Playing Catch Up:

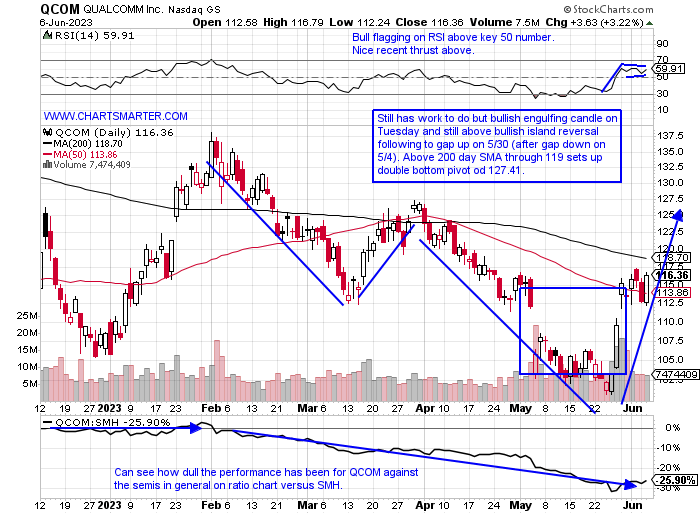

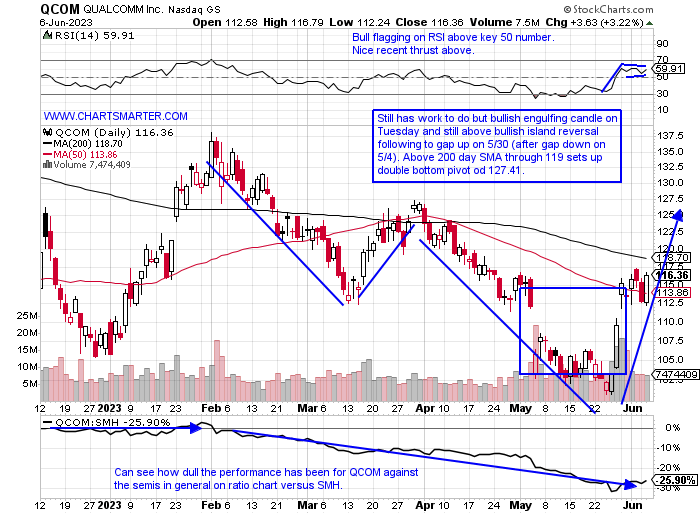

- Some of the "old tech" names are trying to show the new kids on the block they can still learn something from them. IBM is somewhat coming to life as it has cleared a narrow range between the round 120-130 number since late February, and give it some extra credit for recapturing its 200-day SMA. INTC is trying to hold onto the round 30 number, an important one, as bulls and bears have been playing tug of war there since it lost the figure on 9/13/22. Below is the chart of another mature supertanker, which are historically difficult to turnaround, in QCOM. It is still 26% off most recent 52-week highs but did find a floor just above the very round par number recently. Both of its 50 and 200-day SMAs are tilting lower but there are some green shoots. Can these aforementioned names catch a strong bid, as dinosaur software names like ACN ADBE and INTU have? ACN is defending the very round 300 number well, ADBE blasted through 400 several sessions back, and INTU looks exhausted to me trading wide and loose with a possible quadruple top at 460 and an upside gap fill from the 5/23 session.

Software Rolling:

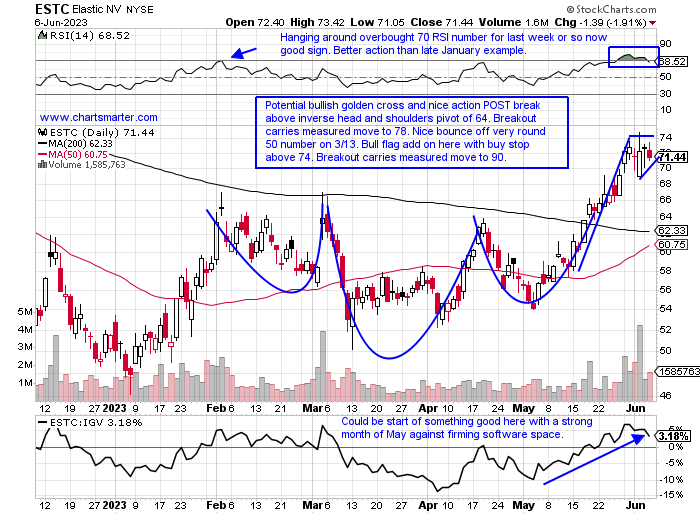

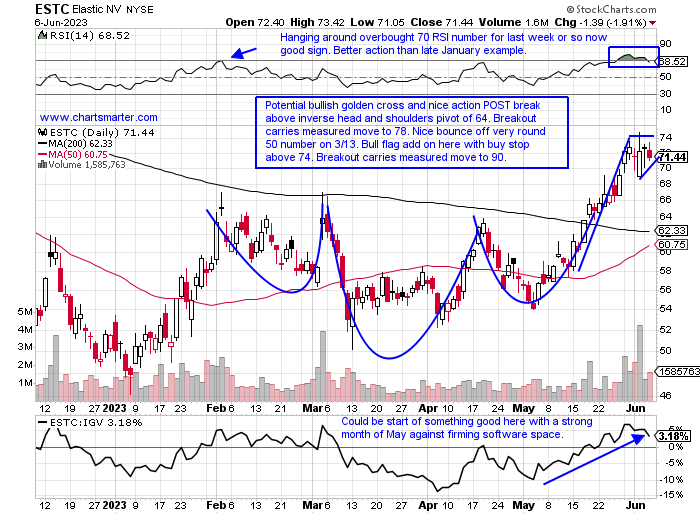

- As the earnings releases continue to pour in from names in the software arena some have been powerful, in both directions. GTLB comes to mind which scorched higher by more than 30% Tuesday after a well-received report. On 6/2 MDB screamed higher by nearly the same amount and is now challenging the very round 400 number. Some that missed and recorded poor reactions, maybe a tell for future softness were PD and GWRE. The former broke below a bearish head and shoulders pivot of 27 which carries a measured move to 20. GWRE fell 14% on 6/2, but can these pull off a SNOW that slumped 16.5% on 5/25 and has roared all the way back and then some from the earnings miss? Below is the chart that I am watching of a former leader attempting to resurrect itself in ESTC. This Dutch play is comfortably North of an inverse head and shoulders breakout and watch for an add-on above a bull flag, as we know the best stocks give opportunities to add to on the way UP.

Recent Examples:

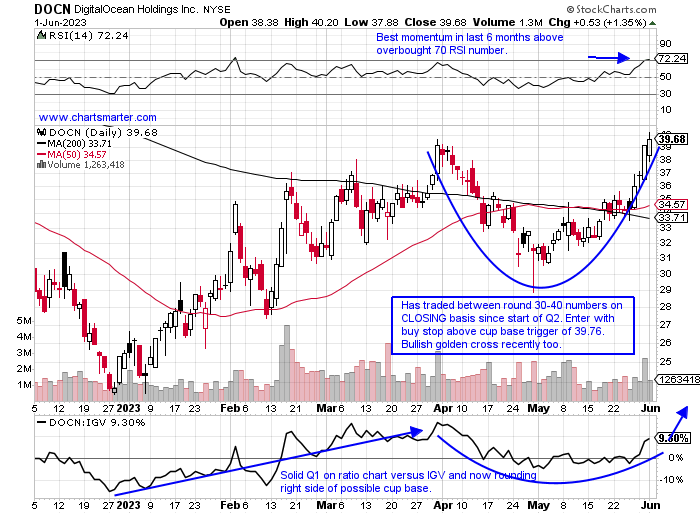

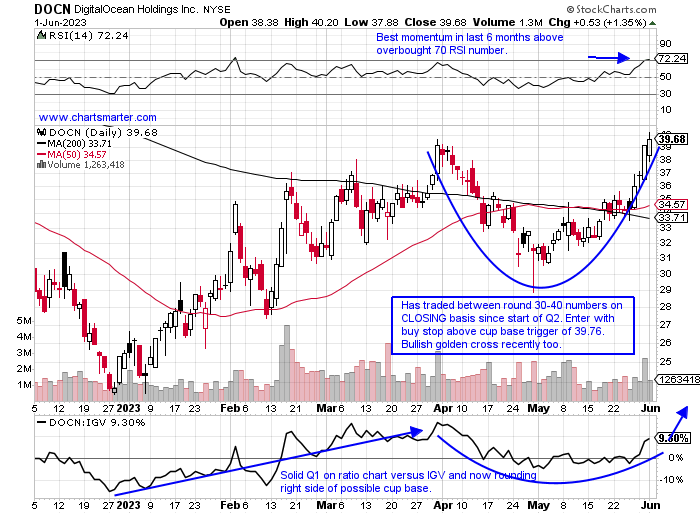

- Many software names are trying to turn the proverbial ship around after a tough 2022 for the overall technology space. Some are acting better than others and those should be paid very close attention to. Others are still well off their most recent 52-week highs and it begs the question that technicians like to buy strength, and whether one's hard-earned capital should just be deployed to names already "winning". Below is the chart of DOCN and how it appeared in our 6/2 Technology Note, and it still rests 17% off its annual peak made last August, but its chart complexion is making some amends. This week is up almost 8% heading into Wednesday and this is firm follow-through after the prior week rose by 15%. For April and May it traded between the round 30-40 numbers but has now broken well above that former 40 ceiling and has taken out a cup base pivot of 39.76, and more importantly, has been acting well POST the move. Look for this name to compete for leadership going forward in 2023 in a nice software space.

Special Situations:

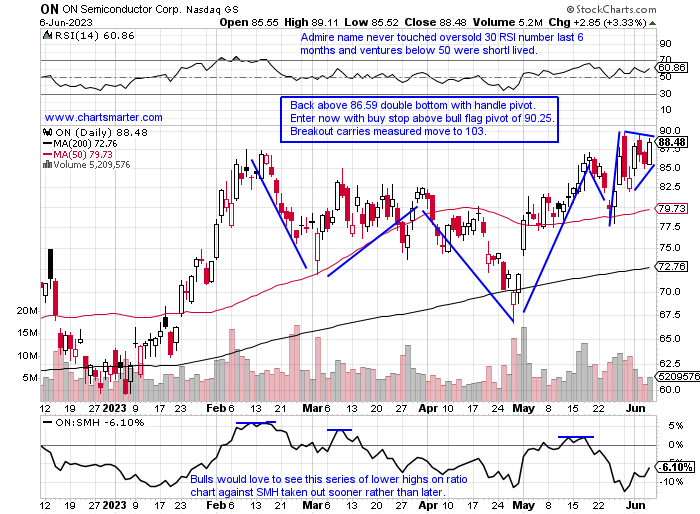

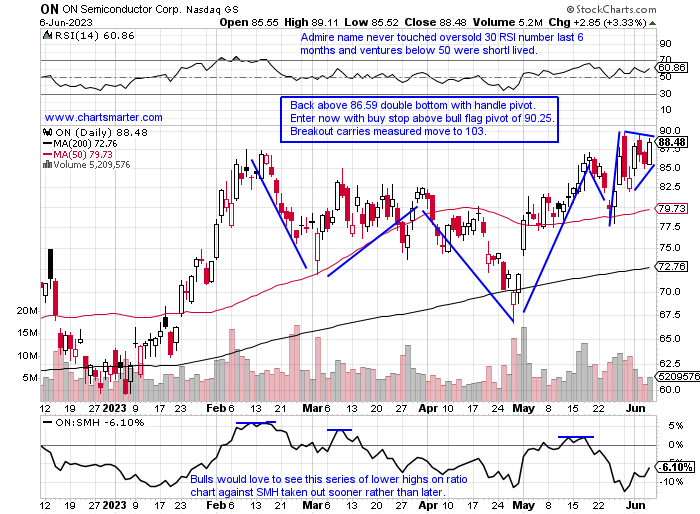

ON Semiconductor:

- Semiconductor leader up 42% YTD and 34% over last one year period.

- Name 2% off most recent 52-week highs and looking for 6-week win streak up 2% headed into Wednesday. Flirting with very round 90 number and break above could be powerful.

- Earnings reactions mostly lower off .6, 9, and 4.7%% on 2/6, 10/31, and 8/1/22 before a recent gain of 8.8% on 5/1.

- Enter with buy stop above bull flag.

- Entry ON 90.25. Stop 85.

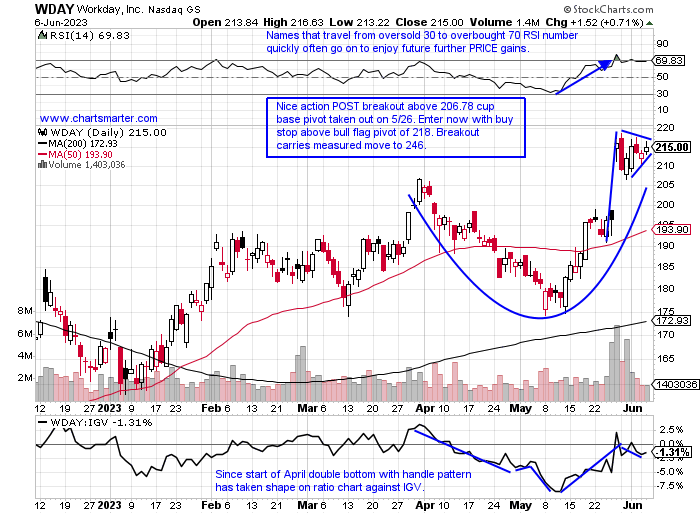

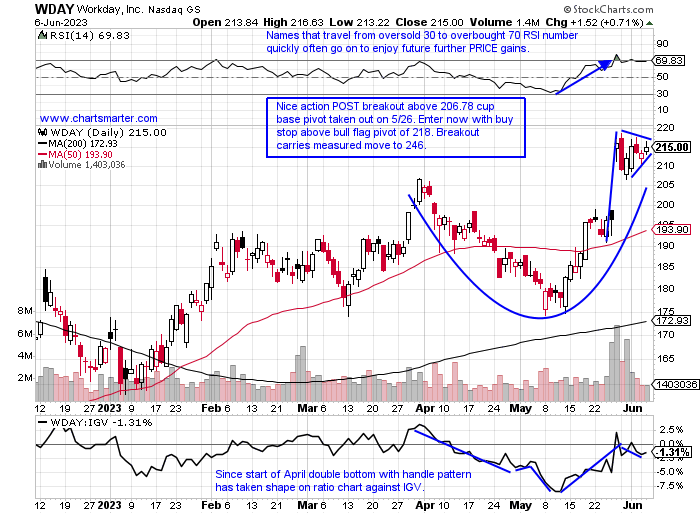

Workday:

- Software play up 28% YTD and 35% over last one year period.

- Name 2% off most recent 52-week highs and could be building right side of cup base following bearish WEEKLY engulfing candle at very round 300 number from week ending 11/19/21. Digesting nearly 50 handle run during 3-week win streak weeks ending between 5/12-26 well.

- FOUR straight positive earnings reactions up 10, .3, 17.2, and 2.5% on 5/26, 2/28, 11/30, and 8/26/22.

- Enter with buy stop above bull flag.

- Entry WDAY 218. Stop 208.

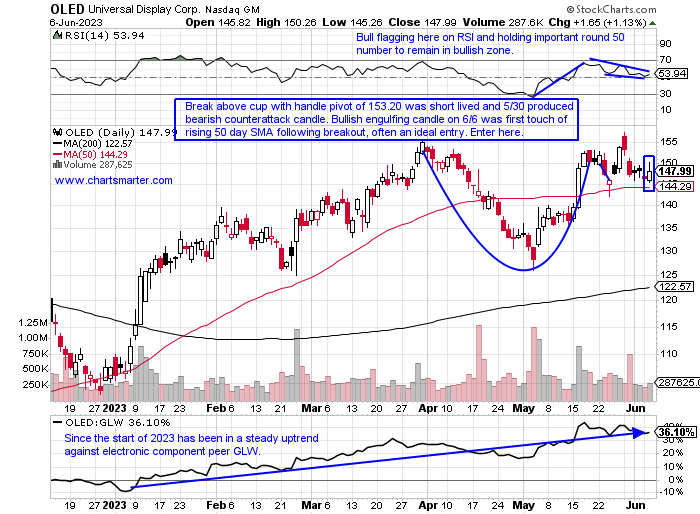

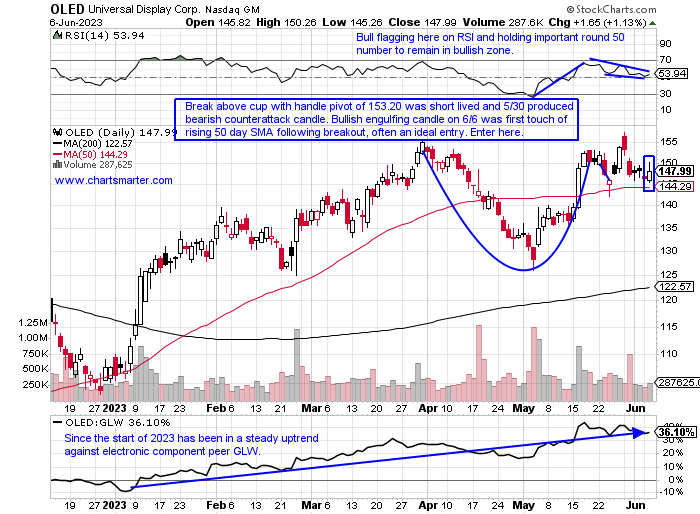

Universal Display Corporation:

- Electronics component play up 37% YTD and 17% over last one year period. Dividend yield of .9%.

- Name 6% off most recent 52-week highs and nice action following week ending 5/5 that rose 3% and recorded bullish WEEKLY hammer candle. Good volume trends with no distribution weeks since fall of 2022.

- FOUR straight positive earnings reactions (SIX consecutive all together) up 5.1, 6.1, 12.1, and 5.3% on 5/4, 2/24, 11/4 and 8/5/22.

- Enter after first touch of rising 50-day SMA following recent breakout.

- Entry OLED here. Stop 144.

Entry summaries:

Buy stop above bull flag ON 90.25. Stop 85.

Buy stop above bull flag WDAY 218. Stop 208.

Buy after first touch of rising 50-day SMA following recent breakout OLED here. Stop 144.

Good luck.

This article requires a Chartsmarter membership. Please click here to join.

Playing Catch Up:

- Some of the "old tech" names are trying to show the new kids on the block they can still learn something from them. IBM is somewhat coming to life as it has cleared a narrow range between the round 120-130 number since late February, and give it some extra credit for recapturing its 200-day SMA. INTC is trying to hold onto the round 30 number, an important one, as bulls and bears have been playing tug of war there since it lost the figure on 9/13/22. Below is the chart of another mature supertanker, which are historically difficult to turnaround, in QCOM. It is still 26% off most recent 52-week highs but did find a floor just above the very round par number recently. Both of its 50 and 200-day SMAs are tilting lower but there are some green shoots. Can these aforementioned names catch a strong bid, as dinosaur software names like ACN ADBE and INTU have? ACN is defending the very round 300 number well, ADBE blasted through 400 several sessions back, and INTU looks exhausted to me trading wide and loose with a possible quadruple top at 460 and an upside gap fill from the 5/23 session.

Software Rolling:

- As the earnings releases continue to pour in from names in the software arena some have been powerful, in both directions. GTLB comes to mind which scorched higher by more than 30% Tuesday after a well-received report. On 6/2 MDB screamed higher by nearly the same amount and is now challenging the very round 400 number. Some that missed and recorded poor reactions, maybe a tell for future softness were PD and GWRE. The former broke below a bearish head and shoulders pivot of 27 which carries a measured move to 20. GWRE fell 14% on 6/2, but can these pull off a SNOW that slumped 16.5% on 5/25 and has roared all the way back and then some from the earnings miss? Below is the chart that I am watching of a former leader attempting to resurrect itself in ESTC. This Dutch play is comfortably North of an inverse head and shoulders breakout and watch for an add-on above a bull flag, as we know the best stocks give opportunities to add to on the way UP.

Recent Examples:

- Many software names are trying to turn the proverbial ship around after a tough 2022 for the overall technology space. Some are acting better than others and those should be paid very close attention to. Others are still well off their most recent 52-week highs and it begs the question that technicians like to buy strength, and whether one's hard-earned capital should just be deployed to names already "winning". Below is the chart of DOCN and how it appeared in our 6/2 Technology Note, and it still rests 17% off its annual peak made last August, but its chart complexion is making some amends. This week is up almost 8% heading into Wednesday and this is firm follow-through after the prior week rose by 15%. For April and May it traded between the round 30-40 numbers but has now broken well above that former 40 ceiling and has taken out a cup base pivot of 39.76, and more importantly, has been acting well POST the move. Look for this name to compete for leadership going forward in 2023 in a nice software space.

Special Situations:

ON Semiconductor:

- Semiconductor leader up 42% YTD and 34% over last one year period.

- Name 2% off most recent 52-week highs and looking for 6-week win streak up 2% headed into Wednesday. Flirting with very round 90 number and break above could be powerful.

- Earnings reactions mostly lower off .6, 9, and 4.7%% on 2/6, 10/31, and 8/1/22 before a recent gain of 8.8% on 5/1.

- Enter with buy stop above bull flag.

- Entry ON 90.25. Stop 85.

Workday:

- Software play up 28% YTD and 35% over last one year period.

- Name 2% off most recent 52-week highs and could be building right side of cup base following bearish WEEKLY engulfing candle at very round 300 number from week ending 11/19/21. Digesting nearly 50 handle run during 3-week win streak weeks ending between 5/12-26 well.

- FOUR straight positive earnings reactions up 10, .3, 17.2, and 2.5% on 5/26, 2/28, 11/30, and 8/26/22.

- Enter with buy stop above bull flag.

- Entry WDAY 218. Stop 208.

Universal Display Corporation:

- Electronics component play up 37% YTD and 17% over last one year period. Dividend yield of .9%.

- Name 6% off most recent 52-week highs and nice action following week ending 5/5 that rose 3% and recorded bullish WEEKLY hammer candle. Good volume trends with no distribution weeks since fall of 2022.

- FOUR straight positive earnings reactions (SIX consecutive all together) up 5.1, 6.1, 12.1, and 5.3% on 5/4, 2/24, 11/4 and 8/5/22.

- Enter after first touch of rising 50-day SMA following recent breakout.

- Entry OLED here. Stop 144.

Entry summaries:

Buy stop above bull flag ON 90.25. Stop 85.

Buy stop above bull flag WDAY 218. Stop 208.

Buy after first touch of rising 50-day SMA following recent breakout OLED here. Stop 144.

Good luck.