"Mixed emotions, buddy. Like Larry Wildman going off a cliff in my new Maserati." Gordon Gekko

Clashing Signals:

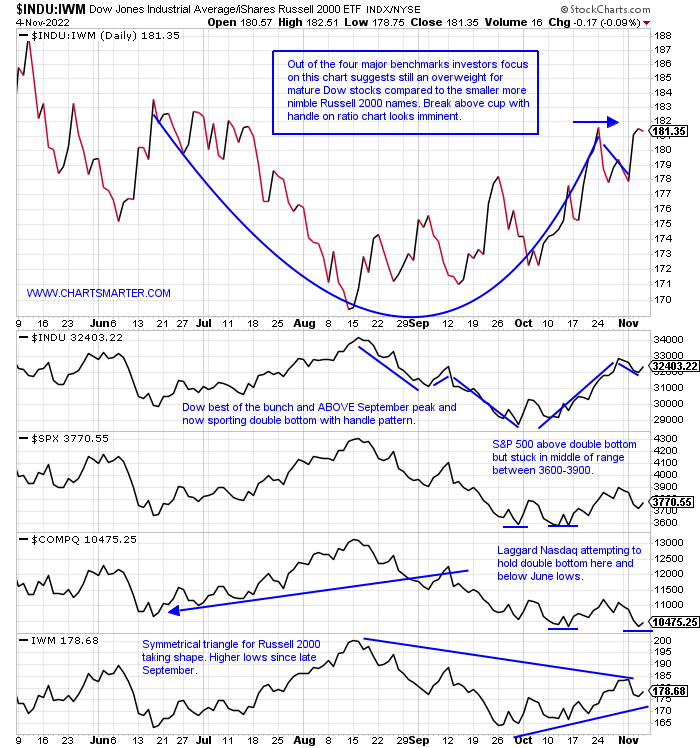

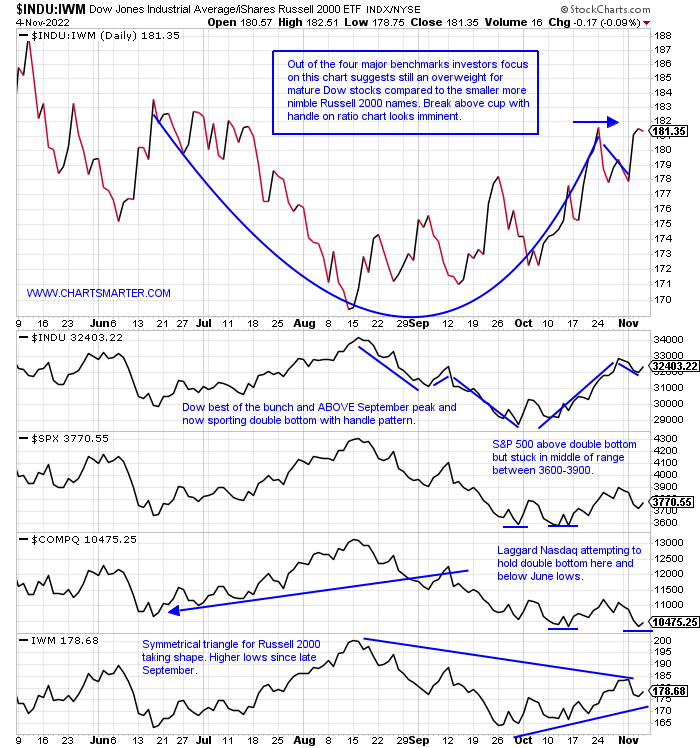

- Unless one has been hiding underneath a rock there have been some glaring bifurcations among the major indexes. The obvious laggard has been technology, with the Nasdaq lower by 6% over the last one-month period. Easily the best of the bunch has been the old, stodgy Dow which has gained 7% (over the same time period the Russell 2000 is higher by 1% and the S&P 500 is UNCH). The Nasdaq is off 7 of the last 11 weeks, with three WEEKLY declines of 5% or more. In all this contrast even with the Dow's strength (although it still can not catapult above its 200-day SMA) investors must have mixed feelings. Typically the big, mature defensive names are the last to crack as market participants cling to what they perceive as "safety". Are these stocks ready to join the others in their misery? It has certainly helped there are just 6 tech stocks in the Dow currently (one is CRM and in August 2020 Exxon was removed from the Dow and Salesforce was added to the index. Total Returns since, Exxon +214%, Salesforce: -41% thanks Will). Very few of the 30 names have good long-term setups, perhaps some tactically so in my opinion cash overall is still king with some good trading opportunities.

Communication Issues:

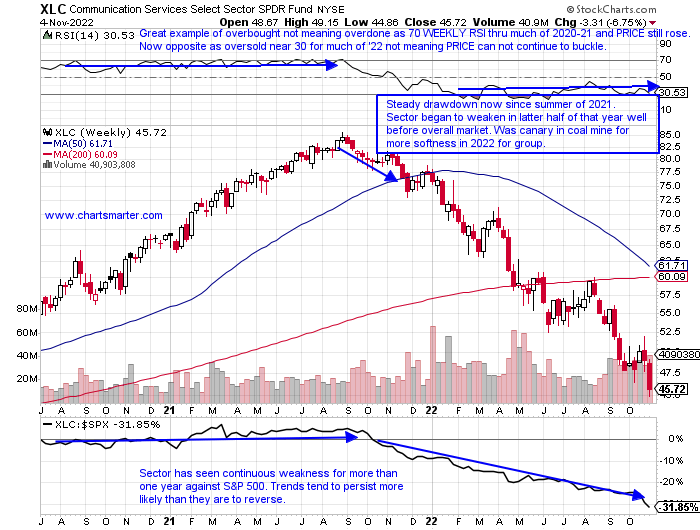

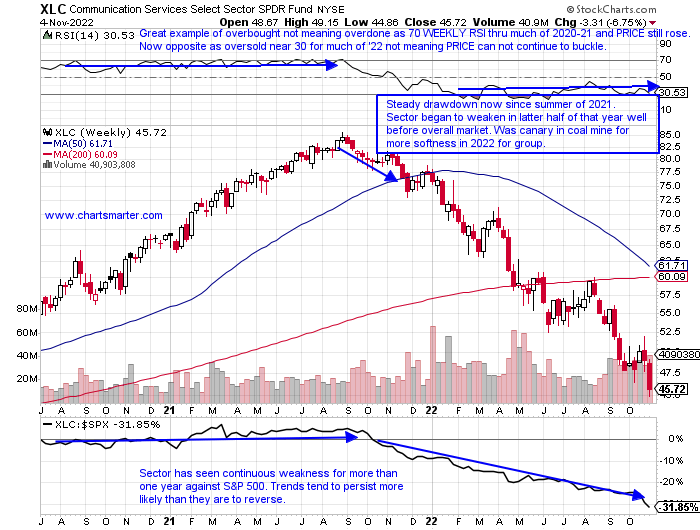

- Misery loves company. Within the worst-performing major S&P sector YTD in the XLC down more than 40% as a whole, it is not hard to see failures. Surely opportunity will emerge from the rubble but for the time being META may be the poster boy for weakness within. The stock is now three-quarters off its most recent 52-week highs and the last two weeks has lost almost a third of its value. The volume looks similar to the fortnight the weeks ending 2/4/11 that slumped on robust trade by 29%. SPOT and SNAP are 76 and 84% off their annual peaks, with the latter not being able to make any progress above the very round 10 number which was also an upside gap fill from the 10/20 session. GOOGL is off 8 of the last 11 weeks with PRICE accelerating to the downside fast the last two. Overall the XLC is in a swift downtrend as seen below and names like TMUS and SFTBY can not make up for all the weakness in the space. But NFLX is a stock I think has a good chance at succeeding into year-end.

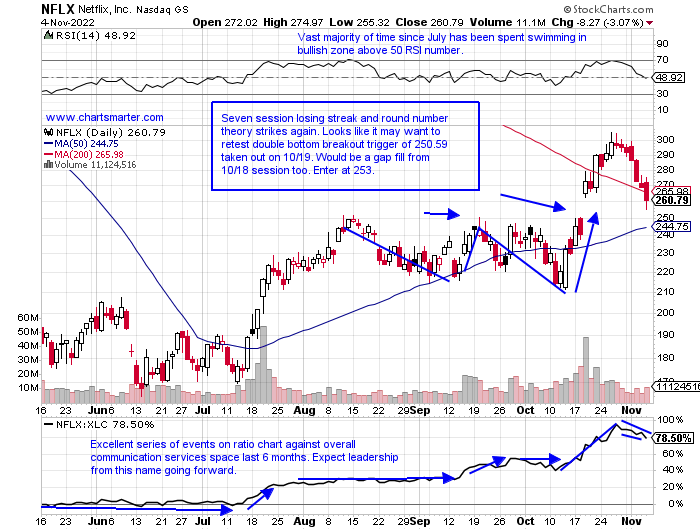

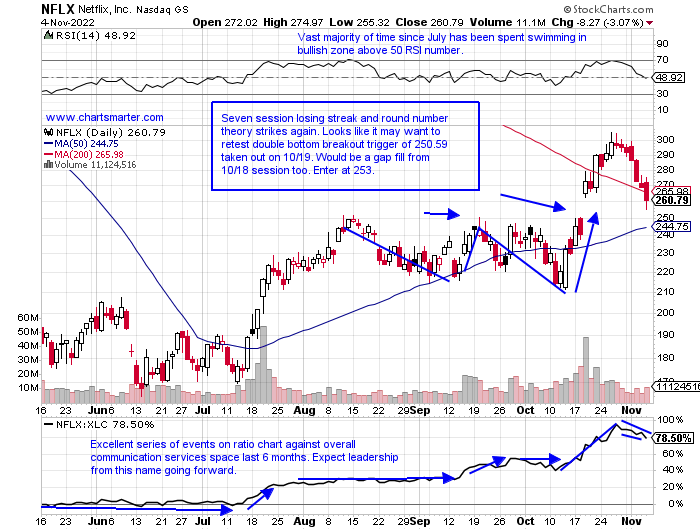

Netflix:

- Entertainment play down 57% YTD and 61% over last one year period.

- Name 63% off most recent 52 week highs and advanced 12 of last 18 weeks. Last week fell 12% rejected for second straight week at very round 300 number completing bearish WEEKLY evening star candle.

- Consecutive positive earnings reactions up 13.1 and 7.3% on 10/19 and 7/20 and drops of 35.1 and 21.8% on 4/20 and 1/21.

- Enter on pullback into double bottom breakout/gap fill/50 day SMA.

- Entry NFLX 253. Stop 240.

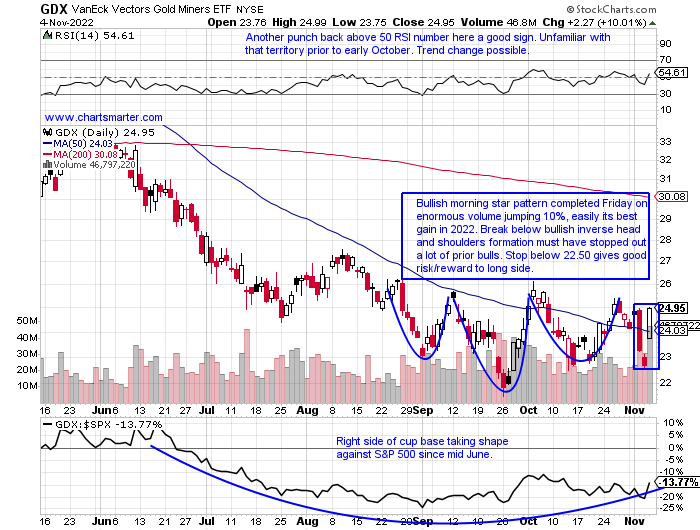

Gold Bug Relief?

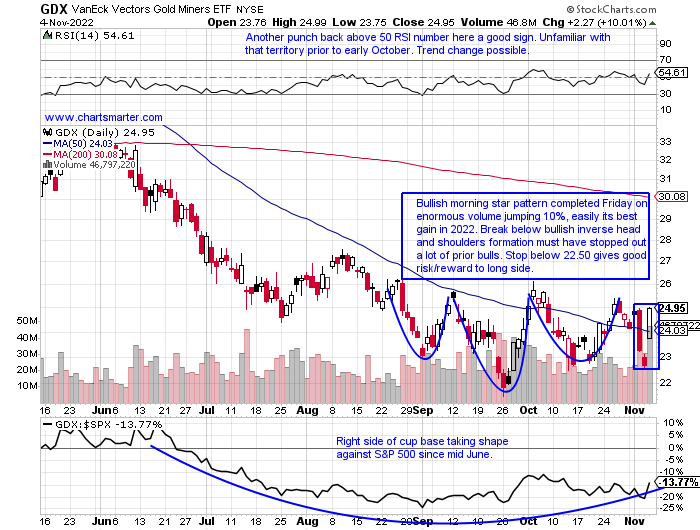

- Gold bulls have had it rough since the GDX recorded a bearish engulfing week ending 4/22 that lost 9.6% (almost the same amount it rallied last week). On its WEEKLY chart that engulfing candle was one week after a nice breakout above a 40.23 double bottom pivot and we know that breakouts that fail quickly are a red flag. Sure enough, it went on to fall 14 of the next 22 weeks, but it has now advanced 5 of the last 6 weeks. This nascent run started with a bullish engulfing candle the week ending 9/30 that rose in the best WEEKLY volume in 8 months. Last week registered a bullish hammer candle. Further supporting a possible bottom is the MONTHLY chart has CLOSED with back-to-back spinning top candles which are adept at signaling potential reversals in the prevailing trend. Below is the daily chart, and this is yet another time frame that looks energetic. Is the GDX ready for another run similar to the move from the round 30-40 numbers from February-April?

Healthcare Still In Focus:

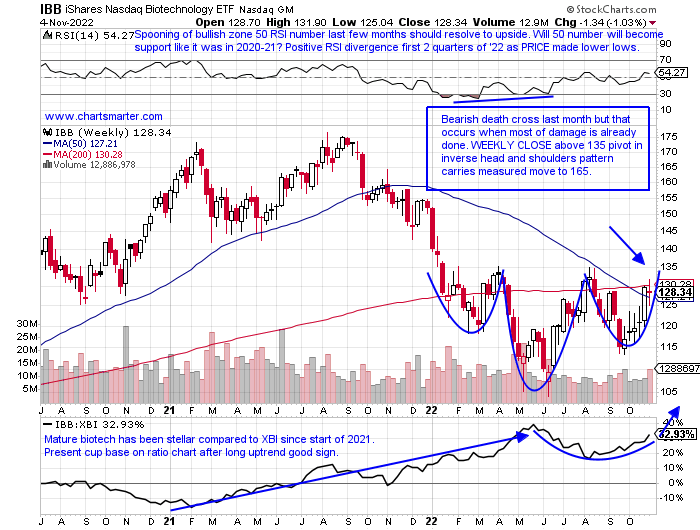

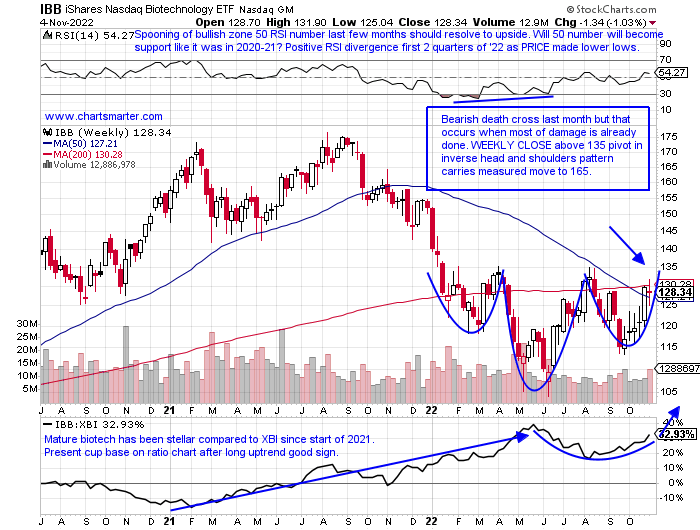

- With the mid-term elections coming this week the group will be in focus. I will leave it to others to determine if a potential red wave will impact them in a positive way. But just the perception that they may is enough to put a bid under them. As always focus on the leaders and there was some solid action this week in the larger cap names we discussed last week. GILD is just 1% off most recent 52-week highs and rose more than 1% after its screamed higher by 17% the week prior. HZNP was awoken from the dead, with the former best-of-breed Irish play jumping 21% last week in double average WEEKLY volume. MRNA added 5% last week as it emerged from an inverse head and shoulders and CLOSED above its 200-day SMA. Below is the chart of the IBB and it too has a WEEKLY inverse head and shoulders pattern and it outperformed the XBI last week "down" 1% as the XBI dropped 4.5%. Let's take a look at a couple individual names that may benefit from the tailwind in the space.

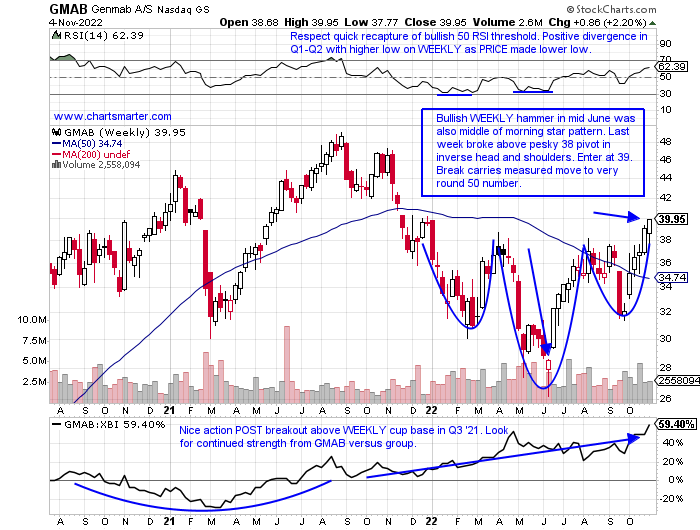

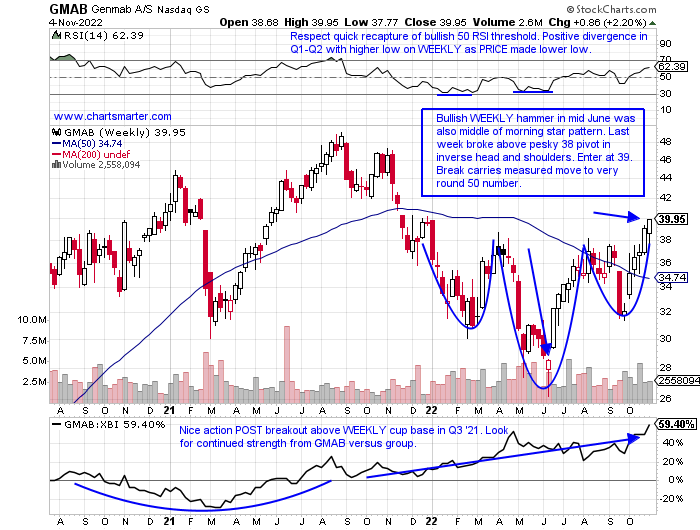

Genmab:

- Denmark biotech play UNCH YTD and lower by 15% over last one year period.

- Name 15% off most recent 52 week highs and on current 6 week winning streak. Nice relative strength last week with gain of 2.2% as XBI fell 4.5%.

- Earnings mostly higher up 5.6, 1.2, and 1.9% on 8/11, 5/12, and 11/11/21, and fell 2.6% on 2/17.

- Enter on pullback into WEEKLY inverse head and shoulders breakout.

- Entry GMAB 39. Stop 36 (REPORTS 11/9 after close).

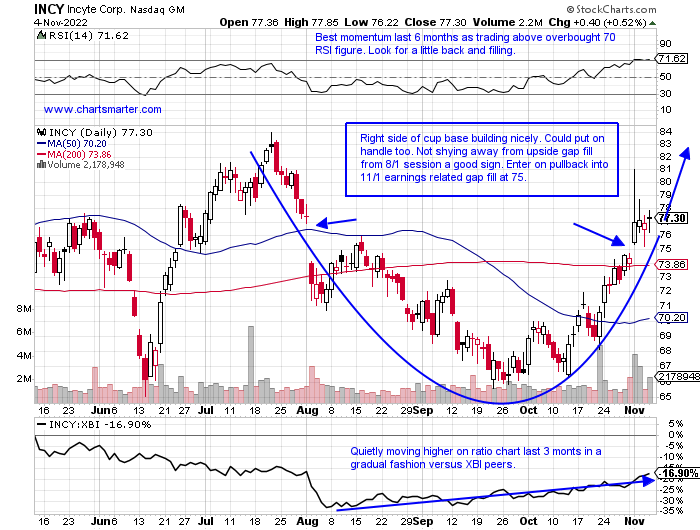

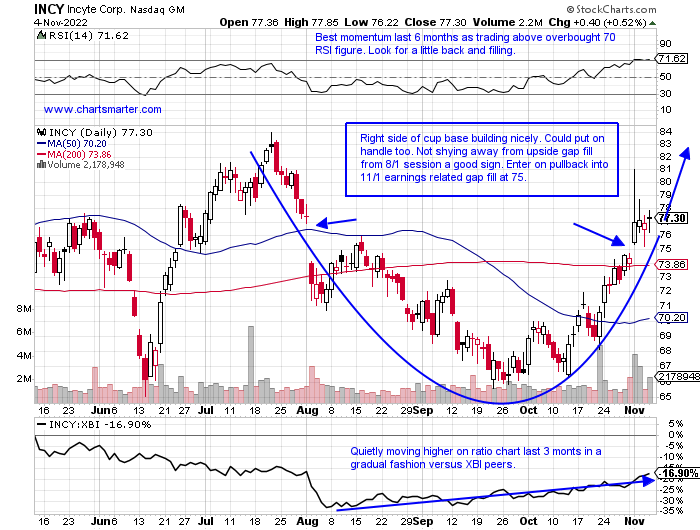

Incyte Corp:

- Biotech play higher by 5% YTD and 15% over the last one-year period.

- Name 9% off most recent 52-week highs and rejection at round 80 number continues dating back to summer '21. The level was support in late 2020 and the first half of 2021. Break above could be powerful.

- Earnings mixed with gains of 3.5 and 1.5% on 11/1 and 5/3 and losses of 6.2 and 4.5% on 8/2 and 2/8 (between May '20-February '22 recorded 8 straight negative earnings reactions).

- Enter on earnings-related gap fill.

- Entry INCY 75. Stop 72.

Good luck.

This article requires a Chartsmarter membership. Please click here to join.

"Mixed emotions, buddy. Like Larry Wildman going off a cliff in my new Maserati." Gordon Gekko

Clashing Signals:

- Unless one has been hiding underneath a rock there have been some glaring bifurcations among the major indexes. The obvious laggard has been technology, with the Nasdaq lower by 6% over the last one-month period. Easily the best of the bunch has been the old, stodgy Dow which has gained 7% (over the same time period the Russell 2000 is higher by 1% and the S&P 500 is UNCH). The Nasdaq is off 7 of the last 11 weeks, with three WEEKLY declines of 5% or more. In all this contrast even with the Dow's strength (although it still can not catapult above its 200-day SMA) investors must have mixed feelings. Typically the big, mature defensive names are the last to crack as market participants cling to what they perceive as "safety". Are these stocks ready to join the others in their misery? It has certainly helped there are just 6 tech stocks in the Dow currently (one is CRM and in August 2020 Exxon was removed from the Dow and Salesforce was added to the index. Total Returns since, Exxon +214%, Salesforce: -41% thanks Will). Very few of the 30 names have good long-term setups, perhaps some tactically so in my opinion cash overall is still king with some good trading opportunities.

Communication Issues:

- Misery loves company. Within the worst-performing major S&P sector YTD in the XLC down more than 40% as a whole, it is not hard to see failures. Surely opportunity will emerge from the rubble but for the time being META may be the poster boy for weakness within. The stock is now three-quarters off its most recent 52-week highs and the last two weeks has lost almost a third of its value. The volume looks similar to the fortnight the weeks ending 2/4/11 that slumped on robust trade by 29%. SPOT and SNAP are 76 and 84% off their annual peaks, with the latter not being able to make any progress above the very round 10 number which was also an upside gap fill from the 10/20 session. GOOGL is off 8 of the last 11 weeks with PRICE accelerating to the downside fast the last two. Overall the XLC is in a swift downtrend as seen below and names like TMUS and SFTBY can not make up for all the weakness in the space. But NFLX is a stock I think has a good chance at succeeding into year-end.

Netflix:

- Entertainment play down 57% YTD and 61% over last one year period.

- Name 63% off most recent 52 week highs and advanced 12 of last 18 weeks. Last week fell 12% rejected for second straight week at very round 300 number completing bearish WEEKLY evening star candle.

- Consecutive positive earnings reactions up 13.1 and 7.3% on 10/19 and 7/20 and drops of 35.1 and 21.8% on 4/20 and 1/21.

- Enter on pullback into double bottom breakout/gap fill/50 day SMA.

- Entry NFLX 253. Stop 240.

Gold Bug Relief?

- Gold bulls have had it rough since the GDX recorded a bearish engulfing week ending 4/22 that lost 9.6% (almost the same amount it rallied last week). On its WEEKLY chart that engulfing candle was one week after a nice breakout above a 40.23 double bottom pivot and we know that breakouts that fail quickly are a red flag. Sure enough, it went on to fall 14 of the next 22 weeks, but it has now advanced 5 of the last 6 weeks. This nascent run started with a bullish engulfing candle the week ending 9/30 that rose in the best WEEKLY volume in 8 months. Last week registered a bullish hammer candle. Further supporting a possible bottom is the MONTHLY chart has CLOSED with back-to-back spinning top candles which are adept at signaling potential reversals in the prevailing trend. Below is the daily chart, and this is yet another time frame that looks energetic. Is the GDX ready for another run similar to the move from the round 30-40 numbers from February-April?

Healthcare Still In Focus:

- With the mid-term elections coming this week the group will be in focus. I will leave it to others to determine if a potential red wave will impact them in a positive way. But just the perception that they may is enough to put a bid under them. As always focus on the leaders and there was some solid action this week in the larger cap names we discussed last week. GILD is just 1% off most recent 52-week highs and rose more than 1% after its screamed higher by 17% the week prior. HZNP was awoken from the dead, with the former best-of-breed Irish play jumping 21% last week in double average WEEKLY volume. MRNA added 5% last week as it emerged from an inverse head and shoulders and CLOSED above its 200-day SMA. Below is the chart of the IBB and it too has a WEEKLY inverse head and shoulders pattern and it outperformed the XBI last week "down" 1% as the XBI dropped 4.5%. Let's take a look at a couple individual names that may benefit from the tailwind in the space.

Genmab:

- Denmark biotech play UNCH YTD and lower by 15% over last one year period.

- Name 15% off most recent 52 week highs and on current 6 week winning streak. Nice relative strength last week with gain of 2.2% as XBI fell 4.5%.

- Earnings mostly higher up 5.6, 1.2, and 1.9% on 8/11, 5/12, and 11/11/21, and fell 2.6% on 2/17.

- Enter on pullback into WEEKLY inverse head and shoulders breakout.

- Entry GMAB 39. Stop 36 (REPORTS 11/9 after close).

Incyte Corp:

- Biotech play higher by 5% YTD and 15% over the last one-year period.

- Name 9% off most recent 52-week highs and rejection at round 80 number continues dating back to summer '21. The level was support in late 2020 and the first half of 2021. Break above could be powerful.

- Earnings mixed with gains of 3.5 and 1.5% on 11/1 and 5/3 and losses of 6.2 and 4.5% on 8/2 and 2/8 (between May '20-February '22 recorded 8 straight negative earnings reactions).

- Enter on earnings-related gap fill.

- Entry INCY 75. Stop 72.

Good luck.