Energy has been a clear leader going into last year, and that performance is gushing over into 2018, pun intended. As I have said recently to people who have commented that it represents lousy leadership, it could be true but PRICE action must be respected. It could also be giving other sectors that investors may prefer to lead, like technology a chance to catch its breath after a big move last year. It feels like shorts are being unwound on a daily basis, and in a perfect storm for bulls, natural longs like to see 3% GDP prints that show economic growth. And on top of that global growth is powerful. The XLE is looking for a 3 week winning streak and is rapidly seeking out a 78.45 cup base trigger in a pattern nearly 13 months long. Below is a best of breed energy play that we look at in a past and present view.

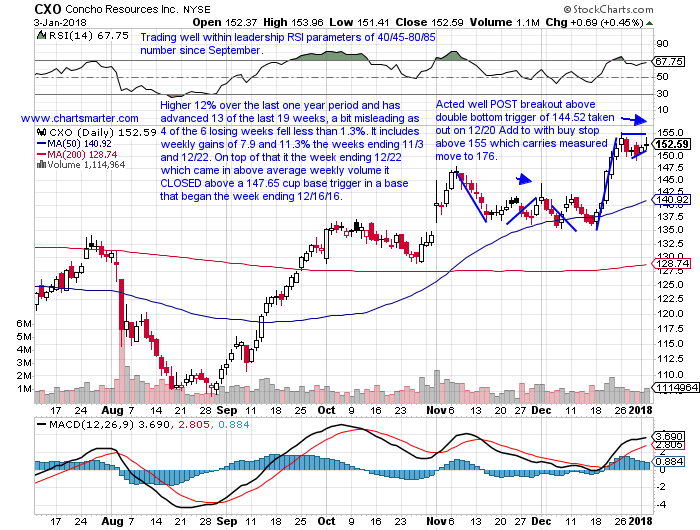

Stocks that can be bought after recent initial touches of their 50 day SMAs following breakouts are CXO. CXO is an energy play higher by 6% YTD and lower by 1% over the last one year period. Earnings have been mostly lower with three straight losses of 8.7, 1.3 and 6.8% on 8/3, 5/4 and 2/22 before a recent gain of 4.5% on 11/1. The stock is higher 12 of the last 16 weeks, with 3 of the down weeks off less than 1.3%, and shows good volume trends. It has acted well POST breakout from a 134.15 cup base breakout trigger taken out on 10/2 and on 11/29 tested its 50 day SMA for the first time after the break. Enter CXO here and add to above a 144.52 double bottom trigger. Successful gap fill from 10/31 session on 12/7 adds to bullish appeal.

Trigger CXO here. Stop 135.

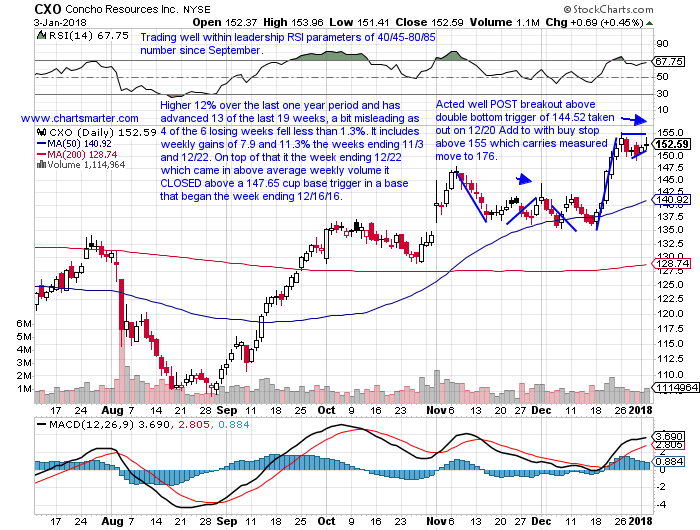

Taking a present view CXO is now higher by 12% over the last one year period and has advanced 13 of the last 19 weeks, a bit misleading as 4 of the 6 losing weeks fell less than 1.3%. It includes weekly gains of 7.9 and 11.3% the weeks ending 11/3 and 12/22. On top of that it the week ending 12/22, which came in above average weekly volume it CLOSED above a 147.65 cup base trigger in a base that began the week ending 12/16/16. It has acted well POST breakout from a recent move above a double bottom trigger of 144.52 taken out on 12/20 and now sports a bull flag. Add to CXO with a buy stop above 155 which carries a measured move to 176.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com.

Energy has been a clear leader going into last year, and that performance is gushing over into 2018, pun intended. As I have said recently to people who have commented that it represents lousy leadership, it could be true but PRICE action must be respected. It could also be giving other sectors that investors may prefer to lead, like technology a chance to catch its breath after a big move last year. It feels like shorts are being unwound on a daily basis, and in a perfect storm for bulls, natural longs like to see 3% GDP prints that show economic growth. And on top of that global growth is powerful. The XLE is looking for a 3 week winning streak and is rapidly seeking out a 78.45 cup base trigger in a pattern nearly 13 months long. Below is a best of breed energy play that we look at in a past and present view.

Stocks that can be bought after recent initial touches of their 50 day SMAs following breakouts are CXO. CXO is an energy play higher by 6% YTD and lower by 1% over the last one year period. Earnings have been mostly lower with three straight losses of 8.7, 1.3 and 6.8% on 8/3, 5/4 and 2/22 before a recent gain of 4.5% on 11/1. The stock is higher 12 of the last 16 weeks, with 3 of the down weeks off less than 1.3%, and shows good volume trends. It has acted well POST breakout from a 134.15 cup base breakout trigger taken out on 10/2 and on 11/29 tested its 50 day SMA for the first time after the break. Enter CXO here and add to above a 144.52 double bottom trigger. Successful gap fill from 10/31 session on 12/7 adds to bullish appeal.

Trigger CXO here. Stop 135.

Taking a present view CXO is now higher by 12% over the last one year period and has advanced 13 of the last 19 weeks, a bit misleading as 4 of the 6 losing weeks fell less than 1.3%. It includes weekly gains of 7.9 and 11.3% the weeks ending 11/3 and 12/22. On top of that it the week ending 12/22, which came in above average weekly volume it CLOSED above a 147.65 cup base trigger in a base that began the week ending 12/16/16. It has acted well POST breakout from a recent move above a double bottom trigger of 144.52 taken out on 12/20 and now sports a bull flag. Add to CXO with a buy stop above 155 which carries a measured move to 176.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com.