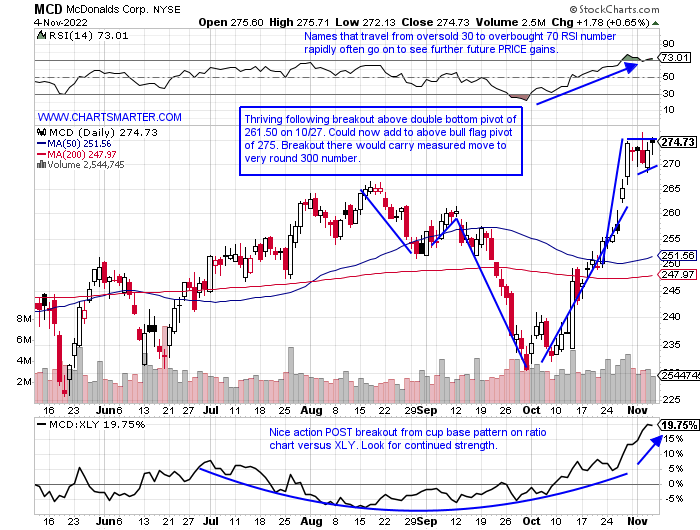

Golden Arches:

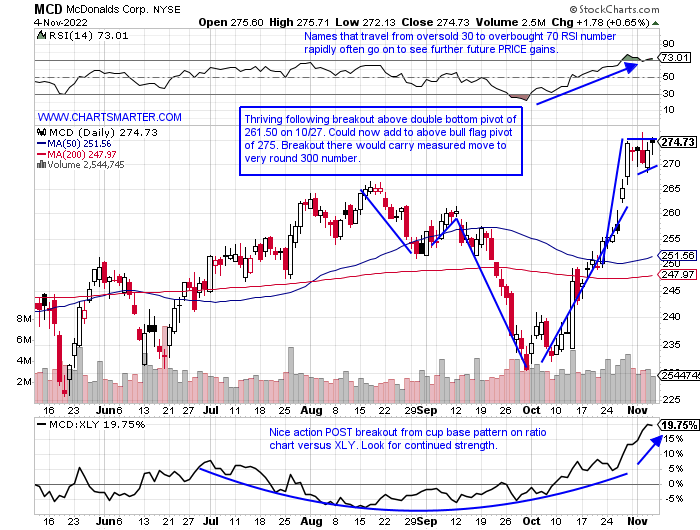

- The consumer discretionary space continues to be a cumbersome one. On a YTD basis, it is now lower by 32% and just the 10th best of the 11 major S&P sectors. And inside the fund's top 10 holdings there are just two names above both their 50 and 200-day SMAs and they happen to be casual diners. SBUX never came close to retesting its May-June lows, a very good sign, and is quietly higher in 14 of the last 20 weeks (4 of the 6 decliners fell less than 2%). Friday it broke above a 90.80 double bottom pivot. Below is the chart of best-in-breed MCD. It is just 1% off most recent all-time highs and this week displayed good relative strength UNCH as the XLY fell more than 5%, and this is after the prior week jumped 7.8%, its best WEEKLY gain since April 2020. It is funny how things tend to come full circle as the name it spun off in CMG in 2006 was the general in the diners and that is now struggling since nearly touching the very round 2000 number in September 2021. Respect the fact that MCD is offering an add-on buy point on the way UP, exactly what leaders do and it is doing so in a weak market climate. "I'm loving it".

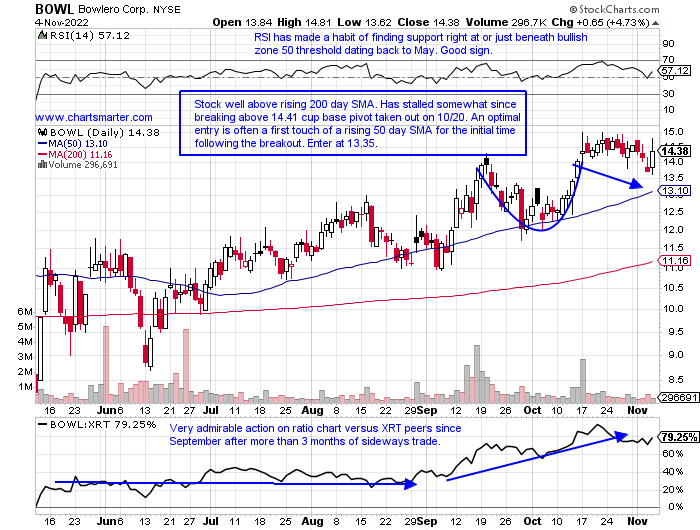

Enjoying Their "Spare" Time:

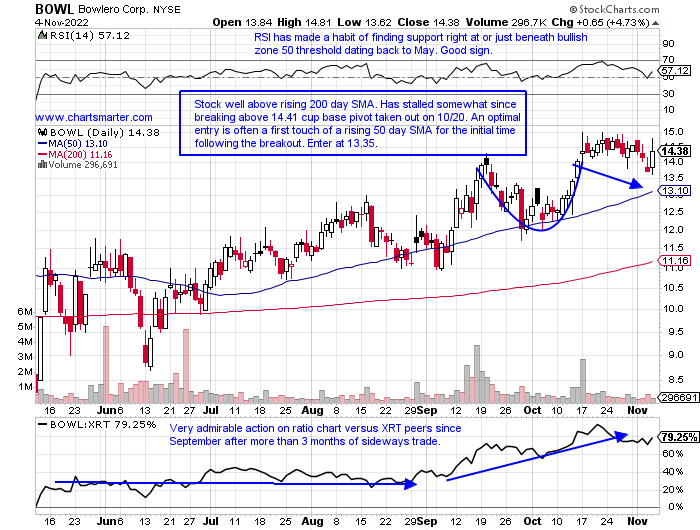

- Consumers are always looking for something to keep them occupied in their spare time. From the look at the chart below of BOWL, a clever ticker symbol, many are taking up bowling. Former best-of-breed recreational name BC which makes bowling balls has fallen on hard times like most discretionary names and has the look of a bearish head and shoulders formation. A break there below 64 carries a measured move to 42. Looking at BOWL one can see the ease with which it has thus far held up during the market meltdown and it must be commended for that. This week was looking like a bull flag until late when that pattern was never taken out, although it did gain firmly Friday. It has recorded just two earnings reactions thus far and both were well received up 7.5 and 18.9% on 9/16 and 5/12 (REPORTS 11/16 after close). Look now for a move into its rising 50-day SMA the first time following the recent cup base breakout.

Recent Examples:

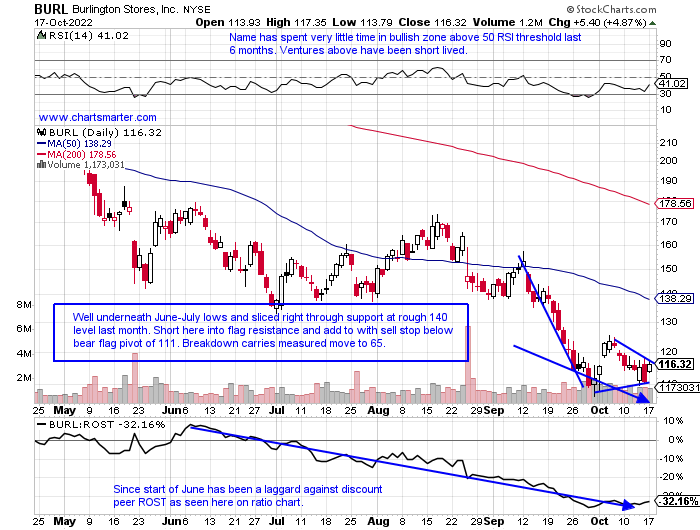

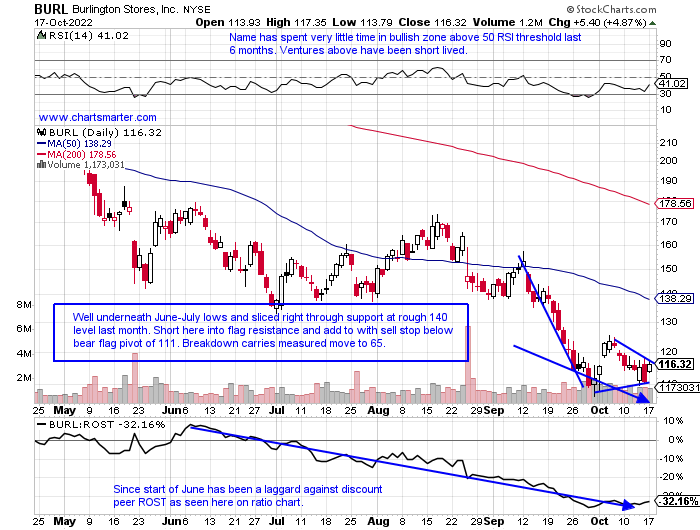

- The discount retail space has been a mixed one. OLLI a former general in the group is 29% from most recent 52-week highs and slumped more than 10% last week. If the stock can remain above the very round 50 number on its WEEKLY chart it would keep its string of higher lows in place dating back to March. DLTR is trading 12% off most recent and has recorded big WEEKLY drawdowns of 20 and 17% the weeks ending 5/20 and 8/26, and it is shaping out a cup with handle base with a break above 160 to most likely fill in the upside gap from the 8/24 session. Below is a name I was WRONG about in BURL and how it appeared in our 10/18 Consumer Note. The 1/22 stop should have one exited on 10/24, and the very next day jumped more than 12% in double the average daily volume. The week ending 10/28 rose almost 17% in the best WEEKLY volume in an up week in years and last week was UNCH. It is still making lower highs dating back to August 2021 when the stock was above 350. In my opinion, there are better fish to fry.

Special Situations:

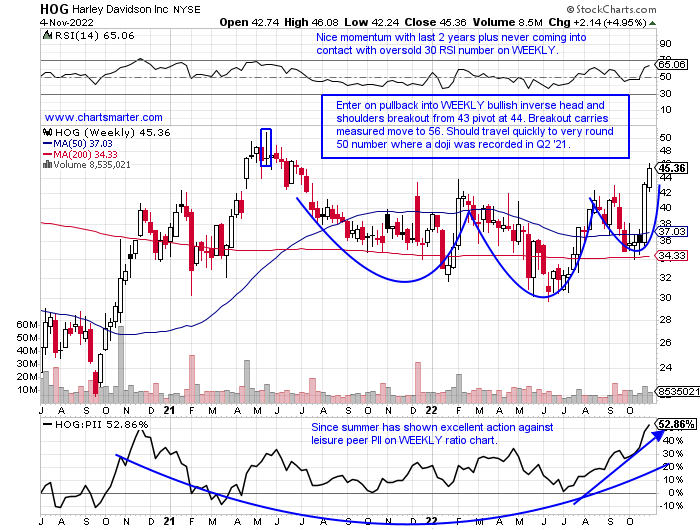

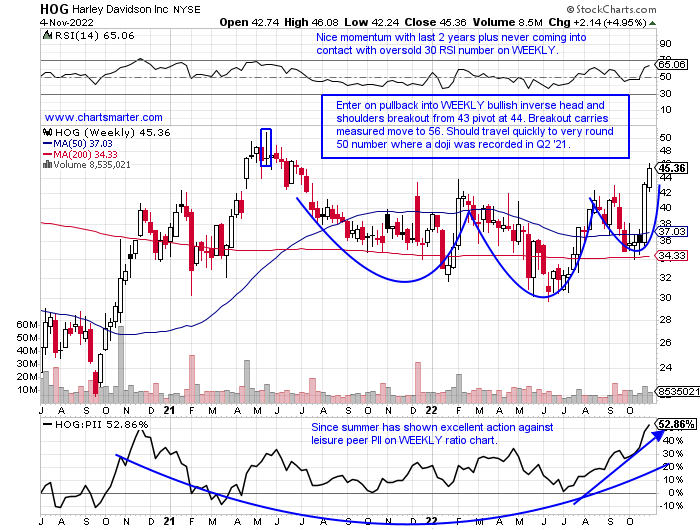

- Leisure play higher by 20% YTD and over last one year period. Dividend yield of 1.4%.

- Name just 2% off most recent 52-week highs and fine action last week up 5% as XLY fell 5% and good follow through on prior weeks surge of 20.4%. Weeks ending between 10/7-21 all CLOSED very tautly all within just .10 of each other.

- Earnings mostly higher up 12.6, 7.8, and 15.5% on 10/26, 7/28, and 2/8, and fell .5% on 4/27.

- Enter on pullback into bullish inverse head and shoulders breakout.

- Entry HOG 44. Stop 41.

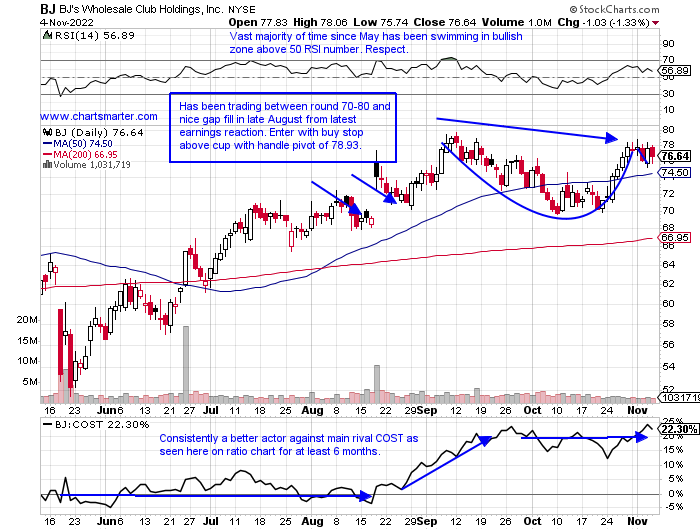

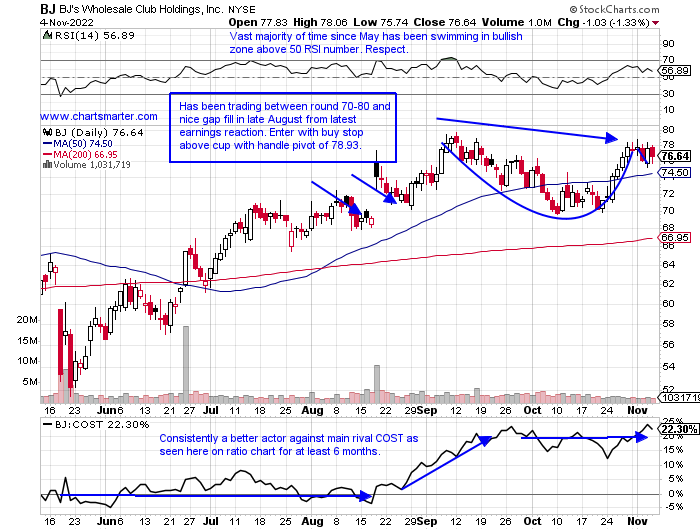

- Discount retailer higher by 14% YTD and 24% over last one year period.

- Name 4% off most recent 52-week highs and since 16.1% loss week ending 5/20 has been nearly a straight line up. A better actor than COST last week down 1.5% while Costco dropped 5%.

- Earnings mostly higher up 7.2, 7.4, and 19.9% on 8/18, 5/19, and 11/18/21, and fell 13.2% on 3/3.

- Enter with buy stop above cup with handle.

- Entry BJ 78.93. Stop 74 (REPORTS 11/17 before open).

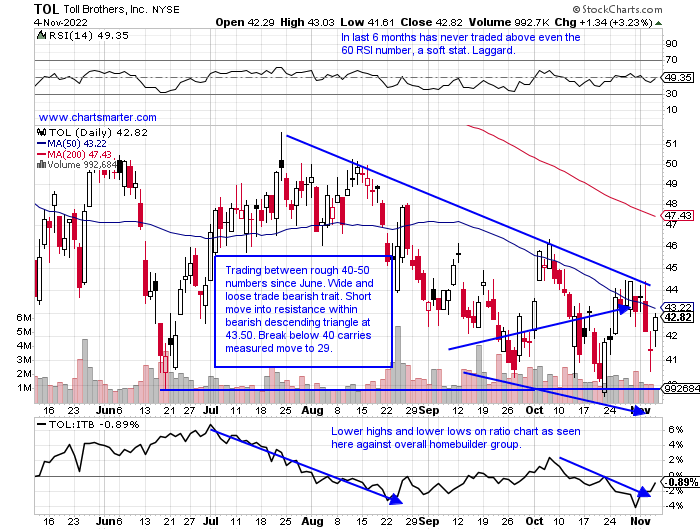

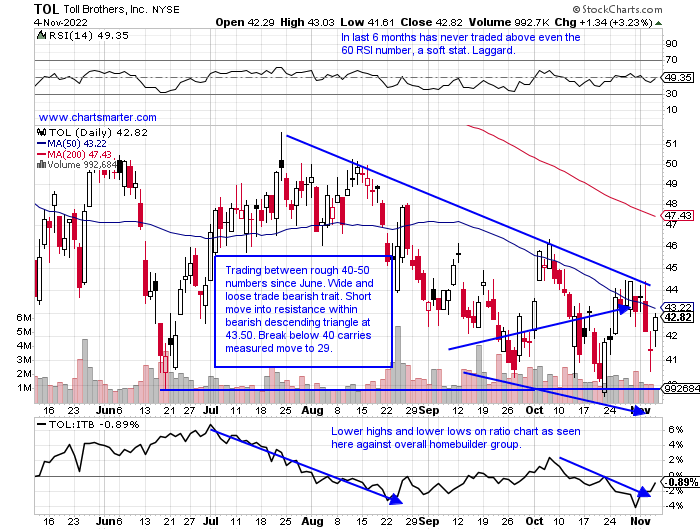

- Housing laggard lower by 41% YTD and 30% over the last one year period. Dividend yield of 1.9%.

- Name 44% off most recent 52-week highs and in the lower end of range between round 40-50 numbers which started this March. The WEEKLY chart suggests bearish head and shoulders pattern with 40 pivot dating back to summer 2020.

- Earnings mostly higher up 1.3, 8, and 1.7% on 8/24, 5/25, and 12/8/21, and a loss of 6.4% on 2/23.

- Short into descending triangle resistance.

- Entry TOL 43.50. Buy stop 46.

Good luck.

Entry summaries:

Buy pullback into bullish inverse head and shoulders breakout HOG 44. Stop 41.

Buy stop above cup with handle BJ 78.93. Stop 74.

Short into descending triangle resistance TOL 43.50. Buy stop 46.

This article requires a Chartsmarter membership. Please click here to join.

Golden Arches:

- The consumer discretionary space continues to be a cumbersome one. On a YTD basis, it is now lower by 32% and just the 10th best of the 11 major S&P sectors. And inside the fund's top 10 holdings there are just two names above both their 50 and 200-day SMAs and they happen to be casual diners. SBUX never came close to retesting its May-June lows, a very good sign, and is quietly higher in 14 of the last 20 weeks (4 of the 6 decliners fell less than 2%). Friday it broke above a 90.80 double bottom pivot. Below is the chart of best-in-breed MCD. It is just 1% off most recent all-time highs and this week displayed good relative strength UNCH as the XLY fell more than 5%, and this is after the prior week jumped 7.8%, its best WEEKLY gain since April 2020. It is funny how things tend to come full circle as the name it spun off in CMG in 2006 was the general in the diners and that is now struggling since nearly touching the very round 2000 number in September 2021. Respect the fact that MCD is offering an add-on buy point on the way UP, exactly what leaders do and it is doing so in a weak market climate. "I'm loving it".

Enjoying Their "Spare" Time:

- Consumers are always looking for something to keep them occupied in their spare time. From the look at the chart below of BOWL, a clever ticker symbol, many are taking up bowling. Former best-of-breed recreational name BC which makes bowling balls has fallen on hard times like most discretionary names and has the look of a bearish head and shoulders formation. A break there below 64 carries a measured move to 42. Looking at BOWL one can see the ease with which it has thus far held up during the market meltdown and it must be commended for that. This week was looking like a bull flag until late when that pattern was never taken out, although it did gain firmly Friday. It has recorded just two earnings reactions thus far and both were well received up 7.5 and 18.9% on 9/16 and 5/12 (REPORTS 11/16 after close). Look now for a move into its rising 50-day SMA the first time following the recent cup base breakout.

Recent Examples:

- The discount retail space has been a mixed one. OLLI a former general in the group is 29% from most recent 52-week highs and slumped more than 10% last week. If the stock can remain above the very round 50 number on its WEEKLY chart it would keep its string of higher lows in place dating back to March. DLTR is trading 12% off most recent and has recorded big WEEKLY drawdowns of 20 and 17% the weeks ending 5/20 and 8/26, and it is shaping out a cup with handle base with a break above 160 to most likely fill in the upside gap from the 8/24 session. Below is a name I was WRONG about in BURL and how it appeared in our 10/18 Consumer Note. The 1/22 stop should have one exited on 10/24, and the very next day jumped more than 12% in double the average daily volume. The week ending 10/28 rose almost 17% in the best WEEKLY volume in an up week in years and last week was UNCH. It is still making lower highs dating back to August 2021 when the stock was above 350. In my opinion, there are better fish to fry.

Special Situations:

- Leisure play higher by 20% YTD and over last one year period. Dividend yield of 1.4%.

- Name just 2% off most recent 52-week highs and fine action last week up 5% as XLY fell 5% and good follow through on prior weeks surge of 20.4%. Weeks ending between 10/7-21 all CLOSED very tautly all within just .10 of each other.

- Earnings mostly higher up 12.6, 7.8, and 15.5% on 10/26, 7/28, and 2/8, and fell .5% on 4/27.

- Enter on pullback into bullish inverse head and shoulders breakout.

- Entry HOG 44. Stop 41.

- Discount retailer higher by 14% YTD and 24% over last one year period.

- Name 4% off most recent 52-week highs and since 16.1% loss week ending 5/20 has been nearly a straight line up. A better actor than COST last week down 1.5% while Costco dropped 5%.

- Earnings mostly higher up 7.2, 7.4, and 19.9% on 8/18, 5/19, and 11/18/21, and fell 13.2% on 3/3.

- Enter with buy stop above cup with handle.

- Entry BJ 78.93. Stop 74 (REPORTS 11/17 before open).

- Housing laggard lower by 41% YTD and 30% over the last one year period. Dividend yield of 1.9%.

- Name 44% off most recent 52-week highs and in the lower end of range between round 40-50 numbers which started this March. The WEEKLY chart suggests bearish head and shoulders pattern with 40 pivot dating back to summer 2020.

- Earnings mostly higher up 1.3, 8, and 1.7% on 8/24, 5/25, and 12/8/21, and a loss of 6.4% on 2/23.

- Short into descending triangle resistance.

- Entry TOL 43.50. Buy stop 46.

Good luck.

Entry summaries:

Buy pullback into bullish inverse head and shoulders breakout HOG 44. Stop 41.

Buy stop above cup with handle BJ 78.93. Stop 74.

Short into descending triangle resistance TOL 43.50. Buy stop 46.