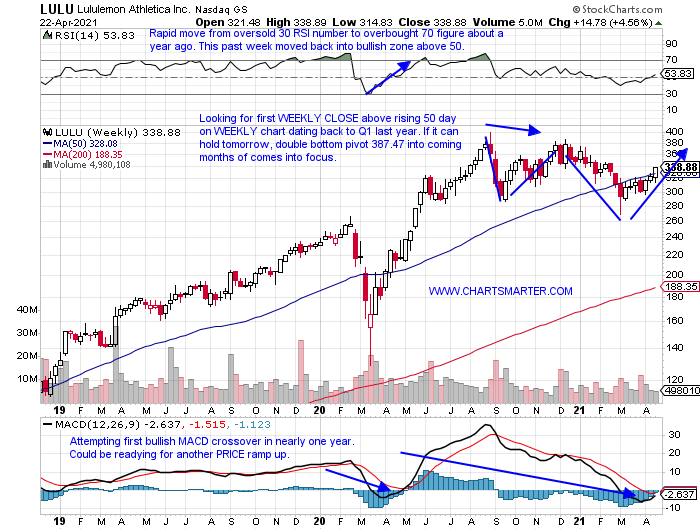

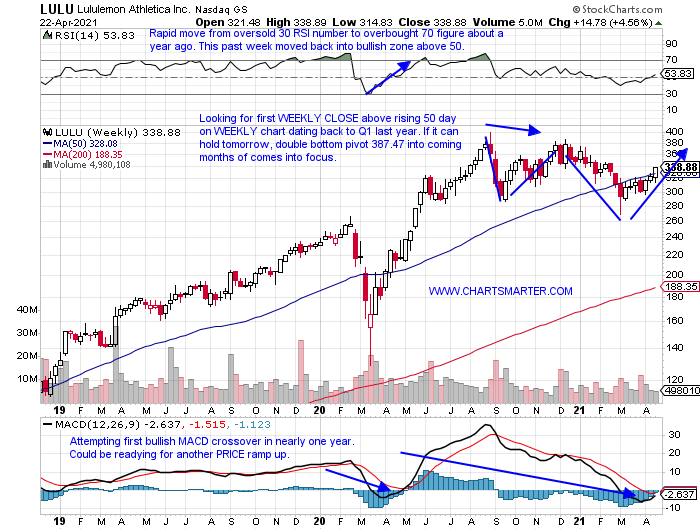

"See-Through" 50 day SMA:

- We may be dating ourselves with the "scandal story" when the CEO of LULU made controversy of transparent workout gear. The stock has encountered issues since those remarks, but it is trying to act firm these days, and Thursday shareholders saw a shadow of its former self. The stock rose almost 4% on a soft tape today, in good volume to boot as it reclaimed its 200 day SMA. On its WEEKLY chart, it met resistance last September precisely at the very round 400 number. Immediately prior to that, it rose 19 of 23 weeks between the weeks ending 3/27-8/28/20. Heading into Friday it has advanced 5 of the last 6 weeks, and it up almost 5% this week heading into Friday. It is still 15% off its most recent 52-week highs, and to be frank, has been a laggard. One that was a former best in breed retail name. LULU is still lower by 3% YTD, as the XRT has risen 42%. Mean reversion time?

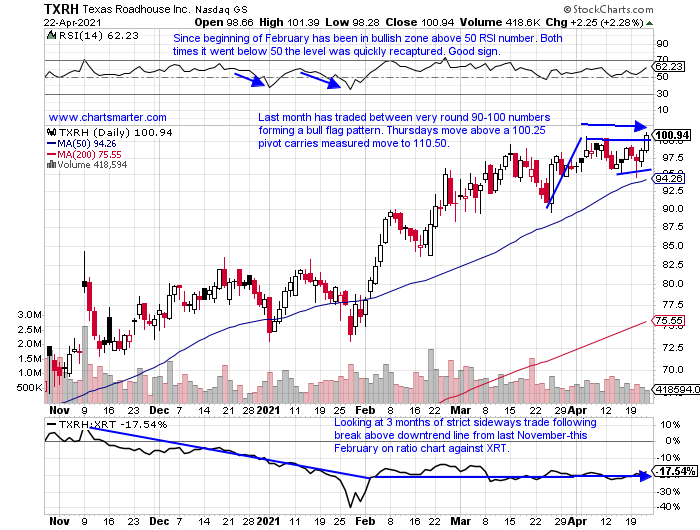

Appetizing Add On:

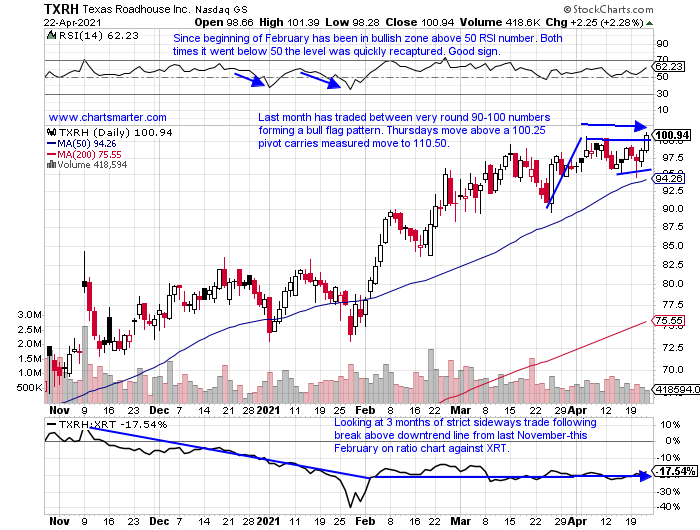

- When stocks were barely hurt during late last year's market sell-off one should take notice. Names that withstand strong selling pressure will often be your leaders going forward. Below could be a good example of that with the chart of TXRH. We profiled the name last in our 3/26 Consumer Note, and now it could be setting up a new "add on" buy point. The last 3 weeks have all been above the very round par number, but there have been ZERO CLOSES above 100 on a WEEKLY or daily basis, until Thursday. Even more bullish is the fact that the last 2 weeks CLOSED, right at highs for the WEEKLY range, and there is a possibility of the last 3 weeks all CLOSING very taut. Breaks above that type of digestion tend to be explosive, especially at all-time highs. It REPORTS earnings next Thursday after the close.

Recent Examples:

- Automobiles seem to be in the news endlessly. F received another couple of upgrades this week. Of course, TSLA is talked about incessantly, and it is for now holding the bullish ascending triangle breakout that aligned with the very round 700 number (measured move to 850). NKLA found the good fortune of round number theory at the 10 figure this week, for the moment shrugging off single digit status. Volkswagen and Porsche charts look solid too. Below is the chart of GM, and how it appeared in our 4/20 Consumer Note. It is trading right near the suggested entry of 56.50, and it did register a bullish engulfing candle at its rising 50 day SMA Wednesday. GM looked hesitant the 2 times it traded north of the 60 number and looked to be putting an end to the 50-60 range. The third time above 60, if it can occur, could the charm.

Special Situations:

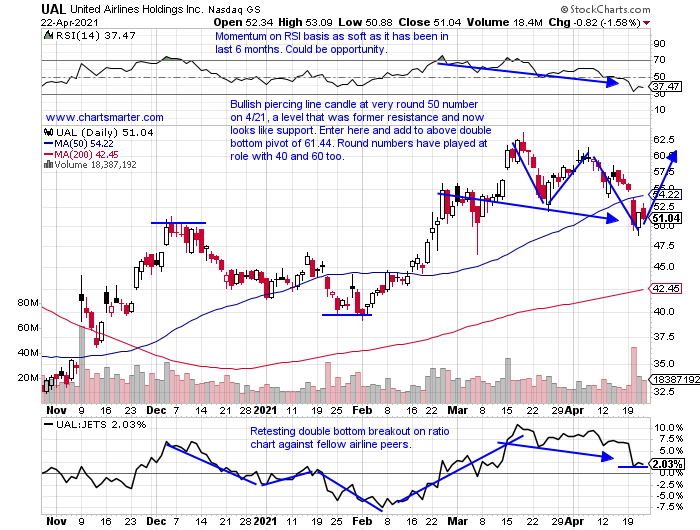

- Airline play higher by 18% YTD and 97% over last one-year period.

- Now 20% off most recent 52 week highs, and down almost 9% this week. Looking like consecutive WEEKLY losses for first time since January. Last 2 CLOSED well off intraweek highs, and this one is doing the same thus far.

- FOUR straight negative earnings reactions down 8.5, 5.7, 3.8, and 4.2% on 4/20, 1/21, 10/15, and 7/22/2o.

- Enter on pullback into very round number/bullish piercing line candle.

- Entry UAL here. Stop 49.

- Lesiure play up 22% YTD and 187% over last one-year period.

- Now 11% off most recent 52 week highs, and looking for a fourth consecutive WEEKLY CLOSE near highs for WEEKLY range. This week UNCH, good action after prior week jumped 4.8%, and XRT down 1.8% this week so far.

- Three straight negative earnings reactions down 3, 2.6, and 5.9% on 2/11, 11/10, and 8/7/20 (rose 2.8% on 5/8/20).

- Enter after break above 50 day SMA/bullish engulfing candle.

- Entry ELY here. Stop 28 (REPORT 5/7 after close).

- Apparel higher by 44% YTD and 130% over last one year period. Dividend yield of .8%.

- Just 2% off most recent all-time highs (company public just 2 years), and this week off fractionally after prior 2 weeks before that rose more than 21%. Excellent volume trends with just one week of distribution in last 10 months.

- Earnings mixed with larger losses off 5.7 and 8.3% on 1/28 and 7/8/20, and gains of 2.6 and 5.1% on 4/9 and 10/7/20.

- Enter short into round number.

- Entry LEVI 29.25. Buy stop 31.

Good luck.

Entry summaries:

Buy pullback into very round number/bullish piercing line candle UAL here. Stop 49.

Buy pullback into bullish engulfing candle/break above 50 day SMA ELY here. Stop 28.

Sell into round number LEVI 29.25. Buy stop 31.

This article requires a Chartsmarter membership. Please click here to join.

"See-Through" 50 day SMA:

- We may be dating ourselves with the "scandal story" when the CEO of LULU made controversy of transparent workout gear. The stock has encountered issues since those remarks, but it is trying to act firm these days, and Thursday shareholders saw a shadow of its former self. The stock rose almost 4% on a soft tape today, in good volume to boot as it reclaimed its 200 day SMA. On its WEEKLY chart, it met resistance last September precisely at the very round 400 number. Immediately prior to that, it rose 19 of 23 weeks between the weeks ending 3/27-8/28/20. Heading into Friday it has advanced 5 of the last 6 weeks, and it up almost 5% this week heading into Friday. It is still 15% off its most recent 52-week highs, and to be frank, has been a laggard. One that was a former best in breed retail name. LULU is still lower by 3% YTD, as the XRT has risen 42%. Mean reversion time?

Appetizing Add On:

- When stocks were barely hurt during late last year's market sell-off one should take notice. Names that withstand strong selling pressure will often be your leaders going forward. Below could be a good example of that with the chart of TXRH. We profiled the name last in our 3/26 Consumer Note, and now it could be setting up a new "add on" buy point. The last 3 weeks have all been above the very round par number, but there have been ZERO CLOSES above 100 on a WEEKLY or daily basis, until Thursday. Even more bullish is the fact that the last 2 weeks CLOSED, right at highs for the WEEKLY range, and there is a possibility of the last 3 weeks all CLOSING very taut. Breaks above that type of digestion tend to be explosive, especially at all-time highs. It REPORTS earnings next Thursday after the close.

Recent Examples:

- Automobiles seem to be in the news endlessly. F received another couple of upgrades this week. Of course, TSLA is talked about incessantly, and it is for now holding the bullish ascending triangle breakout that aligned with the very round 700 number (measured move to 850). NKLA found the good fortune of round number theory at the 10 figure this week, for the moment shrugging off single digit status. Volkswagen and Porsche charts look solid too. Below is the chart of GM, and how it appeared in our 4/20 Consumer Note. It is trading right near the suggested entry of 56.50, and it did register a bullish engulfing candle at its rising 50 day SMA Wednesday. GM looked hesitant the 2 times it traded north of the 60 number and looked to be putting an end to the 50-60 range. The third time above 60, if it can occur, could the charm.

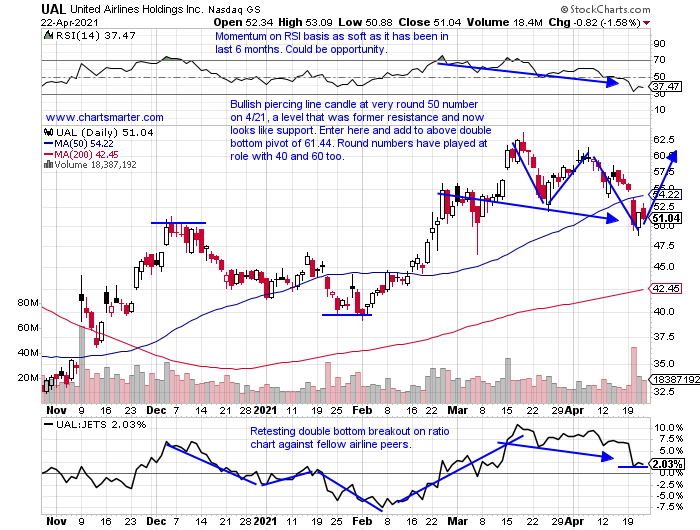

Special Situations:

- Airline play higher by 18% YTD and 97% over last one-year period.

- Now 20% off most recent 52 week highs, and down almost 9% this week. Looking like consecutive WEEKLY losses for first time since January. Last 2 CLOSED well off intraweek highs, and this one is doing the same thus far.

- FOUR straight negative earnings reactions down 8.5, 5.7, 3.8, and 4.2% on 4/20, 1/21, 10/15, and 7/22/2o.

- Enter on pullback into very round number/bullish piercing line candle.

- Entry UAL here. Stop 49.

- Lesiure play up 22% YTD and 187% over last one-year period.

- Now 11% off most recent 52 week highs, and looking for a fourth consecutive WEEKLY CLOSE near highs for WEEKLY range. This week UNCH, good action after prior week jumped 4.8%, and XRT down 1.8% this week so far.

- Three straight negative earnings reactions down 3, 2.6, and 5.9% on 2/11, 11/10, and 8/7/20 (rose 2.8% on 5/8/20).

- Enter after break above 50 day SMA/bullish engulfing candle.

- Entry ELY here. Stop 28 (REPORT 5/7 after close).

- Apparel higher by 44% YTD and 130% over last one year period. Dividend yield of .8%.

- Just 2% off most recent all-time highs (company public just 2 years), and this week off fractionally after prior 2 weeks before that rose more than 21%. Excellent volume trends with just one week of distribution in last 10 months.

- Earnings mixed with larger losses off 5.7 and 8.3% on 1/28 and 7/8/20, and gains of 2.6 and 5.1% on 4/9 and 10/7/20.

- Enter short into round number.

- Entry LEVI 29.25. Buy stop 31.

Good luck.

Entry summaries:

Buy pullback into very round number/bullish piercing line candle UAL here. Stop 49.

Buy pullback into bullish engulfing candle/break above 50 day SMA ELY here. Stop 28.

Sell into round number LEVI 29.25. Buy stop 31.