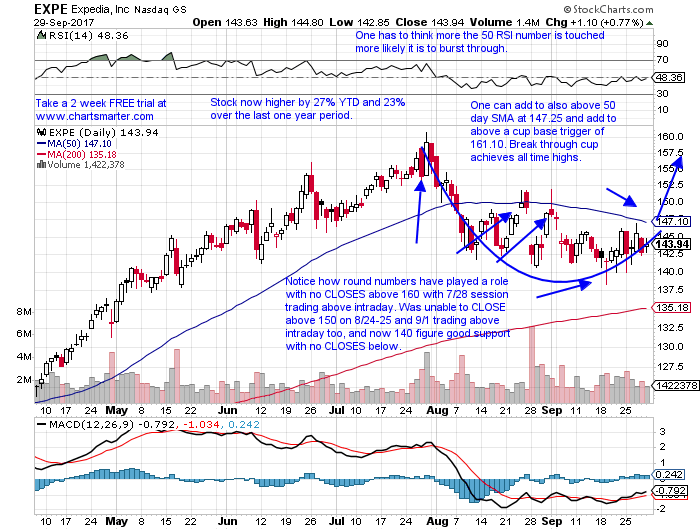

The leisure space has been holding its own during the market rally and consumers as many have mentioned have not stopped their spending habits, but seem now to be more selective in how they spend their hard earned cash. One name that I used to follow to gauge how flush consumers were feeling was PII. If they felt good enough to purchase snowmobiles and the like, that was a good sign (its chart at the moment is not frosty at all). Consumers now seem to be looking to find enjoyment in experiences and stocks like MAR, 1% off all time highs confirm this. Below is the chart of EXPE and how we profiled the name in our Friday 9/22 Game Plan, and then we take a updated view at the end of this post.

Stocks that can be bought as they touch the lower ends of bullish falling wedge patterns are EXPE. EXPE is a leisure play higher by 26% YTD and 33% over the last one year period and sports a small dividend yield of .8%. Earnings have been mixed with gains of 3.4 and 4.1% on 7/28 and 10/28 and losses of 1.8 and .5% on 4/28 and 2/10 (most recent reaction hit an all time high at round 160 number). The stock is lower 5 of the last 7 weeks and this week up by .7% heading into Friday. It is now 11% off most recent 52 week highs and testing a long cup base trigger of 140.61 taken out the week ending 5/19 that began the week ending 11/6/15. Enter EXPE at 141 near the bottom of a bullish falling wedge pattern.

Trigger EXPE 141. Stop 134.

A present look at EXPE has the stock now higher by 27% YTD and 23% over the last one year period. The stock is still in correction mode now 11% off most recent all time highs (keep in mind it is acting much better than peers TRIP and TRVG now trading off by 39 and 55% off their most recent 52 week highs) and its 50 day SMA is still sloping lower. It has declined 6 of the last 9 weeks, but is holding the round 140 number now which is important as that is for the moment successfully retesting a 140.61 cup base trigger that started way back during week ending 11/6/15. After adding above the falling wedge from chart in first paragraph add to above the 50 day SMA at 147.25 and then through a cup base trigger of 161.10.

If you like what you read why not take a 2 week FREE trial at www.chartsmarter.com.

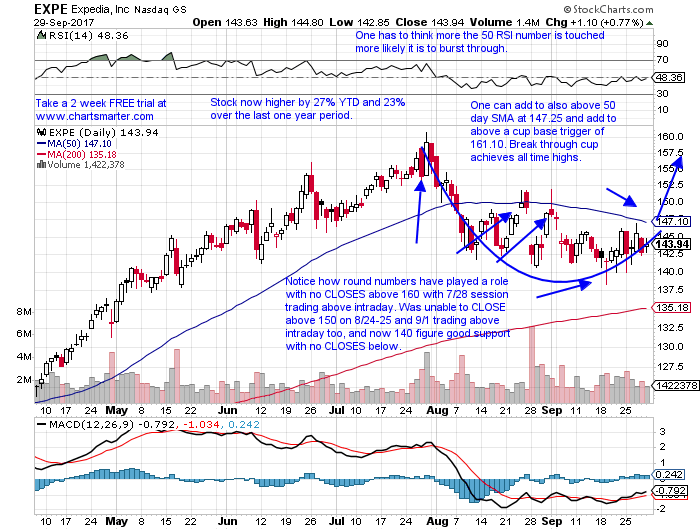

The leisure space has been holding its own during the market rally and consumers as many have mentioned have not stopped their spending habits, but seem now to be more selective in how they spend their hard earned cash. One name that I used to follow to gauge how flush consumers were feeling was PII. If they felt good enough to purchase snowmobiles and the like, that was a good sign (its chart at the moment is not frosty at all). Consumers now seem to be looking to find enjoyment in experiences and stocks like MAR, 1% off all time highs confirm this. Below is the chart of EXPE and how we profiled the name in our Friday 9/22 Game Plan, and then we take a updated view at the end of this post.

Stocks that can be bought as they touch the lower ends of bullish falling wedge patterns are EXPE. EXPE is a leisure play higher by 26% YTD and 33% over the last one year period and sports a small dividend yield of .8%. Earnings have been mixed with gains of 3.4 and 4.1% on 7/28 and 10/28 and losses of 1.8 and .5% on 4/28 and 2/10 (most recent reaction hit an all time high at round 160 number). The stock is lower 5 of the last 7 weeks and this week up by .7% heading into Friday. It is now 11% off most recent 52 week highs and testing a long cup base trigger of 140.61 taken out the week ending 5/19 that began the week ending 11/6/15. Enter EXPE at 141 near the bottom of a bullish falling wedge pattern.

Trigger EXPE 141. Stop 134.

A present look at EXPE has the stock now higher by 27% YTD and 23% over the last one year period. The stock is still in correction mode now 11% off most recent all time highs (keep in mind it is acting much better than peers TRIP and TRVG now trading off by 39 and 55% off their most recent 52 week highs) and its 50 day SMA is still sloping lower. It has declined 6 of the last 9 weeks, but is holding the round 140 number now which is important as that is for the moment successfully retesting a 140.61 cup base trigger that started way back during week ending 11/6/15. After adding above the falling wedge from chart in first paragraph add to above the 50 day SMA at 147.25 and then through a cup base trigger of 161.10.

If you like what you read why not take a 2 week FREE trial at www.chartsmarter.com.