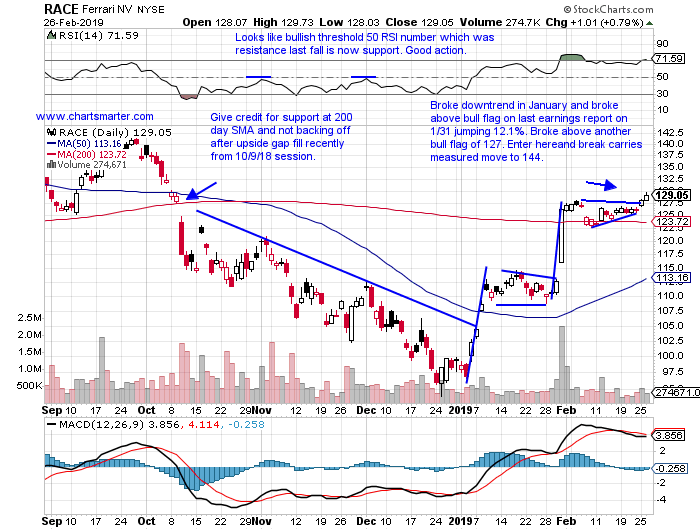

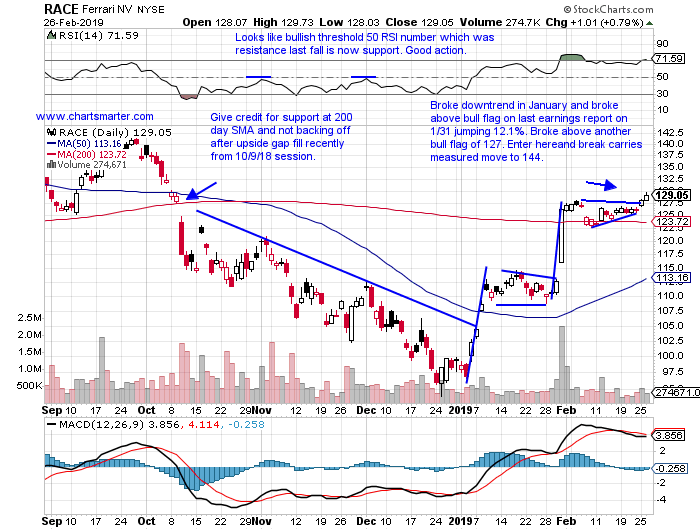

The automobile space has been slow to move over the years, pun intended. Names like F have seemed like dead money, HMC still trades 17% off most recent 52 week highs (give GM credit as it battles here with the round 40 number and still pays a handsome dividend of 3.8%). Below is the chart of RACE and how it appeared in our 2/27 Consumer Sector Report. And later we will take a look at its current chart.

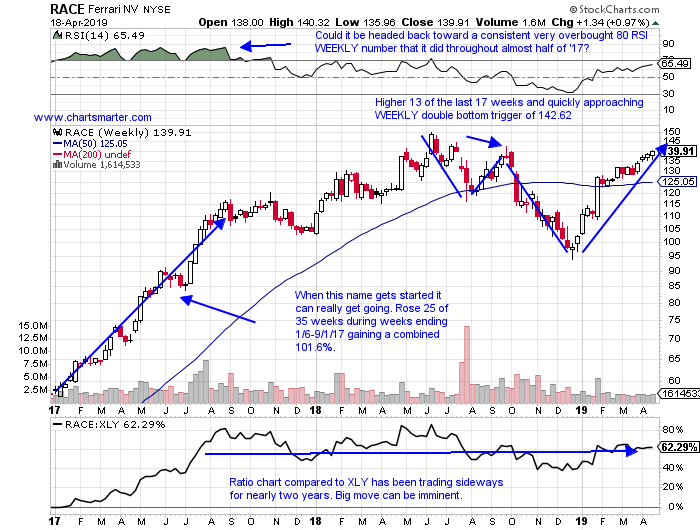

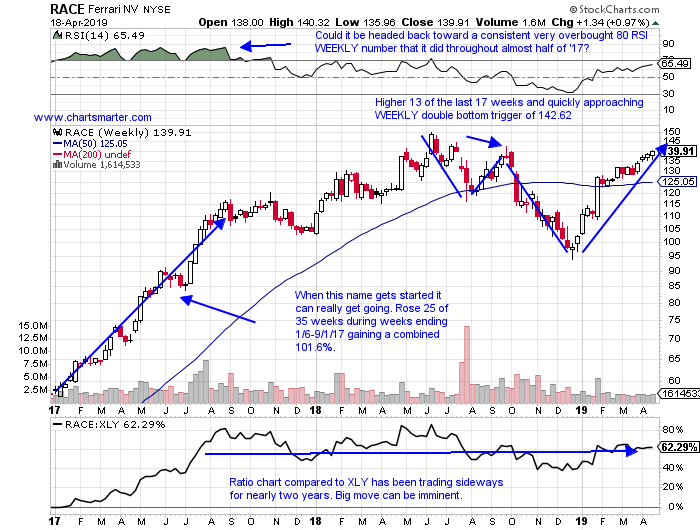

We always like to mention that the best breakouts tend to work right away and leading stocks will give investors a chance to add to their positions on the way UP. Here is a good example with the present WEEKLY chart of RACE. It has move 10 handles since the flag breakout above and now one can enter or add to with a buy stop above a 142.62 double bottom pivot. The name trades just 7% off most recent 52 week highs, while F is 21% off its own highs, TSLA is 29% off its own recent peak, and NIO is 65% off its September highs.

Thank you for reading.

The automobile space has been slow to move over the years, pun intended. Names like F have seemed like dead money, HMC still trades 17% off most recent 52 week highs (give GM credit as it battles here with the round 40 number and still pays a handsome dividend of 3.8%). Below is the chart of RACE and how it appeared in our 2/27 Consumer Sector Report. And later we will take a look at its current chart.

We always like to mention that the best breakouts tend to work right away and leading stocks will give investors a chance to add to their positions on the way UP. Here is a good example with the present WEEKLY chart of RACE. It has move 10 handles since the flag breakout above and now one can enter or add to with a buy stop above a 142.62 double bottom pivot. The name trades just 7% off most recent 52 week highs, while F is 21% off its own highs, TSLA is 29% off its own recent peak, and NIO is 65% off its September highs.

Thank you for reading.