Relative Performance:

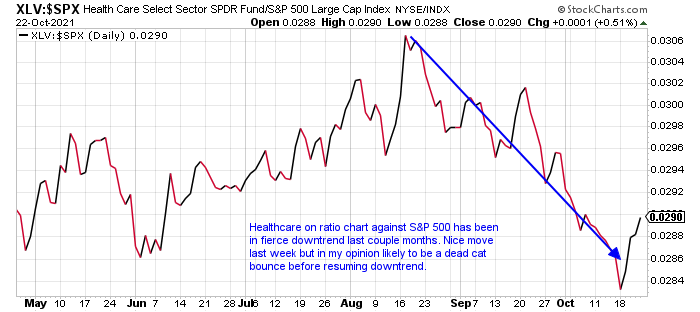

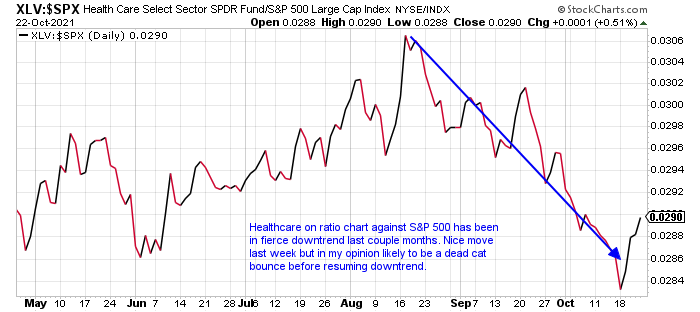

- Ratio chart below compared to S&P 500 makes it look like healthcare is having a tough year. Just the opposite with XLV higher by more than 17%, but that makes it just the ninth-best major S&P sector actor of 11. Not helping is that the XLV is just the 10th best of 11 on a one and three-month lookback period, basically UNCH during the time frame.

Safety Measures:

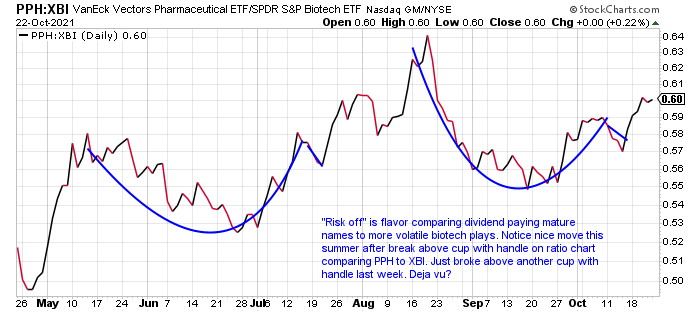

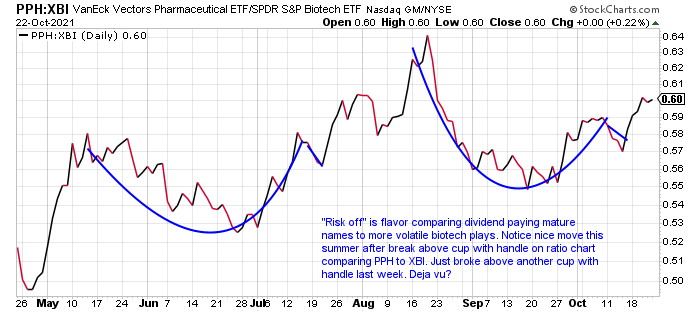

- Investors continue to clamor for more "defensive" pharma names compared to biotech as seen on ratio chart below comparing the PPH to the XBI. On a YTD basis, the returns tell the picture with the PPH up 12% while the XBI is lower by 11%. Names like BHVN and vaccine plays have helped the PPH.

Individual Names:

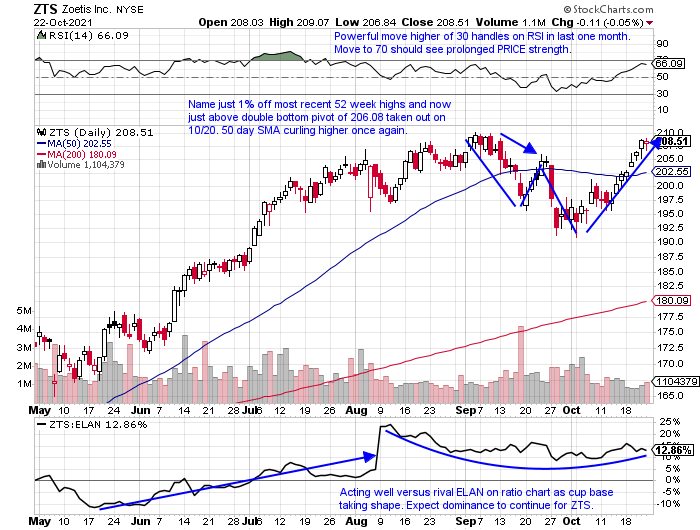

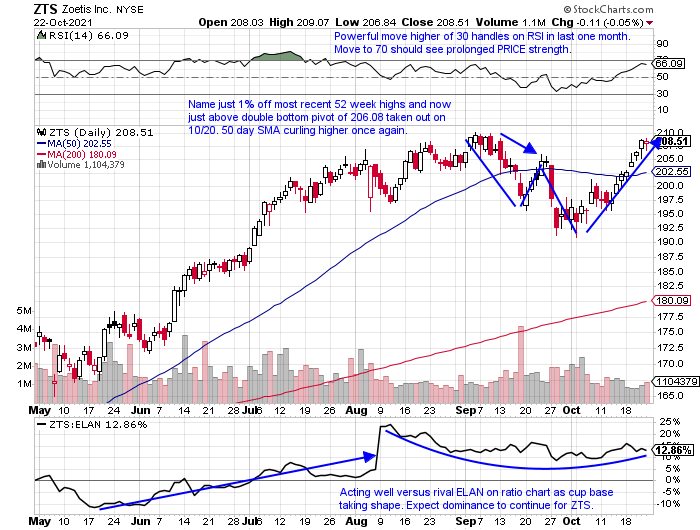

- Animal pharma plays are limited in nature with ZTS being best in breed. One can see that with the name just 1% off most recent all-time highs, while peer ELAN is 10% of its annual peak. Other names like WOOF have come to the picture and this one is 24% off recent highs. Admire how ZTS trades in a very taut manner too, a hallmark bullish trait, unlike ELAN.

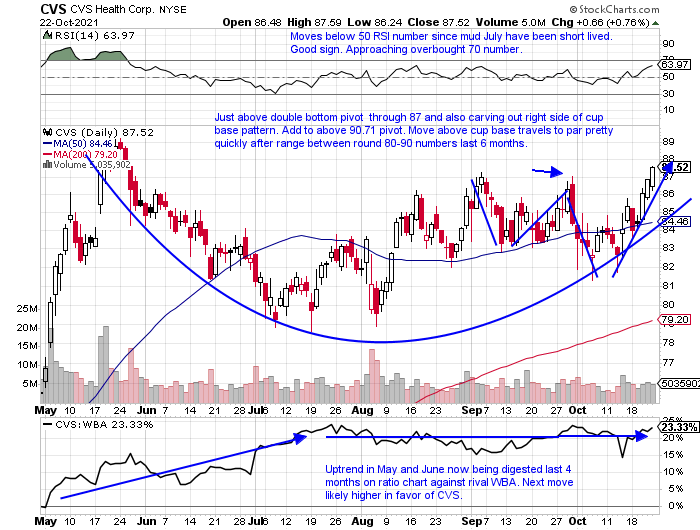

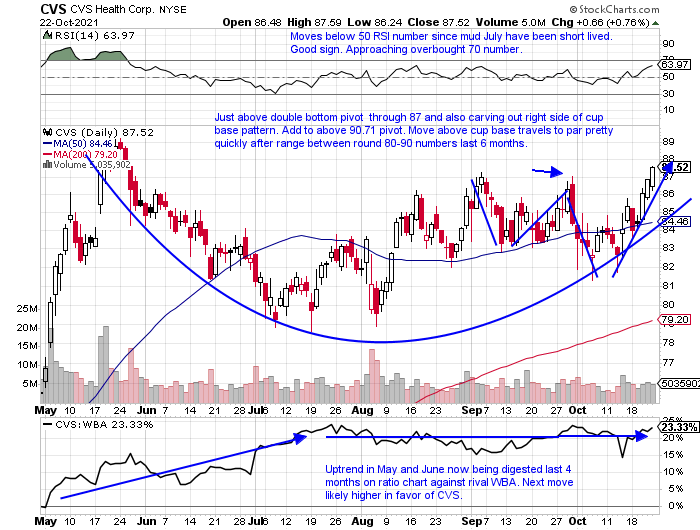

- No question this name is best in breed just 3% off highs and sniffing out longer cup base pivot here. The stock is just 3% off most recent 52 week highs, while peers WBA and RAD are 14 and 56% off their respective annual peaks. Still with quality as this name looks ready to break above 6-month range and make a big move into year-end.

Alternatives:

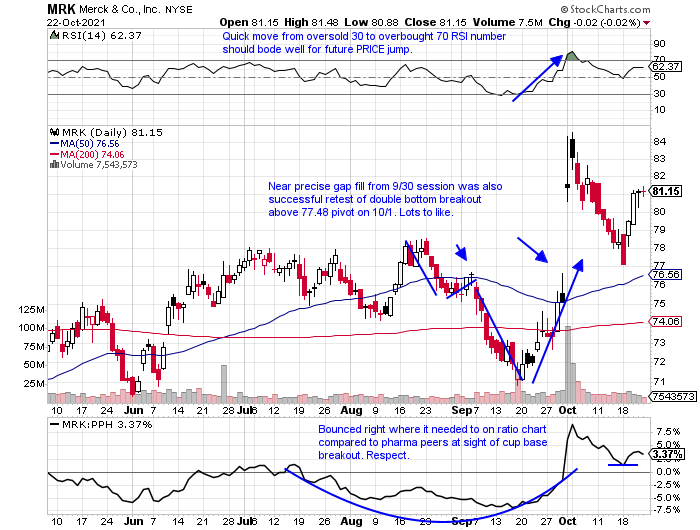

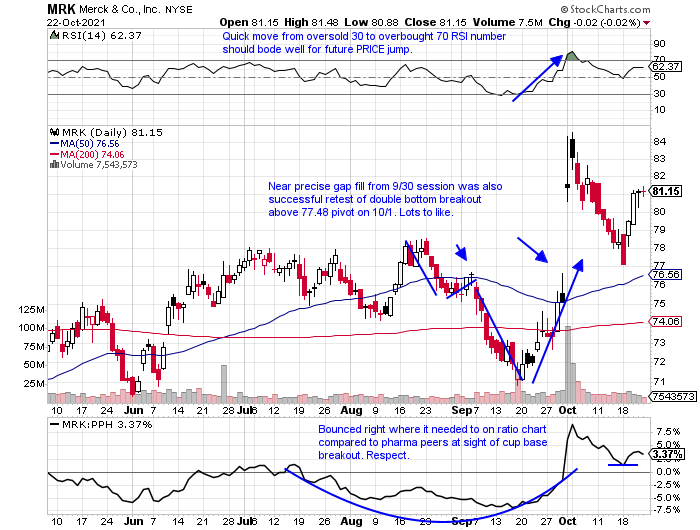

- Big pharma names have been of interest in 2021. The action in many of the recognizable ones have been volatile. In a what have you done for me lately market MRK looks the most technically attractive. It is just 4% off most recent 52 week highs, while LLY, BMY and PFE are 12, 17 and 17% off theirs. And MRK pays a dividend yield of 3.1% (PFE 3.6%).

This article requires a Chartsmarter membership. Please click here to join.

Relative Performance:

- Ratio chart below compared to S&P 500 makes it look like healthcare is having a tough year. Just the opposite with XLV higher by more than 17%, but that makes it just the ninth-best major S&P sector actor of 11. Not helping is that the XLV is just the 10th best of 11 on a one and three-month lookback period, basically UNCH during the time frame.

Safety Measures:

- Investors continue to clamor for more "defensive" pharma names compared to biotech as seen on ratio chart below comparing the PPH to the XBI. On a YTD basis, the returns tell the picture with the PPH up 12% while the XBI is lower by 11%. Names like BHVN and vaccine plays have helped the PPH.

Individual Names:

- Animal pharma plays are limited in nature with ZTS being best in breed. One can see that with the name just 1% off most recent all-time highs, while peer ELAN is 10% of its annual peak. Other names like WOOF have come to the picture and this one is 24% off recent highs. Admire how ZTS trades in a very taut manner too, a hallmark bullish trait, unlike ELAN.

- No question this name is best in breed just 3% off highs and sniffing out longer cup base pivot here. The stock is just 3% off most recent 52 week highs, while peers WBA and RAD are 14 and 56% off their respective annual peaks. Still with quality as this name looks ready to break above 6-month range and make a big move into year-end.

Alternatives:

- Big pharma names have been of interest in 2021. The action in many of the recognizable ones have been volatile. In a what have you done for me lately market MRK looks the most technically attractive. It is just 4% off most recent 52 week highs, while LLY, BMY and PFE are 12, 17 and 17% off theirs. And MRK pays a dividend yield of 3.1% (PFE 3.6%).