The healthcare group has been somewhat of a laggard this year as it is 7th of 9 on one week, 8th of 9 on one month time frame and 7th of 9 on the one year period regarding the major S&P groups (to be fair on a 3 and 6 month basis it has acted fourth and second best). With any group it pays to watch its generals and the name we will look at tonight is a best of breed name KITE. Once this group gets the wind behind its back this name could fly even stronger than it has. It is higher YTD by a robust 170% and the chart shows no sign of slowing down. It did REPORT earnings Tuesday morning, but like any leading stock it has offered add on buy points HIGHER, not lower, along the way. Below we take a look at the name and how we profiled it twice in the last 2 months and at the very bottom of the post the current outlook.

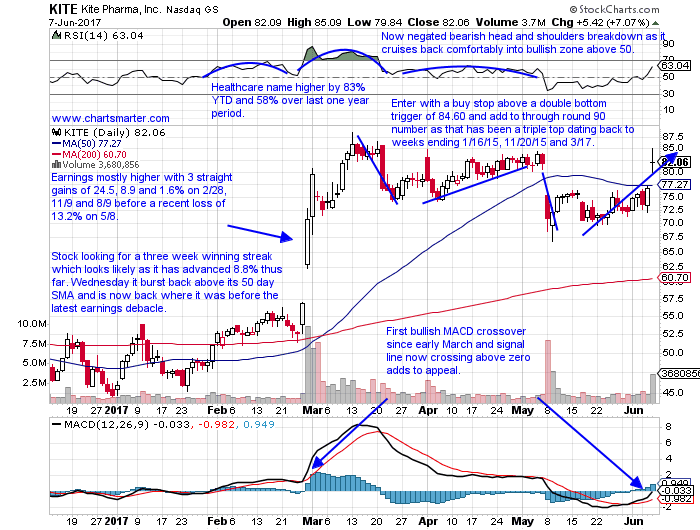

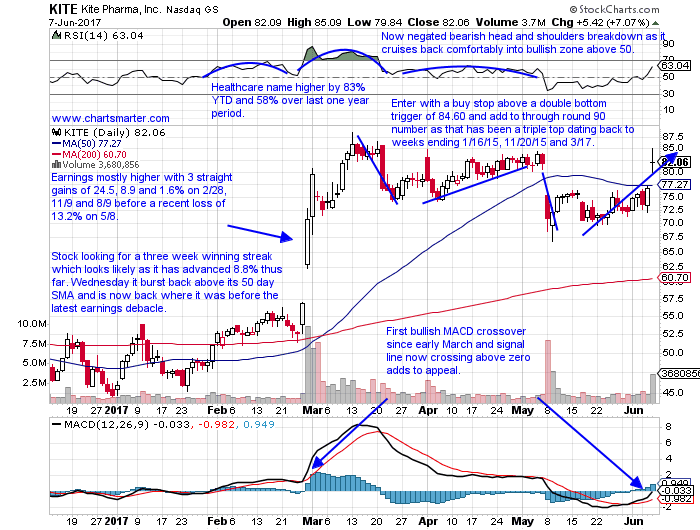

This is how we looked at the stock in our Thursday 6/8 Game Plan. Stocks that can be bought as they take out double bottom triggers are KITE. KITE is a healthcare name higher by 83% YTD and 58% over last one year period. Earnings have been mostly higher with 3 straight gains of 24.5, 8.9 and 1.6% on 2/28, 11/9 and 8/9 before a recent loss of 13.2% on 5/8. The stock is looking for a three week winning streak which looks likely as it has advanced 8.8% thus far. Wednesday it burst back above its 50 day SMA and is now back where it was before the latest earnings debacle. Enter KITE with a buy stop above a double bottom trigger of 84.60 and add to through round 90 number as that has been a triple top dating back to weeks ending 1/16/15, 11/20/15 and 3/17 (it is now up more than 30% from the double bottom breakout trigger).

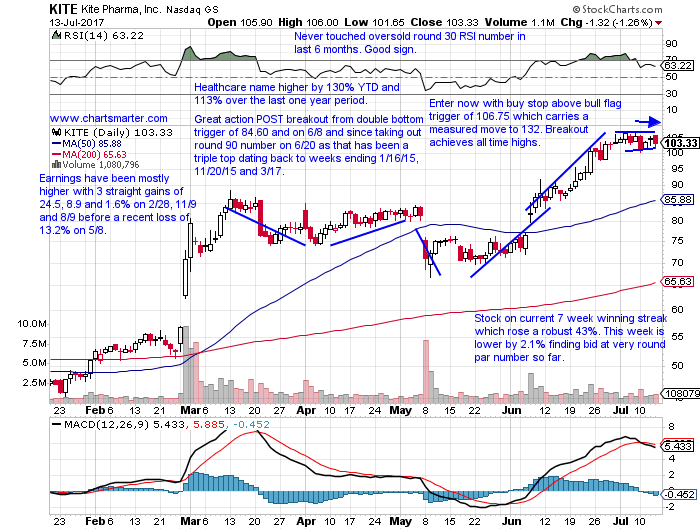

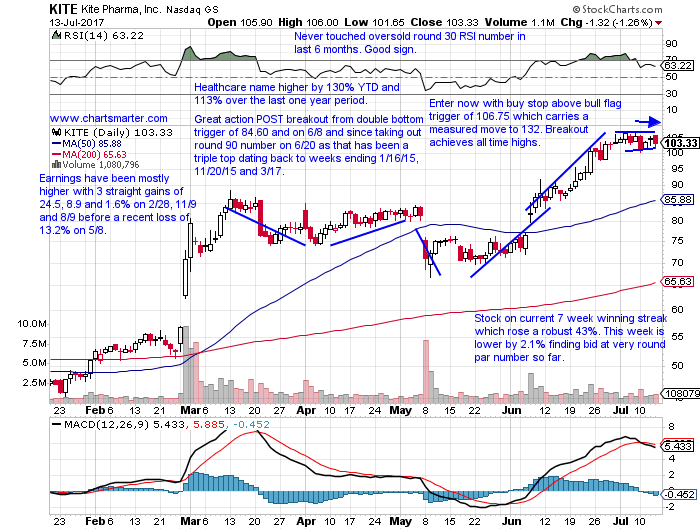

This is how we looked at the stock in our Friday 7/14 Game Plan. Stocks that can be bought as they take out bull flag triggers are KITE. KITE is a healthcare name higher by 130% YTD and 113% over the last one year period. Earnings have been mostly higher with 3 straight gains of 24.5, 8.9 and 1.6% on 2/28, 11/9 and 8/9 before a recent loss of 13.2% on 5/8. The stock is on current 7 week winning streak which rose a robust 43%. This week is lower by 2.1% finding bid at very round par number so far. It has demonstrated great action POST breakout from double bottom trigger of 84.60 and on 6/8 and since taking out round 90 number on 6/20 as that has been a triple top dating back to weeks ending 1/16/15, 11/20/15 and 3/17. Enter KITE with buy stop above bull flag trigger of 106.75 which carries a measured move to 132. Breakout achieves all time highs.

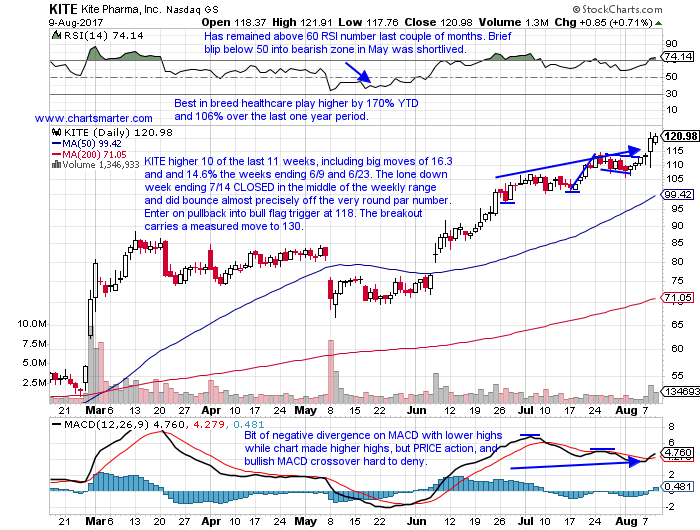

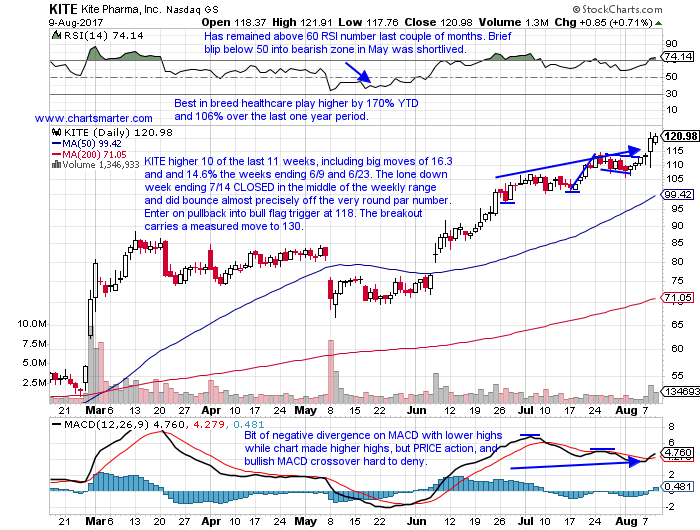

Looking presently at the name it broke above yet another bull flag trigger of 115. It rose 5.8% on 8/8 after earnings were disclosed and had produced three consecutive gains after earnings prior before the recent loss of 13.2% on 5/8. The stock sits just 1% off all time highs and is higher by 317% since inception in June '14. KITE is now higher 10 of the last 11 weeks and the lone down week ending 7/14 CLOSED in the middle of the weekly range (this week has advanced 7.5% thus far) and did bounce almost precisely off the very round par number. Look to enter KITE on a slight pullback into bull flag trigger at 118. The breakout carries a measured move to 130.

Trigger KITE 118. Stop 107.75.

If you like what you read why not take a 2 week FREE trial at www.chartsmarter.com

The healthcare group has been somewhat of a laggard this year as it is 7th of 9 on one week, 8th of 9 on one month time frame and 7th of 9 on the one year period regarding the major S&P groups (to be fair on a 3 and 6 month basis it has acted fourth and second best). With any group it pays to watch its generals and the name we will look at tonight is a best of breed name KITE. Once this group gets the wind behind its back this name could fly even stronger than it has. It is higher YTD by a robust 170% and the chart shows no sign of slowing down. It did REPORT earnings Tuesday morning, but like any leading stock it has offered add on buy points HIGHER, not lower, along the way. Below we take a look at the name and how we profiled it twice in the last 2 months and at the very bottom of the post the current outlook.

This is how we looked at the stock in our Thursday 6/8 Game Plan. Stocks that can be bought as they take out double bottom triggers are KITE. KITE is a healthcare name higher by 83% YTD and 58% over last one year period. Earnings have been mostly higher with 3 straight gains of 24.5, 8.9 and 1.6% on 2/28, 11/9 and 8/9 before a recent loss of 13.2% on 5/8. The stock is looking for a three week winning streak which looks likely as it has advanced 8.8% thus far. Wednesday it burst back above its 50 day SMA and is now back where it was before the latest earnings debacle. Enter KITE with a buy stop above a double bottom trigger of 84.60 and add to through round 90 number as that has been a triple top dating back to weeks ending 1/16/15, 11/20/15 and 3/17 (it is now up more than 30% from the double bottom breakout trigger).

This is how we looked at the stock in our Friday 7/14 Game Plan. Stocks that can be bought as they take out bull flag triggers are KITE. KITE is a healthcare name higher by 130% YTD and 113% over the last one year period. Earnings have been mostly higher with 3 straight gains of 24.5, 8.9 and 1.6% on 2/28, 11/9 and 8/9 before a recent loss of 13.2% on 5/8. The stock is on current 7 week winning streak which rose a robust 43%. This week is lower by 2.1% finding bid at very round par number so far. It has demonstrated great action POST breakout from double bottom trigger of 84.60 and on 6/8 and since taking out round 90 number on 6/20 as that has been a triple top dating back to weeks ending 1/16/15, 11/20/15 and 3/17. Enter KITE with buy stop above bull flag trigger of 106.75 which carries a measured move to 132. Breakout achieves all time highs.

Looking presently at the name it broke above yet another bull flag trigger of 115. It rose 5.8% on 8/8 after earnings were disclosed and had produced three consecutive gains after earnings prior before the recent loss of 13.2% on 5/8. The stock sits just 1% off all time highs and is higher by 317% since inception in June '14. KITE is now higher 10 of the last 11 weeks and the lone down week ending 7/14 CLOSED in the middle of the weekly range (this week has advanced 7.5% thus far) and did bounce almost precisely off the very round par number. Look to enter KITE on a slight pullback into bull flag trigger at 118. The breakout carries a measured move to 130.

Trigger KITE 118. Stop 107.75.

If you like what you read why not take a 2 week FREE trial at www.chartsmarter.com