The healthcare space continues to act well, as it is the best performing major S&P sector on a 6 month look back period higher by nearly 11%. The space has the allure of both capital appreciation and nice dividend yields. Leading names will offer investors to add to their positions on the way up, and today we will look at that with a past and present view of NVS.

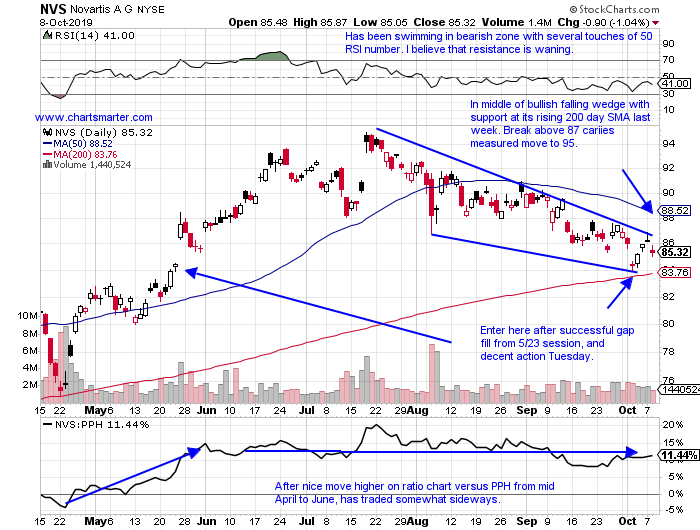

Below is how we looked at NVS in our 10/9 Healthcare Note.

- Swiss pharma play UNCH both on a YTD and over last one year period. Dividend yield of 3.3%.

- Lower 8 of the last 11 weeks, and one would think would be lower than the 10% it is off from most recent 52 week highs.

- FOUR consecutive positive earnings reactions higher by 4.5, 2.5, 2.2 and 1.1% on 7/18, 4/24, 1/31 and 10/18/18.

- Enter here after recent gap fill and support at upward sloping 200 day SMA.

- Entry NVS here. Stop 82 (REPORTS 10/22 before open).

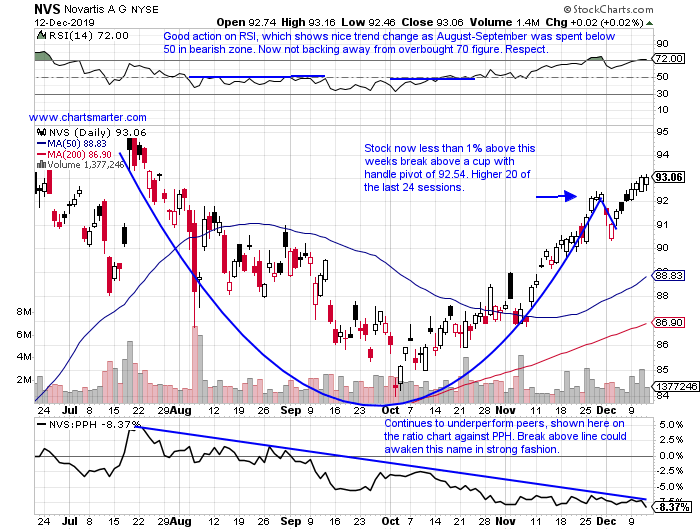

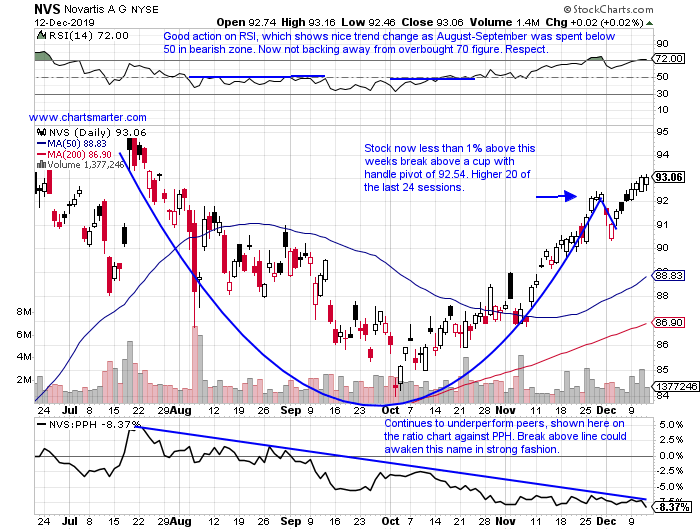

Here we take a current look at NVS.

- Name now higher by 8% YTD and 6% over last one year period. Dividend yield of 3%.

- Higher 8 of the last 9 weeks, and lone down week, last week, fell less than .3% and CLOSED at top of weekly range.

- Just 2% off most recent 52 week highs, and look to add yet again above WEEKLY cup base pivot of 95.10 in pattern 5 months long.

- Enter after recent break above cup with handle pivot.

- Entry NVS here. Stop 89.

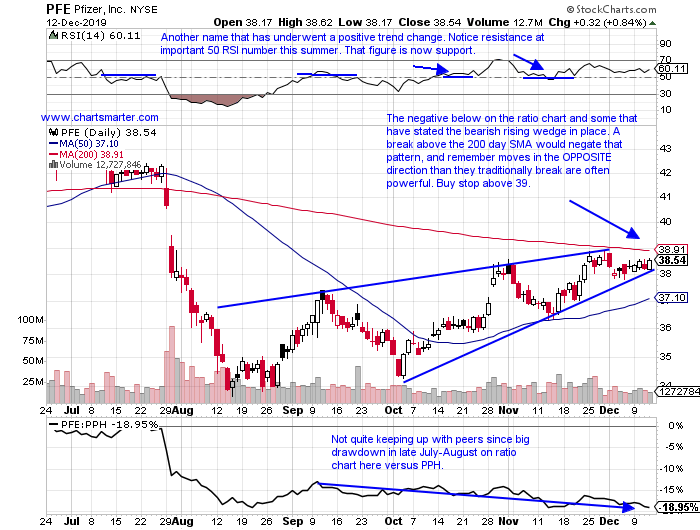

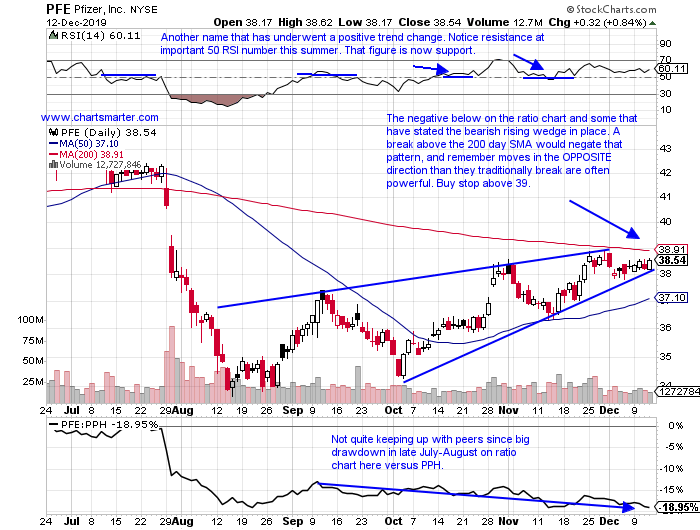

The large cap pharma space seems littered with possibilities. LLY is building the right side of its cup base, and below we take a look at the present set up in PFE.

- Laggard still LOWER by 12% YTD and 13% over last one year period. Dividend yield of 3.7%.

- Still trying to recover from large 21% haircut during 3 week losing streak weeks ending between 8/2-16 in huge volume.

- Now 14% off most recent 52 week highs, but last 3 weeks CLOSED very taut all within just .23 of each other.

- Enter with break above 200 day SMA. If that occurs look to add to above WEEKLY double bottom pivot of 44.66.

- Entry PFE 39. Stop 38.

If you liked what you read why not visit www.chartsmarter.com.

The healthcare space continues to act well, as it is the best performing major S&P sector on a 6 month look back period higher by nearly 11%. The space has the allure of both capital appreciation and nice dividend yields. Leading names will offer investors to add to their positions on the way up, and today we will look at that with a past and present view of NVS.

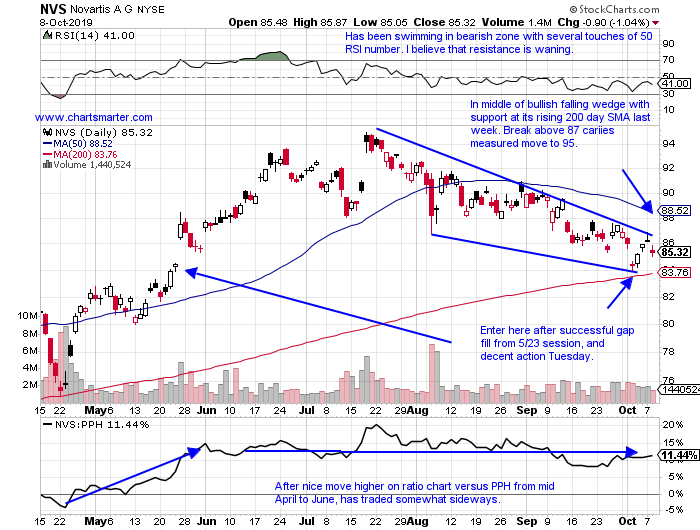

Below is how we looked at NVS in our 10/9 Healthcare Note.

- Swiss pharma play UNCH both on a YTD and over last one year period. Dividend yield of 3.3%.

- Lower 8 of the last 11 weeks, and one would think would be lower than the 10% it is off from most recent 52 week highs.

- FOUR consecutive positive earnings reactions higher by 4.5, 2.5, 2.2 and 1.1% on 7/18, 4/24, 1/31 and 10/18/18.

- Enter here after recent gap fill and support at upward sloping 200 day SMA.

- Entry NVS here. Stop 82 (REPORTS 10/22 before open).

Here we take a current look at NVS.

- Name now higher by 8% YTD and 6% over last one year period. Dividend yield of 3%.

- Higher 8 of the last 9 weeks, and lone down week, last week, fell less than .3% and CLOSED at top of weekly range.

- Just 2% off most recent 52 week highs, and look to add yet again above WEEKLY cup base pivot of 95.10 in pattern 5 months long.

- Enter after recent break above cup with handle pivot.

- Entry NVS here. Stop 89.

The large cap pharma space seems littered with possibilities. LLY is building the right side of its cup base, and below we take a look at the present set up in PFE.

- Laggard still LOWER by 12% YTD and 13% over last one year period. Dividend yield of 3.7%.

- Still trying to recover from large 21% haircut during 3 week losing streak weeks ending between 8/2-16 in huge volume.

- Now 14% off most recent 52 week highs, but last 3 weeks CLOSED very taut all within just .23 of each other.

- Enter with break above 200 day SMA. If that occurs look to add to above WEEKLY double bottom pivot of 44.66.

- Entry PFE 39. Stop 38.

If you liked what you read why not visit www.chartsmarter.com.