Whistling Past The Graveyard:

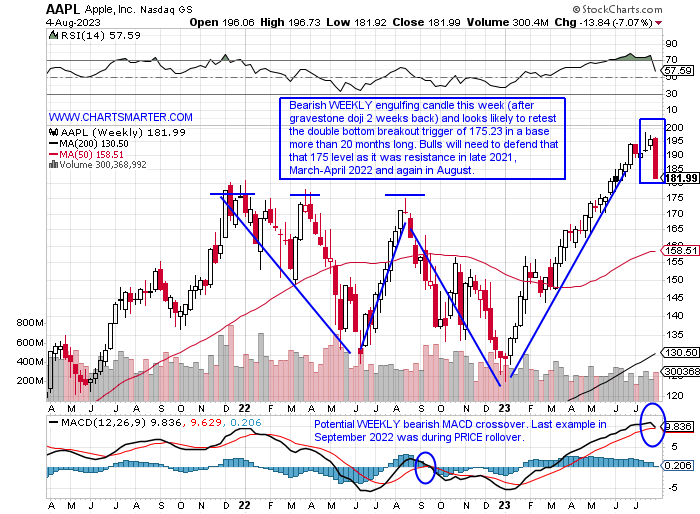

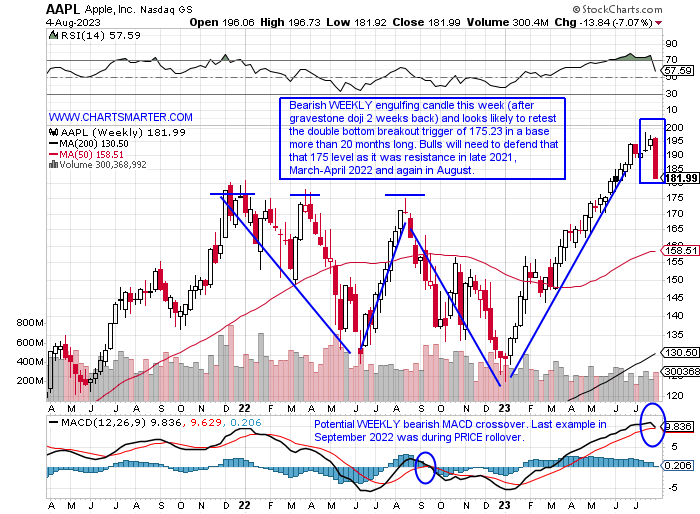

- Last week we mentioned how the WEEKLY gravestone candle on AAPL which occurred right at the very round 200 number (round number theory) was something to be wary of before its earnings reaction. The last time that occurred almost exactly one year ago the week ending 8/19/22 started a 50-handle downtrend after a powerful 6-week win streak between the weeks ending 7/8-8/12. That also provided the pivot in a WEEKLY double bottom base and with this week's ugly action falling 7%, a retest of that area near 175 is certainly plausible. Now remember this will not have such a large impact on the Dow as it is a PRICE-weighted index and there are 11 of the 30 names that are trading above the 184 area where it trades, but it is still easily the largest holding in the Nasdaq 100, after the "special" rebalancing. It is the biggest component in the S&P 500 so this name carries a ton of influence, and with the tech sector already showing some signs of fatigue, this could be the trigger that starts a potential sell-off.

"Old Tech" Revival:

- As we look through the technology space as it may be in transition the next couple of months with weakness, some names are standing out, which could be because of their defensive nature. One can take a look at IBM, although it is extended here, which has advanced 10 of the last 12 weeks. It is on a 4-week win streak (and 13 of the last 15 sessions) and for the last 3 weeks has outperformed the Nasdaq, with the most notable being the week ending 7/21 where IBM added 4.1% and the Nasdaq fell .7%. INTC is also trying to resurrect itself but still has work to do on Gelsingers possible turnaround, but the week ending 6/16 that jumped more than 16% in the strongest WEEKLY volume in at least 5 years surely caught many off guard. Last week displayed good relative strength up more than 8%, doubling the gain of the SMH. Below is the chart of another tech dinosaur in JBL and it is well above the late 2021 highs, as the Nasdaq is still 2000 handles below it. It may be setting up for another northward.

Recent Examples:

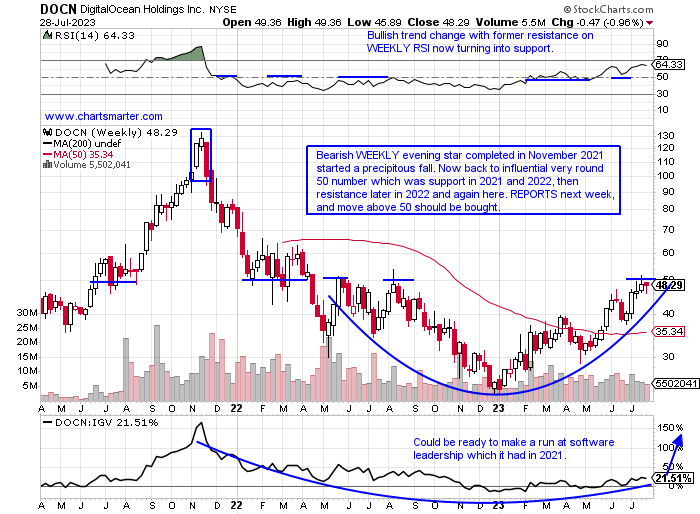

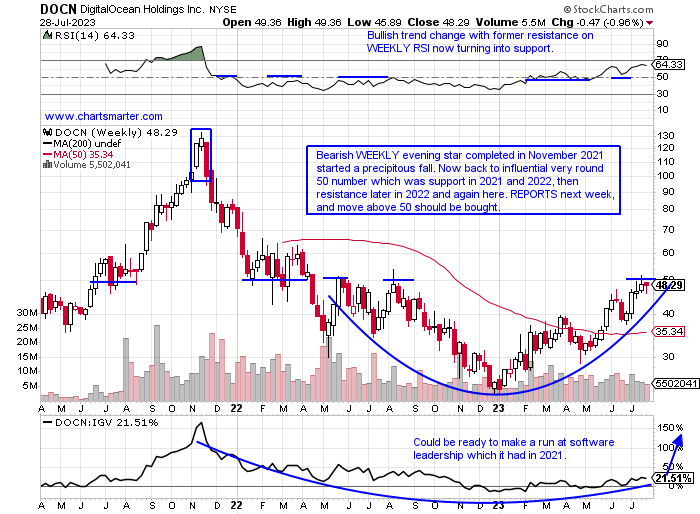

- Earnings season can be a tricky one and I often will stress the importance of not holding into a number unless one has a good enough basis prior to the report. As well I will always capitalize the word CLOSE, which is of utter importance, as many triggers will be taken out mid-session only to finish below it which is usually a red flag. Below is the chart of DOCN and how it appeared in our 7/31 Technology Note and we stressed how a move above the very round 50 number should have been purchased, preferably after the release. Well, Friday the reaction was dismal as the name fell 25%. As good as a setup will look it is only acted upon with PRICE confirmation and that never came. It is now testing along its 200-day SMA, and it is most likely best to move one as this will need time to shake out as the institutions decide how they want to proceed going forward. And that is not even to mention the opportunity cost that will arise too.

Special Situations:

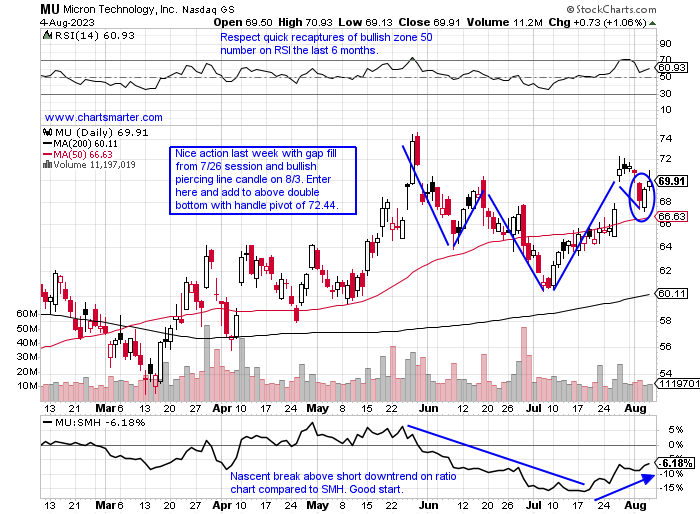

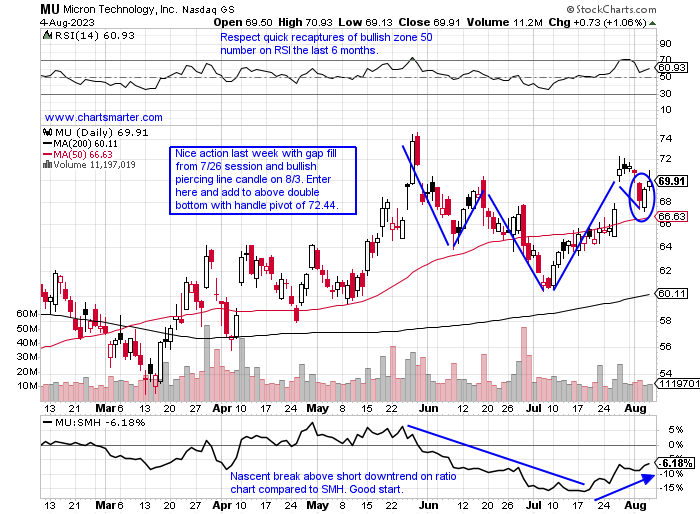

Micron:

- "Old tech" semi-play up 40% YTD and 8% over last one-year period. Dividend yield of .7%.

- Name 6% off most recent 52-week highs and decent relative "strength" this week down 1.8% as SMH fell nearly 4%. Good action this week digesting 16% combined run during 3-week win streak weeks ending between 7/14-28.

- Earnings reactions mixed up 7.2 and .2% on 3/29 and 9/30/22 and fell 4.1 and 3.5% on 6/29 and 12/22/22.

- Enter after recent gap fill/bullish piercing line candle.

- Entry MU here. Stop 67.

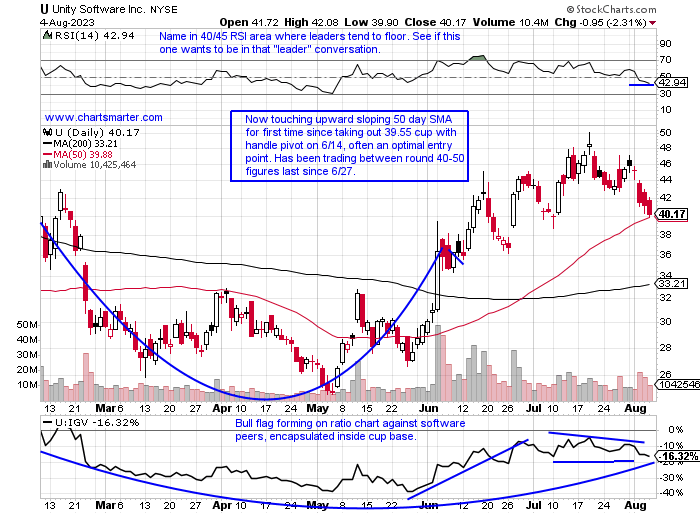

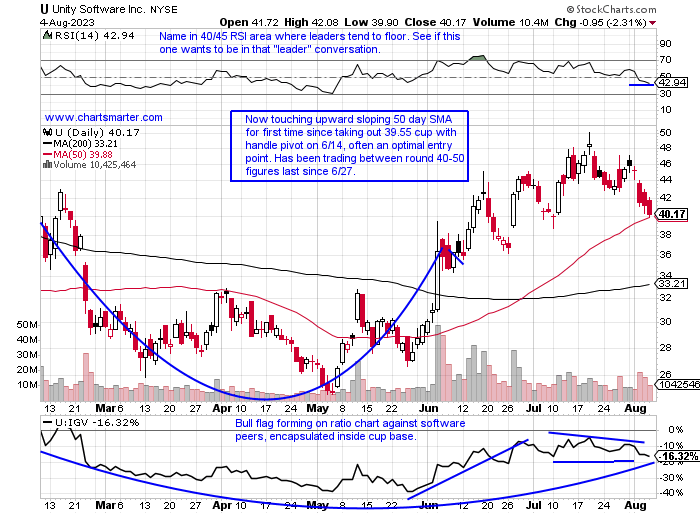

Unity Software:

- Software play up 40% YTD and down 11% over last one year period.

- Name 31% off most recent 52-week highs and has doubled since first week of May to top in late July. Soft relative strength this week down 11.5% compared to IGV slipping 3.5%.

- Earnings reactions mixed up 12.9 and 29.4% on 5/11 and 11/10/22 and fell .8 and 15.9% on 8/3 and 2/23.

- Enter after first touch of rising 50-day SMA following recent breakout.

- Entry U here. Stop 38.

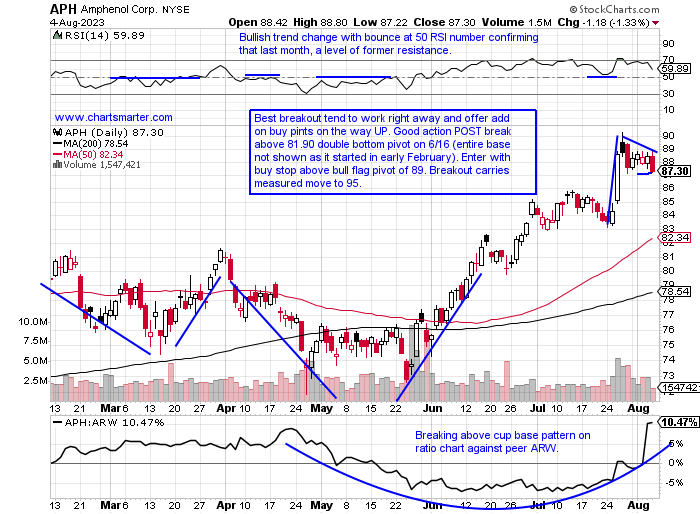

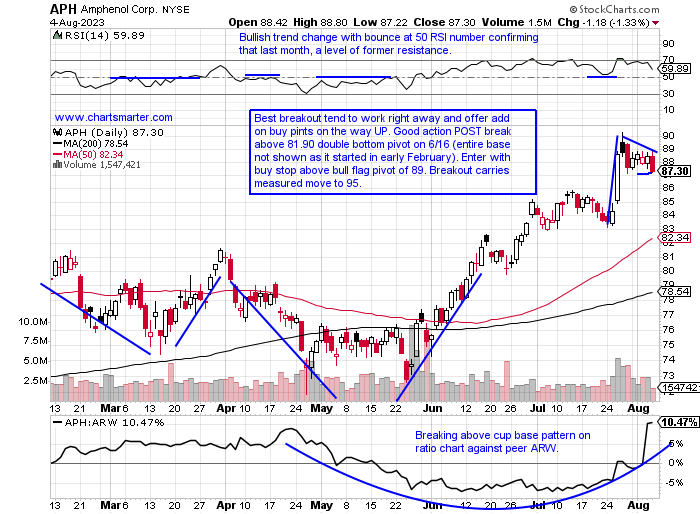

Amphenol:

- Electrical components play up 15% YTD and 13% over last one year period. Dividend yield of 1%.

- Name 3% off most recent 52-week highs and now ABOVE late 2021 highs, a very commendable achievement, taking out a long WEEKLY cup base and we know the longer the base the greater potential space higher on the breakout.

- Earnings reactions mixed up 5.1 and .6% on 7/26 and 10/26/22 and fell 1.3 and .1% on 4/26 and 1/25.

- Enter with buy stop above bull flag.

- Entry APH 89. Stop 87.

Good luck.

Entry summaries:

Buy after recent gap fill/bullish piercing line candle MU here. Stop 67.

Buy after first touch of rising 50-day SMA following recent breakout U here. Stop 38.

Buy stop above bull flag APH 89. Stop 87.

This article requires a Chartsmarter membership. Please click here to join.

Whistling Past The Graveyard:

- Last week we mentioned how the WEEKLY gravestone candle on AAPL which occurred right at the very round 200 number (round number theory) was something to be wary of before its earnings reaction. The last time that occurred almost exactly one year ago the week ending 8/19/22 started a 50-handle downtrend after a powerful 6-week win streak between the weeks ending 7/8-8/12. That also provided the pivot in a WEEKLY double bottom base and with this week's ugly action falling 7%, a retest of that area near 175 is certainly plausible. Now remember this will not have such a large impact on the Dow as it is a PRICE-weighted index and there are 11 of the 30 names that are trading above the 184 area where it trades, but it is still easily the largest holding in the Nasdaq 100, after the "special" rebalancing. It is the biggest component in the S&P 500 so this name carries a ton of influence, and with the tech sector already showing some signs of fatigue, this could be the trigger that starts a potential sell-off.

"Old Tech" Revival:

- As we look through the technology space as it may be in transition the next couple of months with weakness, some names are standing out, which could be because of their defensive nature. One can take a look at IBM, although it is extended here, which has advanced 10 of the last 12 weeks. It is on a 4-week win streak (and 13 of the last 15 sessions) and for the last 3 weeks has outperformed the Nasdaq, with the most notable being the week ending 7/21 where IBM added 4.1% and the Nasdaq fell .7%. INTC is also trying to resurrect itself but still has work to do on Gelsingers possible turnaround, but the week ending 6/16 that jumped more than 16% in the strongest WEEKLY volume in at least 5 years surely caught many off guard. Last week displayed good relative strength up more than 8%, doubling the gain of the SMH. Below is the chart of another tech dinosaur in JBL and it is well above the late 2021 highs, as the Nasdaq is still 2000 handles below it. It may be setting up for another northward.

Recent Examples:

- Earnings season can be a tricky one and I often will stress the importance of not holding into a number unless one has a good enough basis prior to the report. As well I will always capitalize the word CLOSE, which is of utter importance, as many triggers will be taken out mid-session only to finish below it which is usually a red flag. Below is the chart of DOCN and how it appeared in our 7/31 Technology Note and we stressed how a move above the very round 50 number should have been purchased, preferably after the release. Well, Friday the reaction was dismal as the name fell 25%. As good as a setup will look it is only acted upon with PRICE confirmation and that never came. It is now testing along its 200-day SMA, and it is most likely best to move one as this will need time to shake out as the institutions decide how they want to proceed going forward. And that is not even to mention the opportunity cost that will arise too.

Special Situations:

Micron:

- "Old tech" semi-play up 40% YTD and 8% over last one-year period. Dividend yield of .7%.

- Name 6% off most recent 52-week highs and decent relative "strength" this week down 1.8% as SMH fell nearly 4%. Good action this week digesting 16% combined run during 3-week win streak weeks ending between 7/14-28.

- Earnings reactions mixed up 7.2 and .2% on 3/29 and 9/30/22 and fell 4.1 and 3.5% on 6/29 and 12/22/22.

- Enter after recent gap fill/bullish piercing line candle.

- Entry MU here. Stop 67.

Unity Software:

- Software play up 40% YTD and down 11% over last one year period.

- Name 31% off most recent 52-week highs and has doubled since first week of May to top in late July. Soft relative strength this week down 11.5% compared to IGV slipping 3.5%.

- Earnings reactions mixed up 12.9 and 29.4% on 5/11 and 11/10/22 and fell .8 and 15.9% on 8/3 and 2/23.

- Enter after first touch of rising 50-day SMA following recent breakout.

- Entry U here. Stop 38.

Amphenol:

- Electrical components play up 15% YTD and 13% over last one year period. Dividend yield of 1%.

- Name 3% off most recent 52-week highs and now ABOVE late 2021 highs, a very commendable achievement, taking out a long WEEKLY cup base and we know the longer the base the greater potential space higher on the breakout.

- Earnings reactions mixed up 5.1 and .6% on 7/26 and 10/26/22 and fell 1.3 and .1% on 4/26 and 1/25.

- Enter with buy stop above bull flag.

- Entry APH 89. Stop 87.

Good luck.

Entry summaries:

Buy after recent gap fill/bullish piercing line candle MU here. Stop 67.

Buy after first touch of rising 50-day SMA following recent breakout U here. Stop 38.

Buy stop above bull flag APH 89. Stop 87.