Relative Performance:

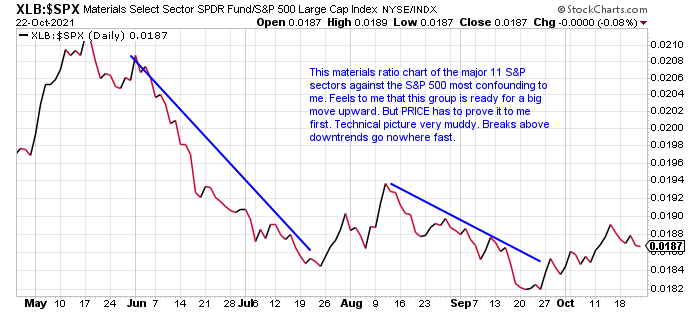

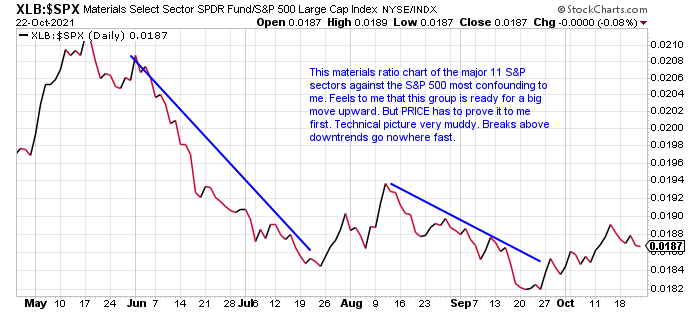

- Group has seen some real bifurcating action this year. Of course, gold and gold miners have been a big weight on the overall materials space as the only 2 subsectors within negative on the year. On the other hand, aluminum and steel, and chemicals have been a tailwind for the group. On ratio chart below one can see the failed rally attempts last 6 months.

Is Bitcoin The New "Gold":

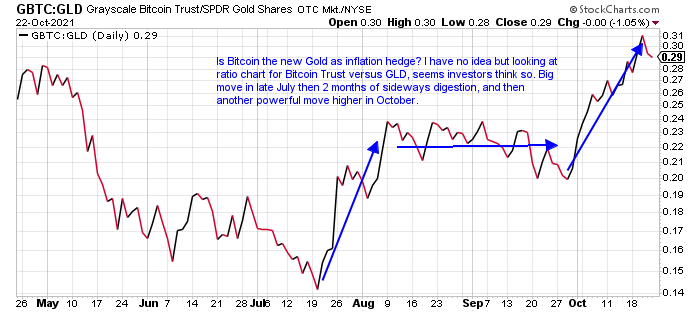

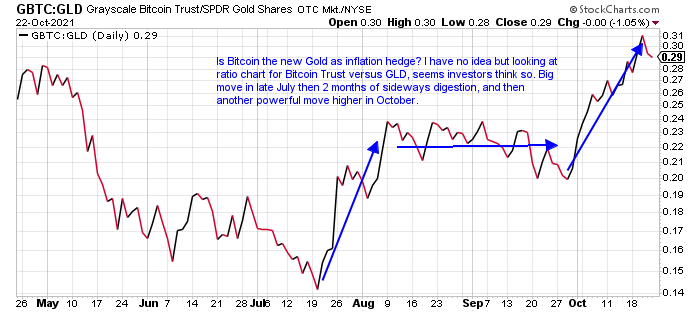

- This has been the subject of much discussion and it could be possible as the GLD has been weak since last September and Bitcoin via the GBTC rallied powerfully off the very round 10 number. GLD just 9% off most recent 52 week highs but has now been making lower highs for last 15 months.

Suggestions:

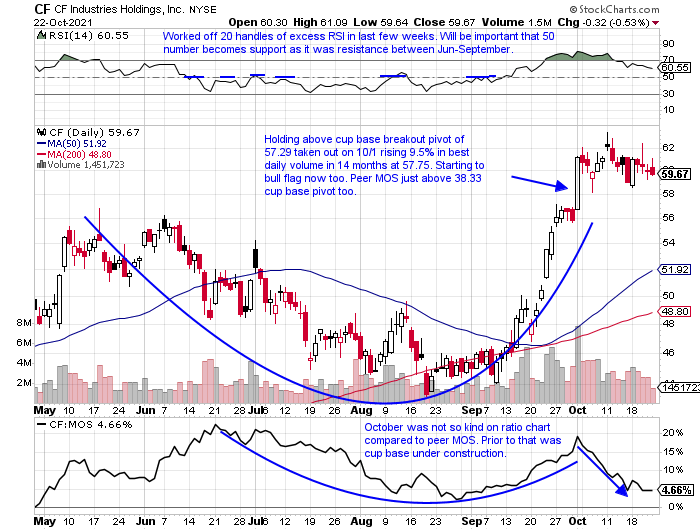

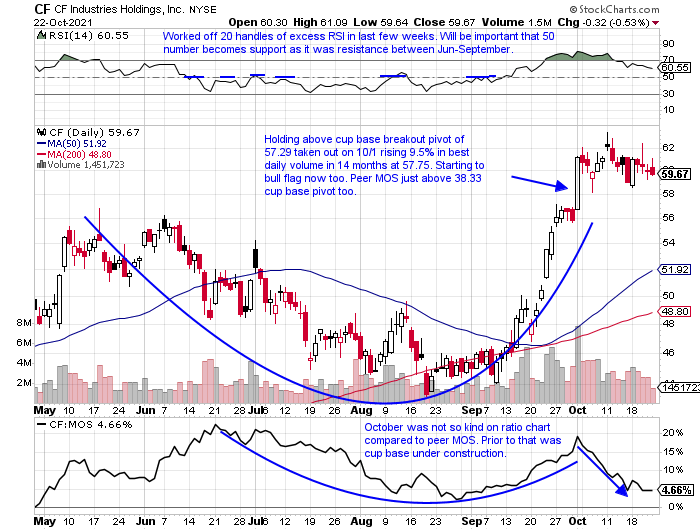

- The agriculture names have been acting well with their chemical exposure. CF sports a dividend yield of 2% and is up a respectable 57% YTD (lagging peer MOS which has advanced 83% in 2021 but sports a smaller dividend yield of .6%). CF has been smartly digesting big 3-week winning streak that rose a combined 31% weeks ending between 9/17-10/1 and looks ready for next leg higher.

Alternates:

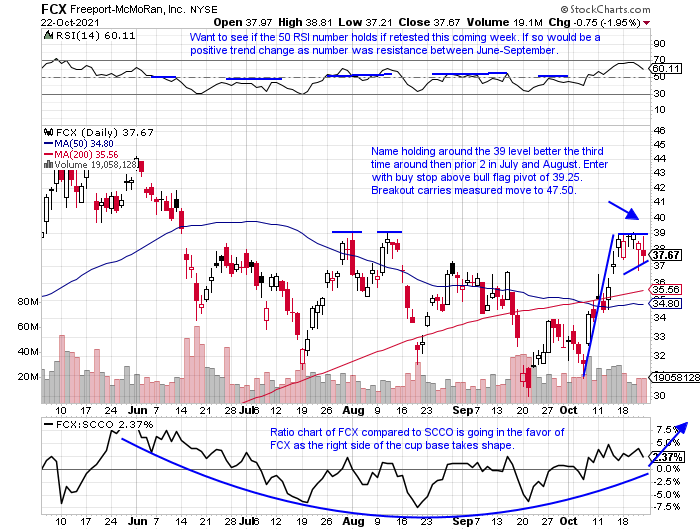

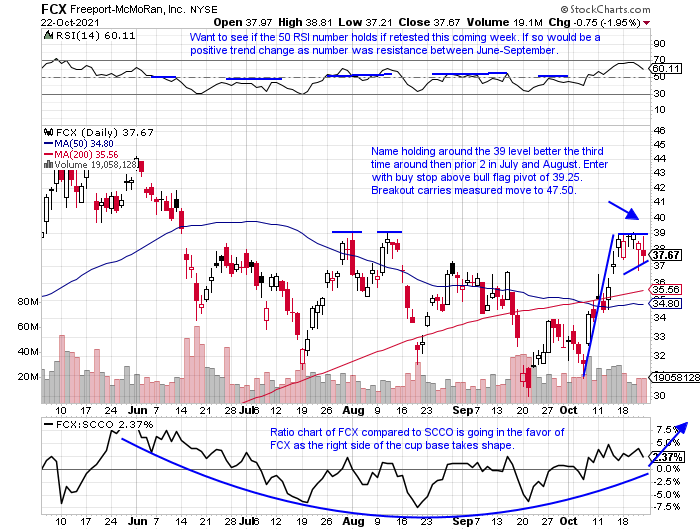

- Has performed well in 2021 even with its gold exposure. Up 45% in 2021 and has been knocking on familiar resistance now for the third time in as many months. It is also filling in an upside gap from mid-June there too near 39 level. That same area on WEEKLY chart is also a double bottom pattern so a move through this area can be explosive.

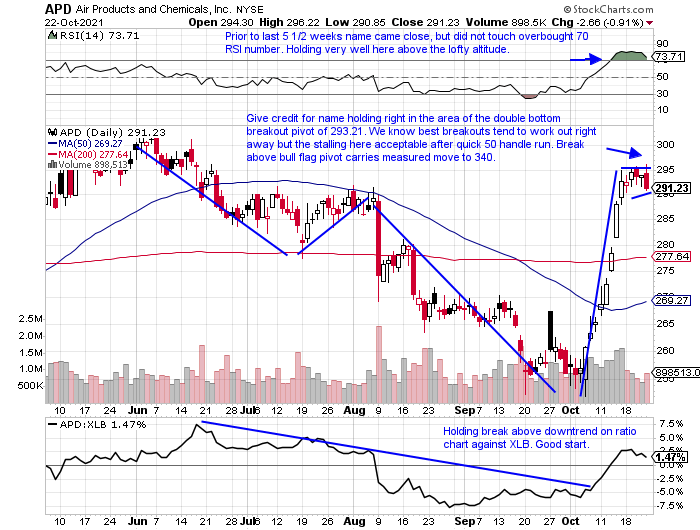

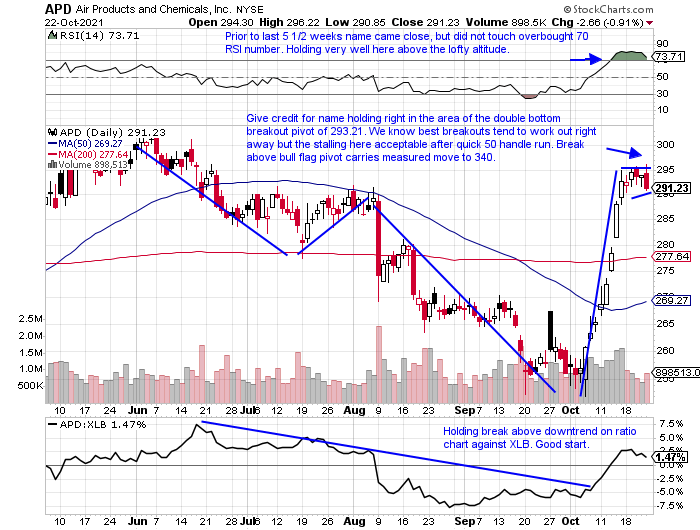

- The name has exposure to chemical names which have seen very powerful moves in HUN and OLN to name a couple (each sport nice technical action and dividend yields of 2.1 and 1.4% respectively). Also helping APD could be its exposure to natural gas. Admire how last week gave back very little of big move higher in early October.

This article requires a Chartsmarter membership. Please click here to join.

Relative Performance:

- Group has seen some real bifurcating action this year. Of course, gold and gold miners have been a big weight on the overall materials space as the only 2 subsectors within negative on the year. On the other hand, aluminum and steel, and chemicals have been a tailwind for the group. On ratio chart below one can see the failed rally attempts last 6 months.

Is Bitcoin The New "Gold":

- This has been the subject of much discussion and it could be possible as the GLD has been weak since last September and Bitcoin via the GBTC rallied powerfully off the very round 10 number. GLD just 9% off most recent 52 week highs but has now been making lower highs for last 15 months.

Suggestions:

- The agriculture names have been acting well with their chemical exposure. CF sports a dividend yield of 2% and is up a respectable 57% YTD (lagging peer MOS which has advanced 83% in 2021 but sports a smaller dividend yield of .6%). CF has been smartly digesting big 3-week winning streak that rose a combined 31% weeks ending between 9/17-10/1 and looks ready for next leg higher.

Alternates:

- Has performed well in 2021 even with its gold exposure. Up 45% in 2021 and has been knocking on familiar resistance now for the third time in as many months. It is also filling in an upside gap from mid-June there too near 39 level. That same area on WEEKLY chart is also a double bottom pattern so a move through this area can be explosive.

- The name has exposure to chemical names which have seen very powerful moves in HUN and OLN to name a couple (each sport nice technical action and dividend yields of 2.1 and 1.4% respectively). Also helping APD could be its exposure to natural gas. Admire how last week gave back very little of big move higher in early October.