"Old Tech" Bifurcation:

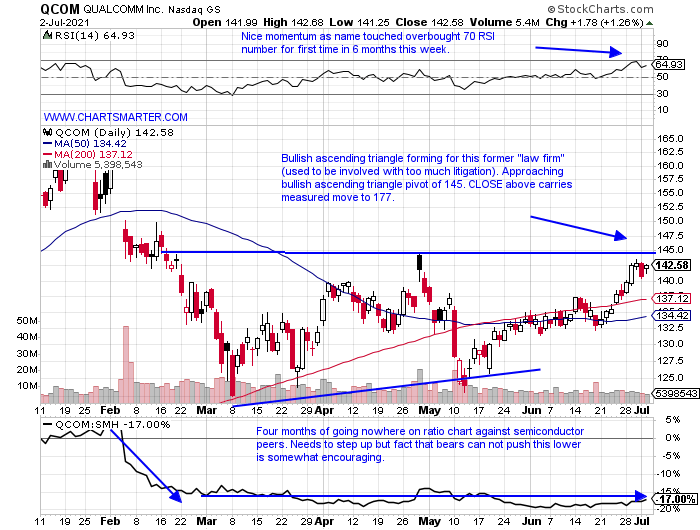

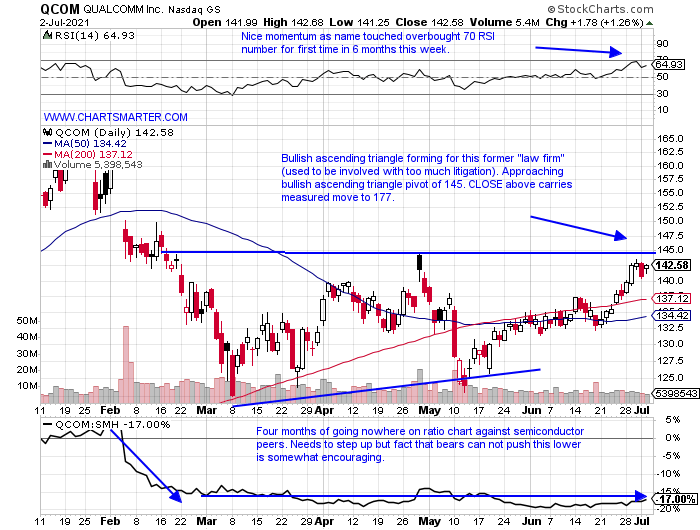

- Friday witnessed some contrasting action in some of the bigger, mature tech players. Big Blue was feeling blue to end the week falling almost 5% in the second-largest daily volume of 2021, trailing just the negative earnings reaction on 1/22 that slumped 10%. If the name gets close to filling the gap from the 4/19 session consider that a gift. On the other hand, ORCL put up a combined 5% advance the last 2 days this week, and it filled an upside gap from 6/15. It CLOSED above the former bullish ascending triangle pivot of 80, and for me, there are better stocks to play. Below is one of them with the chart of QCOM. It is 15% off most recent 52 week highs, lagging as the SMH is just 1% off its peak. The stock has registered back-to-back 3.5% WEEKLY gains, not long after 3 very taut WEEKLY CLOSES all within just .28 of each other the weeks ending 5/28-6/11. This name could be a big 2nd half winner.

Social Shining:

- Social media plays have been acting well as of late. For all the chatter of lack of names trading below their 50 day SMAs, this space can not be spoken of in that conversation. FB is now about 10% north of its 50 day. It now trades just 1% off all-time highs, after the last 2 weeks produced 3% plus advances, after the prior 4 weeks all CLOSED tight within just 2.93 of each other. SNAP is dealing with the round 70 number and put up a decent showing this past week up more than 1% after the prior week jumped 7.1%. PINS recorded a spinning top at the round 80 number Friday, and it was also halted at the very round 90 number on 2/16. Below is the current chart of TWTR, and link here is how it appeared in our 5/13 Technology Note. If this can push and CLOSE above 70 next week it is likely to trade above a double bottom pivot of 73.32 on its way back to all-time highs at 80. We can then reassess there.

Recent Examples:

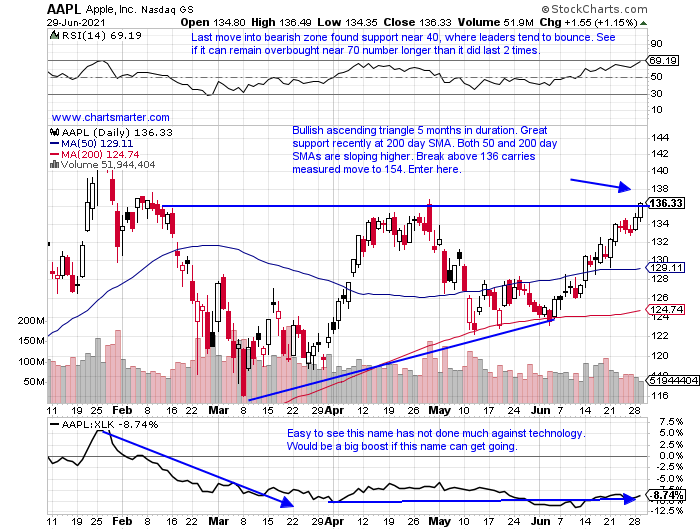

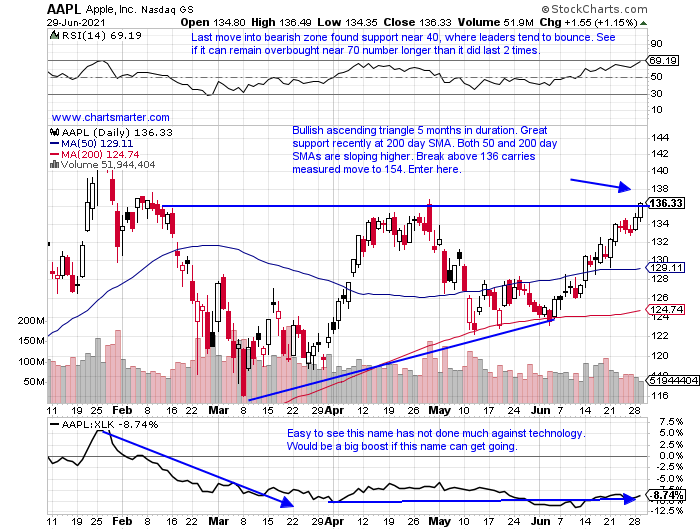

- Size matters. We frequently mention that in regards to the stock market and there is no bigger player than AAPL. It is the largest component in both the S&P 500 and the Nasdaq, so its direction can sway not only the benchmarks but the underlying stocks within. Below is the chart of Apple, and how it appeared in our 6/30 Technology Note. The stock rose every day this past week and each session CLOSED at the top of the daily range. It is now on a 5-week winning streak, and Friday CLOSED right below the round 140 number. In fact, this week recorded its strongest WEEKLY CLOSE ever. The stock now trades 4% off most recent all-time highs and a move above 145.19 could really get this uptrend in motion. Remember this one was until recently a laggard and if it joins the party in a firm way technology will make a run up the major S&P sector leaderboard. Energy is too far ahead to catch, but the XLK could be a force to contend with in the second half.

Special Situations:

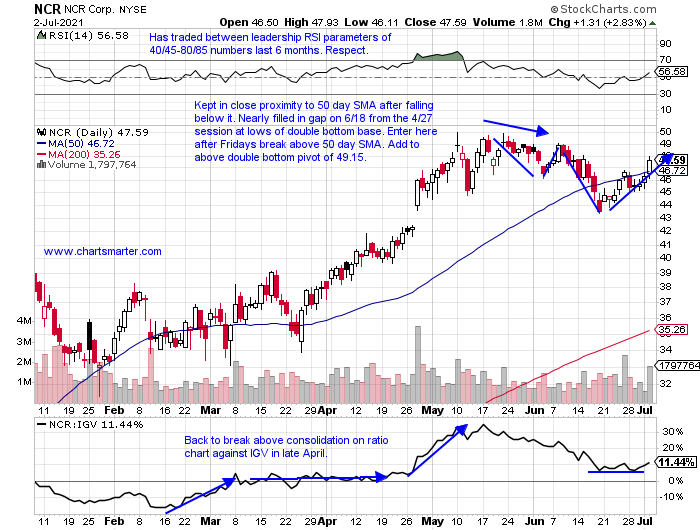

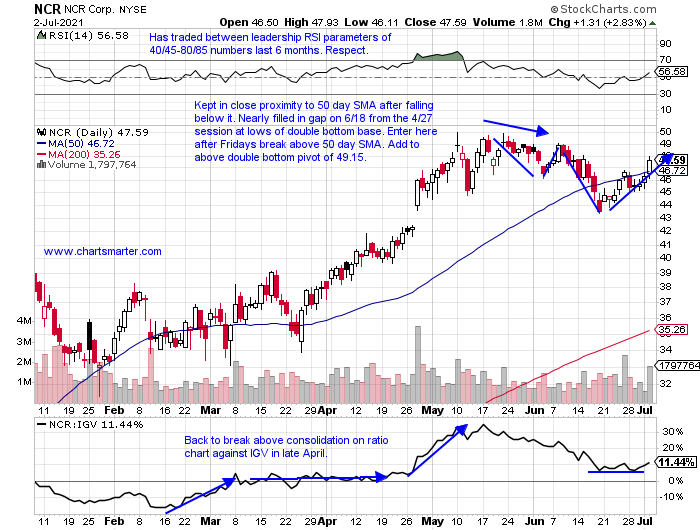

- "Old tech" software play up 27% YTD and 117% over last one-year period.

- Now 5% off most recent 52 week highs, and up just 3 of the last 6 weeks. Most likely digesting prior 9 week winning streak weeks ending between 3/26-5/21 which rose by a combined 47.4%.

- Earnings mixed, up 8.7 and 13.9% on 4/28 and 7/29/20, and losses of 6.8 and 10.7% on 2/10 and 10/28/20.

- Enter after break above rising 50 day SMA.

- Entry NCR here. Stop 46.

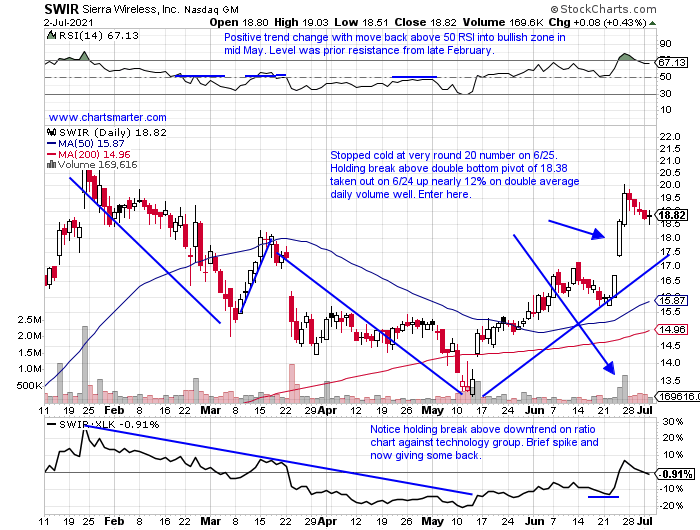

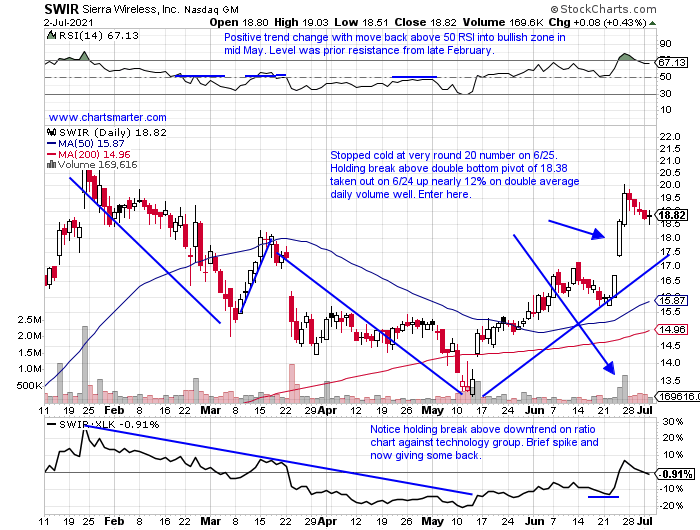

- Telecommunications equipment play up 29% YTD and 114% over last one-year period.

- Still 15% off most recent 52 week highs, but has risen 6 of the last 8 weeks. This week slipped 4.4%, which can be forgiven as prior week jumped by 23.6%.

- Three straight positive earnings reactions up 9.8, 6.9, and 4.6% on 5/14, 2/24, and 11/13/20 (fell 5% on 8/6/20).

- Enter on pullback into double bottom breakout.

- Entry SWIR here. Stop 17.50.

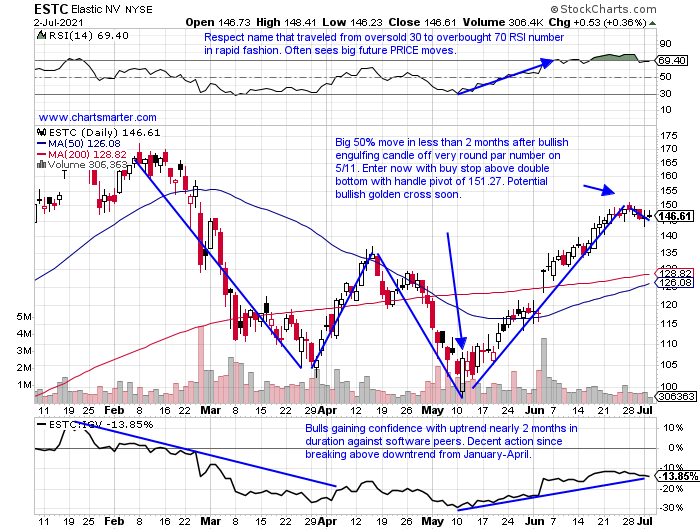

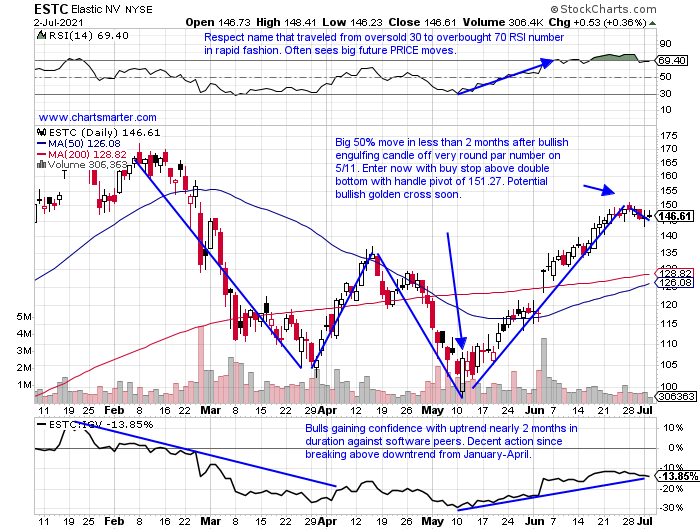

- Dutch software leader UNCH YTD and higher by 55% over last one year period.

- Name still 17% off most recent 52 week highs, and this week fell fractionally by 1.5% ending a prior 7 week winning streak that traveled from the very round par number to 150.

- Earnings mixed with gains of 10 and 12.6% on 6/3 and 12/3/20, and losses of 16 and 1.6% on 2/25 and 8/27/20.

- Enter with buy stop above double bottom with handle.

- Entry ESTC 151.27. Stop 145.

Good luck.

Entry summaries:

Buy after break above 50 day SMA NCR here. Stop 46.

Buy pullback into double bottom breakout SWIR here. Stop 17.50.

Buy stop above double bottom with handle ESTC 151.27. Stop 145.

This article requires a Chartsmarter membership. Please click here to join.

"Old Tech" Bifurcation:

- Friday witnessed some contrasting action in some of the bigger, mature tech players. Big Blue was feeling blue to end the week falling almost 5% in the second-largest daily volume of 2021, trailing just the negative earnings reaction on 1/22 that slumped 10%. If the name gets close to filling the gap from the 4/19 session consider that a gift. On the other hand, ORCL put up a combined 5% advance the last 2 days this week, and it filled an upside gap from 6/15. It CLOSED above the former bullish ascending triangle pivot of 80, and for me, there are better stocks to play. Below is one of them with the chart of QCOM. It is 15% off most recent 52 week highs, lagging as the SMH is just 1% off its peak. The stock has registered back-to-back 3.5% WEEKLY gains, not long after 3 very taut WEEKLY CLOSES all within just .28 of each other the weeks ending 5/28-6/11. This name could be a big 2nd half winner.

Social Shining:

- Social media plays have been acting well as of late. For all the chatter of lack of names trading below their 50 day SMAs, this space can not be spoken of in that conversation. FB is now about 10% north of its 50 day. It now trades just 1% off all-time highs, after the last 2 weeks produced 3% plus advances, after the prior 4 weeks all CLOSED tight within just 2.93 of each other. SNAP is dealing with the round 70 number and put up a decent showing this past week up more than 1% after the prior week jumped 7.1%. PINS recorded a spinning top at the round 80 number Friday, and it was also halted at the very round 90 number on 2/16. Below is the current chart of TWTR, and link here is how it appeared in our 5/13 Technology Note. If this can push and CLOSE above 70 next week it is likely to trade above a double bottom pivot of 73.32 on its way back to all-time highs at 80. We can then reassess there.

Recent Examples:

- Size matters. We frequently mention that in regards to the stock market and there is no bigger player than AAPL. It is the largest component in both the S&P 500 and the Nasdaq, so its direction can sway not only the benchmarks but the underlying stocks within. Below is the chart of Apple, and how it appeared in our 6/30 Technology Note. The stock rose every day this past week and each session CLOSED at the top of the daily range. It is now on a 5-week winning streak, and Friday CLOSED right below the round 140 number. In fact, this week recorded its strongest WEEKLY CLOSE ever. The stock now trades 4% off most recent all-time highs and a move above 145.19 could really get this uptrend in motion. Remember this one was until recently a laggard and if it joins the party in a firm way technology will make a run up the major S&P sector leaderboard. Energy is too far ahead to catch, but the XLK could be a force to contend with in the second half.

Special Situations:

- "Old tech" software play up 27% YTD and 117% over last one-year period.

- Now 5% off most recent 52 week highs, and up just 3 of the last 6 weeks. Most likely digesting prior 9 week winning streak weeks ending between 3/26-5/21 which rose by a combined 47.4%.

- Earnings mixed, up 8.7 and 13.9% on 4/28 and 7/29/20, and losses of 6.8 and 10.7% on 2/10 and 10/28/20.

- Enter after break above rising 50 day SMA.

- Entry NCR here. Stop 46.

- Telecommunications equipment play up 29% YTD and 114% over last one-year period.

- Still 15% off most recent 52 week highs, but has risen 6 of the last 8 weeks. This week slipped 4.4%, which can be forgiven as prior week jumped by 23.6%.

- Three straight positive earnings reactions up 9.8, 6.9, and 4.6% on 5/14, 2/24, and 11/13/20 (fell 5% on 8/6/20).

- Enter on pullback into double bottom breakout.

- Entry SWIR here. Stop 17.50.

- Dutch software leader UNCH YTD and higher by 55% over last one year period.

- Name still 17% off most recent 52 week highs, and this week fell fractionally by 1.5% ending a prior 7 week winning streak that traveled from the very round par number to 150.

- Earnings mixed with gains of 10 and 12.6% on 6/3 and 12/3/20, and losses of 16 and 1.6% on 2/25 and 8/27/20.

- Enter with buy stop above double bottom with handle.

- Entry ESTC 151.27. Stop 145.

Good luck.

Entry summaries:

Buy after break above 50 day SMA NCR here. Stop 46.

Buy pullback into double bottom breakout SWIR here. Stop 17.50.

Buy stop above double bottom with handle ESTC 151.27. Stop 145.