Biotech Feels Firm:

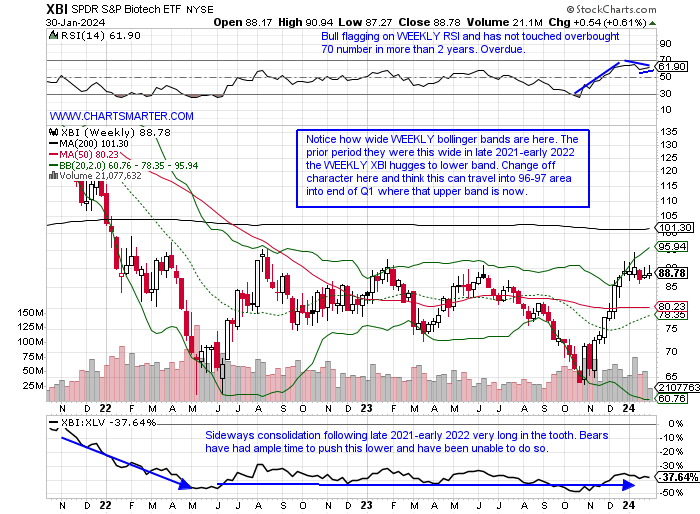

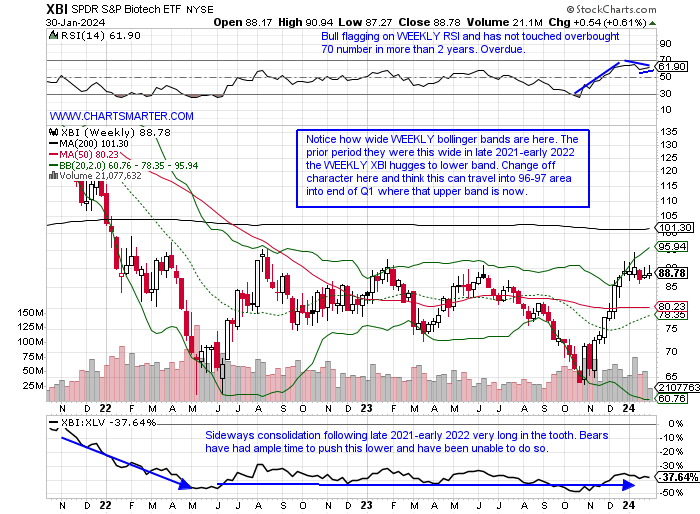

- As with an abundance of big tech firms REPORTING earnings this week, it may be wise to pivot one's attention to some overlooked parts of the market to potentially capitalize. The biotechs did record a powerful run last year in harmony with the overall market and they have since stalled. No one would fault those who are skeptical given their history, and therein may lie the opportunity. The WEEKLY chart below shows just how well the fund has been holding up at the very round 90 number. The prior 3 times it has tested that level witnessed drawdowns to 75, 72, and more recently 64 late last year, and note it started descending almost immediately. This is now the 6th week it is "glued" to 90 and I think that is encouraging for a move toward par in the near term. The period of the summer of 2022 and the present move to 90 was very similar, each taking roughly 9 weeks, and again the fact that it is keeping this altitude near the figure is a good sign. Some of the large names in the IBB are behaving themselves very well too with the AMGN bull flag, which has found support at the very round 300 within the formation. VRTX has broken above a bull flag and there has been plenty of M&A activity in the entire biotech arena. Taking a peek at the annual returns of the XBI over the last several years shows last year was the first single-digit move since 2017. Is it ready for another strong double-digit advance in 2024?

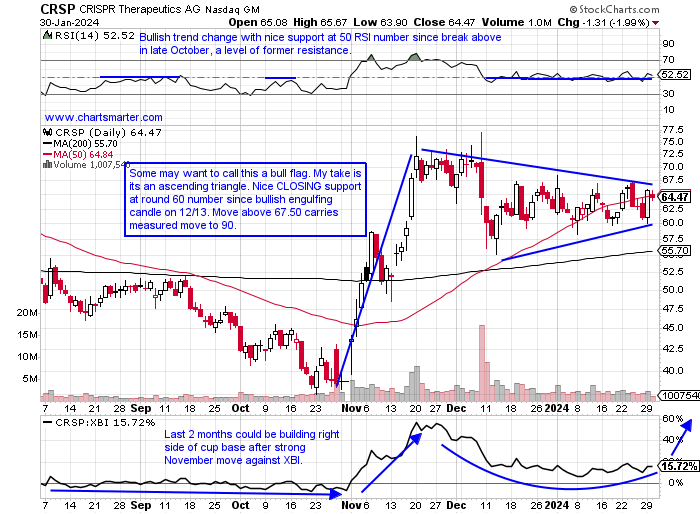

CRISPR Moment:

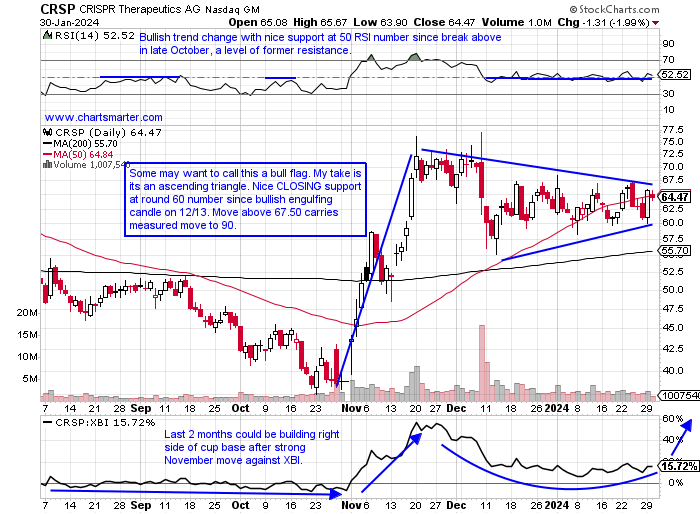

- I will be the first to say I know nothing about this biotechnology, but I am rooting for it. The charts of some of the names in this niche space are saying PRICES may want higher. TWST is 17% off most recent 52-week highs and REPORTS Friday before the open, but it went from 14 to 40 from last October to highs made at the end of December. It recently touched its rising 50-day SMA for the first time following a breakout and is now sporting a double-bottom pivot of 38.09 (notice how it has traded between leadership RSI parameters of 40/45-80/85 as well). BEAM is certainly the laggard of the trio now trading almost 50% off its annual peak. Below is the chart of CRSP which has some appealing technical qualities. Monday recorded a bullish engulfing candle and is now back above its 21-day EMA which is now starting to curl higher. Its MONTHLY chart is very attractive as it looks for its third straight CLOSE above its 21 MONTH EMA, a line it was below prior since September 2021 and it too is beginning to slope higher (notice the bearish shooting star in January 2021 led to a precipitous decline).

Recent Examples:

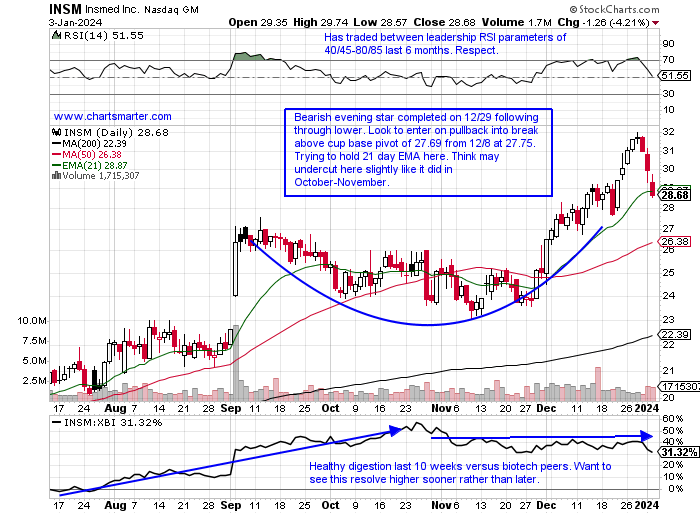

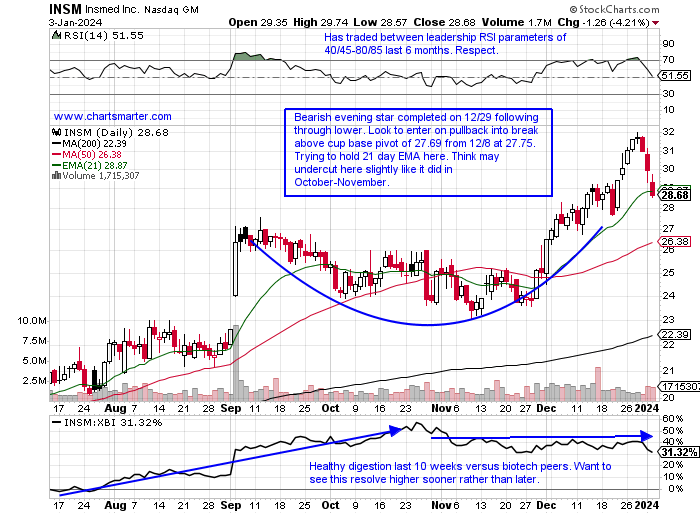

- Biotech names that trade in a taut manner are somewhat rare but those that do appeal to my style a bit more as I get older. Below could be a good example of this theme with the chart of INSM and how it appeared in our 1/4 Healthcare Note. One can see here how the completion of the bearish evening star on the last day of 2023 was an indication that some downside pressure was likely. That did occur and the stock, now 9% off most recent 52-week highs, has not advanced a single week in 2024 thus far. It is firming up at a prior cup base breakout area and its rising 50-day SMA for the first time following that move is often an ideal entry point (and notice the potential bullish MACD crossover looming). The stock is displaying good relative strength this week up 4.5% heading into Wednesday with the XBI higher by less than 1%. On the WEEKLY chart, we can see a possible bullish engulfing candle developing and so far it is successfully retesting that cup with handle pivot of 27.69 from the first week of last December.

Special Situations:

Repligen:

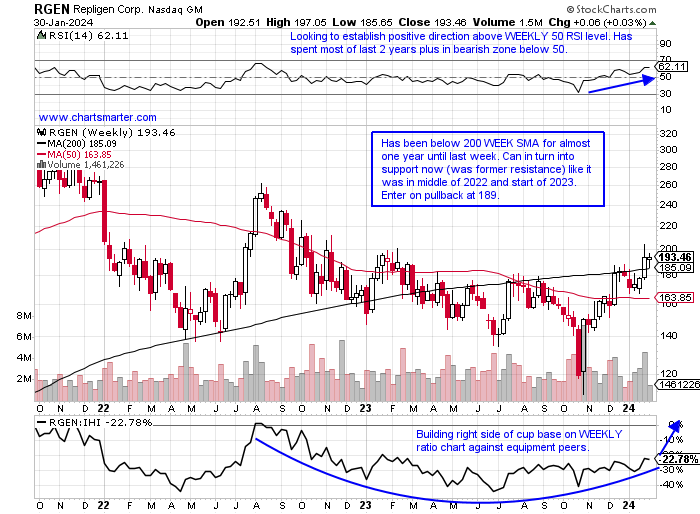

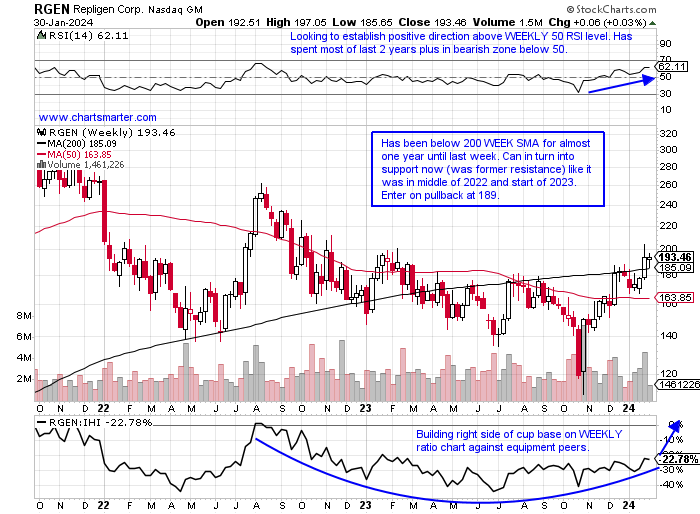

- Medical instruments play up 7% YTD and over last one year period.

- Name 5% off most recent 52-week highs and looking for first 4-week win streak since summer of 2022. DAILY chart shows issues with very round 200 number but still well above double bottom breakout pivot of 180.64.

- Earnings reactions mostly higher up 17.9, 2, and 2.4% on 10/31, 8/2, and 5/2, and fell 4.5% on 2/22.

- Enter on pullback into WEEKLY 200-day SMA.

- Entry RGEN 189. Stop 179.

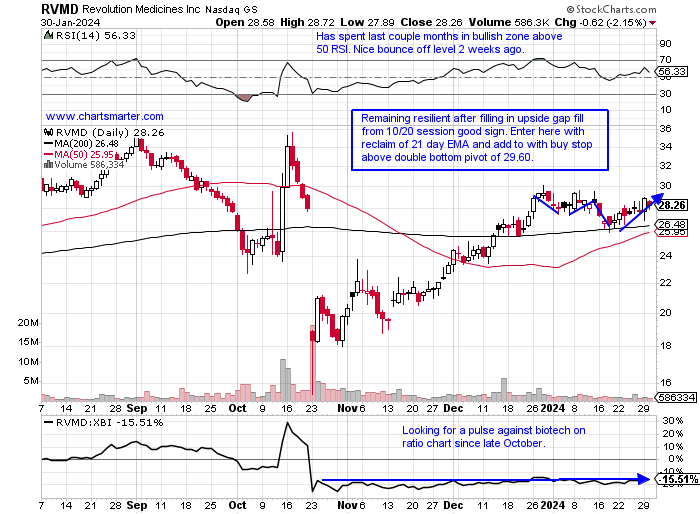

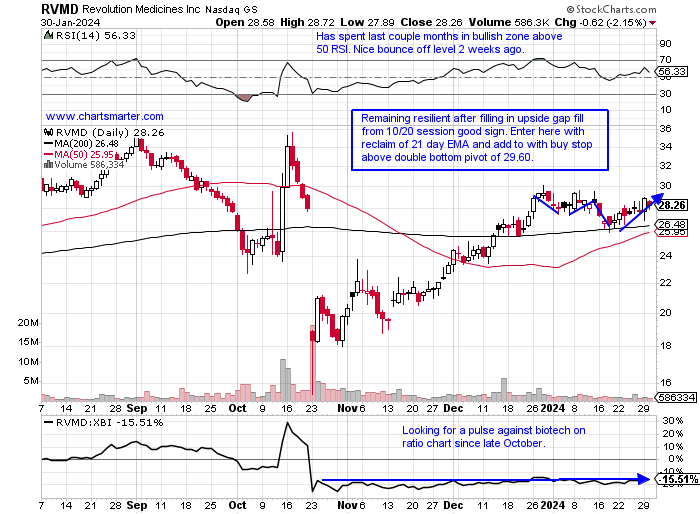

Revolution Medicines:

- Biotech play down 1% YTD and up 6% over last one year period.

- Name 21% off most recent 52-week highs and doubled in PRICE since last October to recent highs at round 30 number as a bull flag forms. Add to with buy stop above WEEKLY bull flag pivot of 29. Breakout carries measured move to 44.

- Earnings reactions mixed down .2 and 1.8% on 11/7 and 8/9 and rose 3.1 and 9.8% on 5/9 and 2/28.

- Enter after reclaim of 21-day EMA.

- Entry RVMD here. Stop 26.50.

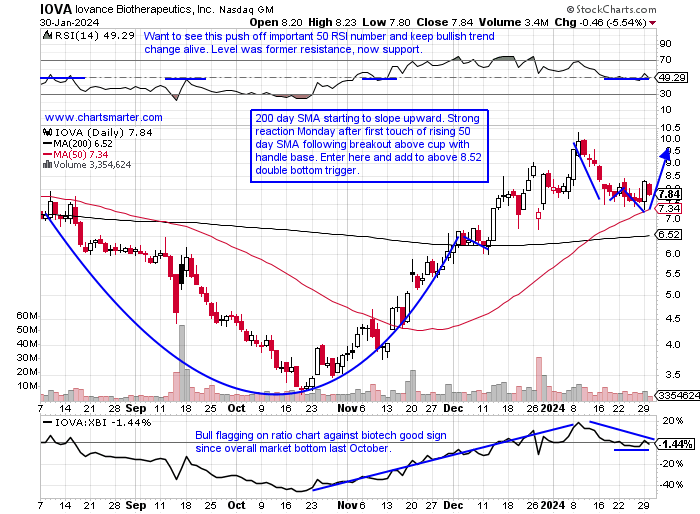

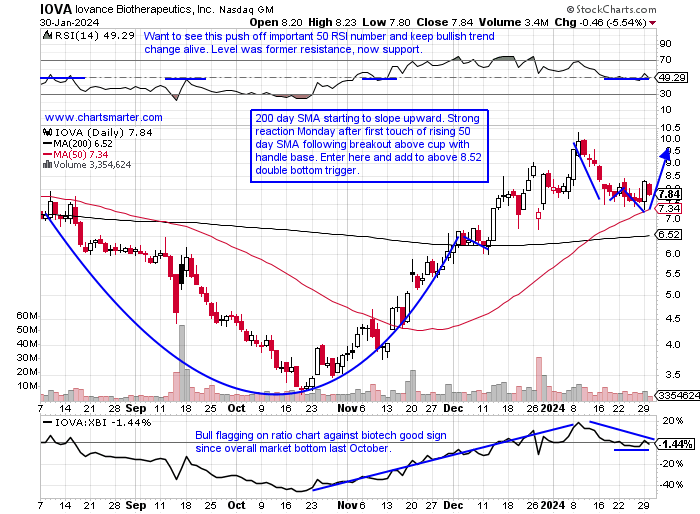

Iovance Therapeutics:

- Biotech play down 4% YTD and 2% over last one year period.

- Name 24% off most recent 52-week highs and found some pushback at very round 10 number after a huge 221% advance from low to highs of range between late October and January. Briefly broke lower highs with shooting start candle week ending 1/12, dating back to start of 2021.

- Earnings reactions mostly higher up 6.4, 3.8, and .1% on 8/9, 5/10, and 3/1, and fell 3.5% on 11/8.

- Enter after first touch of rising 50-day SMA following breakout.

- Entry IOVA here. Stop 7.40.

Good luck.

Entry summaries:

Buy pullback into WEEKLY 200-day SMA RGEN 189. Stop 179.

Buy reclaim of 21 day EMA RVMD here. Stop 26.50.

Buy first touch of rising 50-day SMA following breakout IOVA here. Stop 7.40.

This article requires a Chartsmarter membership. Please click here to join.

Biotech Feels Firm:

- As with an abundance of big tech firms REPORTING earnings this week, it may be wise to pivot one's attention to some overlooked parts of the market to potentially capitalize. The biotechs did record a powerful run last year in harmony with the overall market and they have since stalled. No one would fault those who are skeptical given their history, and therein may lie the opportunity. The WEEKLY chart below shows just how well the fund has been holding up at the very round 90 number. The prior 3 times it has tested that level witnessed drawdowns to 75, 72, and more recently 64 late last year, and note it started descending almost immediately. This is now the 6th week it is "glued" to 90 and I think that is encouraging for a move toward par in the near term. The period of the summer of 2022 and the present move to 90 was very similar, each taking roughly 9 weeks, and again the fact that it is keeping this altitude near the figure is a good sign. Some of the large names in the IBB are behaving themselves very well too with the AMGN bull flag, which has found support at the very round 300 within the formation. VRTX has broken above a bull flag and there has been plenty of M&A activity in the entire biotech arena. Taking a peek at the annual returns of the XBI over the last several years shows last year was the first single-digit move since 2017. Is it ready for another strong double-digit advance in 2024?

CRISPR Moment:

- I will be the first to say I know nothing about this biotechnology, but I am rooting for it. The charts of some of the names in this niche space are saying PRICES may want higher. TWST is 17% off most recent 52-week highs and REPORTS Friday before the open, but it went from 14 to 40 from last October to highs made at the end of December. It recently touched its rising 50-day SMA for the first time following a breakout and is now sporting a double-bottom pivot of 38.09 (notice how it has traded between leadership RSI parameters of 40/45-80/85 as well). BEAM is certainly the laggard of the trio now trading almost 50% off its annual peak. Below is the chart of CRSP which has some appealing technical qualities. Monday recorded a bullish engulfing candle and is now back above its 21-day EMA which is now starting to curl higher. Its MONTHLY chart is very attractive as it looks for its third straight CLOSE above its 21 MONTH EMA, a line it was below prior since September 2021 and it too is beginning to slope higher (notice the bearish shooting star in January 2021 led to a precipitous decline).

Recent Examples:

- Biotech names that trade in a taut manner are somewhat rare but those that do appeal to my style a bit more as I get older. Below could be a good example of this theme with the chart of INSM and how it appeared in our 1/4 Healthcare Note. One can see here how the completion of the bearish evening star on the last day of 2023 was an indication that some downside pressure was likely. That did occur and the stock, now 9% off most recent 52-week highs, has not advanced a single week in 2024 thus far. It is firming up at a prior cup base breakout area and its rising 50-day SMA for the first time following that move is often an ideal entry point (and notice the potential bullish MACD crossover looming). The stock is displaying good relative strength this week up 4.5% heading into Wednesday with the XBI higher by less than 1%. On the WEEKLY chart, we can see a possible bullish engulfing candle developing and so far it is successfully retesting that cup with handle pivot of 27.69 from the first week of last December.

Special Situations:

Repligen:

- Medical instruments play up 7% YTD and over last one year period.

- Name 5% off most recent 52-week highs and looking for first 4-week win streak since summer of 2022. DAILY chart shows issues with very round 200 number but still well above double bottom breakout pivot of 180.64.

- Earnings reactions mostly higher up 17.9, 2, and 2.4% on 10/31, 8/2, and 5/2, and fell 4.5% on 2/22.

- Enter on pullback into WEEKLY 200-day SMA.

- Entry RGEN 189. Stop 179.

Revolution Medicines:

- Biotech play down 1% YTD and up 6% over last one year period.

- Name 21% off most recent 52-week highs and doubled in PRICE since last October to recent highs at round 30 number as a bull flag forms. Add to with buy stop above WEEKLY bull flag pivot of 29. Breakout carries measured move to 44.

- Earnings reactions mixed down .2 and 1.8% on 11/7 and 8/9 and rose 3.1 and 9.8% on 5/9 and 2/28.

- Enter after reclaim of 21-day EMA.

- Entry RVMD here. Stop 26.50.

Iovance Therapeutics:

- Biotech play down 4% YTD and 2% over last one year period.

- Name 24% off most recent 52-week highs and found some pushback at very round 10 number after a huge 221% advance from low to highs of range between late October and January. Briefly broke lower highs with shooting start candle week ending 1/12, dating back to start of 2021.

- Earnings reactions mostly higher up 6.4, 3.8, and .1% on 8/9, 5/10, and 3/1, and fell 3.5% on 11/8.

- Enter after first touch of rising 50-day SMA following breakout.

- Entry IOVA here. Stop 7.40.

Good luck.

Entry summaries:

Buy pullback into WEEKLY 200-day SMA RGEN 189. Stop 179.

Buy reclaim of 21 day EMA RVMD here. Stop 26.50.

Buy first touch of rising 50-day SMA following breakout IOVA here. Stop 7.40.