Dog No More?

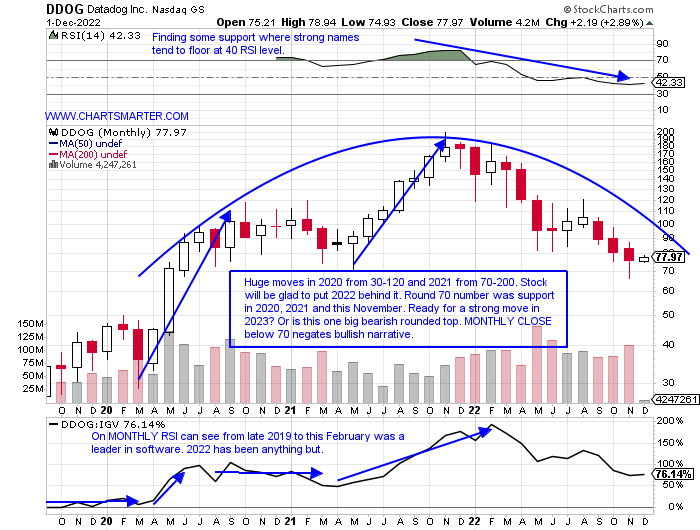

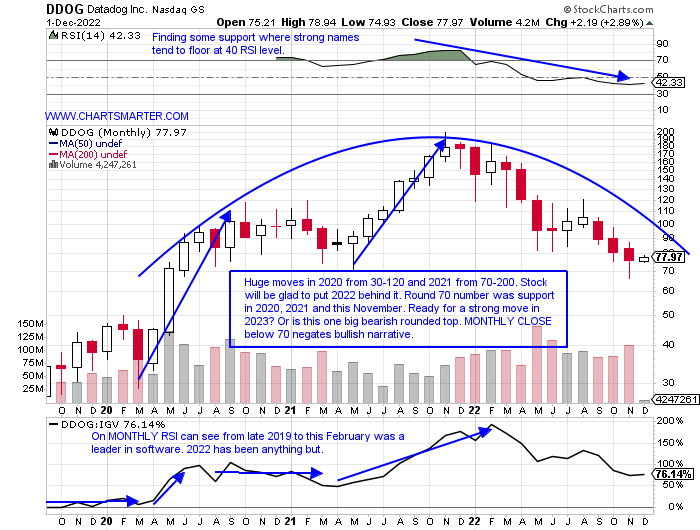

- The software names have been among some of the wobbliest in the tech sector. With one month left in 2022, many are looking to put the year in the rearview mirror. Will the space be hit with year-end tax selling and see further declines? Stocks down more than 70% YTD, not a typo, include TWLO ASAN and COIN. Other larger cap names that were pulled down with the overall weight are ADBE CRWD TEAM DOCU WDAY and INTU. Looking at the MONTHLY chart below of DDOG, could this name be looked at as a turnaround candidate? Of course, only PRICE will let us know but the round 70 level has been influential in the past and will likely continue to do so. Last month it traded with an intramonth low of 66.45 but CLOSED just below 76. In May 2021 it touched the number and went on to advance 7 consecutive months. If it can stay north of 70 perhaps 2023 will look kindly on this name. Its daily chart on Wednesday recorded a bullish engulfing candle, which also filled in a gap from the 11/9 session. The bulls song theme for 2023 could be "Who Let The Dogs Out." If the level fails to hold look out below.

Beware Of Name Changes:

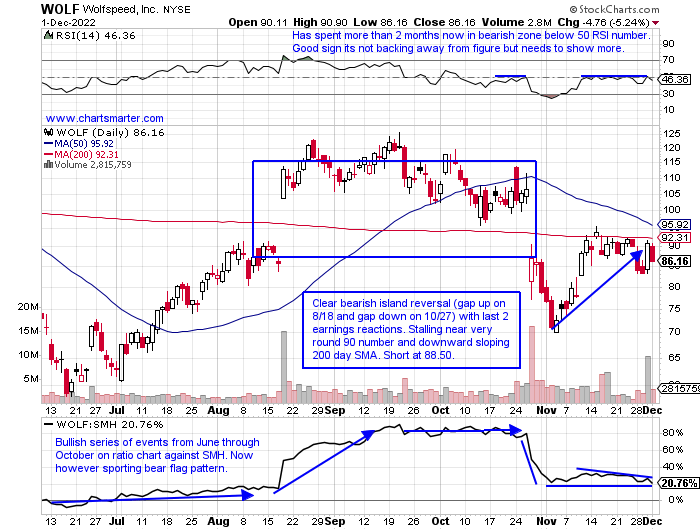

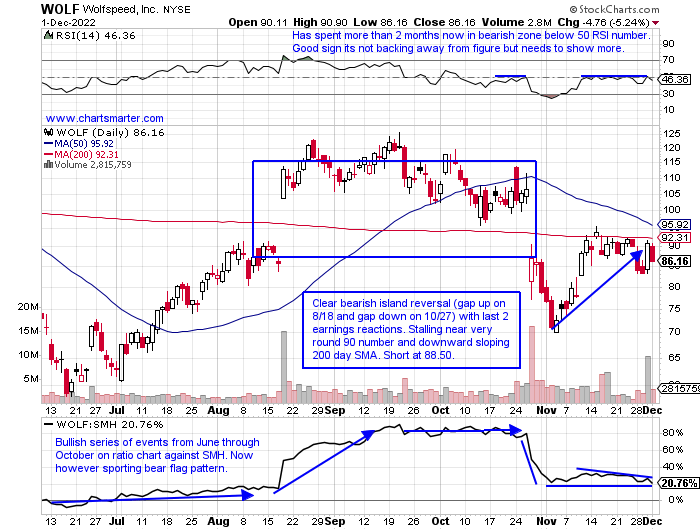

- The important semiconductor industry has been a source of strength recently inside technology. The SMH during the last 3 weeks has nicely digested the robust week ending 11/11 gain of 15.4% in strong volume which CLOSED right at the top of the WEEKLY range. Thursday understandably stalled right at its 200-day SMA in a bull flag formation. Truth be told, those types of continuation patterns work best near 52-week highs, but give credit to some names within behaving beautifully. Names up better than 25% over the last month include AMKR LSCC TSM AMD and NVDA. Of course, others have not participated like an MU which is essentially UNCH over the same time frame. Below is the chart of former best-in-breed WOLF (former CREE) and it too has been feeble. Over the last 3 months, as the SMH has risen 8%, it has declined by 22%. It plummeted 31% in the two weeks ending between 10/28-11/4 as the SMH gained 3%. This name must be looked at cautiously until it can recoup its 200-day SMA. Until then deploy capital to better-deserving names within.

Recent Examples:

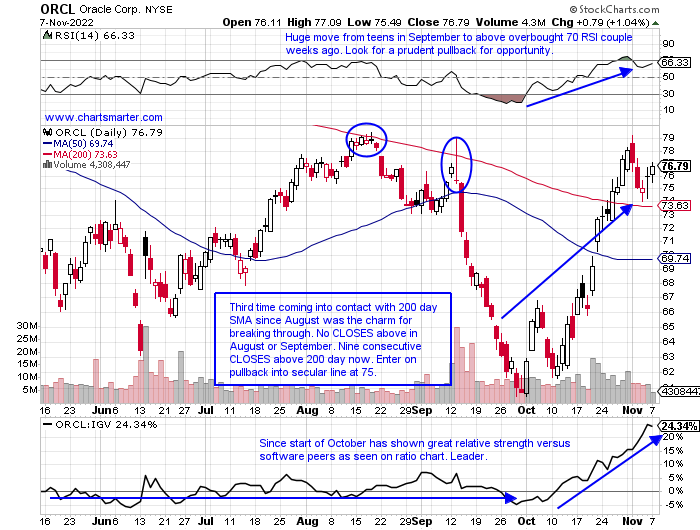

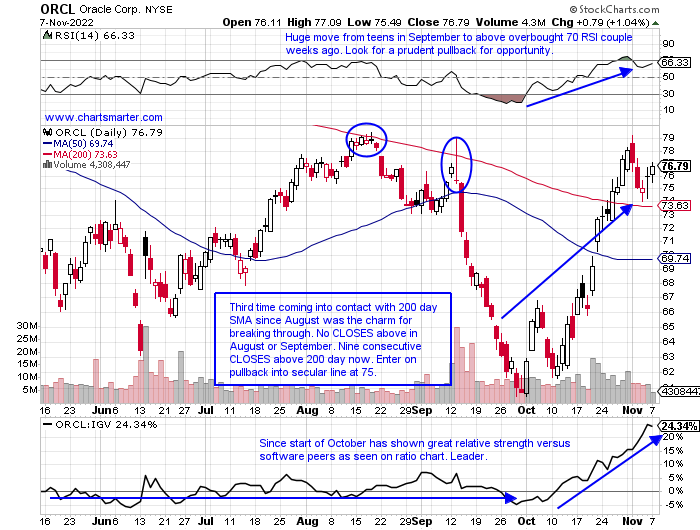

- "Old tech" has found some love with investors' recent affinity to mature stocks. IBM is just 1% off most recent 52-week highs and is still paying a dividend well north of 4%. CSCO is trying to definitively break above the ceiling in the round number range between 50-60 it has been trading at since late April and it pays a 3% yield. INTC, whose PRICE action has a lot to be desired has recorded just 8% WEEKLY gains and its dividend pays 5%. JBL is building the right side of a long WEEKLY cup base now one year in duration. Below is the chart of another in ORCL and how it appeared in our 11/7 Technology Note. Over the last month, it has added a gradual 9% advance and is looking for its 8th gain in the last 9 weeks depending on Fridays CLOSE. On its WEEKLY chart, it has broken the string of lower highs dating back to last December just above the very round par number. It now has the look of breaking above an inverse head and shoulders pivot of 80 that carries a measured move right back to that 100 figure.

Special Situations:

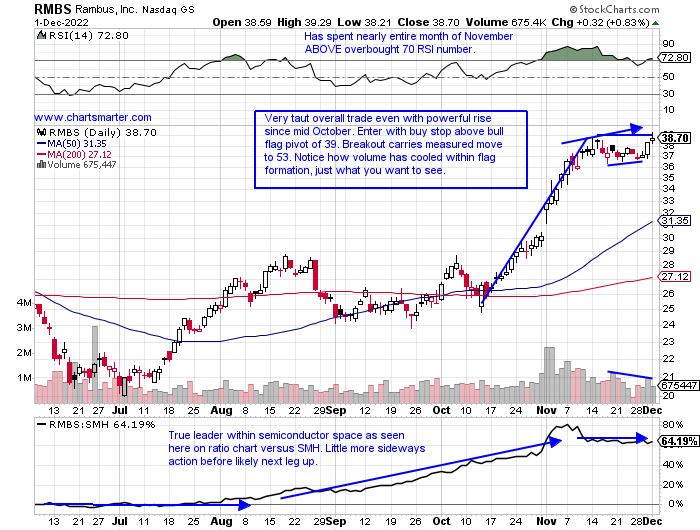

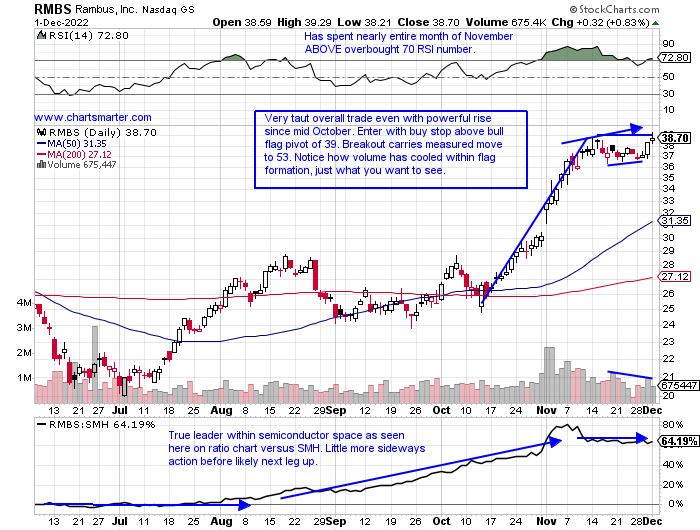

- "Old tech" semi-play up 32% YTD and 42% over last one year period.

- Name 2% off decade-plus highs and last 3 weeks all CLOSED very tight within just .31 of each other. Has nearly doubled since run off very round 20 number since bullish piercing line candle the week ending 7/8.

- FOUR straight positive earnings reactions (seven in total) up 8.8, 3.8, 2.9, and 4.7% on 11/1, 8/2, 5/3, and 2/8.

- Enter with buy stop above bull flag.

- Entry RMBS 39. Stop 36.25.

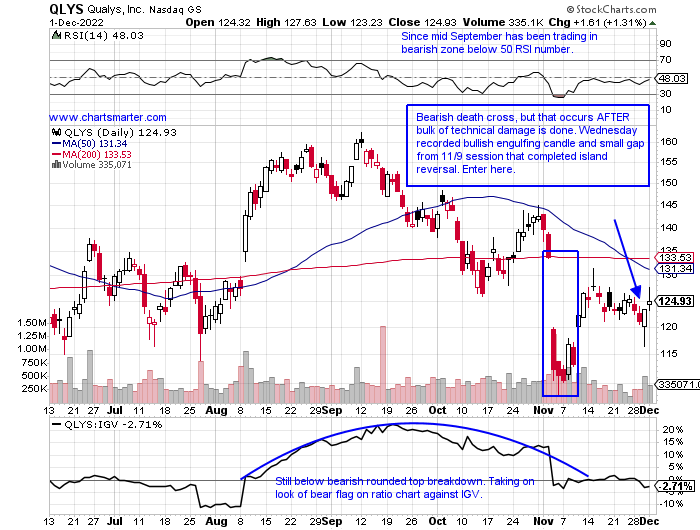

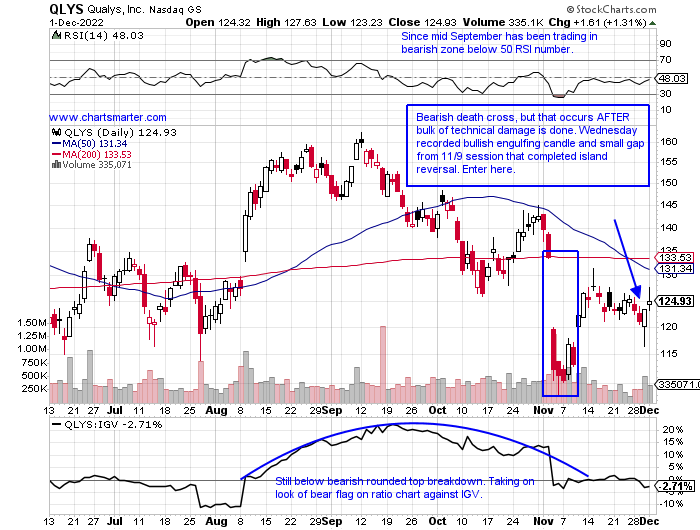

- Software name down 9% YTD and UNCH over last one year period.

- Name 23% off most recent 52-week highs and attempting to recover huge WEEKLY loss ending 11/4 that fell 21.8% in the second largest WEEKLY volume in 1 1/2 years.

- Earnings mostly lower off 16, 5.5, and 14.3% on 11/3, 5/4, and 2/11 and rose 12% on 8/9.

- Enter after gap fill/retest of island reversal/engulfing candle.

- Entry QLYS here. Stop 116.

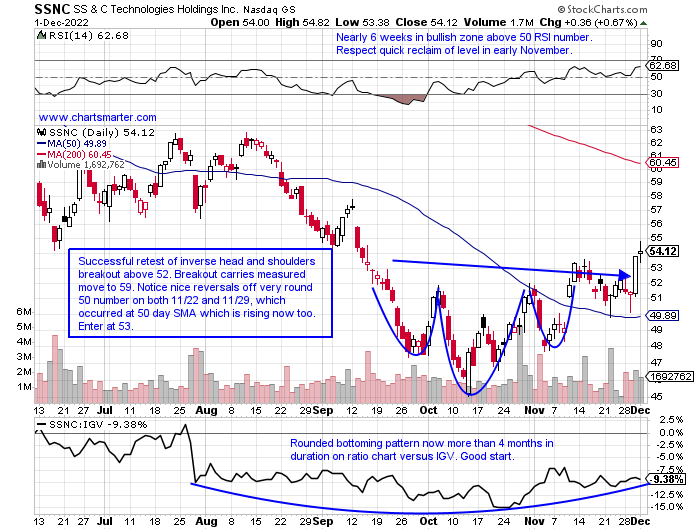

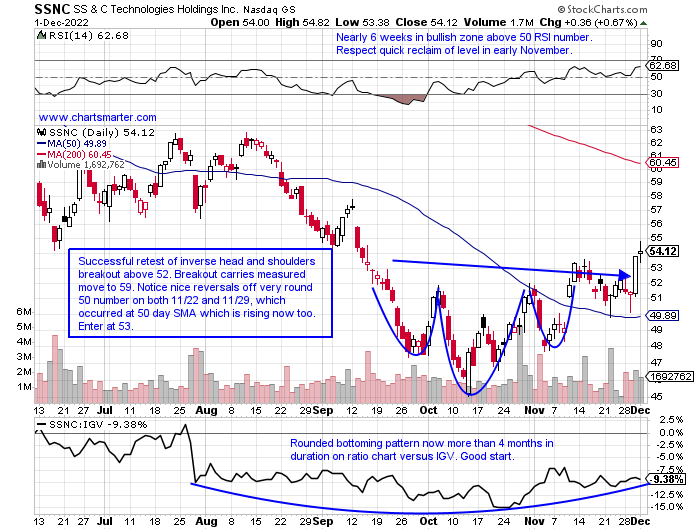

- Software name down 34% YTD and 27% over last one year period. Dividend yield of 1.5%.

- Name 36% off most recent 52-week highs and higher 4 of the last 6 weeks with the last 3 WEEKLY advancers all CLOSING right at highs for WEEKLY range, including jumps 6.8 and 9.2%.

- Earnings mostly lower with 3 straight drops of 6.4, 6.3, and 5.1% on 7/28, 4/29, and 2/11 before gain of 3.8% on 10/28.

- Enter after retest of inverse head and shoulders breakout.

- Entry SSNC 53. Stop 49.

Good luck.

Entry summaries:

Buy stop above bull flag RMBS 39. Stop 36.25.

Buy after gap fill/retest of island reversal/engulfing candle QLYS here. Stop 116.

Buy after retest of inverse head and shoulders breakout SSNC 53. Stop 49.

This article requires a Chartsmarter membership. Please click here to join.

Dog No More?

- The software names have been among some of the wobbliest in the tech sector. With one month left in 2022, many are looking to put the year in the rearview mirror. Will the space be hit with year-end tax selling and see further declines? Stocks down more than 70% YTD, not a typo, include TWLO ASAN and COIN. Other larger cap names that were pulled down with the overall weight are ADBE CRWD TEAM DOCU WDAY and INTU. Looking at the MONTHLY chart below of DDOG, could this name be looked at as a turnaround candidate? Of course, only PRICE will let us know but the round 70 level has been influential in the past and will likely continue to do so. Last month it traded with an intramonth low of 66.45 but CLOSED just below 76. In May 2021 it touched the number and went on to advance 7 consecutive months. If it can stay north of 70 perhaps 2023 will look kindly on this name. Its daily chart on Wednesday recorded a bullish engulfing candle, which also filled in a gap from the 11/9 session. The bulls song theme for 2023 could be "Who Let The Dogs Out." If the level fails to hold look out below.

Beware Of Name Changes:

- The important semiconductor industry has been a source of strength recently inside technology. The SMH during the last 3 weeks has nicely digested the robust week ending 11/11 gain of 15.4% in strong volume which CLOSED right at the top of the WEEKLY range. Thursday understandably stalled right at its 200-day SMA in a bull flag formation. Truth be told, those types of continuation patterns work best near 52-week highs, but give credit to some names within behaving beautifully. Names up better than 25% over the last month include AMKR LSCC TSM AMD and NVDA. Of course, others have not participated like an MU which is essentially UNCH over the same time frame. Below is the chart of former best-in-breed WOLF (former CREE) and it too has been feeble. Over the last 3 months, as the SMH has risen 8%, it has declined by 22%. It plummeted 31% in the two weeks ending between 10/28-11/4 as the SMH gained 3%. This name must be looked at cautiously until it can recoup its 200-day SMA. Until then deploy capital to better-deserving names within.

Recent Examples:

- "Old tech" has found some love with investors' recent affinity to mature stocks. IBM is just 1% off most recent 52-week highs and is still paying a dividend well north of 4%. CSCO is trying to definitively break above the ceiling in the round number range between 50-60 it has been trading at since late April and it pays a 3% yield. INTC, whose PRICE action has a lot to be desired has recorded just 8% WEEKLY gains and its dividend pays 5%. JBL is building the right side of a long WEEKLY cup base now one year in duration. Below is the chart of another in ORCL and how it appeared in our 11/7 Technology Note. Over the last month, it has added a gradual 9% advance and is looking for its 8th gain in the last 9 weeks depending on Fridays CLOSE. On its WEEKLY chart, it has broken the string of lower highs dating back to last December just above the very round par number. It now has the look of breaking above an inverse head and shoulders pivot of 80 that carries a measured move right back to that 100 figure.

Special Situations:

- "Old tech" semi-play up 32% YTD and 42% over last one year period.

- Name 2% off decade-plus highs and last 3 weeks all CLOSED very tight within just .31 of each other. Has nearly doubled since run off very round 20 number since bullish piercing line candle the week ending 7/8.

- FOUR straight positive earnings reactions (seven in total) up 8.8, 3.8, 2.9, and 4.7% on 11/1, 8/2, 5/3, and 2/8.

- Enter with buy stop above bull flag.

- Entry RMBS 39. Stop 36.25.

- Software name down 9% YTD and UNCH over last one year period.

- Name 23% off most recent 52-week highs and attempting to recover huge WEEKLY loss ending 11/4 that fell 21.8% in the second largest WEEKLY volume in 1 1/2 years.

- Earnings mostly lower off 16, 5.5, and 14.3% on 11/3, 5/4, and 2/11 and rose 12% on 8/9.

- Enter after gap fill/retest of island reversal/engulfing candle.

- Entry QLYS here. Stop 116.

- Software name down 34% YTD and 27% over last one year period. Dividend yield of 1.5%.

- Name 36% off most recent 52-week highs and higher 4 of the last 6 weeks with the last 3 WEEKLY advancers all CLOSING right at highs for WEEKLY range, including jumps 6.8 and 9.2%.

- Earnings mostly lower with 3 straight drops of 6.4, 6.3, and 5.1% on 7/28, 4/29, and 2/11 before gain of 3.8% on 10/28.

- Enter after retest of inverse head and shoulders breakout.

- Entry SSNC 53. Stop 49.

Good luck.

Entry summaries:

Buy stop above bull flag RMBS 39. Stop 36.25.

Buy after gap fill/retest of island reversal/engulfing candle QLYS here. Stop 116.

Buy after retest of inverse head and shoulders breakout SSNC 53. Stop 49.