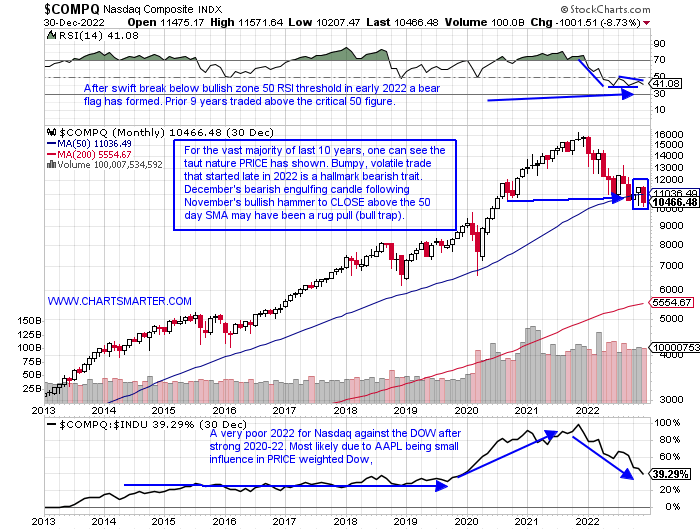

Monthly Blues:

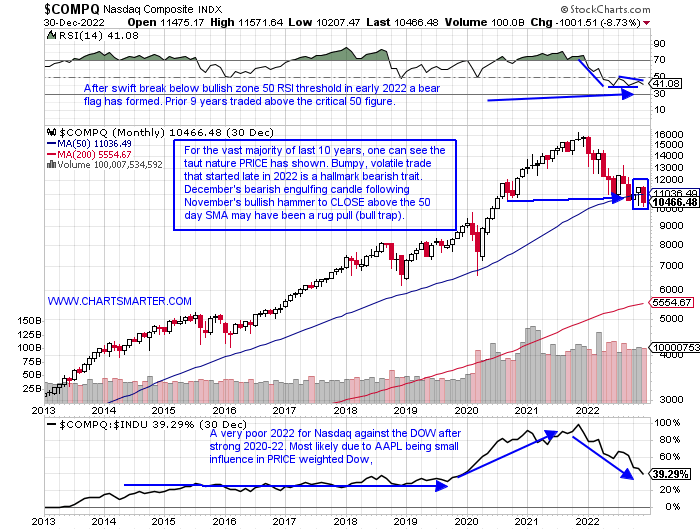

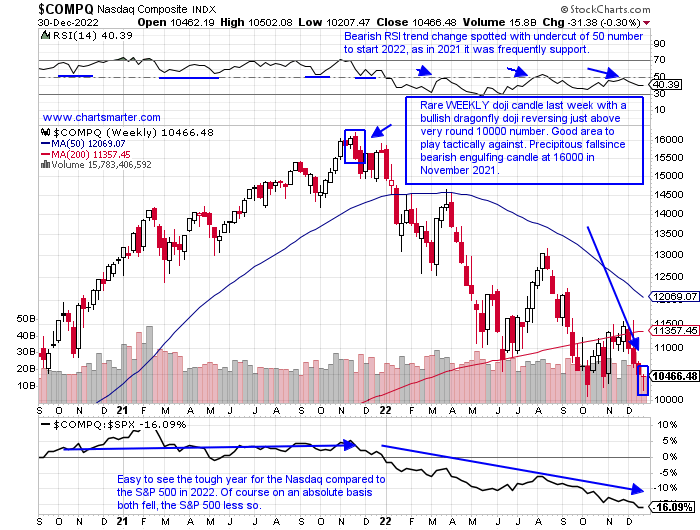

- At the end of each month, it is a pleasure to be able to look at the longer-term PRICE frames, and the end of the year puts an even more special emphasis on it. Below we see how 3 of the last 4 months the Nasdaq has now CLOSED below its MONTHLY 50-day SMA. We have spoken about the inability of the tech-heavy index to thrust off the line as it has in February 2016, January 2019, and March of 2020. Just the fact that it is stalling here should be a concern, even after the 6000 handle decline from the November 2021 MONTHLY gravestone doji candle. Remember trends in motion tend to stay that way more likely than they are to reverse. And when they do change course there will often be a technical footprint as in a bottoming candlestick pattern, thus avoiding the proverbial "catching a falling knife." This is a good time to start building a watchlist, focusing on those names that are shrugging off the overall weakness. They will often be the first ones out of the gate once the market can catch an uptrend. Patience will certainly be required.

Tactical Approach:

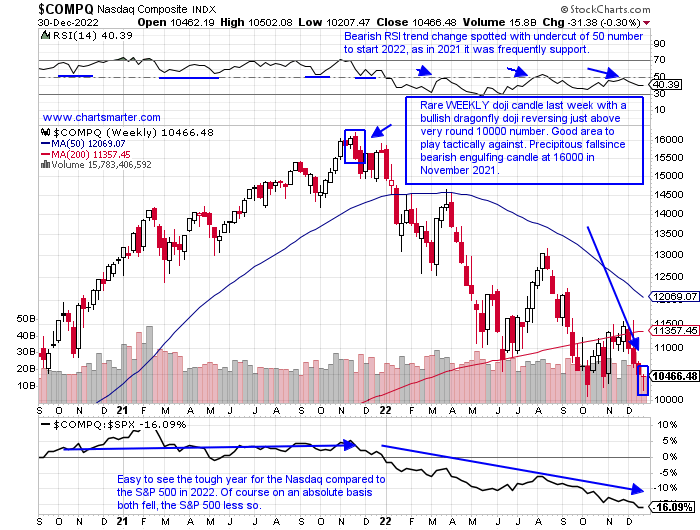

- If one wanted to look at technology with a bullish lens, last week provided you with a clue. There is obviously an enormous amount of work the index needs to accomplish, but like last year I think 2023 will be another year where individual stock pickers will be in strong demand. Leaders will show relative strength and one should employ a tactical strategy (as long as the Nasdaq is below its 200-day SMA) meaning look to take profits with 10-20% gains before they potentially evaporate in another wave of selling. The WEEKLY chart of the Nasdaq below recorded a bullish dragonfly doji candle (just the second such candle in the last 2 years), but this one did so near a psychologically important very round number and CLOSED more than 300 handles off the intraweek lows. Shorts are still in firm control, but the rubber band may be stretched a bit too much to the downside, and names that have been acting well within technology may see a bounce to get this new year started.

Solar Power:

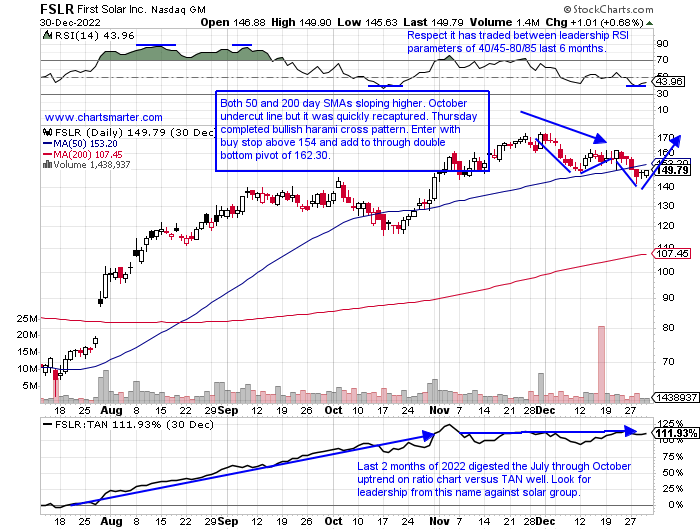

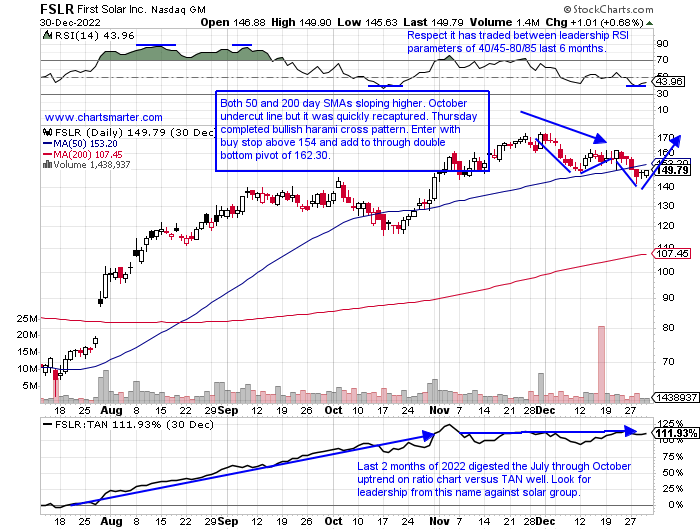

- The renewable energy equipment group was the lone bright spot within technology in 2022. Peering at the TAN ETF is on a 4-week losing streak with all four CLOSING at lows for the WEEKLY range (immediately prior to that it enjoyed a 7-week winning streak). Concerning action is being seen from ENPH which slumped 10% last week, quadrupling the loss from TAN of 2.6%. Others like ARRY if it can reclaim the very round 20 number look like an opportunity and on 12/28 it filled in a gap from the 11/8 session. Of course, nothing is guaranteed heading into the new year but some names have shined brightly, pun intended. Below is best-in-breed FSLR, which I see many are pointing to as a bearish head and shoulders formation, which did break down last Wednesday, but if no follow through to the downside is seen could be a good long candidate as we know from FALSE moves come fast ones in the opposite direction. Last week's low also retested a short cup base breakout pivot of 145.84 taken out on 11/1. Let this name prove it, on strength with a buy stop above 154.

Recent Examples:

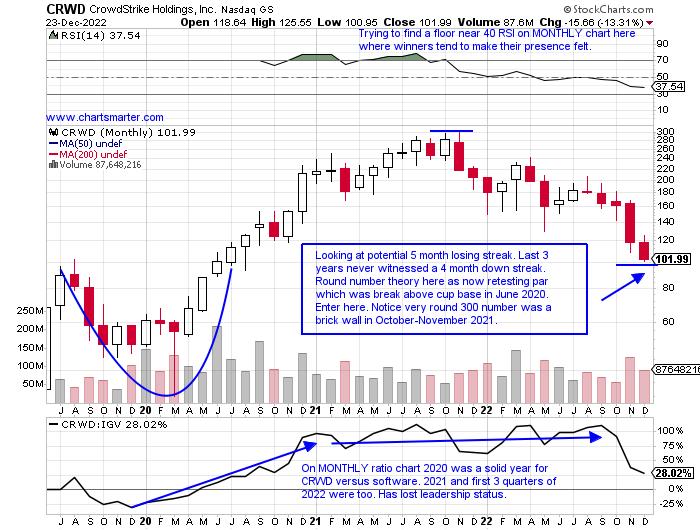

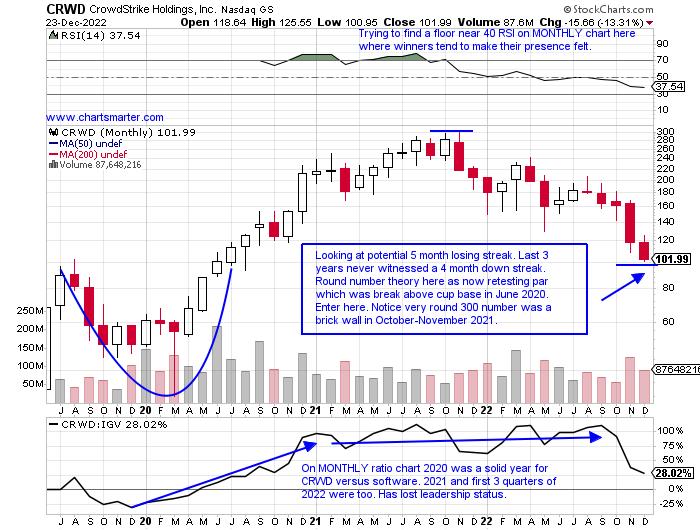

- Software as we have discussed was an area that witnessed strong consolidation in 2022. It was a glass-half-full analogy we used as it is good to see companies seeing "value" in these names, but many were bought out at PRICES that were well beneath their multi-year or 52-week highs. Software security names were not immune from the tech slump with HACK falling somewhat in line last year with their IGV cousins by 29%. PANW rose just three sessions in all of December, but other top 5 holdings like CSCO are acting well and a move above 50 in 2023 can see a quick move to 60 in my opinion. A name that will be happy to put last year in the rearview mirror is the chart below of CRWD and how it appeared in our 12/27 Technology Note. Last week it found support at an inflection point at the very round par figure from a WEEKLY cup base breakout in mid-2020. Use the stop of 94 on a CLOSING basis if involved.

Special Situations:

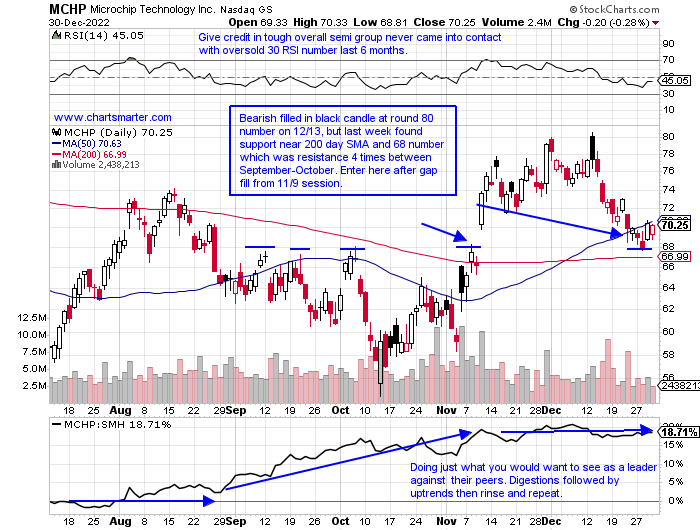

Microchip Technology:

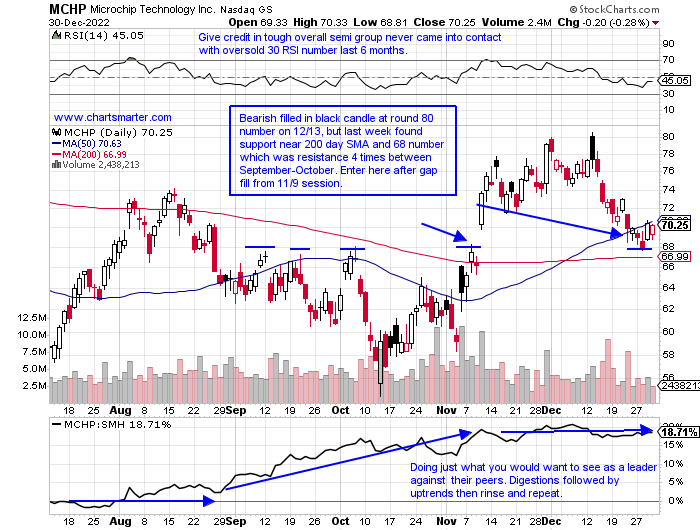

- Semiconductor leader down 19% over last one year period. Dividend yield of 1.9%.

- Name 21% off most recent 52-week highs and bullish WEEKLY hammer candle last week off rising 50-day SMA. Last week's low also gave up 50% off huge move higher from the mid-October low.

- Three straight positive earnings reactions up 7.4, 5.7, and 6.1% on 11/4, 8/3, and 5/10.

- Enter after recent gap fill, support now at prior resistance.

- Entry MCHP here. Stop 65.

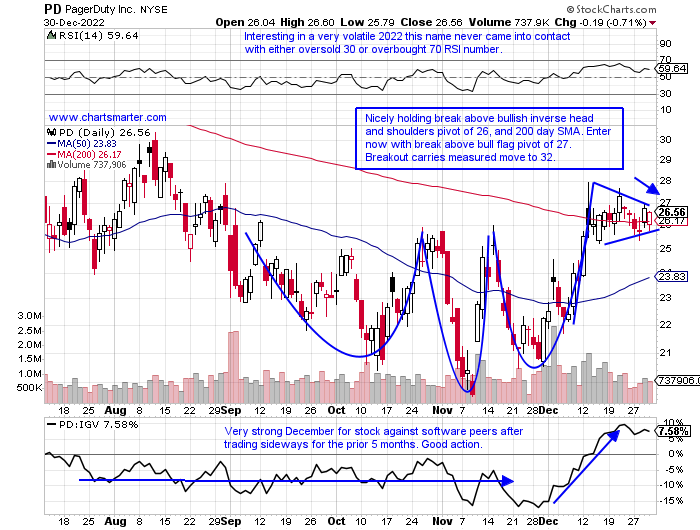

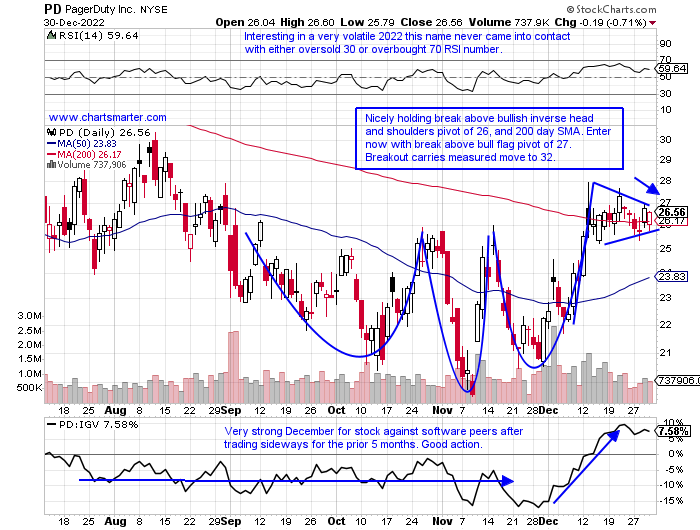

PagerDuty:

- Software play down 24% over last one year period, decent relative strength as IGV off 36% over same time period.

- Name 31% off most recent 52-week highs and last 3 weeks have all CLOSED very taut within just .05 of each other. Breaks higher from that type of consolidation are often very powerful. PD rose 3 of last 4 weeks while IGV has fell 3 of last 4.

- Earnings mixed with gains of 5.1 and 20.9% on 12/2 and 3/17 and losses of 2.4 and 5.1% on 9/2 and 6/3.

- Enter with buy stop above bull flag.

- Entry PD 27. Stop 25.50.

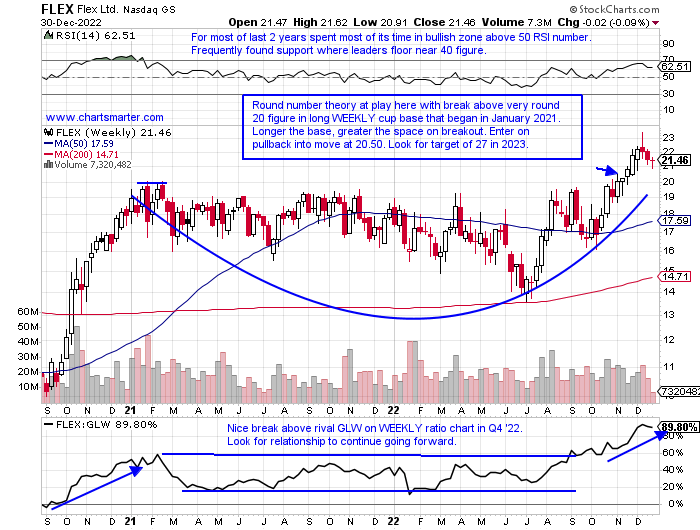

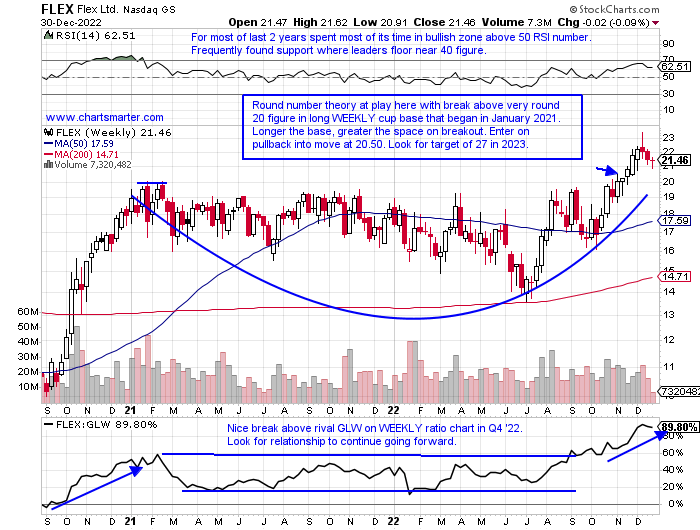

Flex Ltd:

- Electronic equipment play rose 17% over last one year period in a difficult tech environment.

- Name "just" 8% off most recent 52-week highs and great accumulation in second half of 2022 including strong WEEKLY gains of 10.2, 9.8 and 9.8% the weeks ending 7/29, 8/12 and 10/28 each in nearly double average WEEKLY volume.

- Earnings mixed up 3 and 5.2% on 10/27 and 7/28 and fell 2.9 and .4% on 5/5 and 1/27.

- Enter on pullback into WEEKLY cup base breakout.

- Entry FLEX 20.50. Stop 18.75.

Good luck.

Entry summaries:

Buy after recent gap fill, support now at prior resistance MCHP here. Stop 65.

Buy stop above bull flag PD 27. Stop 25.50.

Buy pullback into WEEKLY cup base breakout FLEX 20.50. Stop 18.75.

This article requires a Chartsmarter membership. Please click here to join.

Monthly Blues:

- At the end of each month, it is a pleasure to be able to look at the longer-term PRICE frames, and the end of the year puts an even more special emphasis on it. Below we see how 3 of the last 4 months the Nasdaq has now CLOSED below its MONTHLY 50-day SMA. We have spoken about the inability of the tech-heavy index to thrust off the line as it has in February 2016, January 2019, and March of 2020. Just the fact that it is stalling here should be a concern, even after the 6000 handle decline from the November 2021 MONTHLY gravestone doji candle. Remember trends in motion tend to stay that way more likely than they are to reverse. And when they do change course there will often be a technical footprint as in a bottoming candlestick pattern, thus avoiding the proverbial "catching a falling knife." This is a good time to start building a watchlist, focusing on those names that are shrugging off the overall weakness. They will often be the first ones out of the gate once the market can catch an uptrend. Patience will certainly be required.

Tactical Approach:

- If one wanted to look at technology with a bullish lens, last week provided you with a clue. There is obviously an enormous amount of work the index needs to accomplish, but like last year I think 2023 will be another year where individual stock pickers will be in strong demand. Leaders will show relative strength and one should employ a tactical strategy (as long as the Nasdaq is below its 200-day SMA) meaning look to take profits with 10-20% gains before they potentially evaporate in another wave of selling. The WEEKLY chart of the Nasdaq below recorded a bullish dragonfly doji candle (just the second such candle in the last 2 years), but this one did so near a psychologically important very round number and CLOSED more than 300 handles off the intraweek lows. Shorts are still in firm control, but the rubber band may be stretched a bit too much to the downside, and names that have been acting well within technology may see a bounce to get this new year started.

Solar Power:

- The renewable energy equipment group was the lone bright spot within technology in 2022. Peering at the TAN ETF is on a 4-week losing streak with all four CLOSING at lows for the WEEKLY range (immediately prior to that it enjoyed a 7-week winning streak). Concerning action is being seen from ENPH which slumped 10% last week, quadrupling the loss from TAN of 2.6%. Others like ARRY if it can reclaim the very round 20 number look like an opportunity and on 12/28 it filled in a gap from the 11/8 session. Of course, nothing is guaranteed heading into the new year but some names have shined brightly, pun intended. Below is best-in-breed FSLR, which I see many are pointing to as a bearish head and shoulders formation, which did break down last Wednesday, but if no follow through to the downside is seen could be a good long candidate as we know from FALSE moves come fast ones in the opposite direction. Last week's low also retested a short cup base breakout pivot of 145.84 taken out on 11/1. Let this name prove it, on strength with a buy stop above 154.

Recent Examples:

- Software as we have discussed was an area that witnessed strong consolidation in 2022. It was a glass-half-full analogy we used as it is good to see companies seeing "value" in these names, but many were bought out at PRICES that were well beneath their multi-year or 52-week highs. Software security names were not immune from the tech slump with HACK falling somewhat in line last year with their IGV cousins by 29%. PANW rose just three sessions in all of December, but other top 5 holdings like CSCO are acting well and a move above 50 in 2023 can see a quick move to 60 in my opinion. A name that will be happy to put last year in the rearview mirror is the chart below of CRWD and how it appeared in our 12/27 Technology Note. Last week it found support at an inflection point at the very round par figure from a WEEKLY cup base breakout in mid-2020. Use the stop of 94 on a CLOSING basis if involved.

Special Situations:

Microchip Technology:

- Semiconductor leader down 19% over last one year period. Dividend yield of 1.9%.

- Name 21% off most recent 52-week highs and bullish WEEKLY hammer candle last week off rising 50-day SMA. Last week's low also gave up 50% off huge move higher from the mid-October low.

- Three straight positive earnings reactions up 7.4, 5.7, and 6.1% on 11/4, 8/3, and 5/10.

- Enter after recent gap fill, support now at prior resistance.

- Entry MCHP here. Stop 65.

PagerDuty:

- Software play down 24% over last one year period, decent relative strength as IGV off 36% over same time period.

- Name 31% off most recent 52-week highs and last 3 weeks have all CLOSED very taut within just .05 of each other. Breaks higher from that type of consolidation are often very powerful. PD rose 3 of last 4 weeks while IGV has fell 3 of last 4.

- Earnings mixed with gains of 5.1 and 20.9% on 12/2 and 3/17 and losses of 2.4 and 5.1% on 9/2 and 6/3.

- Enter with buy stop above bull flag.

- Entry PD 27. Stop 25.50.

Flex Ltd:

- Electronic equipment play rose 17% over last one year period in a difficult tech environment.

- Name "just" 8% off most recent 52-week highs and great accumulation in second half of 2022 including strong WEEKLY gains of 10.2, 9.8 and 9.8% the weeks ending 7/29, 8/12 and 10/28 each in nearly double average WEEKLY volume.

- Earnings mixed up 3 and 5.2% on 10/27 and 7/28 and fell 2.9 and .4% on 5/5 and 1/27.

- Enter on pullback into WEEKLY cup base breakout.

- Entry FLEX 20.50. Stop 18.75.

Good luck.

Entry summaries:

Buy after recent gap fill, support now at prior resistance MCHP here. Stop 65.

Buy stop above bull flag PD 27. Stop 25.50.

Buy pullback into WEEKLY cup base breakout FLEX 20.50. Stop 18.75.