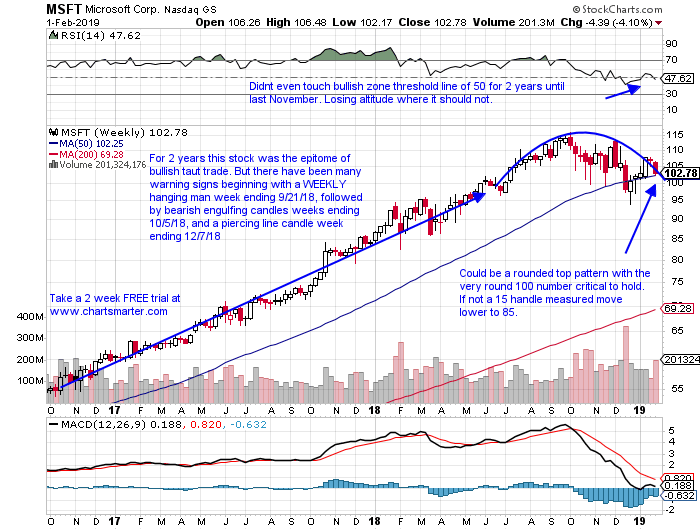

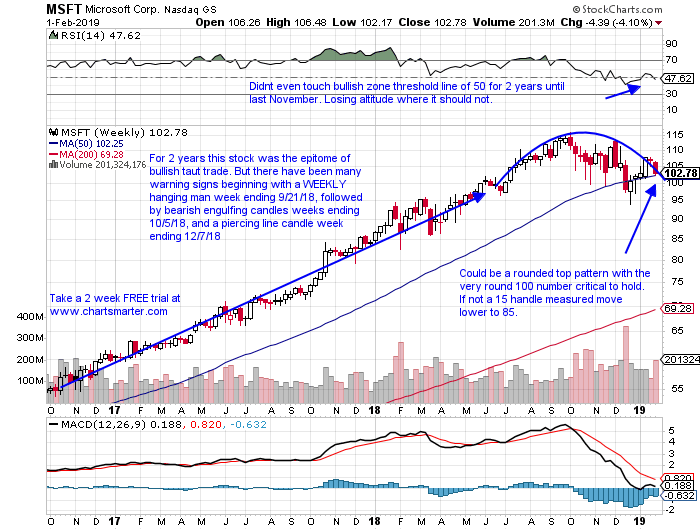

Mister Softee Feels Heavy:

- The Nasdaq has enjoyed a nice run, on a current 6 week winning streak, its first since the fall of '17. I am a believer this move still has legs, but one concern is the price action in its largest component MSFT. Below is the chart and this name has not kept pace with many big cap tech plays falling 4.1% this week, and is now lower 11 of the last 18 weeks. As many software plays reside at all time highs, this one is swimming 12% off most recent 52 week highs. Others in the software space are picking up the slack like TWLO, WDAY, NOW and OKTA. Add in some nice life in the semiconductors and technology looks ready to push not only the Nasdaq northward, but the overall markets too.

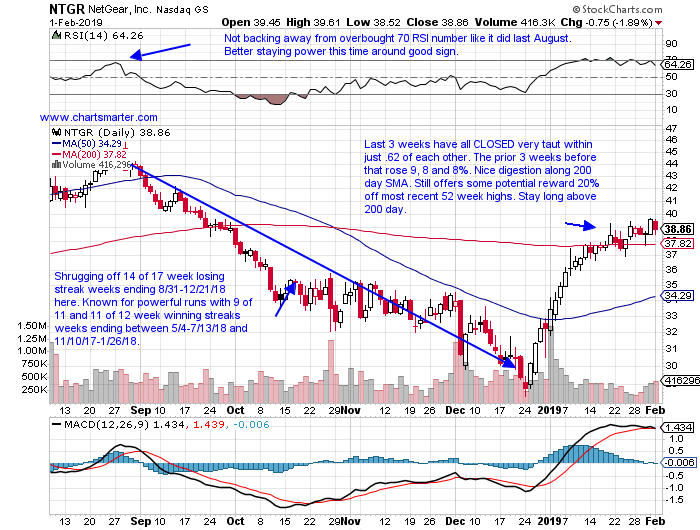

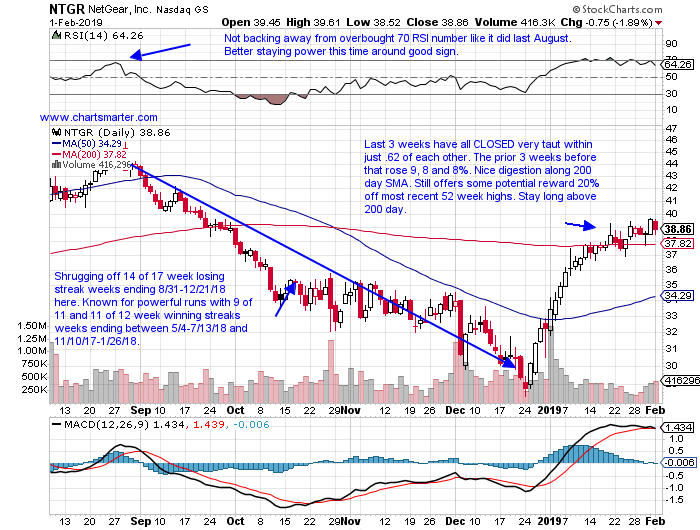

The Need For Speed:

- The telecommunications equipment group has been a winner, and some "old tech" names have been making a nifty comeback. As connectivity becomes more important by the day, stocks like ACIA, GLW and PANW have comeback to life. Consolidation took place in Q4 as companies took advantage of deflated prices to go shopping. ARRS and FNSR were devoured. Below is the chart of NTGR, long rumored to be a takeover candidate. Of course one should never make decisions based solely on this hope.

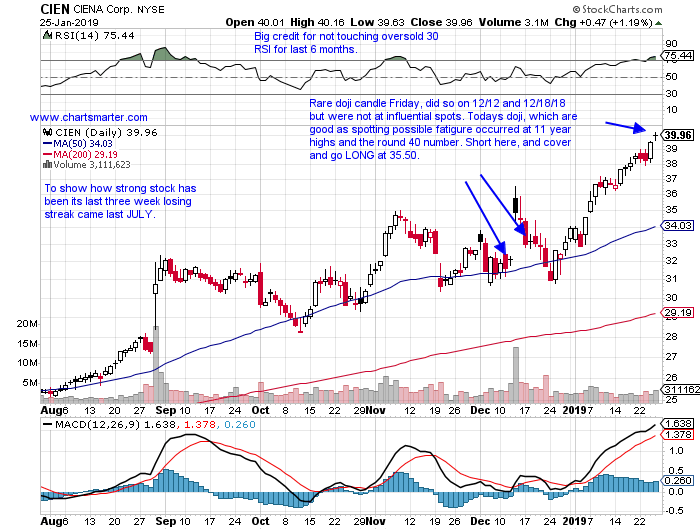

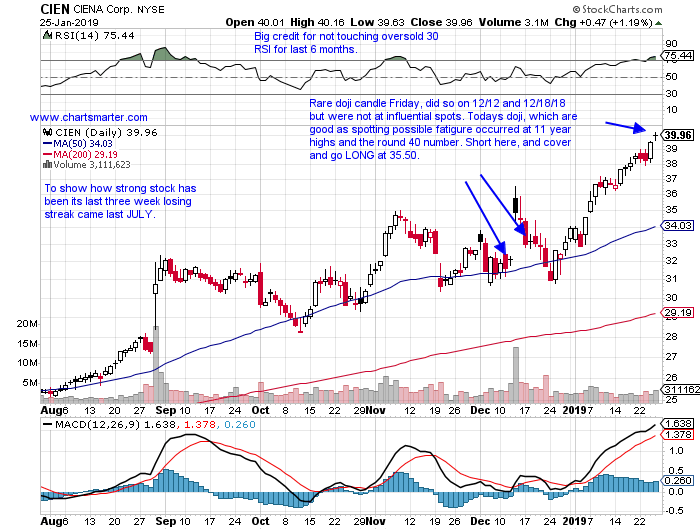

Examples:

- PRICE action supersedes all other indicators, although some can help in the decision making process. Below is the chart of CIEN and how it appeared in our 1/28 Technology Report. Let us be clear this name is a leader and should be bought on pullbacks, but a doji candle, an excellent predictor of changes in the prevailing direction was recorded on 1/25. It occurred at the very round 40 figure at 17 year highs as well. The stock showed poor relative strength this week falling 4.1%, JNPR miss aided that fall, as the Nasdaq advanced 1.4%.

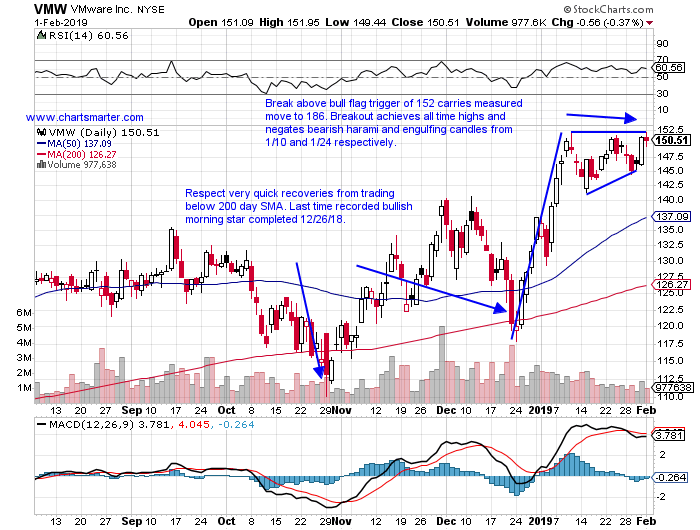

Special Situations:

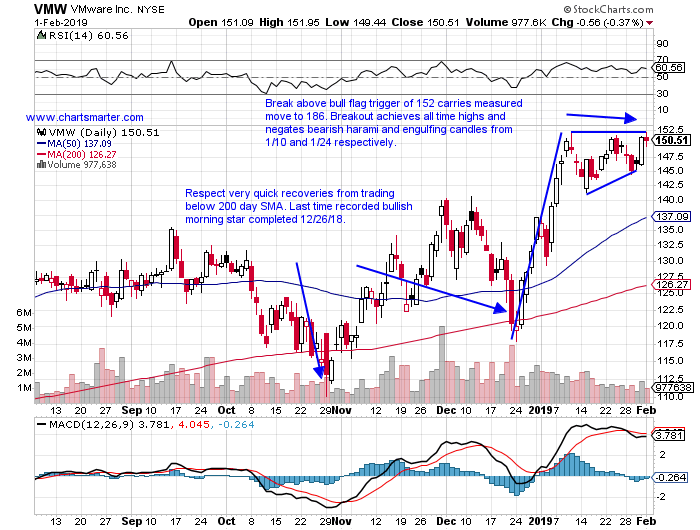

- "Old tech" software play higher by 10% YTD and 20% over last one year period.

- Six week winning streak, and first weekly CLOSE above very round 150 figure.

- Among best group within technology, and trades just 1% off most recent all time highs.

- Enter with buy stop above bull flag trigger of 152 which carries measured move to 186.

- Entry VMW 152. Stop 146.

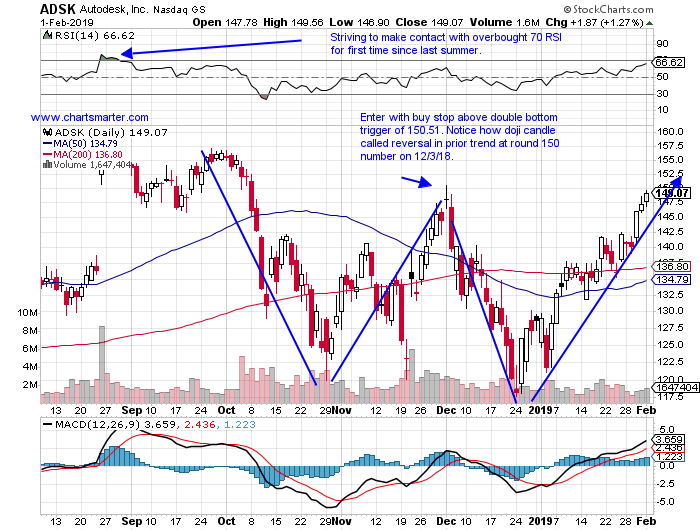

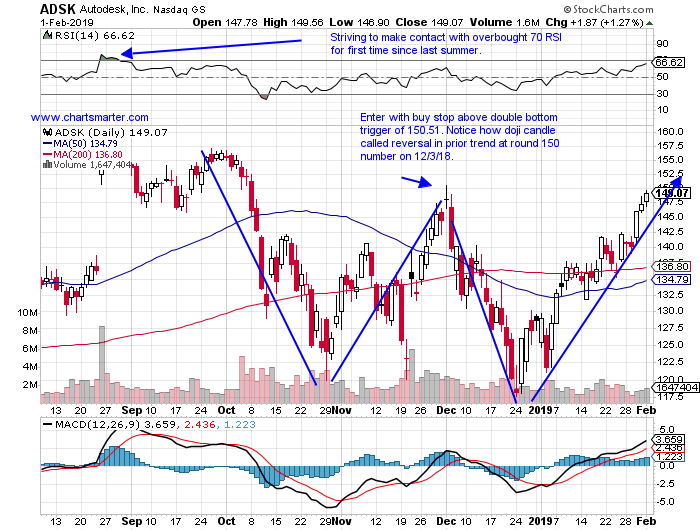

- "Old tech" software play higher by 16% YTD and 29% over last one year period.

- Good relative strength this week up 4.9%, and now sits just 7% off most recent all time highs.

- Trading between round 120-160 numbers since bursting above 120 week ending 3/9/18 that rose 20% on second best weekly volume in last 3 years.

- Enter with buy stop above double bottom trigger of 150.51.

- Entry ADSK 150.51. Stop 145.75.

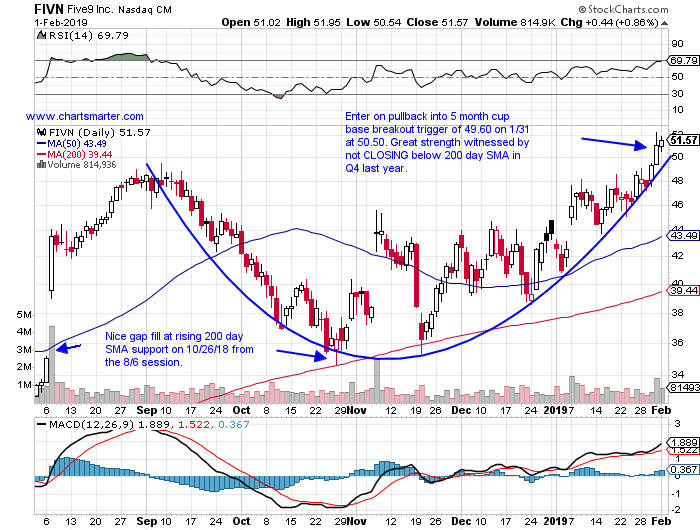

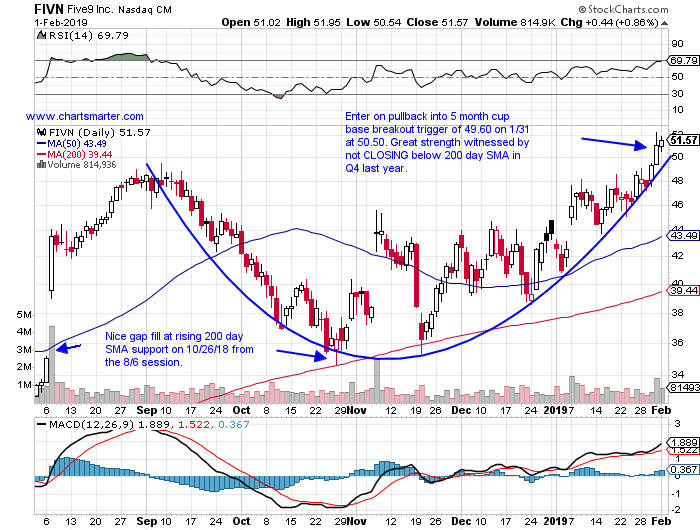

- Cloud software leader higher by 18% YTD and 99% over the last one year period.

- FIVE straight positive reactions higher by 14, 24.2, 7.9, 12.7 and 1.4% on 11/7, 8/7, 5/2, 2/22/18 and 11/9/17.

- One of select handful of names that never CLOSED underneath their 200 day SMAs during market rout late last year.

- Enter on pullback into 5 month cup base breakout trigger of 49.60 on 1/31 at 50.50.

- Entry FIVN 50.50. Stop 48.

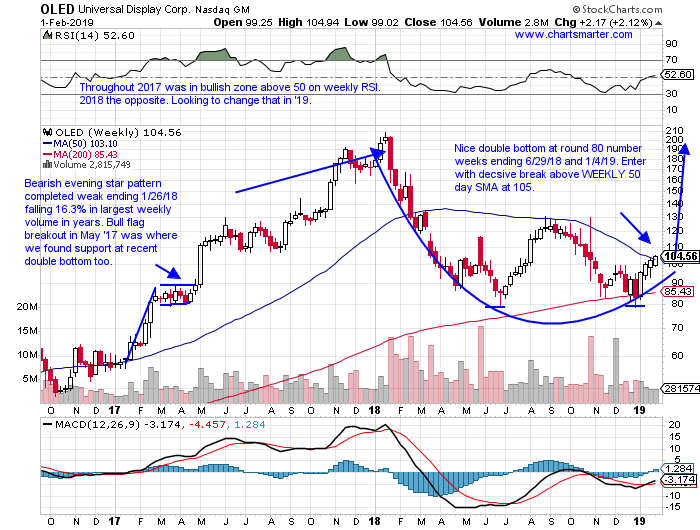

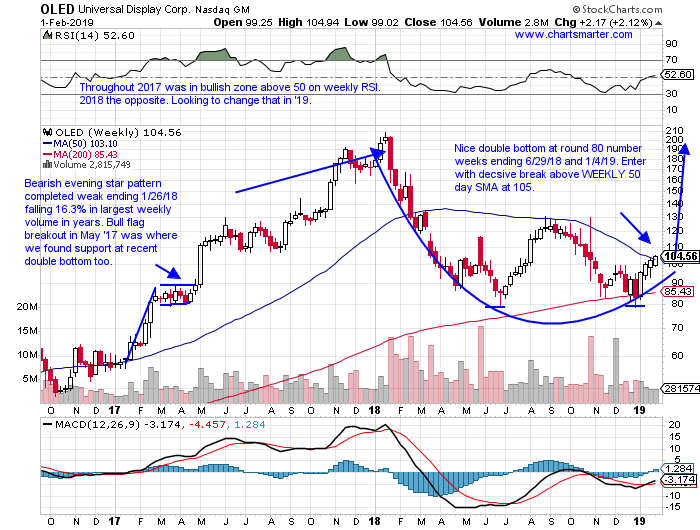

- Electronic components play up 12% YTD but lower by 32% over last one year period. Small dividend yield of .2%.

- Fell 10% week ending 1/4, but regained that and more following week up more than 15%. Up 24% over last 4 weeks.

- Just one weekly CLOSE above very round 200 number, week ending 1/19/18, before big slide.

- Enter with decisive buy stop above WEEKLY 50 day SMA at 105.

- Entry OLED 105. Stop 98.75.

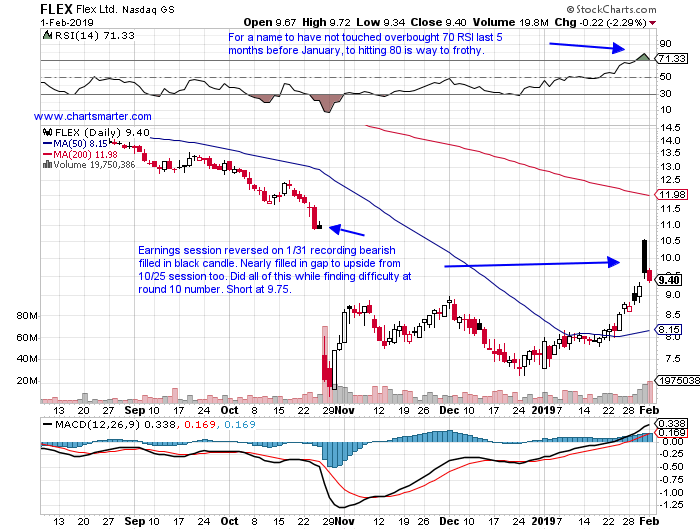

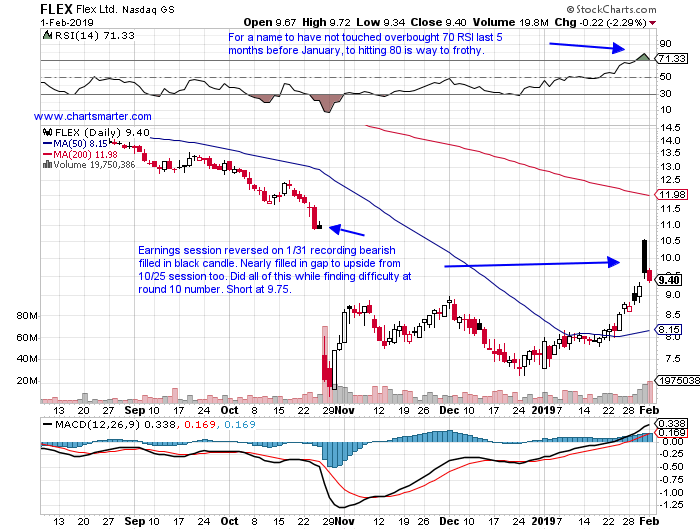

- Electronic components laggard up 24% YTD, but lower by 48% over last one year period.

- Six week winning streak, but reversed and CLOSED 12.4% off intraweek highs.

- Now trades 51% off most recent 52 week highs, just unacceptable in the current, exuberant market behavior.

- Short into bearish black filled candle from 1/31 and into round 10 number at 9.75.

- Entry FLEX 9.75. Buy stop 10.60.

Good luck.

Entry summaries:

Buy stop above bull flag trigger VMW 152. Stop 146.

Buy stop above double bottom trigger ADSK 150.51. Stop 145.75.

Buy pullback into recent cup base breakout FIVN 50.50. Stop 48.

Decisive buy stop above weekly 50 day SMA OLED 105. Stop 98.75.

Short into bearish black filled candle and round 10 number FLEX 9.75. Buy stop 10.60.

Mister Softee Feels Heavy:

- The Nasdaq has enjoyed a nice run, on a current 6 week winning streak, its first since the fall of '17. I am a believer this move still has legs, but one concern is the price action in its largest component MSFT. Below is the chart and this name has not kept pace with many big cap tech plays falling 4.1% this week, and is now lower 11 of the last 18 weeks. As many software plays reside at all time highs, this one is swimming 12% off most recent 52 week highs. Others in the software space are picking up the slack like TWLO, WDAY, NOW and OKTA. Add in some nice life in the semiconductors and technology looks ready to push not only the Nasdaq northward, but the overall markets too.

The Need For Speed:

- The telecommunications equipment group has been a winner, and some "old tech" names have been making a nifty comeback. As connectivity becomes more important by the day, stocks like ACIA, GLW and PANW have comeback to life. Consolidation took place in Q4 as companies took advantage of deflated prices to go shopping. ARRS and FNSR were devoured. Below is the chart of NTGR, long rumored to be a takeover candidate. Of course one should never make decisions based solely on this hope.

Examples:

- PRICE action supersedes all other indicators, although some can help in the decision making process. Below is the chart of CIEN and how it appeared in our 1/28 Technology Report. Let us be clear this name is a leader and should be bought on pullbacks, but a doji candle, an excellent predictor of changes in the prevailing direction was recorded on 1/25. It occurred at the very round 40 figure at 17 year highs as well. The stock showed poor relative strength this week falling 4.1%, JNPR miss aided that fall, as the Nasdaq advanced 1.4%.

Special Situations:

- "Old tech" software play higher by 10% YTD and 20% over last one year period.

- Six week winning streak, and first weekly CLOSE above very round 150 figure.

- Among best group within technology, and trades just 1% off most recent all time highs.

- Enter with buy stop above bull flag trigger of 152 which carries measured move to 186.

- Entry VMW 152. Stop 146.

- "Old tech" software play higher by 16% YTD and 29% over last one year period.

- Good relative strength this week up 4.9%, and now sits just 7% off most recent all time highs.

- Trading between round 120-160 numbers since bursting above 120 week ending 3/9/18 that rose 20% on second best weekly volume in last 3 years.

- Enter with buy stop above double bottom trigger of 150.51.

- Entry ADSK 150.51. Stop 145.75.

- Cloud software leader higher by 18% YTD and 99% over the last one year period.

- FIVE straight positive reactions higher by 14, 24.2, 7.9, 12.7 and 1.4% on 11/7, 8/7, 5/2, 2/22/18 and 11/9/17.

- One of select handful of names that never CLOSED underneath their 200 day SMAs during market rout late last year.

- Enter on pullback into 5 month cup base breakout trigger of 49.60 on 1/31 at 50.50.

- Entry FIVN 50.50. Stop 48.

- Electronic components play up 12% YTD but lower by 32% over last one year period. Small dividend yield of .2%.

- Fell 10% week ending 1/4, but regained that and more following week up more than 15%. Up 24% over last 4 weeks.

- Just one weekly CLOSE above very round 200 number, week ending 1/19/18, before big slide.

- Enter with decisive buy stop above WEEKLY 50 day SMA at 105.

- Entry OLED 105. Stop 98.75.

- Electronic components laggard up 24% YTD, but lower by 48% over last one year period.

- Six week winning streak, but reversed and CLOSED 12.4% off intraweek highs.

- Now trades 51% off most recent 52 week highs, just unacceptable in the current, exuberant market behavior.

- Short into bearish black filled candle from 1/31 and into round 10 number at 9.75.

- Entry FLEX 9.75. Buy stop 10.60.

Good luck.

Entry summaries:

Buy stop above bull flag trigger VMW 152. Stop 146.

Buy stop above double bottom trigger ADSK 150.51. Stop 145.75.

Buy pullback into recent cup base breakout FIVN 50.50. Stop 48.

Decisive buy stop above weekly 50 day SMA OLED 105. Stop 98.75.

Short into bearish black filled candle and round 10 number FLEX 9.75. Buy stop 10.60.