Relying On Semiconductors:

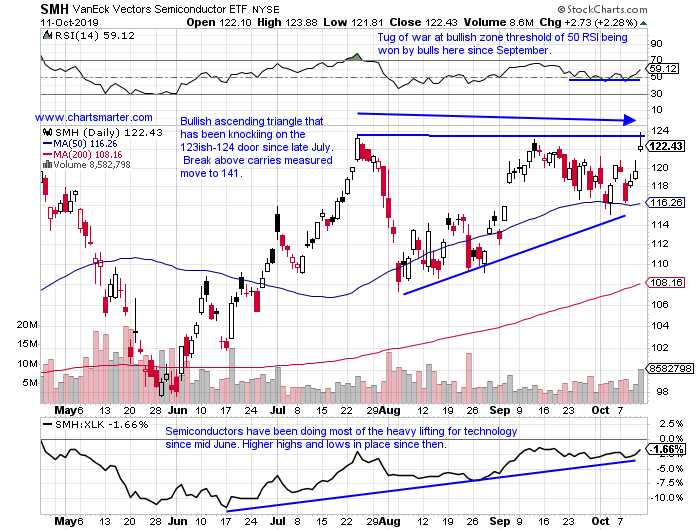

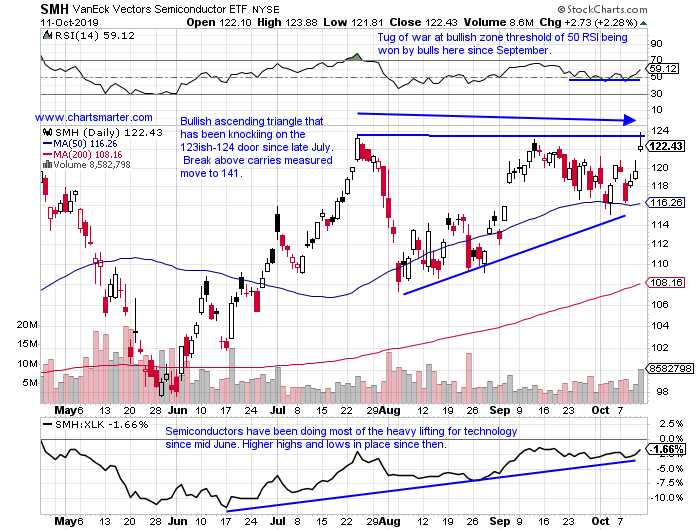

- The two big behemoths in the technology arena of course, are the semiconductors and software. Hardware/service names like ROKU and AAPL are important obviously too, but for the most part tech is dominated by the two aforementioned subsectors. For a long time software ruled, but that changed a couple months ago. The baton was passed recently to the semis, and while many thought that was temporary, that may not be the case. The SMH recorded its best weekly CLOSE ever this week and trades just 1% off most recent highs, while the IGV sits 6% off its most recent yearly peak. Give credit to the IGV for recouping both its 50 and 200 day SMAs in the last couple weeks, as it now has a 221 double bottom pivot. Within the semis, the equipment plays remain the firmest with names like KLAC LRCX ASML and AMAT acting well. Keep an eye on LSCC and QCOM in the near term to see if they can climb above the round 20 and 80 numbers respectively, as always on a CLOSING basis.

Softy Acting Anything But:

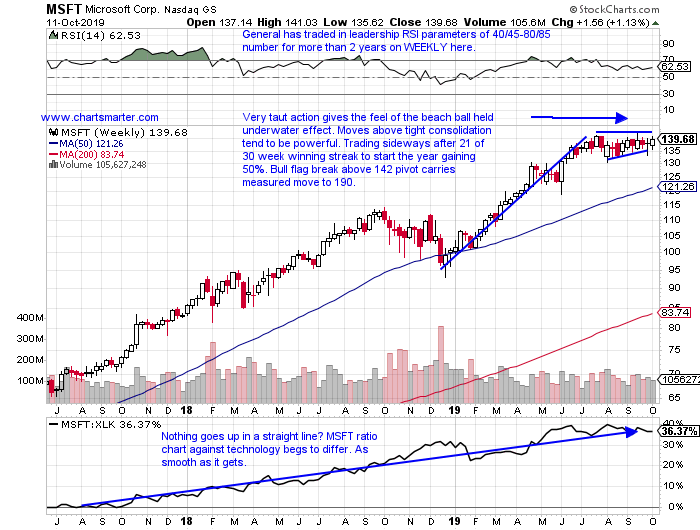

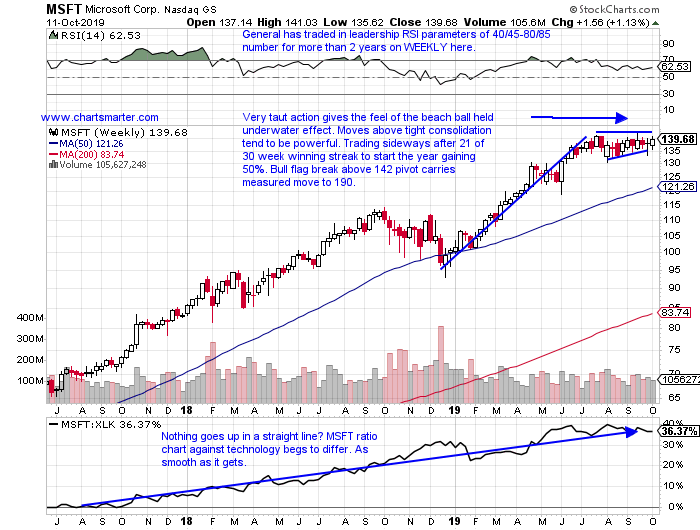

- Market participants are benefitting handsomely if they can find the combination of growth and yield. MSFT fits the bill up 38% YTD, and carries a 2% dividend yield. The chart of the latter is visually more impressive, and has been dealing with the round 140 number for the last 14 weeks. There has been just one WEEKLY CLOSE above that figure, since mid July. In this environment if one can find a name that trades this taut, and remains just 2% off most recent all time highs, they should consider themselves fortunate. The week ending 10/4 recorded a rare doji candle, which often is an indication of a softening of the prior trend. But PRICE supersedes everything. A CLOSE above 142 could really ignite this name, and the Nasdaq as it is the benchmarks largest component at 7.3% (second largest name AAPL is acting just fine as well. That is a pretty solid 1-2 punch).

Examples:

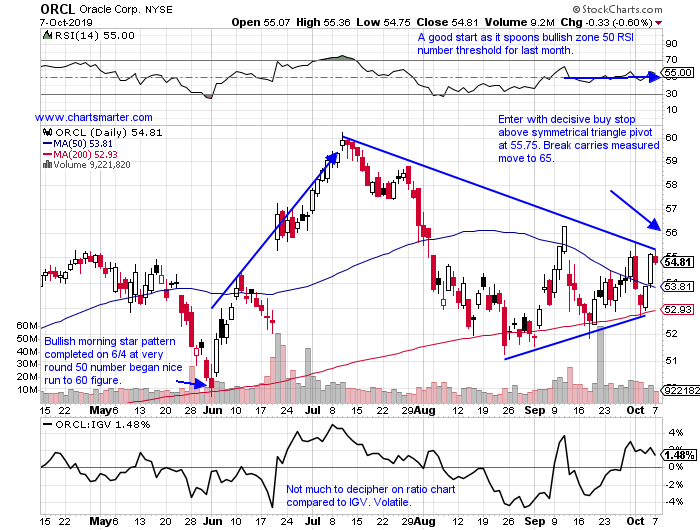

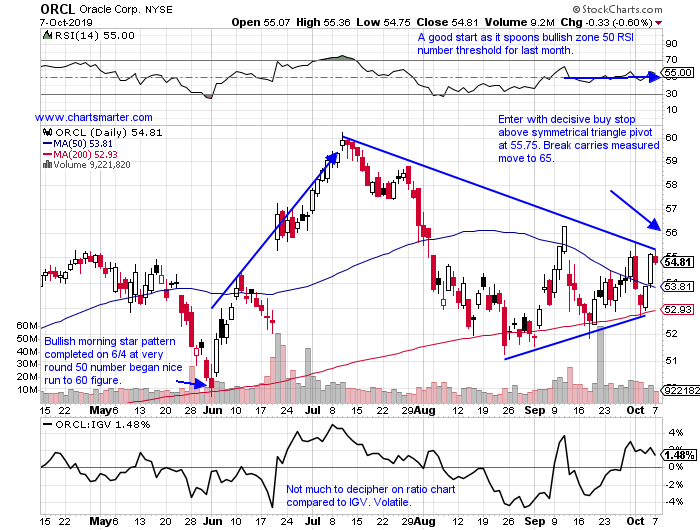

- The overall software group has been in a state of confusion somewhat lately. To be frank it has been to the downside. Best of breed TTD is more than 31% off most recent 52 week highs, not a typo, and is doing battle with the very round 200 number here. It recently suffered a 7 week losing streak, with all 7 CLOSING at or in the lower half of its weekly range. Investors looking for more mature names in the space, might take a look at ORCL. Below is how the chart appeared in our 10/8 Technology Note. The stock has been digesting a strong 23 of 29 week winning streak weeks ending between 12/28/18-7/12, and now looks like its building the right side of a cup base that was stopped cold at the round 60 number in early July. Can you feel the magnetic pull toward the figure?

Special Situations:

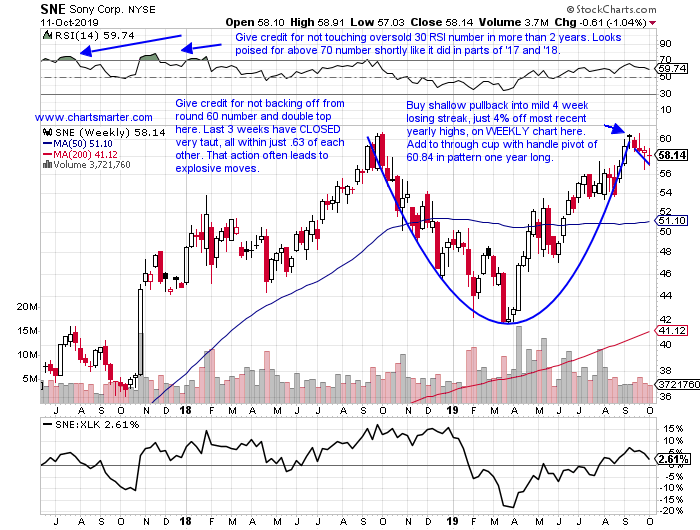

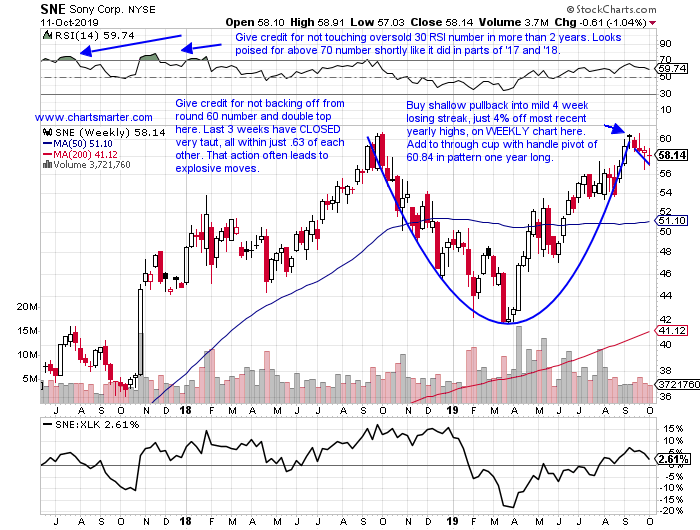

- Electronic equipment play higher by 20% YTD and 5% over last one year period. Dividend yield of .5%.

- Digesting big 18 of 25 week winning streak weeks ending between 3/29-9/13 that rose 44.7%.

- 4 of last 5 earnings reactions positive up 4.4, 7.7, 4.8 and 3.2% on 7/30, 4/26, 10/30 and 7/31/18.

- Buy pullback into very shallow 4 week losing streak here, its first in 2 years.

- Entry SNE here. Stop 56.

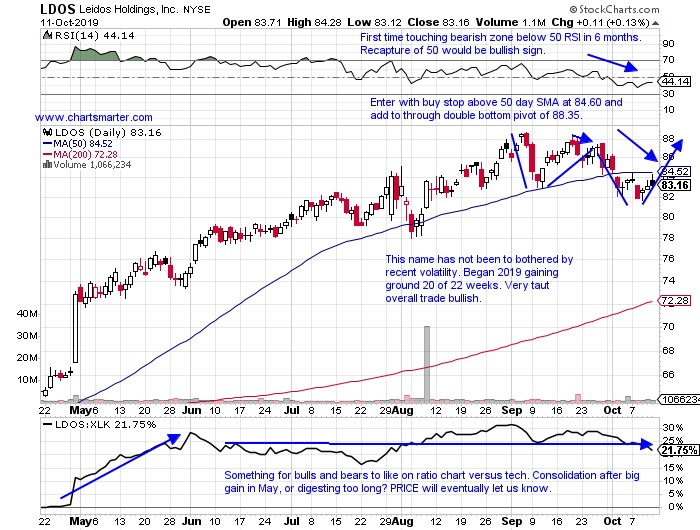

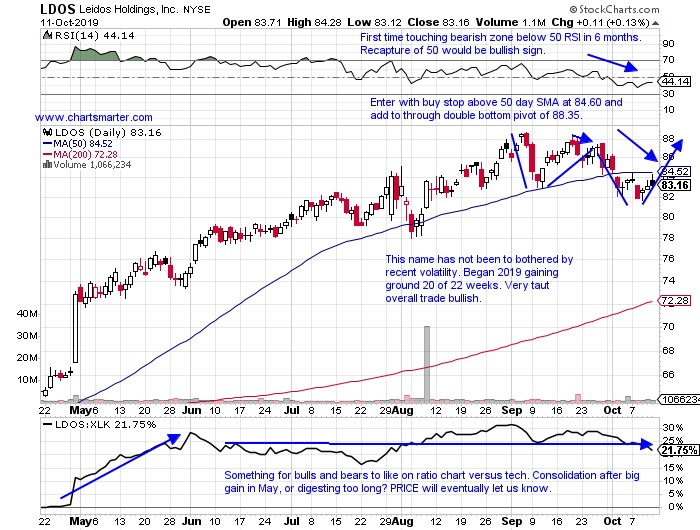

- Computer services play higher by 58% YTD and 28% over last one year period. Dividend yield of 1.6%.

- Higher 31 of last 42 weeks after bounce off very round 50 number week ending 12/28/18. Just 7% off all time highs.

- Consecutive positive earnings reactions rose 1.3 and 9.9% on 7/30 and 4/30, after small losses of 1.7 and 2.2% on 2/19 and 10/25/18.

- Enter with buy stop above 50 day SMA at 84.60 and add to through double bottom pivot of 88.35.

- Entry LDOS 84.60. Stop 81.

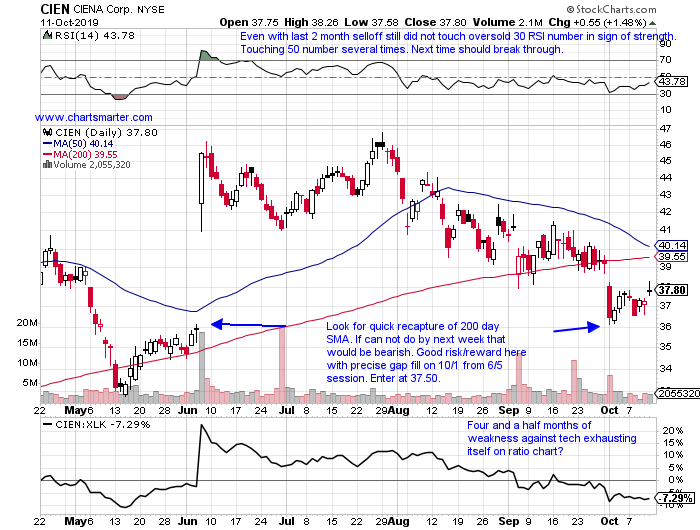

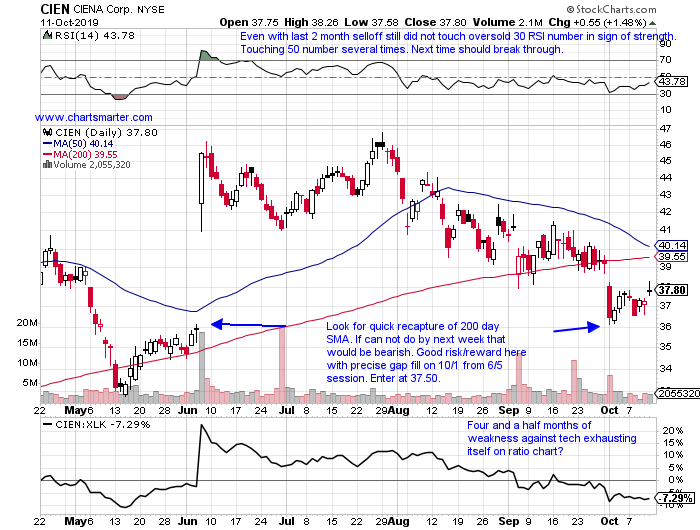

- Telecommunications play higher by 11% YTD and 34% over last one year period.

- Down 9 of last 18 weeks and 19% off most recent 52 week highs, but traded back toward lows of huge week ending 6/7 that jumped 29.4% that came in largest weekly volume in 14 months.

- 3 of last 5 earnings reactions firmly up by 26.8, 8.6 and 12.4% on 6/6, 12/13 and 8/30/18 (fell 3.8 and 4.9% on 9/5 and 3/5).

- Enter on pullback into precise gap fill at 37.50.

- Entry CIEN 37.50. Stop 36.

Good luck.

Entry summaries:

Buy after mild pullback from round 60 number SNE here. Stop 56.

Buy stop above 50 day SMA LDOS 84.60. Stop 81.

Buy pullback into recent gap fill CIEN 37.50. Stop 36.

This article requires a Chartsmarter membership. Please click here to join.

Relying On Semiconductors:

- The two big behemoths in the technology arena of course, are the semiconductors and software. Hardware/service names like ROKU and AAPL are important obviously too, but for the most part tech is dominated by the two aforementioned subsectors. For a long time software ruled, but that changed a couple months ago. The baton was passed recently to the semis, and while many thought that was temporary, that may not be the case. The SMH recorded its best weekly CLOSE ever this week and trades just 1% off most recent highs, while the IGV sits 6% off its most recent yearly peak. Give credit to the IGV for recouping both its 50 and 200 day SMAs in the last couple weeks, as it now has a 221 double bottom pivot. Within the semis, the equipment plays remain the firmest with names like KLAC LRCX ASML and AMAT acting well. Keep an eye on LSCC and QCOM in the near term to see if they can climb above the round 20 and 80 numbers respectively, as always on a CLOSING basis.

Softy Acting Anything But:

- Market participants are benefitting handsomely if they can find the combination of growth and yield. MSFT fits the bill up 38% YTD, and carries a 2% dividend yield. The chart of the latter is visually more impressive, and has been dealing with the round 140 number for the last 14 weeks. There has been just one WEEKLY CLOSE above that figure, since mid July. In this environment if one can find a name that trades this taut, and remains just 2% off most recent all time highs, they should consider themselves fortunate. The week ending 10/4 recorded a rare doji candle, which often is an indication of a softening of the prior trend. But PRICE supersedes everything. A CLOSE above 142 could really ignite this name, and the Nasdaq as it is the benchmarks largest component at 7.3% (second largest name AAPL is acting just fine as well. That is a pretty solid 1-2 punch).

Examples:

- The overall software group has been in a state of confusion somewhat lately. To be frank it has been to the downside. Best of breed TTD is more than 31% off most recent 52 week highs, not a typo, and is doing battle with the very round 200 number here. It recently suffered a 7 week losing streak, with all 7 CLOSING at or in the lower half of its weekly range. Investors looking for more mature names in the space, might take a look at ORCL. Below is how the chart appeared in our 10/8 Technology Note. The stock has been digesting a strong 23 of 29 week winning streak weeks ending between 12/28/18-7/12, and now looks like its building the right side of a cup base that was stopped cold at the round 60 number in early July. Can you feel the magnetic pull toward the figure?

Special Situations:

- Electronic equipment play higher by 20% YTD and 5% over last one year period. Dividend yield of .5%.

- Digesting big 18 of 25 week winning streak weeks ending between 3/29-9/13 that rose 44.7%.

- 4 of last 5 earnings reactions positive up 4.4, 7.7, 4.8 and 3.2% on 7/30, 4/26, 10/30 and 7/31/18.

- Buy pullback into very shallow 4 week losing streak here, its first in 2 years.

- Entry SNE here. Stop 56.

- Computer services play higher by 58% YTD and 28% over last one year period. Dividend yield of 1.6%.

- Higher 31 of last 42 weeks after bounce off very round 50 number week ending 12/28/18. Just 7% off all time highs.

- Consecutive positive earnings reactions rose 1.3 and 9.9% on 7/30 and 4/30, after small losses of 1.7 and 2.2% on 2/19 and 10/25/18.

- Enter with buy stop above 50 day SMA at 84.60 and add to through double bottom pivot of 88.35.

- Entry LDOS 84.60. Stop 81.

- Telecommunications play higher by 11% YTD and 34% over last one year period.

- Down 9 of last 18 weeks and 19% off most recent 52 week highs, but traded back toward lows of huge week ending 6/7 that jumped 29.4% that came in largest weekly volume in 14 months.

- 3 of last 5 earnings reactions firmly up by 26.8, 8.6 and 12.4% on 6/6, 12/13 and 8/30/18 (fell 3.8 and 4.9% on 9/5 and 3/5).

- Enter on pullback into precise gap fill at 37.50.

- Entry CIEN 37.50. Stop 36.

Good luck.

Entry summaries:

Buy after mild pullback from round 60 number SNE here. Stop 56.

Buy stop above 50 day SMA LDOS 84.60. Stop 81.

Buy pullback into recent gap fill CIEN 37.50. Stop 36.