Tech Getting Back Its Long Overdue Mojo?

- As we head into the summer doldrums is technology trying to come alive? It was a solid week for those looking to determine if "risk-on" may be back in play. Peering at the major S&P sectors this week the top 3 were just what bulls want to see. Discretionary, technology and communication services led the way. Now looking at the Nasdaq it rose 4.5% this week, a firm showing. But bears will point out that it has gained ground in just 3 weeks of the last 14. And those came on very light volume, and the other two weeks rose forcibly too by 6.8 and 7.5%, the weeks ending 5/27 and 6/24. No follow-through came. Will the bears come out again next week? We shall see but bulls are still nowhere to be found as measured in AAII sentiment data, the figure came in below 20% this week. Let's remember that the only thing that pays is PRICE, and this week rose every day, but the Nasdaq and QQQs are running right into resistance at their familiar 50-day SMAs. Are too many expecting another failure there?

Small-Cap Looker:

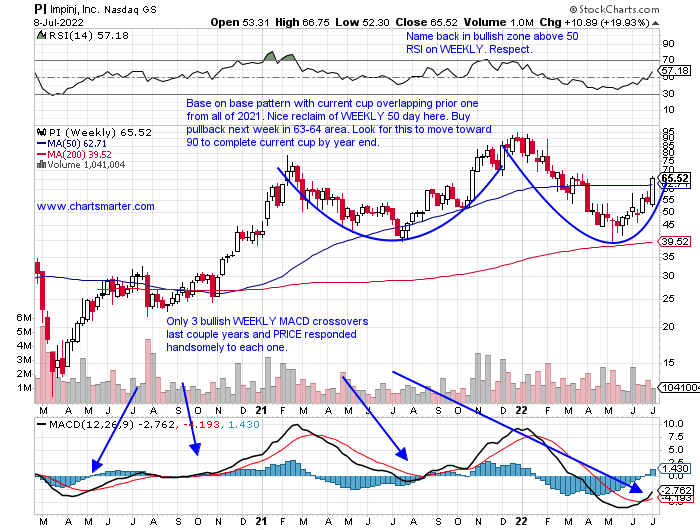

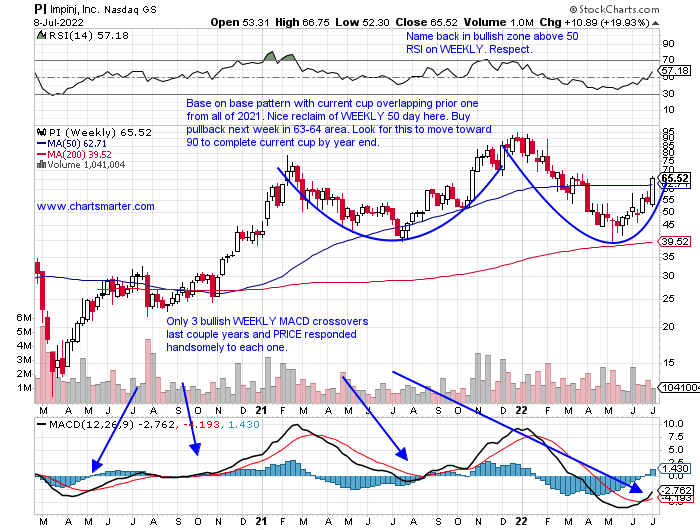

- The belief is that small-cap stocks tend to lead, so it is best to keep an eye on names that are starting to act well as we potentially emerge from this recent swift drawdown. Below is the chart of PI hailing from the telecommunication equipment space and its WEEKLY chart is a strong one. It is still 31% from the most recent 52-week highs, but has advanced 5 of the last 7 weeks with this week's exclamation point powerful rising more than 20%. Since bouncing off support at the round 40 number for the third time since December 2020 it is now constructing the right side of a potential cup base. Another one in the group to keep an eye on is CFLD, which popped 15% last week breaking above a symmetrical triangle pattern. Look for this one to gravitate toward the upper 80s in the near term, where it recorded a bearish WEEKLY engulfing candle the week ending 1/27 that slumped 15% and witnessed robust follow through to the downside the next 2 weeks too by a combined 36%.

Recent Examples:

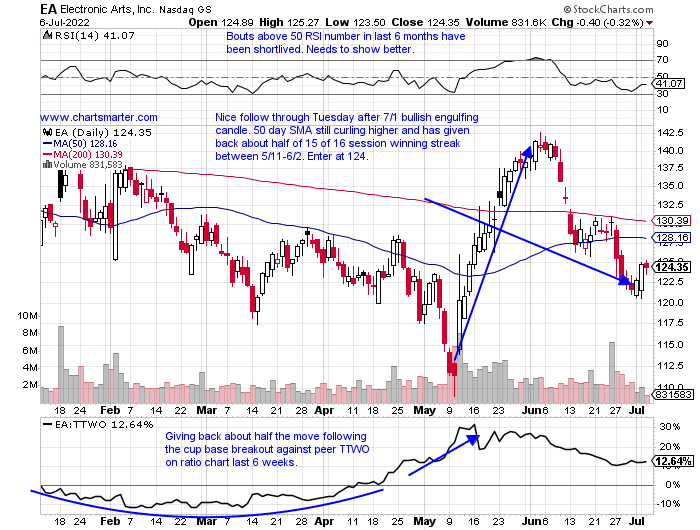

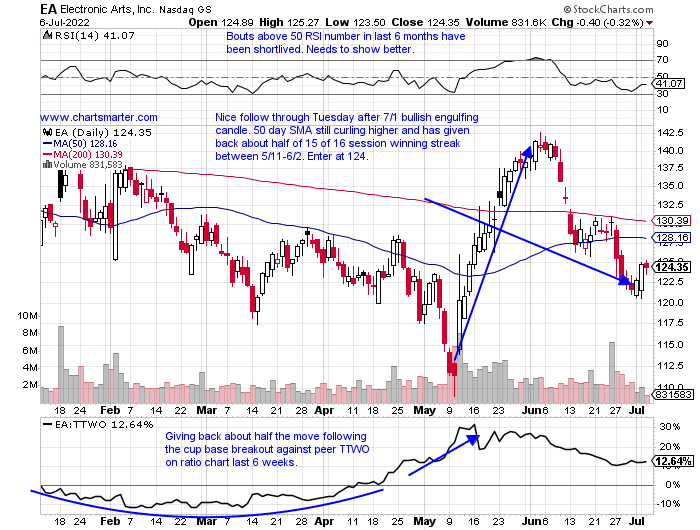

- The gaming software names have had their share of excitement with the blockbuster takeover of ATVI by MSFT earlier this year. TTWO is now 37% off most recent 52-week highs and narrowly avioded back-to-back WEEKLY losses this week UNCH, after dropping nearly 7% the week before. We do not want to sound too bearish, since the stock rose 5 of 6 weeks between weeks ending 5/20-6/24 registering a double bottom not far from the very round par number with the March 2020 bottom. Below is the chart of another play in EA and how it appeared in our 7/7 Technology Note. This name is acting better than TTWO, now 15% off its annual peak and trying to make a stand at the round 120 figure. It still trades below both its 50 and 200-day SMAs, but one could argue this has a path toward the 140 area where it touched this January and June.

Special Situations:

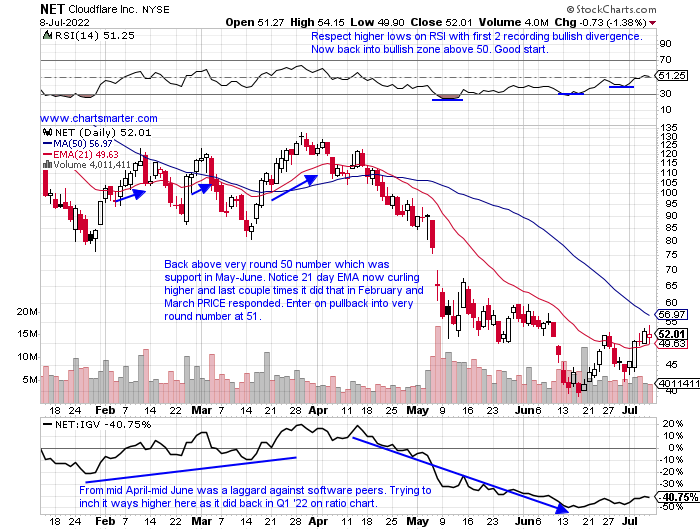

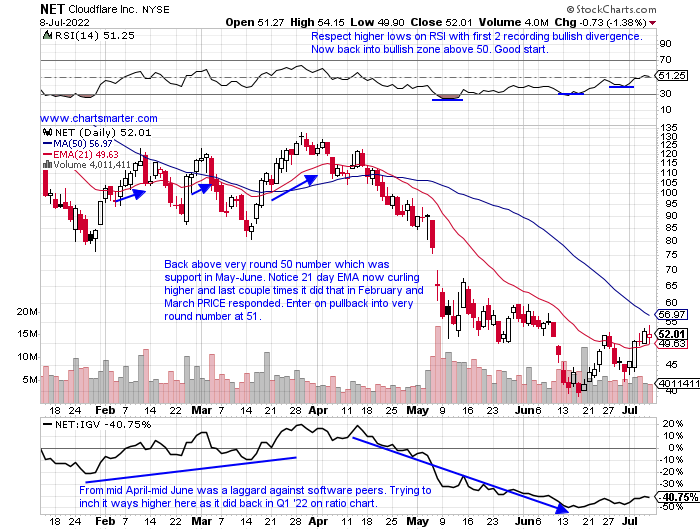

- Software play down 60% YTD and 52% over last one year period.

- Name 77% off most recent 52-week highs after touching a high above 220 last November. Trying to make amends with powerful gains 2 of the last 3 weeks up 25.8 and 13.3% the week ending 6/24 and 7/8.

- FOUR straight negative earnings reactions off 15.7, 9.5, 1.9, and 2.2% on 5/6, 2/11, 11/5 and, 8/6/21.

- Enter on pullback into very round number.

- Entry NET 51. Stop 48.

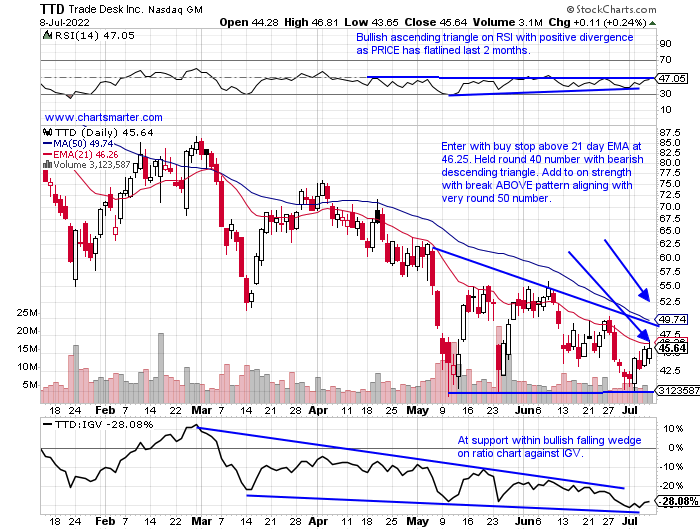

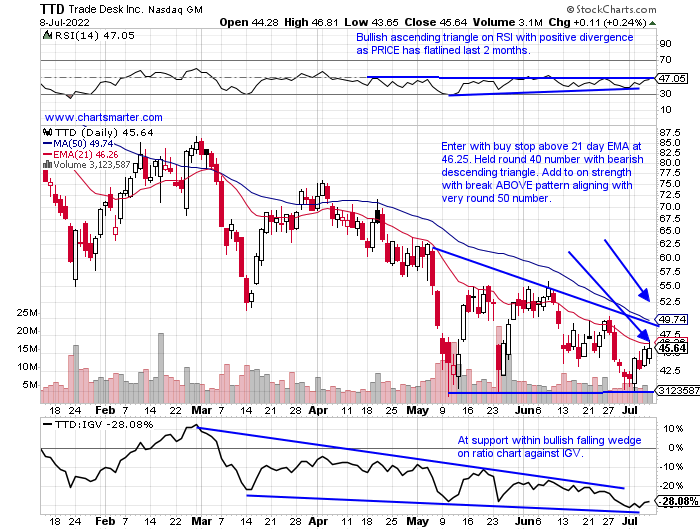

- Software play down 50% YTD and 40% over last one year period.

- Name 60% off most recent 52-week highs and after doubling between May-November '21. Higher just 13 weeks since that top but defending round 40 figure well.

- Earnings mixed with gains of .5 and 29.5% on 2/16 and 11/8/21 and losses of .9 and 3.2% on 5/11 and 8/9/21.

- Enter with buy stop above 21-day EMA.

- Entry TTD 46.25. Stop 43.

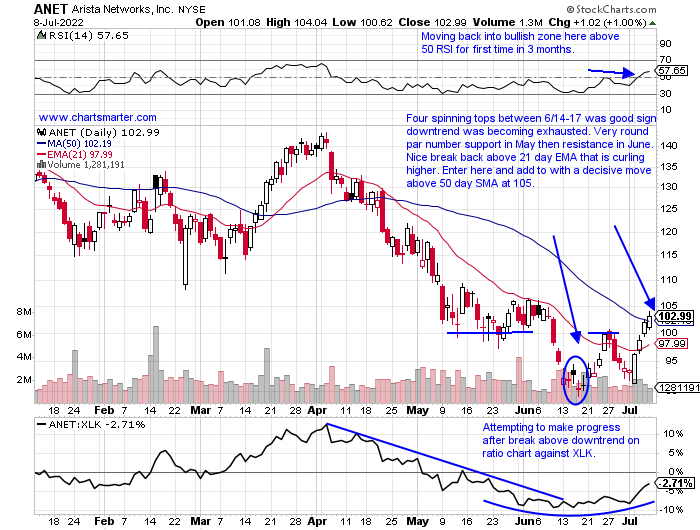

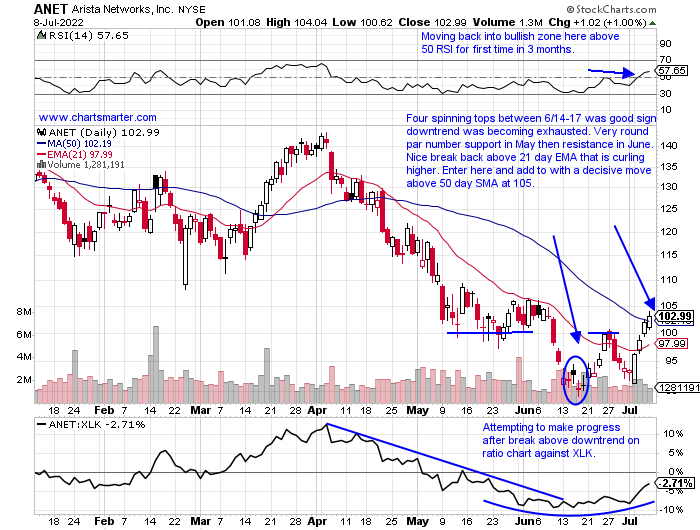

- Telecommunications equipment play down 28% YTD and up 11% over last one year period.

- Name 31% off most recent 52-week highs and lower 10 of 11 weeks ending between 4/8-6/17 but 2 of the last 3 has risen powerfully by 9.8 and 10.3% weeks ending 6/24 and 7/8.

- FOUR straight positive earnings reactions up 5.8, 20.4, .5, and 3.7% on 2/15, 11/2, 8/3, and 5/5/21 before recent loss of 3.6% on 5/3, before recent loss of 3.6% on 5/3.

- Enter after break above very round number.

- Entry ANET here. Stop 98.

Good luck.

Entry summaries:

Buy pullback into very round number NET 51. Stop 48.

Buy stop above 21-day EMA TTD 46.25. Stop 43.

Buy after break above very round number ANET here. Stop 98.

This article requires a Chartsmarter membership. Please click here to join.

Tech Getting Back Its Long Overdue Mojo?

- As we head into the summer doldrums is technology trying to come alive? It was a solid week for those looking to determine if "risk-on" may be back in play. Peering at the major S&P sectors this week the top 3 were just what bulls want to see. Discretionary, technology and communication services led the way. Now looking at the Nasdaq it rose 4.5% this week, a firm showing. But bears will point out that it has gained ground in just 3 weeks of the last 14. And those came on very light volume, and the other two weeks rose forcibly too by 6.8 and 7.5%, the weeks ending 5/27 and 6/24. No follow-through came. Will the bears come out again next week? We shall see but bulls are still nowhere to be found as measured in AAII sentiment data, the figure came in below 20% this week. Let's remember that the only thing that pays is PRICE, and this week rose every day, but the Nasdaq and QQQs are running right into resistance at their familiar 50-day SMAs. Are too many expecting another failure there?

Small-Cap Looker:

- The belief is that small-cap stocks tend to lead, so it is best to keep an eye on names that are starting to act well as we potentially emerge from this recent swift drawdown. Below is the chart of PI hailing from the telecommunication equipment space and its WEEKLY chart is a strong one. It is still 31% from the most recent 52-week highs, but has advanced 5 of the last 7 weeks with this week's exclamation point powerful rising more than 20%. Since bouncing off support at the round 40 number for the third time since December 2020 it is now constructing the right side of a potential cup base. Another one in the group to keep an eye on is CFLD, which popped 15% last week breaking above a symmetrical triangle pattern. Look for this one to gravitate toward the upper 80s in the near term, where it recorded a bearish WEEKLY engulfing candle the week ending 1/27 that slumped 15% and witnessed robust follow through to the downside the next 2 weeks too by a combined 36%.

Recent Examples:

- The gaming software names have had their share of excitement with the blockbuster takeover of ATVI by MSFT earlier this year. TTWO is now 37% off most recent 52-week highs and narrowly avioded back-to-back WEEKLY losses this week UNCH, after dropping nearly 7% the week before. We do not want to sound too bearish, since the stock rose 5 of 6 weeks between weeks ending 5/20-6/24 registering a double bottom not far from the very round par number with the March 2020 bottom. Below is the chart of another play in EA and how it appeared in our 7/7 Technology Note. This name is acting better than TTWO, now 15% off its annual peak and trying to make a stand at the round 120 figure. It still trades below both its 50 and 200-day SMAs, but one could argue this has a path toward the 140 area where it touched this January and June.

Special Situations:

- Software play down 60% YTD and 52% over last one year period.

- Name 77% off most recent 52-week highs after touching a high above 220 last November. Trying to make amends with powerful gains 2 of the last 3 weeks up 25.8 and 13.3% the week ending 6/24 and 7/8.

- FOUR straight negative earnings reactions off 15.7, 9.5, 1.9, and 2.2% on 5/6, 2/11, 11/5 and, 8/6/21.

- Enter on pullback into very round number.

- Entry NET 51. Stop 48.

- Software play down 50% YTD and 40% over last one year period.

- Name 60% off most recent 52-week highs and after doubling between May-November '21. Higher just 13 weeks since that top but defending round 40 figure well.

- Earnings mixed with gains of .5 and 29.5% on 2/16 and 11/8/21 and losses of .9 and 3.2% on 5/11 and 8/9/21.

- Enter with buy stop above 21-day EMA.

- Entry TTD 46.25. Stop 43.

- Telecommunications equipment play down 28% YTD and up 11% over last one year period.

- Name 31% off most recent 52-week highs and lower 10 of 11 weeks ending between 4/8-6/17 but 2 of the last 3 has risen powerfully by 9.8 and 10.3% weeks ending 6/24 and 7/8.

- FOUR straight positive earnings reactions up 5.8, 20.4, .5, and 3.7% on 2/15, 11/2, 8/3, and 5/5/21 before recent loss of 3.6% on 5/3, before recent loss of 3.6% on 5/3.

- Enter after break above very round number.

- Entry ANET here. Stop 98.

Good luck.

Entry summaries:

Buy pullback into very round number NET 51. Stop 48.

Buy stop above 21-day EMA TTD 46.25. Stop 43.

Buy after break above very round number ANET here. Stop 98.