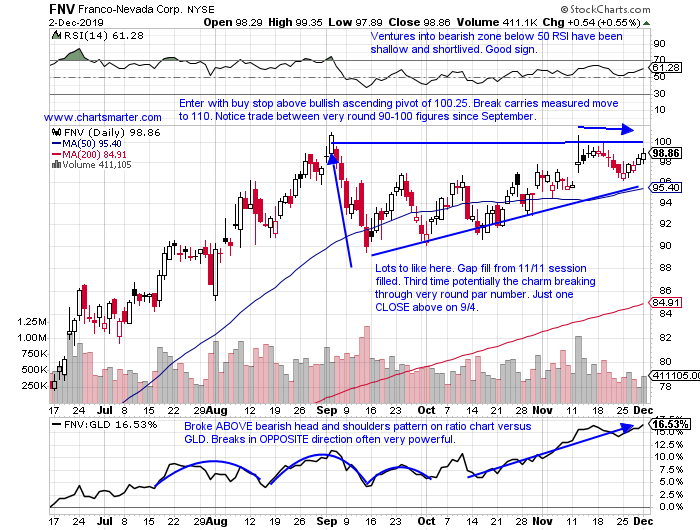

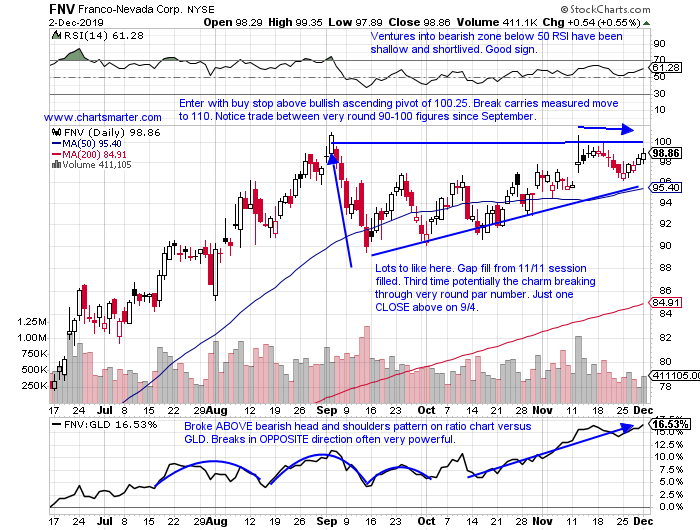

With markets, as in life, good things will take time. Patience is indeed a virtue waiting for set ups. Below we will take a look at an example of this with the gold stock FNV. Immediately below is how we profiled the name in our 12/3 Materials Note. Stocks will often pause at the very round numbers, and par gave this name headaches a few times in 2019. It was above 100 intraday on several occasions but was only able to CLOSE above it on 12/24.

- Best in breed gold play higher by 41% YTD and 44% over last one year period. Dividend yield of 1%.

- Higher 5 of the last 7 weeks, and recent action digesting 13 of 17 week winning streak weeks ending between 5/10-8/30 that ran from round 70 to very round par figure.

- Three consecutive positive earnings reactions higher by 2.3, 2.7 and 3.6% on 11/12. 8/8 and 5/9.

- Enter with buy stop above bullish ascending triangle. Break carries measured move to 110.

- Entry FNV 100.25. Stop 97.

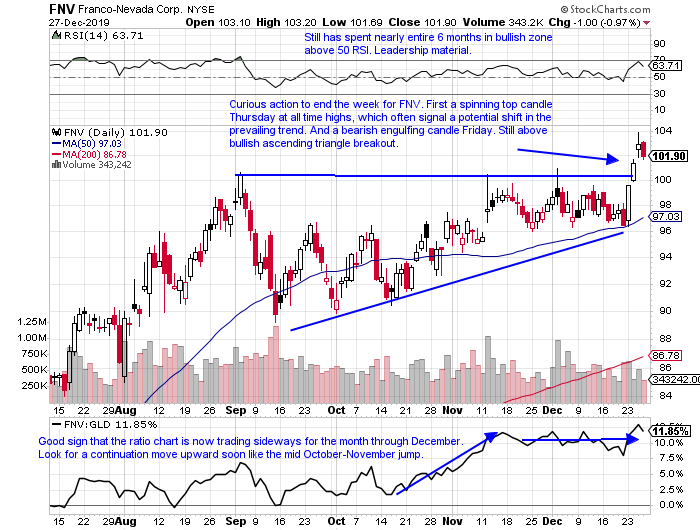

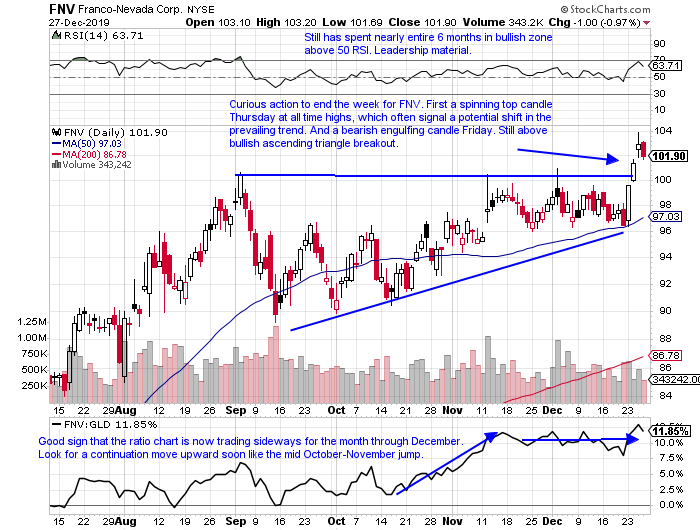

Taking a present look at FNV:

- Surged 5.7% this week, its THIRD best weekly advance in 2019. Sits just 2% off all time highs.

- Higher by 45% YTD, vastly outperforming GLD which has advanced just more than 17%.

- Recorded three straight CLOSES above very round par number. Notice 100 was resistance several times prior in 2019 dating back to September. This number should now be a floor going forward in 2020.

- Remember PRICE supersedes any other indicator, as the dubious candlesticks the last 2 days of the week may be concerning. The same stop on a CLOSING basis of 97 still applies.

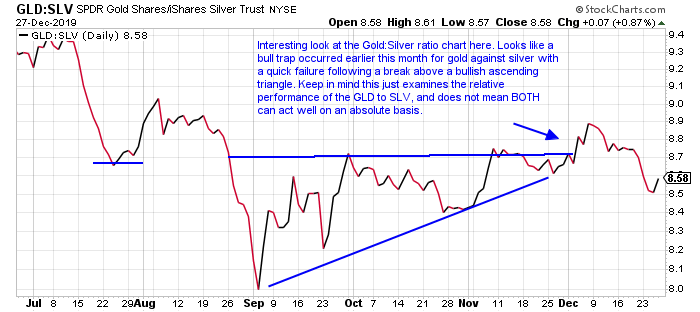

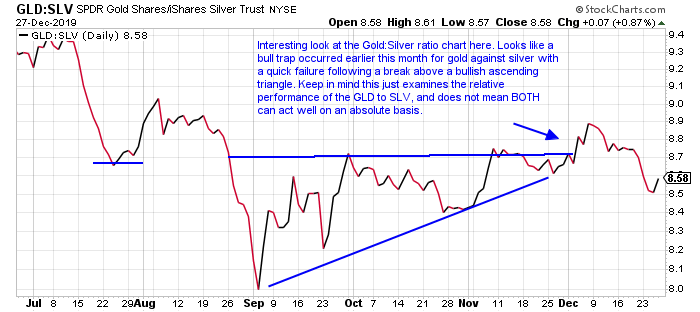

- Here we take a quick look at the gold:silver ratio chart comparing GLD:SLV. Both ETFs recorded stellar weeks with the SLV higher by 3.4%, while the GLD jumped 2%. Each are also stalking buy points in double bottom bases. Potential buy stop triggers are 17.22 for SLV and 143 for GLD.

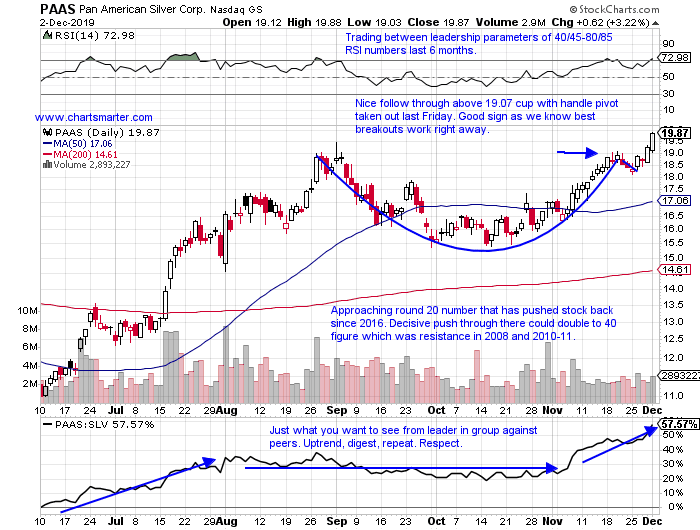

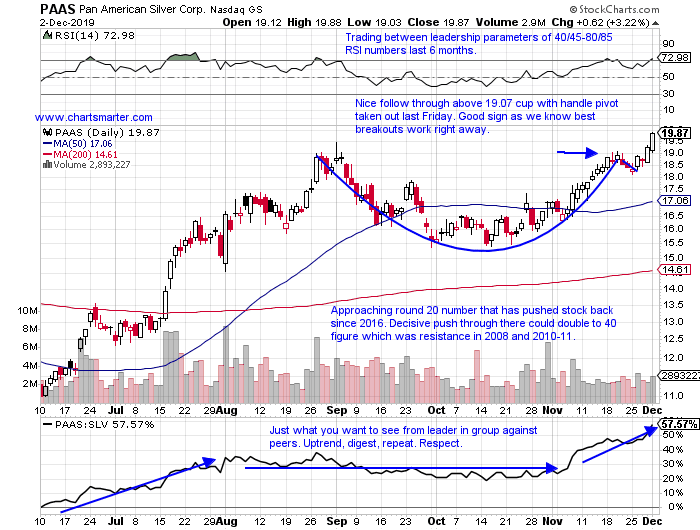

- Here is my favorite silver chart going forward, PAAS and also how it was profiled in our 12/3 Materials Note. Stock trades in a very taut manner, hallmark bullish traits, and any pullbacks toward the very round 20 number in early 2020 should be taken advantage of.

If you liked what you read why not visit www.chartsmarter.com.

With markets, as in life, good things will take time. Patience is indeed a virtue waiting for set ups. Below we will take a look at an example of this with the gold stock FNV. Immediately below is how we profiled the name in our 12/3 Materials Note. Stocks will often pause at the very round numbers, and par gave this name headaches a few times in 2019. It was above 100 intraday on several occasions but was only able to CLOSE above it on 12/24.

- Best in breed gold play higher by 41% YTD and 44% over last one year period. Dividend yield of 1%.

- Higher 5 of the last 7 weeks, and recent action digesting 13 of 17 week winning streak weeks ending between 5/10-8/30 that ran from round 70 to very round par figure.

- Three consecutive positive earnings reactions higher by 2.3, 2.7 and 3.6% on 11/12. 8/8 and 5/9.

- Enter with buy stop above bullish ascending triangle. Break carries measured move to 110.

- Entry FNV 100.25. Stop 97.

Taking a present look at FNV:

- Surged 5.7% this week, its THIRD best weekly advance in 2019. Sits just 2% off all time highs.

- Higher by 45% YTD, vastly outperforming GLD which has advanced just more than 17%.

- Recorded three straight CLOSES above very round par number. Notice 100 was resistance several times prior in 2019 dating back to September. This number should now be a floor going forward in 2020.

- Remember PRICE supersedes any other indicator, as the dubious candlesticks the last 2 days of the week may be concerning. The same stop on a CLOSING basis of 97 still applies.

- Here we take a quick look at the gold:silver ratio chart comparing GLD:SLV. Both ETFs recorded stellar weeks with the SLV higher by 3.4%, while the GLD jumped 2%. Each are also stalking buy points in double bottom bases. Potential buy stop triggers are 17.22 for SLV and 143 for GLD.

- Here is my favorite silver chart going forward, PAAS and also how it was profiled in our 12/3 Materials Note. Stock trades in a very taut manner, hallmark bullish traits, and any pullbacks toward the very round 20 number in early 2020 should be taken advantage of.

If you liked what you read why not visit www.chartsmarter.com.