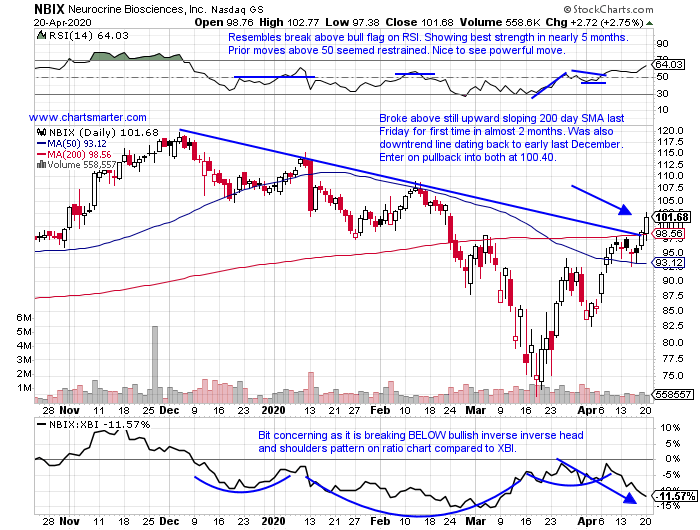

The biotech space remains red hot with the XBI almost completing its "V Shaped" recovery. It trades just 2% below a double bottom pivot of 98.86, and will have a formidable challenge at the very round par number which has been significant resistance. If it can break above that area soundly the group will get a big boost obviously. Below is the chart of NBIX and how it appeared in our 4/21 Healthcare Note.

- Biotech play lower by 6% YTD and higher by 29% over last one year period.

- Nice start to this week after prior two jumped by a combined 15%. Prone to strong moves with 25 of 32 week winning streak between weeks ending 5/3-12/6/19 (4 of 7 WEEKLY decliners fell less than 1%).

- Four of last five earnings reactions lower by .6, .1, 5.9 and 3.8% on 2/5, 11/5, 4/30 and 2/6/19.

- Enter on pullback into very round number/break above long downtrend line.

- Entry NBIX 100.40. Stop 95.

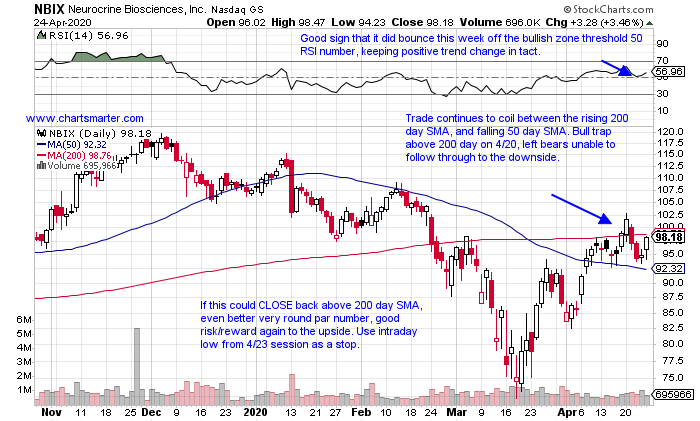

- Taking a current look at NBIX, I believe if this were to break back above its 200 day SMA so quickly after the most recent bull trap, it would be a big positive. The trade WOULD have been stopped out as I was WRONG, and perhaps I could have given a bit more leeway, maybe to the 50 day SMA. It is a good example of being stopped out responsibly, but keeping an open mind to getting back into a potential profitable trade.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com.

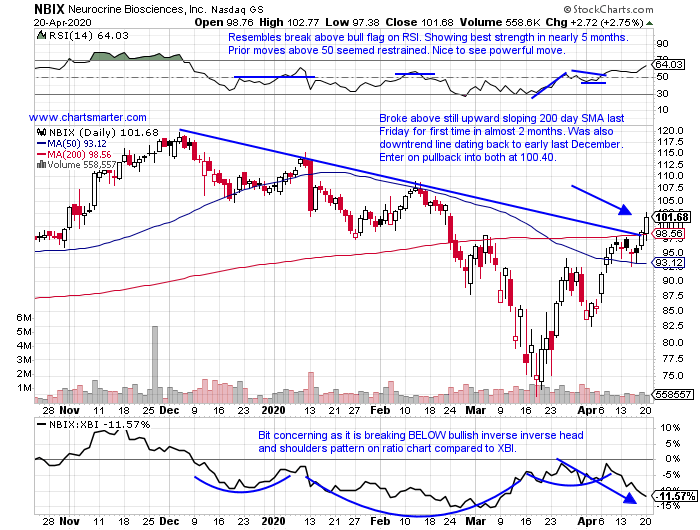

The biotech space remains red hot with the XBI almost completing its "V Shaped" recovery. It trades just 2% below a double bottom pivot of 98.86, and will have a formidable challenge at the very round par number which has been significant resistance. If it can break above that area soundly the group will get a big boost obviously. Below is the chart of NBIX and how it appeared in our 4/21 Healthcare Note.

- Biotech play lower by 6% YTD and higher by 29% over last one year period.

- Nice start to this week after prior two jumped by a combined 15%. Prone to strong moves with 25 of 32 week winning streak between weeks ending 5/3-12/6/19 (4 of 7 WEEKLY decliners fell less than 1%).

- Four of last five earnings reactions lower by .6, .1, 5.9 and 3.8% on 2/5, 11/5, 4/30 and 2/6/19.

- Enter on pullback into very round number/break above long downtrend line.

- Entry NBIX 100.40. Stop 95.

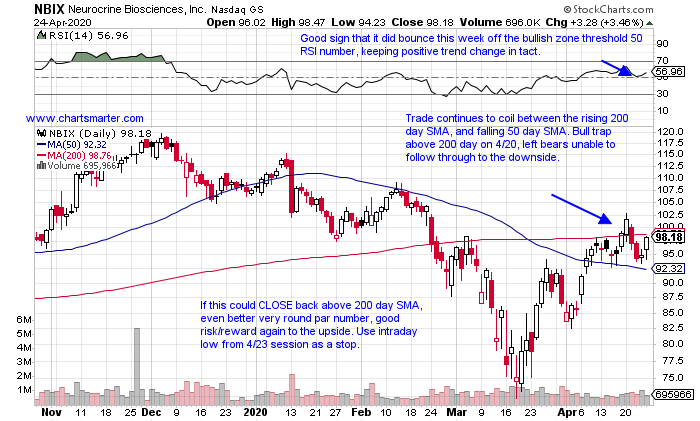

- Taking a current look at NBIX, I believe if this were to break back above its 200 day SMA so quickly after the most recent bull trap, it would be a big positive. The trade WOULD have been stopped out as I was WRONG, and perhaps I could have given a bit more leeway, maybe to the 50 day SMA. It is a good example of being stopped out responsibly, but keeping an open mind to getting back into a potential profitable trade.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com.