 number. Within automobiles, TSLA added 15%, but other noteworthy double-digit moves came from F and GM, the former reclaiming its 50-day SMA. Notable relative strength within foreign car names, RACE was one of the only names to advance over the last one month as it grapples with the very round 200 number here. Ferrari rose 9.1% during the time period whereas STLA (Dutch), DDAIF BMWYY (German), NSANY (Japan), and BYDDF (China) fell between 2.2 and 15.6%.

You've Got To Know When To Hold Them:

- Know when to Fold them. Maybe Kenny Rogers was an analyst he would have put a "hold" rating on LVS here. Referencing the gaming strength in the table in the last paragraph, we are seeing an early winner emerge. And remember stocks that jump out of the gate first are often ones that we lead further once the group catches some love. LVS recorded its second straight positive earnings reaction last Thursday up 6.6% (rose 2.4% on 4/28) after the prior 4 reports all fell. More importantly, it has now recaptured both its 50 and 200-day SMAs. Last week it rose almost 13% and Friday on a soft overall tape fell 1.4% recording a bullish inside day, losing less than half of what peers WYNN and CZR fell by. Do not sleep on fellow gaming peer CHDN which has gained more than 20% over the last one-month period. If that can clear 222 it would put a WEEKLY double bottom add-on pivot of 249.43 into focus.

Cash Is King?

- While cash has been a prudent position for most of 2022, from a tactical standpoint it could be a good time to deploy some now. Based on the chart below from Bank Of America, showing the largest levels since 2001, perhaps too much is on the sidelines. If the benchmarks can solidify their recent gains that can lure those who have been patient to wade back in and create a FOMO-like experience. That is an unlikely scenario but one has to be open-minded too. The markets continue to do what they do best in confounding the most. Keep in mind that this week not only brings a bevy of earnings announcements but the Fed meeting on Wednesday. Either one or surprises from both could have a dramatic impact on cash levels.

Volume Puzzlement?

- For those who believe that volume needs to accompany market rallies, I am one of them, the chart below from Bespoke proves otherwise. Volume to me is the footprint of institutional purchasing and perhaps now I can change my view that it is welcomed, but not actually necessary. For the Nasdaq, just two sessions since the recent low (not yet calling it a bottom) have come in well above average trade on 6/17 and 6/24. Those were both Fridays, and in fact, I was surprised to see the last 5 Fridays before 7/22 all advanced. Keep in mind the indexes do not usually see huge volume sessions, perhaps with the exception of witching, and it is different with individual stocks that would be very bullish when examining breakouts. Also when potential rallies start lack of belief is the reason and it will kick once the move starts to gain credence. Either way, it will not shake my belief in PRICE being omnipotent will never change.

Banking Outlier:

- Looking at bank plays from around the globe it is interesting to see if there are any names that are demonstrating exceptional strength. Of course here at home, many have already recorded earnings results and this week the best actors were GS MS and WFC up 10.4, 5.5, and 5%. In Latin/South America big Brazilian banks ITUB and BBD are trading in the low single digits and are 31 and 43% respectively off their most recent 52-week highs. CIB, in Colombia, looked very promising after a brief break above a cup base pivot of 44.43 but fell 23 of 28 sessions between 6/3-7/14 after election results. Peering broadly at Europe the EUFN is 31% from its peak this January. Below is the chart of an Indian name up 1% YTD and 14% over the last one-year period. It is 10% off the most recent 52-week highs, with good relative strength against PIN down 19% from the annual peak. The stock has recorded SEVEN straight positive earnings reactions and I believe its next reaction will be Monday. It has conquered the very round 20 number Friday on a CLOSING basis for the first time since 2/22. Enter here and use a stop of 18.50.

Good luck.