Always keep a close eye on stocks that are acting much better than the overall market demonstrating great relative strength. Today we take a look at HLF which was in the headlines some years back with Ichan and Ackman. Ignore the noise and focusing purely on PRICE action would have benefitted one handsomely. The name is having a very strong 2018 up 44% as the S&P 500 is LOWER by 1.2% YTD. Below we take a look how the round number theory affected this name in the past and presently.

This name was not affected much by the recent overall market downtrend and looks to be shedding itself from a 3 year double top. HLF is a nutrition name higher by 19% YTD and 35% over the last one year period. Earnings have been mostly lower with losses of 2.9, 1.9 and 4.5% on 11/3, 8/2 and 2/24 and a nice gain of 11.6% on 5/5 (REPORTS 2/22 after close). The stock is higher 3 of last 4 weeks and last weeks drop of .9% digested the prior 3 week winning streak that rose 16% in good volume. It is holding above 79.74 cup base trigger taken out on 1/26. Enter HLF with break above bull pennant as 82 which carries measured move to 96. Keep in mind stock had issues with round 80 number dating back to December '13-January '14 too so decisive move above could be powerful.

Trigger HLF 82. Stop 79.

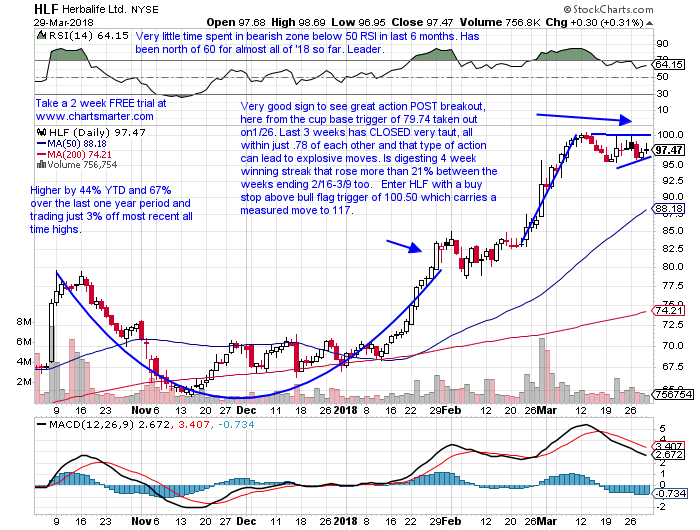

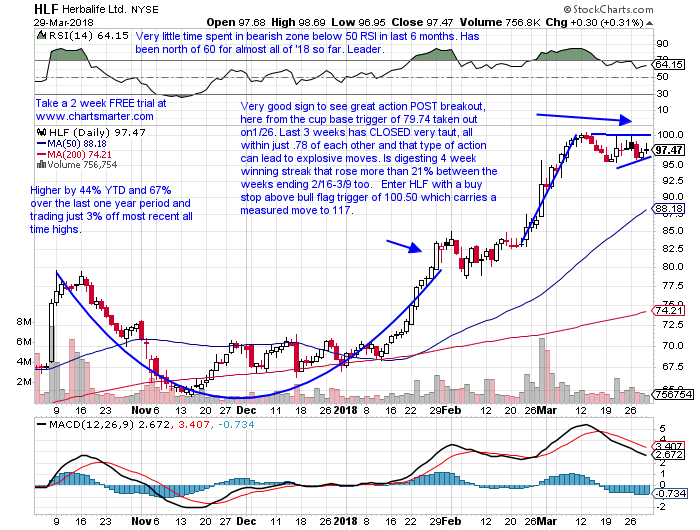

Taking a present view on the stock it is higher by 44% YTD and 67% over the last one year period and trading just 3% off most recent all time highs. The last three weeks the name has CLOSED very taut, all within just .78 of each other and that type of action can lead to explosive moves (it is also digesting the 4 week winning streak that rose more than 21% between the weeks ending 2/16-3/9 well). The round number theory comes into play here again as the last 4 weeks have come into contact with the very round 100 number forming a bull flag. Enter HLF with a buy stop above 100.50 which carries a measured move to 117.

Thank you for taking the time to read this post.

Always keep a close eye on stocks that are acting much better than the overall market demonstrating great relative strength. Today we take a look at HLF which was in the headlines some years back with Ichan and Ackman. Ignore the noise and focusing purely on PRICE action would have benefitted one handsomely. The name is having a very strong 2018 up 44% as the S&P 500 is LOWER by 1.2% YTD. Below we take a look how the round number theory affected this name in the past and presently.

This name was not affected much by the recent overall market downtrend and looks to be shedding itself from a 3 year double top. HLF is a nutrition name higher by 19% YTD and 35% over the last one year period. Earnings have been mostly lower with losses of 2.9, 1.9 and 4.5% on 11/3, 8/2 and 2/24 and a nice gain of 11.6% on 5/5 (REPORTS 2/22 after close). The stock is higher 3 of last 4 weeks and last weeks drop of .9% digested the prior 3 week winning streak that rose 16% in good volume. It is holding above 79.74 cup base trigger taken out on 1/26. Enter HLF with break above bull pennant as 82 which carries measured move to 96. Keep in mind stock had issues with round 80 number dating back to December '13-January '14 too so decisive move above could be powerful.

Trigger HLF 82. Stop 79.

Taking a present view on the stock it is higher by 44% YTD and 67% over the last one year period and trading just 3% off most recent all time highs. The last three weeks the name has CLOSED very taut, all within just .78 of each other and that type of action can lead to explosive moves (it is also digesting the 4 week winning streak that rose more than 21% between the weeks ending 2/16-3/9 well). The round number theory comes into play here again as the last 4 weeks have come into contact with the very round 100 number forming a bull flag. Enter HLF with a buy stop above 100.50 which carries a measured move to 117.

Thank you for taking the time to read this post.