Biotech Lag:

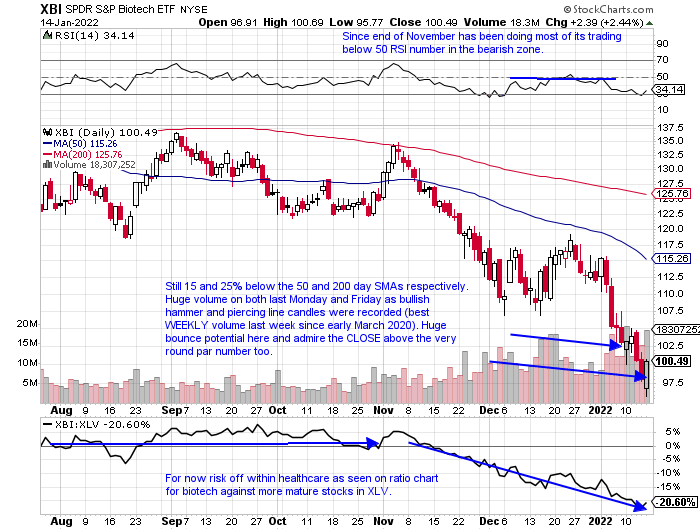

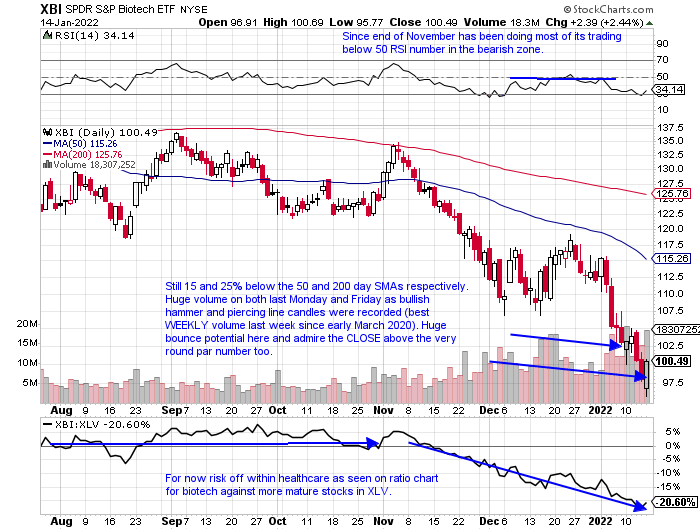

- The XBI which many think of the "equal weight" biotech ETF as its top holding is less than 2% of the fund (by contrast the IBB's top 5 holdings account for nearly 30%). On a one-year lookback time frame, the XBI is lower by 33%, while the IBB which is comprised of the larger, more recognizable names is down just 14%. But on the chart below these higher beta plays in the XBI could be due for a bounce. A good risk/reward situation is setting up here with round number theory coming into play with a nice CLOSE Friday above par (use a CLOSING stop of 95 on the XBI). The bulls, not many left, should be encouraged by not only the bullish candlesticks last Monday and Friday, but the volume that backed it up. One could say it felt like capitulation as WEEKLY volume last week was the heaviest since the big overall markets lows in early 2020. Am I saying this ETF can rise to highs near 175 (which it did in February 2021), following that dramatic bottom made in March 2020? Of course, we will only know in retrospect, but the group is likely to catch some bids here, and let us look at some names that can benefit.

Special Situations:

- Look for names that have already been showing relative strength, and BMRN is a good example higher by 7 and 19% over the last one and three-month time frames. Compare that to the XBI which is down 11 and 20% during the same period.

- Name is now just 2% off most recent 52 week highs and has been unable to produce consecutive WEEKLY CLOSES above very round 90 number since August 2020. A CLOSE above 90 this coming week could be very powerful.

- Bullish outside week and excellent accumulation recently including weeks ending 10/29 and 11/19.

- Enter with buy stop above cup base.

- Entry BMRN 92. Stop 84.

- Again let us look for stocks that have already been acting well against their peers and INCY is doing just that up 4 and 14 over the last one and 3 months, while the XBI is again negative on both of those time frames.

- Name now 26% off most recent 52-week highs. Good relative strength last week up 2.3% after prior 4 weeks all CLOSED very taut within just .58 of each other starting with week ending 12/17 that rose more than 11% on gigantic volume.

- Enter with buy stop above 200 day SMA (bullish change in chart complexion).

- Entry INCY 76. Stop 70.

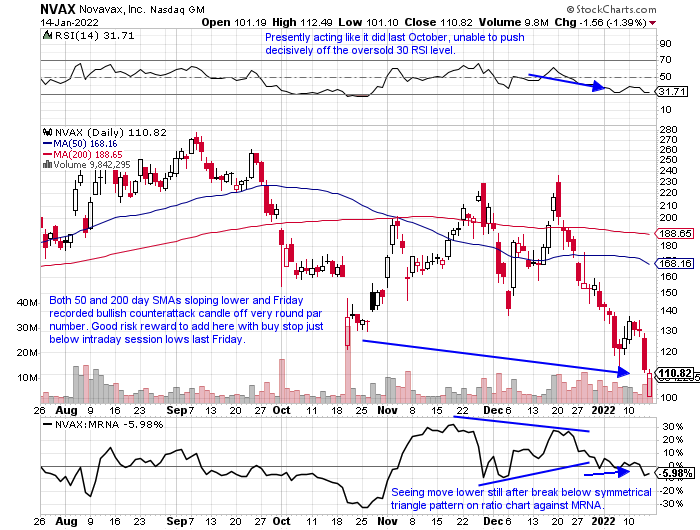

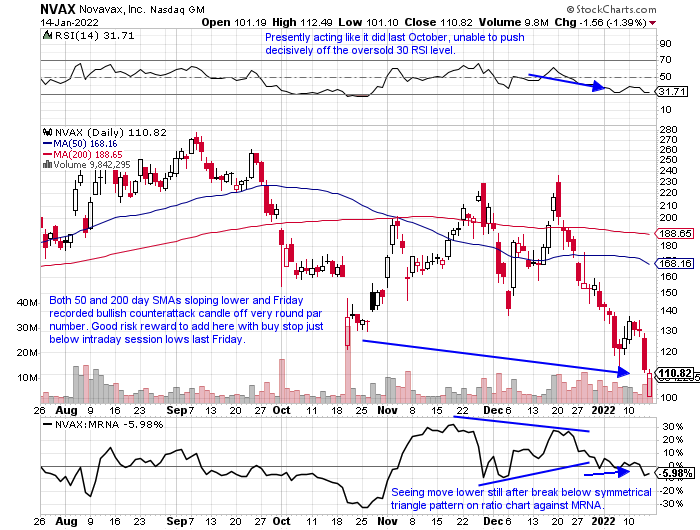

- Vaccine makers have been under pressure recently with NVAX lower by 66% from its most recent 52-week highs, and MRNA and BNTX are each off their own annual peaks by 59 and 58% respectively.

- Name has only recorded two 4 week losing streaks in the last 12 months (before last week). The weeks ending 2/12-3/5 which then went on to gain 28% the 2 weeks ending between 3/12-19/21. And after the 10/1-22 four-week losing streak it was followed by a 5-week winning streak the weeks ending between 10/29-11/26 gaining more than 50%. Deja vu?

- Enter after Friday's bullish counterattack candle.

- Entry NVAX 105. Stop 97.

The author has no positions in stocks mentioned in this article.

This article requires a Chartsmarter membership. Please click here to join.

Biotech Lag:

- The XBI which many think of the "equal weight" biotech ETF as its top holding is less than 2% of the fund (by contrast the IBB's top 5 holdings account for nearly 30%). On a one-year lookback time frame, the XBI is lower by 33%, while the IBB which is comprised of the larger, more recognizable names is down just 14%. But on the chart below these higher beta plays in the XBI could be due for a bounce. A good risk/reward situation is setting up here with round number theory coming into play with a nice CLOSE Friday above par (use a CLOSING stop of 95 on the XBI). The bulls, not many left, should be encouraged by not only the bullish candlesticks last Monday and Friday, but the volume that backed it up. One could say it felt like capitulation as WEEKLY volume last week was the heaviest since the big overall markets lows in early 2020. Am I saying this ETF can rise to highs near 175 (which it did in February 2021), following that dramatic bottom made in March 2020? Of course, we will only know in retrospect, but the group is likely to catch some bids here, and let us look at some names that can benefit.

Special Situations:

- Look for names that have already been showing relative strength, and BMRN is a good example higher by 7 and 19% over the last one and three-month time frames. Compare that to the XBI which is down 11 and 20% during the same period.

- Name is now just 2% off most recent 52 week highs and has been unable to produce consecutive WEEKLY CLOSES above very round 90 number since August 2020. A CLOSE above 90 this coming week could be very powerful.

- Bullish outside week and excellent accumulation recently including weeks ending 10/29 and 11/19.

- Enter with buy stop above cup base.

- Entry BMRN 92. Stop 84.

- Again let us look for stocks that have already been acting well against their peers and INCY is doing just that up 4 and 14 over the last one and 3 months, while the XBI is again negative on both of those time frames.

- Name now 26% off most recent 52-week highs. Good relative strength last week up 2.3% after prior 4 weeks all CLOSED very taut within just .58 of each other starting with week ending 12/17 that rose more than 11% on gigantic volume.

- Enter with buy stop above 200 day SMA (bullish change in chart complexion).

- Entry INCY 76. Stop 70.

- Vaccine makers have been under pressure recently with NVAX lower by 66% from its most recent 52-week highs, and MRNA and BNTX are each off their own annual peaks by 59 and 58% respectively.

- Name has only recorded two 4 week losing streaks in the last 12 months (before last week). The weeks ending 2/12-3/5 which then went on to gain 28% the 2 weeks ending between 3/12-19/21. And after the 10/1-22 four-week losing streak it was followed by a 5-week winning streak the weeks ending between 10/29-11/26 gaining more than 50%. Deja vu?

- Enter after Friday's bullish counterattack candle.

- Entry NVAX 105. Stop 97.

The author has no positions in stocks mentioned in this article.