We like to employ as few strategies here at ChartSmarter to keep it simple, but one thing we constantly do is focus purely on PRICE action. It must confirm the trigger on a CLOSING basis. We are big proponents of round number theory, ascending triangles and gap fills and today we look at an example of entering with a buy stop above the 50 day SMA. This was a unique example as we like the line to be upward sloping at the time of entry, but this name was in a strong uptrend, as it has now tripled from the lows dating back to the week ending 8/20/16, so the risk/reward was there. Often it will offer an additional buy point and FBR broke above a double bottom trigger as well of 16.72 on 1/22. Below is how we looked at the name in our Wednesday 1/3 Game Plan and then the second chart will offer a current view on the stock.

Stocks that can be bought as they take out the their 50 day SMAs and added to through future valid base triggers are FBR. FBR is a Brazilian paper play higher by 54% over the last one year period and sports a dividend yield of 1.4%. Earnings have been mostly lower with three straight losses of 2.9, .4 and 7.7% on 7/25, 4/26 and 1/31 before a recent gain of 6.1% on 11/9. The stock is higher 3 of the last 4 weeks, but to be fair it fell 6 of the 7 prior to that including a 15% slump the weeks ending 11/24-12/1. It held the 14 number nicely about one month ago, important as that was stiff resistance through most of 2015. Enter FBR with a buy stop above its 50 day SMA at 15.25 and add to above a double bottom trigger of 16.72.

Trigger FBR 15.25. Stop 14.15.

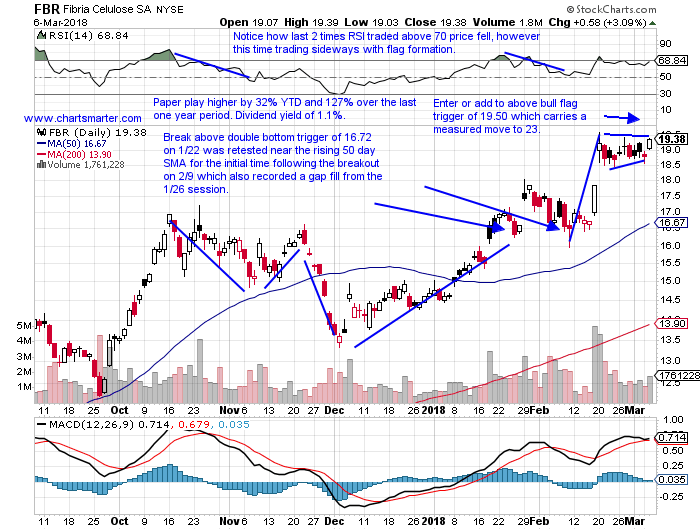

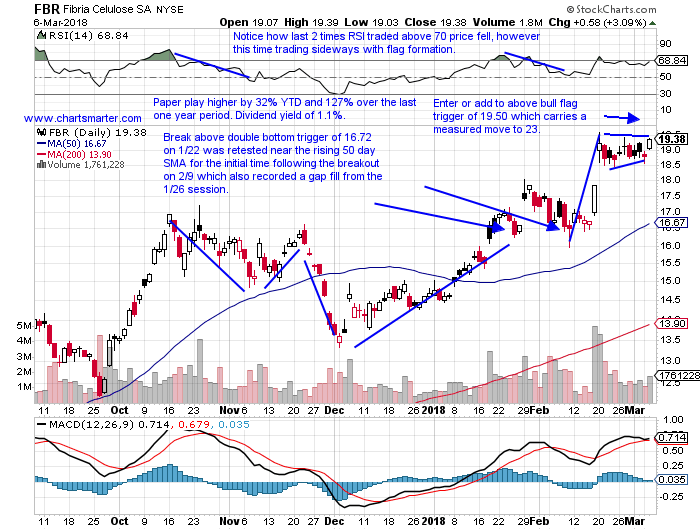

FBR is now higher by 32% YTD and 127% over the last one year period and sports a dividend yield of 1.1%. It is now higher 10 of the last 13 weeks and this week by 2.3% already so far. The week ending 2/23 produced a bearish shooting star and last week a doji candle which can often signal a weakening of the prior trend, but remember PRICE action is omnipotent. One can now enter FBR or add to above bull flag trigger of 19.50 which carries a measured move to 23. Notice the flag commenced with a gap fill on 2/9 from the 1/26 session.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com

We like to employ as few strategies here at ChartSmarter to keep it simple, but one thing we constantly do is focus purely on PRICE action. It must confirm the trigger on a CLOSING basis. We are big proponents of round number theory, ascending triangles and gap fills and today we look at an example of entering with a buy stop above the 50 day SMA. This was a unique example as we like the line to be upward sloping at the time of entry, but this name was in a strong uptrend, as it has now tripled from the lows dating back to the week ending 8/20/16, so the risk/reward was there. Often it will offer an additional buy point and FBR broke above a double bottom trigger as well of 16.72 on 1/22. Below is how we looked at the name in our Wednesday 1/3 Game Plan and then the second chart will offer a current view on the stock.

Stocks that can be bought as they take out the their 50 day SMAs and added to through future valid base triggers are FBR. FBR is a Brazilian paper play higher by 54% over the last one year period and sports a dividend yield of 1.4%. Earnings have been mostly lower with three straight losses of 2.9, .4 and 7.7% on 7/25, 4/26 and 1/31 before a recent gain of 6.1% on 11/9. The stock is higher 3 of the last 4 weeks, but to be fair it fell 6 of the 7 prior to that including a 15% slump the weeks ending 11/24-12/1. It held the 14 number nicely about one month ago, important as that was stiff resistance through most of 2015. Enter FBR with a buy stop above its 50 day SMA at 15.25 and add to above a double bottom trigger of 16.72.

Trigger FBR 15.25. Stop 14.15.

FBR is now higher by 32% YTD and 127% over the last one year period and sports a dividend yield of 1.1%. It is now higher 10 of the last 13 weeks and this week by 2.3% already so far. The week ending 2/23 produced a bearish shooting star and last week a doji candle which can often signal a weakening of the prior trend, but remember PRICE action is omnipotent. One can now enter FBR or add to above bull flag trigger of 19.50 which carries a measured move to 23. Notice the flag commenced with a gap fill on 2/9 from the 1/26 session.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com