Software Firming:

- The newly crowned technology group, that reclaimed the best major S&P sector performer on a YTD basis over healthcare recently is looking to flex its muscles. The XLK is still lower by just over 1% in 2019 thus far, but the seemingly constant tug of war between the two most closely watched sub groups in tech rages on. On 4/28 the IGV recorded a bearish engulfing candle, as it was above a cup with handle pivot intraday, and the fund looked vulnerable. Monday it began the week with a bullish engulfing candle, and is attempting to put that negativity in the rear view mirror. It clearly outperformed today up 2%, compared to the SMH that was higher by 1.1%. On a WEEKLY timeframe last week provided some light as to the surge below in softwares favor on the ratio chart compared to the semis, as the IGV rose .5%, while the SMH fell 3.4%. Software has an advantage as to where its sits just 10% from most recent 52 week highs, whereas the SMH is 15% off its most recent yearly peak. As I always like to say competition brings out the best in things, and do not expect semis to just lay down and die.

Earnings Deluge:

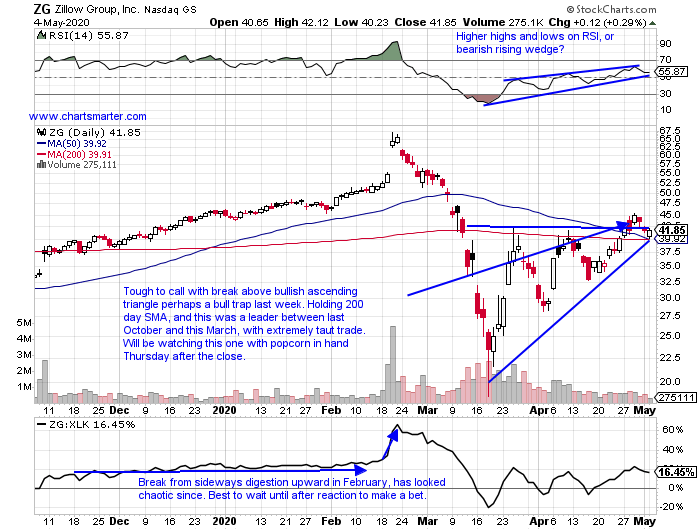

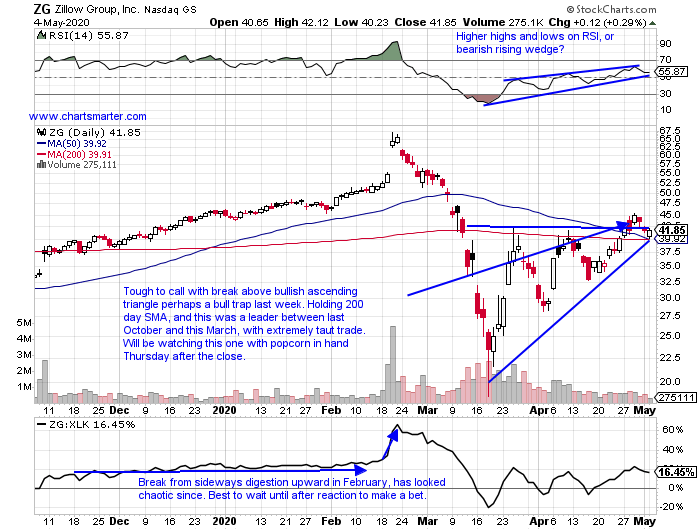

- The earnings this week are coming in hot and heavy, although not as numerous as last week. Some charts that are reporting in the next few days, and I am NOT advocating any buys or sells as one should wait for after the release if one does not have a position, have interesting set ups. Below is the chart of the internet play ZG (IAC also looks compelling), and it REPORTS 5/7 after the close, and has shown FOUR powerful gains in its last 5 reactions higher by 17, 11, 5.5 and 24.7% on 2/20, 11/8, 5/10 and 2/22/19. One could ponder whether the housing market has slowed due to the virus, with the ITB being chopped more than 50% between the 4 weeks ending between 2/28-3/20, after finding a stern rejection at the very round 50 number. The ETF is on a 3 session losing streak after filling in an upside gap at the 38 number from the 3/11 session. Former stalwarts PHM and TOL are now 42 and 50% respectively off their most recent 52 week highs. Will this behavior show up in Zillows reaction later this week?

Recent Examples:

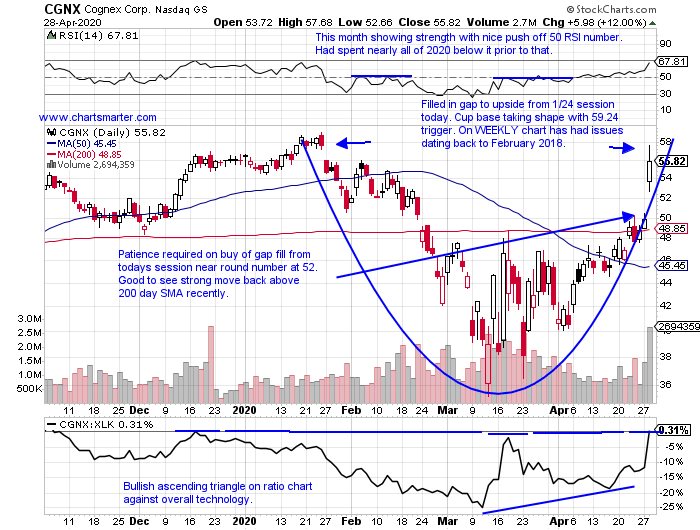

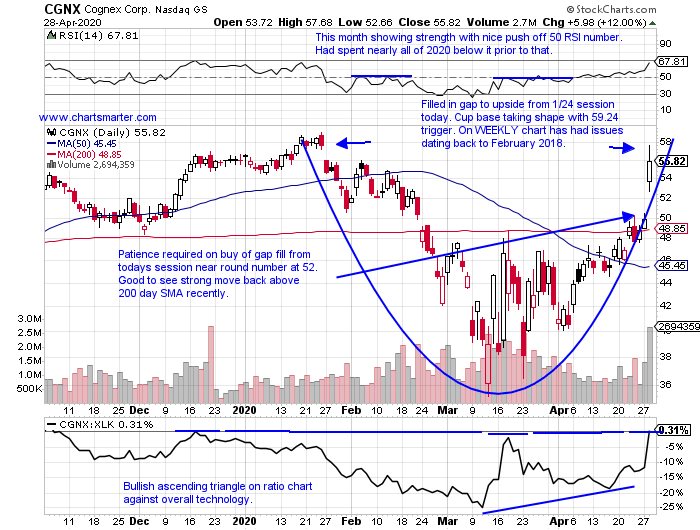

- Patience in life can apply to the stock market too. Longer term traders tend to be more selective, and know that doing less if often more. Below could be a good example of that theory, with the chart of CGNX and how it appeared in our 4/29 Technology Note. The electronic equipment play has peers that are acting well technically including ZBRA and SNE, the former which closed a gap from the 4/27 session today at its 200 day SMA. CGNX is on a 4 week winning streak and a look on its WEEKLY chart shows a huge run of 421%, the weeks ending between 1/15/16-11/24/17, and it has traded roughly sideways since. Here we look at the daily chart and notice with the softness the market was exhibiting, we thought it would be wise to wait for the latest earnings gap to fill near the very round 50 number. It hit the suggested entry and in the next couple months if this can trade above 60, I think this name could potentially have a very strong run like it did during the 2016-2017 move.

Special Situations:

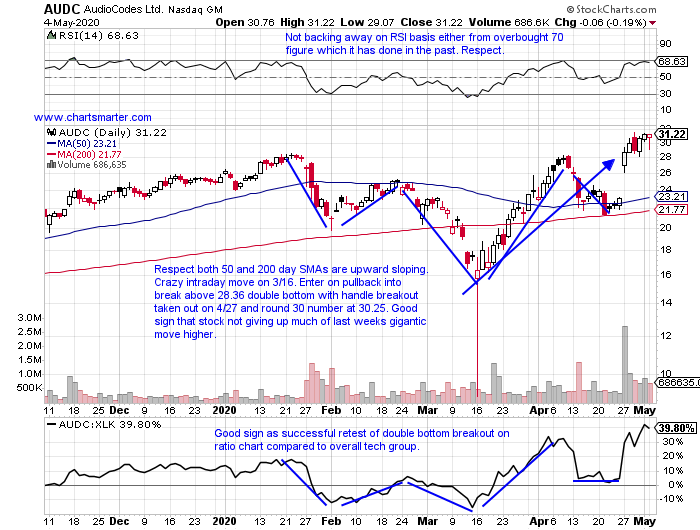

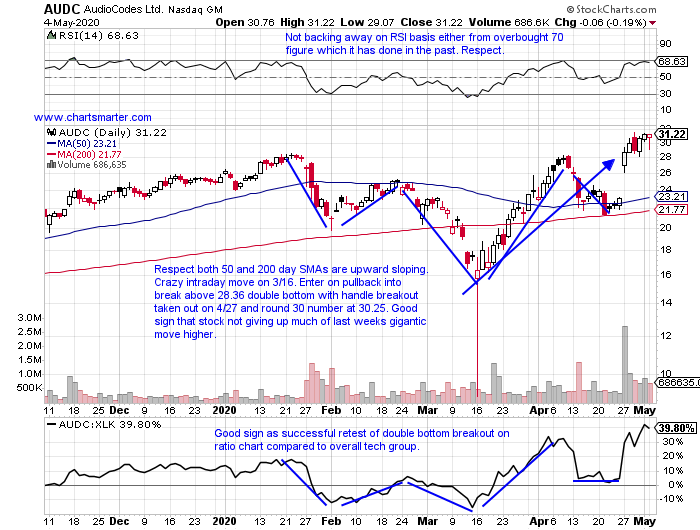

- Telecommunications equipment play up 21% YTD and 111% over last one year period. Dividend yield of .8%.

- Higher 5 of last 7 weeks, and last week jumped by 35.6%. Huge move since week ending 3/20, which CLOSED as it doubled off intraweek lows. Now at two decade highs.

- Earnings well received with gains of 24.7, 7.8 and 10% on 4/27, 10/29 and 7/23/19 (fell 8.6% on 1/28).

- Enter on pullback into double bottom with handle breakout/round number.

- Entry AUDC 30.25. Stop 27.25.

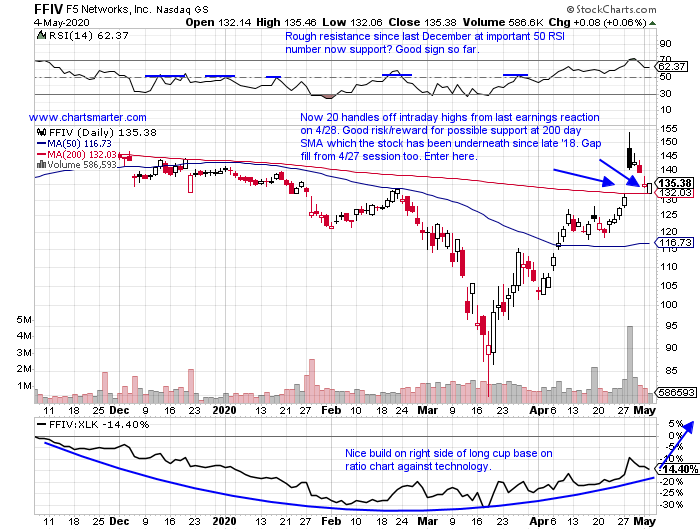

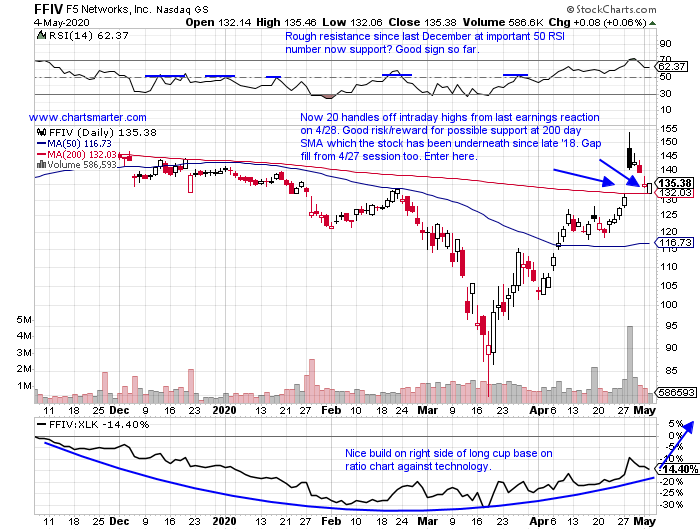

- Telecommunications equipment play lower by 3% YTD and 12% 0ver last one year period.

- Rose 6.3% last week, and higher 4 of last 6 weeks, with the 2 declining weeks off gently, and CLOSING in the upper half of the weekly range.

- Earnings mixed with stronger gains up 7.6 and 5.5% on 4/28 and 10/24/19 (fell 5 and .7% on 1/28 and 7/25/19).

- Enter after gap fill/potential 200 day SMA support.

- Entry FFIV here. Stop 127.50.

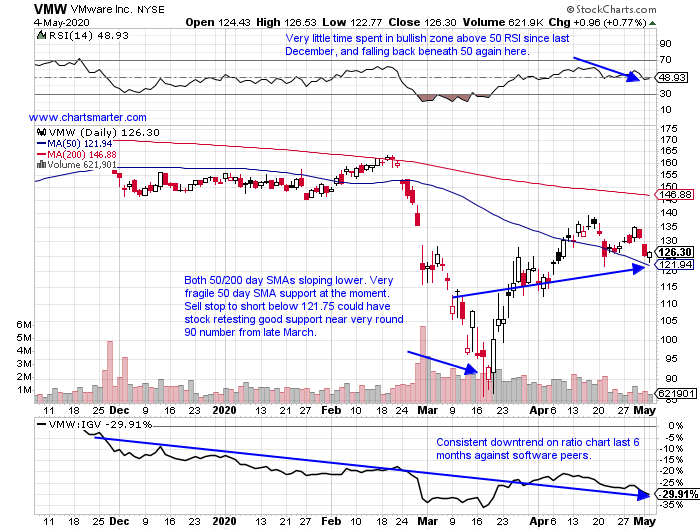

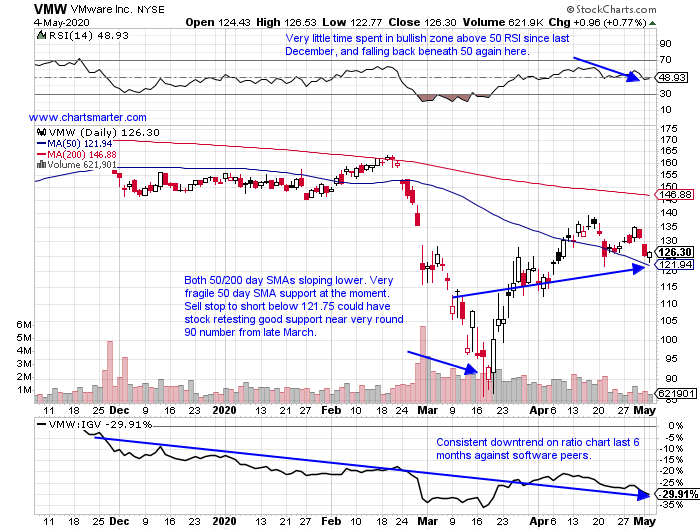

- Software laggard lower by 17% YTD and 38% over last one year period.

- Name still 39% off most recent 52 week highs in strong overall software group. Poor relative strength last 2 weeks as well lower by 6.1 and 2.2% weeks ending 4/24 and 5/1, while IGV lost 1% week ending 4/24, and rose .5% week ending 5/1.

- FOUR straight negative earnings reactions down 11.1, 2.3, 9.9 and 7.4% on 2/28, 11/27, 8/23 and 5/31/19.

- Sell stop to short below 50 day SMA to resume downtrend.

- Entry VMW 121.75. Buy stop 129.

Good luck.

Entry summaries:

Buy pullback into recent double bottom with handle breakout/round number AUDC 30.25. Stop 27.25.

Buy after gap fill/200 day SMA support FFIV here. Stop 127.50.

Sell stop to short below 50 day SMA VMW 121.75. Buy stop 129.

This article requires a Chartsmarter membership. Please click here to join.

Software Firming:

- The newly crowned technology group, that reclaimed the best major S&P sector performer on a YTD basis over healthcare recently is looking to flex its muscles. The XLK is still lower by just over 1% in 2019 thus far, but the seemingly constant tug of war between the two most closely watched sub groups in tech rages on. On 4/28 the IGV recorded a bearish engulfing candle, as it was above a cup with handle pivot intraday, and the fund looked vulnerable. Monday it began the week with a bullish engulfing candle, and is attempting to put that negativity in the rear view mirror. It clearly outperformed today up 2%, compared to the SMH that was higher by 1.1%. On a WEEKLY timeframe last week provided some light as to the surge below in softwares favor on the ratio chart compared to the semis, as the IGV rose .5%, while the SMH fell 3.4%. Software has an advantage as to where its sits just 10% from most recent 52 week highs, whereas the SMH is 15% off its most recent yearly peak. As I always like to say competition brings out the best in things, and do not expect semis to just lay down and die.

Earnings Deluge:

- The earnings this week are coming in hot and heavy, although not as numerous as last week. Some charts that are reporting in the next few days, and I am NOT advocating any buys or sells as one should wait for after the release if one does not have a position, have interesting set ups. Below is the chart of the internet play ZG (IAC also looks compelling), and it REPORTS 5/7 after the close, and has shown FOUR powerful gains in its last 5 reactions higher by 17, 11, 5.5 and 24.7% on 2/20, 11/8, 5/10 and 2/22/19. One could ponder whether the housing market has slowed due to the virus, with the ITB being chopped more than 50% between the 4 weeks ending between 2/28-3/20, after finding a stern rejection at the very round 50 number. The ETF is on a 3 session losing streak after filling in an upside gap at the 38 number from the 3/11 session. Former stalwarts PHM and TOL are now 42 and 50% respectively off their most recent 52 week highs. Will this behavior show up in Zillows reaction later this week?

Recent Examples:

- Patience in life can apply to the stock market too. Longer term traders tend to be more selective, and know that doing less if often more. Below could be a good example of that theory, with the chart of CGNX and how it appeared in our 4/29 Technology Note. The electronic equipment play has peers that are acting well technically including ZBRA and SNE, the former which closed a gap from the 4/27 session today at its 200 day SMA. CGNX is on a 4 week winning streak and a look on its WEEKLY chart shows a huge run of 421%, the weeks ending between 1/15/16-11/24/17, and it has traded roughly sideways since. Here we look at the daily chart and notice with the softness the market was exhibiting, we thought it would be wise to wait for the latest earnings gap to fill near the very round 50 number. It hit the suggested entry and in the next couple months if this can trade above 60, I think this name could potentially have a very strong run like it did during the 2016-2017 move.

Special Situations:

- Telecommunications equipment play up 21% YTD and 111% over last one year period. Dividend yield of .8%.

- Higher 5 of last 7 weeks, and last week jumped by 35.6%. Huge move since week ending 3/20, which CLOSED as it doubled off intraweek lows. Now at two decade highs.

- Earnings well received with gains of 24.7, 7.8 and 10% on 4/27, 10/29 and 7/23/19 (fell 8.6% on 1/28).

- Enter on pullback into double bottom with handle breakout/round number.

- Entry AUDC 30.25. Stop 27.25.

- Telecommunications equipment play lower by 3% YTD and 12% 0ver last one year period.

- Rose 6.3% last week, and higher 4 of last 6 weeks, with the 2 declining weeks off gently, and CLOSING in the upper half of the weekly range.

- Earnings mixed with stronger gains up 7.6 and 5.5% on 4/28 and 10/24/19 (fell 5 and .7% on 1/28 and 7/25/19).

- Enter after gap fill/potential 200 day SMA support.

- Entry FFIV here. Stop 127.50.

- Software laggard lower by 17% YTD and 38% over last one year period.

- Name still 39% off most recent 52 week highs in strong overall software group. Poor relative strength last 2 weeks as well lower by 6.1 and 2.2% weeks ending 4/24 and 5/1, while IGV lost 1% week ending 4/24, and rose .5% week ending 5/1.

- FOUR straight negative earnings reactions down 11.1, 2.3, 9.9 and 7.4% on 2/28, 11/27, 8/23 and 5/31/19.

- Sell stop to short below 50 day SMA to resume downtrend.

- Entry VMW 121.75. Buy stop 129.

Good luck.

Entry summaries:

Buy pullback into recent double bottom with handle breakout/round number AUDC 30.25. Stop 27.25.

Buy after gap fill/200 day SMA support FFIV here. Stop 127.50.

Sell stop to short below 50 day SMA VMW 121.75. Buy stop 129.