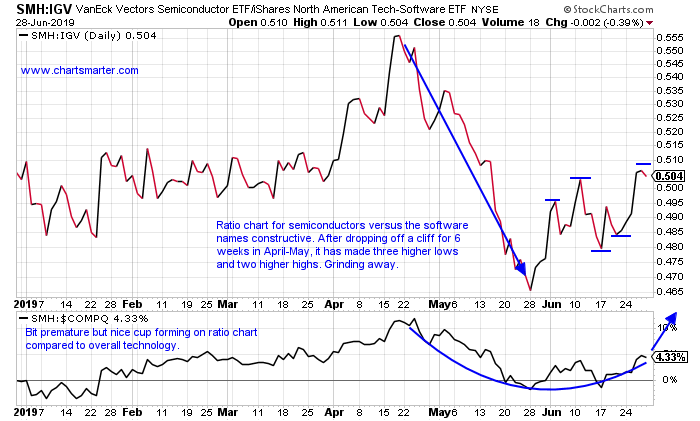

Chips Continue Climbing Wall of Worry:

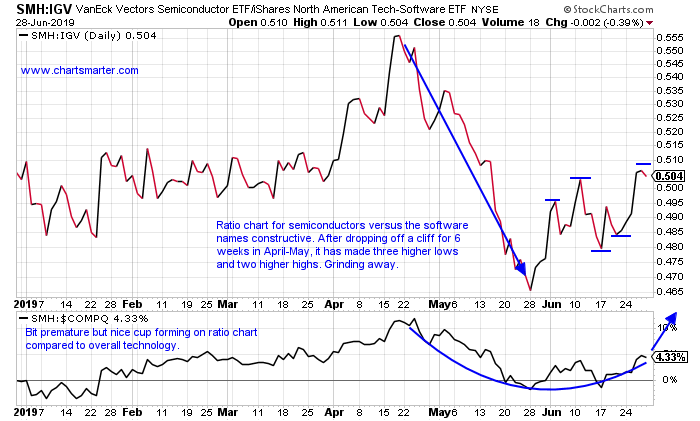

- The semiconductors are getting their mojo back. There is still work to do and we previously mentioned that the space needed a general to guide the group, preferably two or three leaders. XLNX, the prior leader is now higher by more than 11.5% the last 2 weeks, although it is hard to view this as favorable as it still trades 17% off most recent 52 week highs. A more likely candidate is IPHI, however it is grappling with the very round 50 number for the third time since 2017, but it sits just 3% off its most recent peak. There is still time for some future general to make its presence felt, as the ratio chart continues to improve against both software and the Nasdaq.

"Old Tech" On Watch:

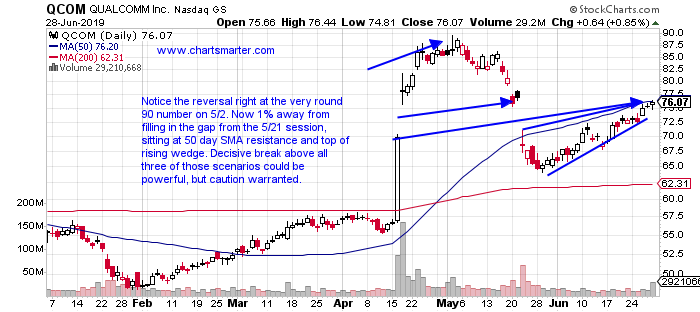

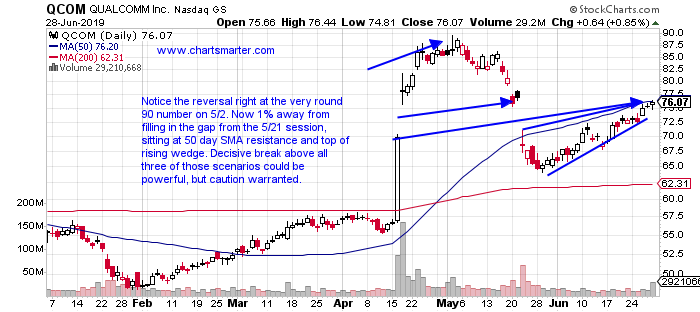

- Many of mature technology plays have been acting peculiarly as of late. AAPL enjoyed a 30 handle move since the first day of June, but has been unable to CLOSE above the round 200 number, even though it was above the figure 5 of the last 8 sessions. VMW, a bastion of strength the first 5 1/2 months of 2019, is now nearly in bear market mode down 19% from most recent 52 week highs. INTC fell 1.5% Thursday, on a day the SMH rose by 1.3%. The most intriguing play here may be QCOM. The stock enjoyed a 3 week combined move of 52% the weeks ending 4/19-5/3, and now is at an inflection point as we look at the chart below.

Examples:

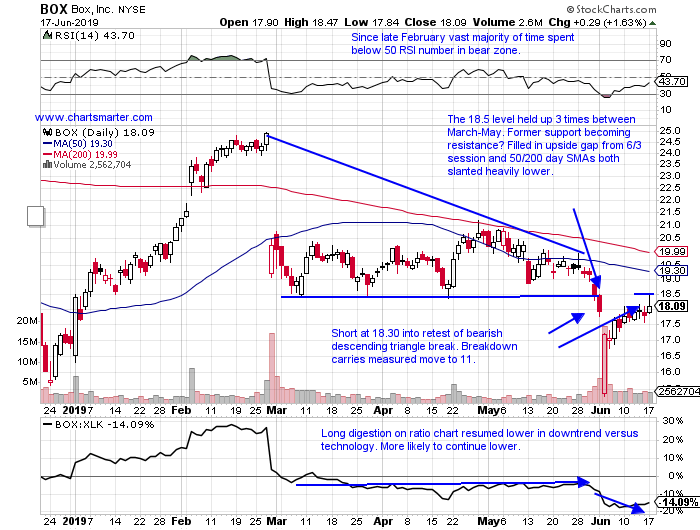

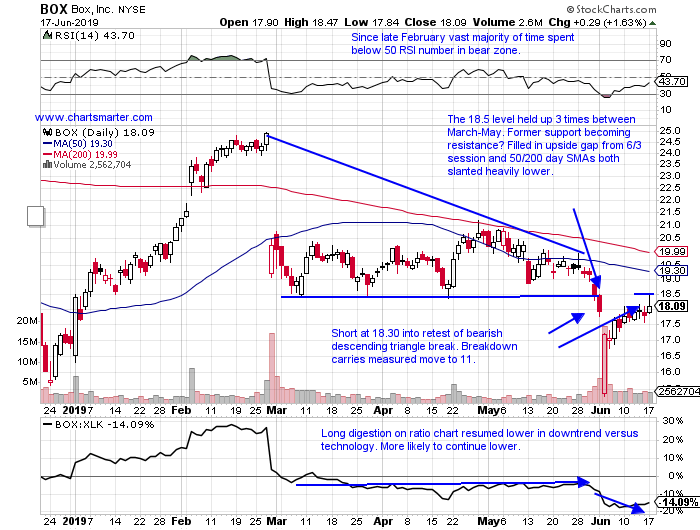

- Clusters of evidence is something we mention during our daily major S&P sector notes. This occurs when two or more entry reasons for entry happen at that same price. Below could be a good example of just that with the chart of BOX and how it appeared in our 6/19 Technology Report. In this particular example an upside gap fill formed in conjunction with a previous break below a bearish descending triangle. Shorts have been tough to come by in 2019, but this name was already nearly 40% off most recent 52 week highs. That relative weakness speaks volumes in this type of strong overall environment.

Special Situations:

- "Old tech" semi play higher by 37% YTD and down 1% over last one year period. Dividend yield of 1.9%.

- Higher 3 of the last 4 weeks, with all gainers impressive up 7.3, 4.2 and 4.6%.

- Resistance late '17 and early '18 at round 60 number, and support at 30 figure week ending 12/28/18.

- Enter with buy stop above 45.85 cup base pivot.

- Entry AMAT 45.85. Stop 43.75.

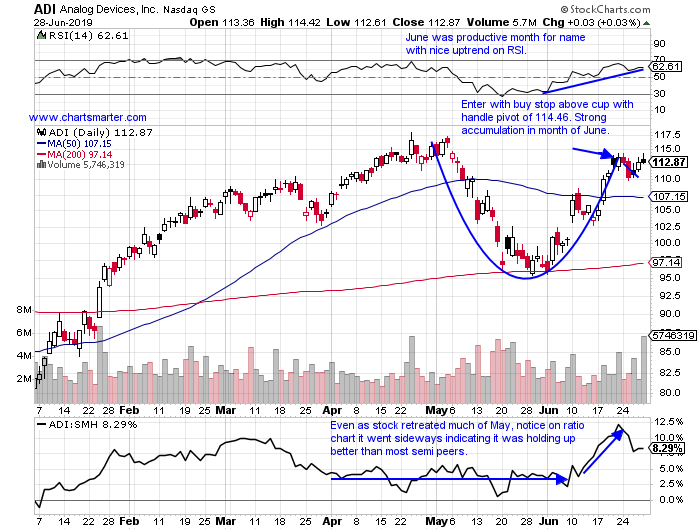

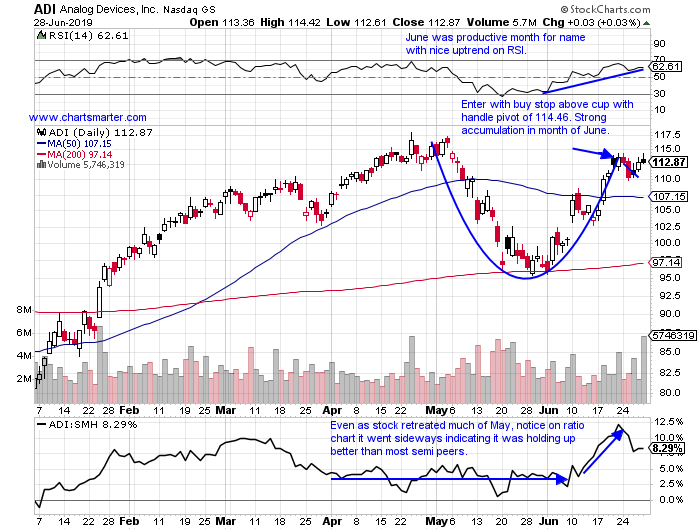

- Semiconductor play higher by 33% YTD and 19% over last one year period. Dividend yield of 1.9%.

- 4 week winning streak denied, and this week lost .7% acceptable, AFTER prior week jumped by 9.3%

- FIVE consecutive positive earnings reactions up 1.6, 2.5, 4.1, 2.1 and .6% on 5/22, 2/20, 11/20, 8/22 and 5/30/18.

- Enter with buy stop above cup with handle pivot of 114.46.

- Entry ADI 114.46. Stop 110.

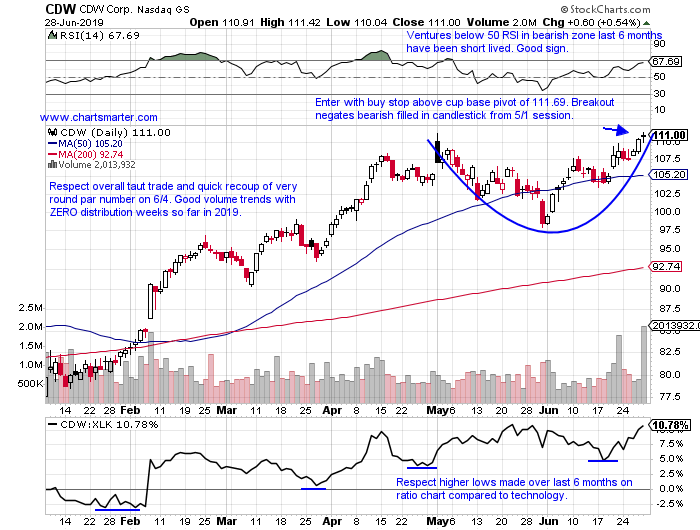

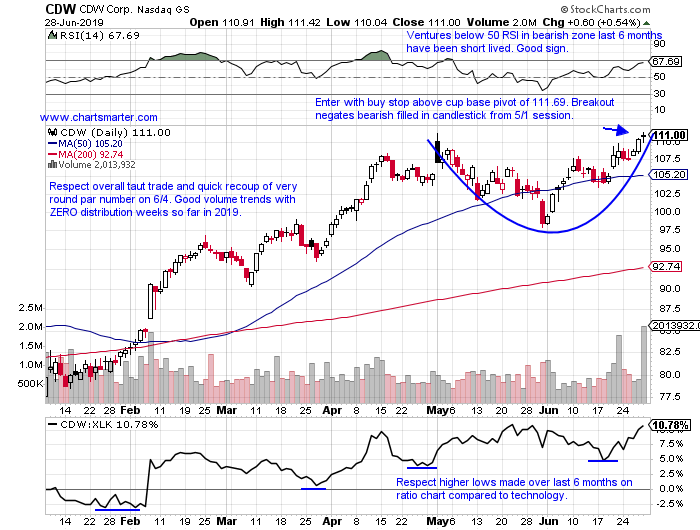

- Computer services play higher by 37% YTD and 36% over last one year period. Dividend yield of 1.1%.

- At all time highs, after digesting big run of 50.1% during 13 of 19 week winning streak weeks ending between 12/28/18-5/3.

- FIVE consecutive positive earnings reactions higher by 1.7, 6.7, 12.1, 4 and 5.1% on 5/1, 2/7, 10/31, 8/2 and 5/2/18.

- Enter with buy stop above cup base pivot of 111.69.

- Entry CDW 111.69. Stop 108.

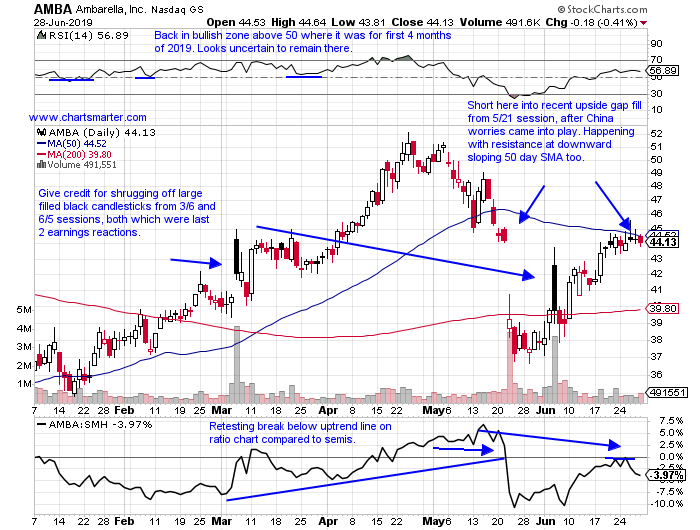

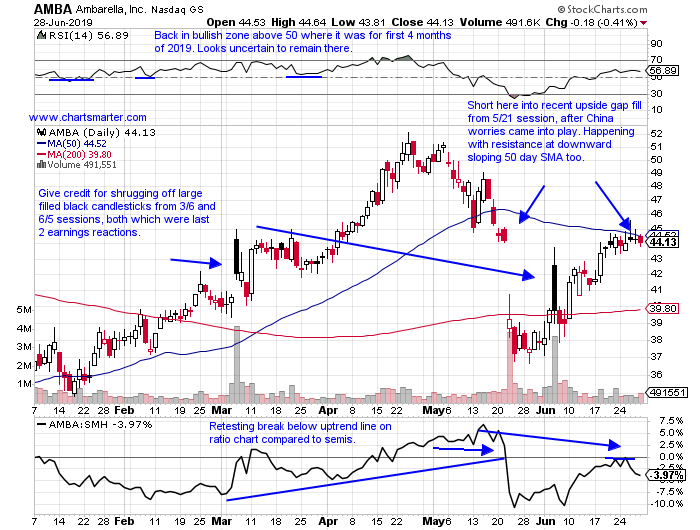

- Semiconductor play higher by 26% YTD and 14% over last one year period.

- CLOSED in lower half of range everyday this week falling .7%. Poor relative strength as SMH ROSE 2.8%.

- Still 15% off most recent 52 week highs, feeling effects of 4 week losing streak that lost 23% weeks ending between 5/10-31.

- Short here into recent upside gap fill from 5/21 session.

- Entry AMBA here. Buy stop 46.

Good luck.

Entry summaries:

Buy stop above cup with handle pivot ADI 114.46. Stop 110.

Buy stop above cup base pivot AMAT 45.85. Stop 43.75.

Buy stop above cup base pivot CDW 111.69. Stop 108.

Short into recent upside gap fill AMBA here. Buy stop 46.

This article requires a Chartsmarter membership. Please click here to join.

Chips Continue Climbing Wall of Worry:

- The semiconductors are getting their mojo back. There is still work to do and we previously mentioned that the space needed a general to guide the group, preferably two or three leaders. XLNX, the prior leader is now higher by more than 11.5% the last 2 weeks, although it is hard to view this as favorable as it still trades 17% off most recent 52 week highs. A more likely candidate is IPHI, however it is grappling with the very round 50 number for the third time since 2017, but it sits just 3% off its most recent peak. There is still time for some future general to make its presence felt, as the ratio chart continues to improve against both software and the Nasdaq.

"Old Tech" On Watch:

- Many of mature technology plays have been acting peculiarly as of late. AAPL enjoyed a 30 handle move since the first day of June, but has been unable to CLOSE above the round 200 number, even though it was above the figure 5 of the last 8 sessions. VMW, a bastion of strength the first 5 1/2 months of 2019, is now nearly in bear market mode down 19% from most recent 52 week highs. INTC fell 1.5% Thursday, on a day the SMH rose by 1.3%. The most intriguing play here may be QCOM. The stock enjoyed a 3 week combined move of 52% the weeks ending 4/19-5/3, and now is at an inflection point as we look at the chart below.

Examples:

- Clusters of evidence is something we mention during our daily major S&P sector notes. This occurs when two or more entry reasons for entry happen at that same price. Below could be a good example of just that with the chart of BOX and how it appeared in our 6/19 Technology Report. In this particular example an upside gap fill formed in conjunction with a previous break below a bearish descending triangle. Shorts have been tough to come by in 2019, but this name was already nearly 40% off most recent 52 week highs. That relative weakness speaks volumes in this type of strong overall environment.

Special Situations:

- "Old tech" semi play higher by 37% YTD and down 1% over last one year period. Dividend yield of 1.9%.

- Higher 3 of the last 4 weeks, with all gainers impressive up 7.3, 4.2 and 4.6%.

- Resistance late '17 and early '18 at round 60 number, and support at 30 figure week ending 12/28/18.

- Enter with buy stop above 45.85 cup base pivot.

- Entry AMAT 45.85. Stop 43.75.

- Semiconductor play higher by 33% YTD and 19% over last one year period. Dividend yield of 1.9%.

- 4 week winning streak denied, and this week lost .7% acceptable, AFTER prior week jumped by 9.3%

- FIVE consecutive positive earnings reactions up 1.6, 2.5, 4.1, 2.1 and .6% on 5/22, 2/20, 11/20, 8/22 and 5/30/18.

- Enter with buy stop above cup with handle pivot of 114.46.

- Entry ADI 114.46. Stop 110.

- Computer services play higher by 37% YTD and 36% over last one year period. Dividend yield of 1.1%.

- At all time highs, after digesting big run of 50.1% during 13 of 19 week winning streak weeks ending between 12/28/18-5/3.

- FIVE consecutive positive earnings reactions higher by 1.7, 6.7, 12.1, 4 and 5.1% on 5/1, 2/7, 10/31, 8/2 and 5/2/18.

- Enter with buy stop above cup base pivot of 111.69.

- Entry CDW 111.69. Stop 108.

- Semiconductor play higher by 26% YTD and 14% over last one year period.

- CLOSED in lower half of range everyday this week falling .7%. Poor relative strength as SMH ROSE 2.8%.

- Still 15% off most recent 52 week highs, feeling effects of 4 week losing streak that lost 23% weeks ending between 5/10-31.

- Short here into recent upside gap fill from 5/21 session.

- Entry AMBA here. Buy stop 46.

Good luck.

Entry summaries:

Buy stop above cup with handle pivot ADI 114.46. Stop 110.

Buy stop above cup base pivot AMAT 45.85. Stop 43.75.

Buy stop above cup base pivot CDW 111.69. Stop 108.

Short into recent upside gap fill AMBA here. Buy stop 46.