Cabin Fever?

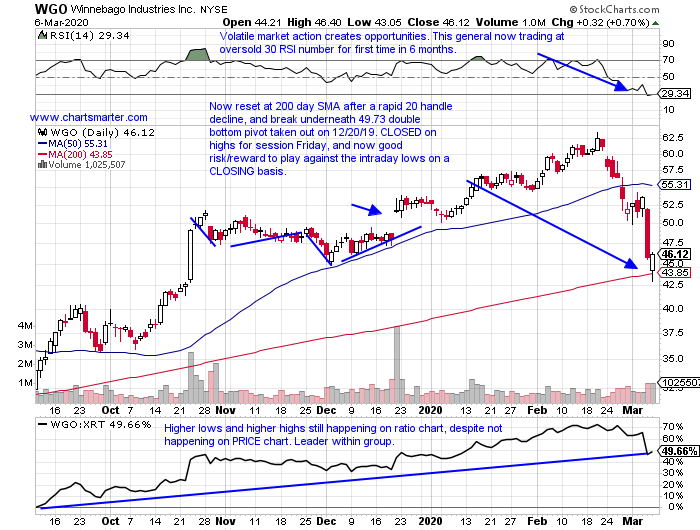

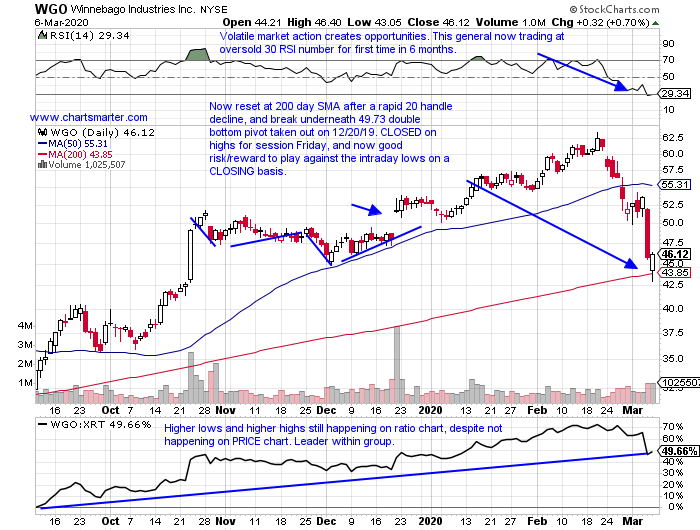

- With the incessant chatter about the coronavirus, some have come up with their own "at home, indoor" names that they think will be shielded from the markets fragility. NFLX is one of those mentioned, just 6% off most recent all time highs, but has recorded three straight WEEKLY spinning top candles in the very round 400 number vicinity. When the herd gathers in numbers, sometimes it pays to monitor what is being overlooked on the other side. Perhaps when names in the "outdoor" arena look like they are possibly bottoming, with some kind of catalyst (remember we are not buying blindly), the tide is beginning to turn. No one rings a bell at the top, or bottom, but candlestick markers can help identify good risk/reward scenarios. Below is the current chart of WGO, that produced solid earnings reactions, rising 5 of last 6 times up 7.8, 13.2, 3.7, 13.6 and 4.6% on 12/20, 10/23, 6/19, 12/19/18 and 10/17/18. Friday gave market participants a glimmer of hope on the long side with a bullish counterattack candle at 200 day SMA support. Honor your stops though, as this market is merciless.

Uncomfortable Shareholders:

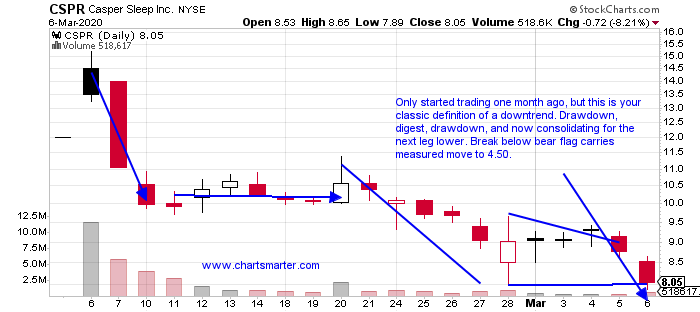

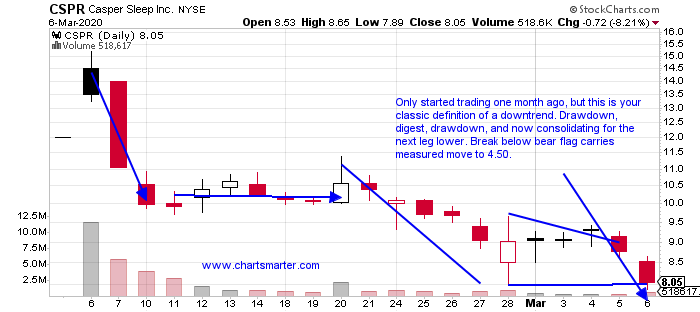

- Talk about coming public at almost the worst time possible. This name thought it could benefit from the decent behavior from established stocks like TPX and SNBR (Tempur Sealy has traded in a quick 30 handle range between the round 70-100 numbers in the last 4 weeks). Below is the chart of Casper, a name that has now been trading for one month, and for the most part, one many believe probably should not have come public at all. It forcefully slashed its IPO price range to $12 to $13, from $17 to $19. The stock has been cut in half from its intraday high, the first day it began trading on 2/6. Between 2/10-24 it briefly found some cushion, pun intended, at the very round 10 number, but that figure was sliced like a punctured waterbed, and now sports a bear flag formation. On its WEEKLY chart, every one of the 5 has CLOSED at or in the lower half of the weekly range.

Recent Examples:

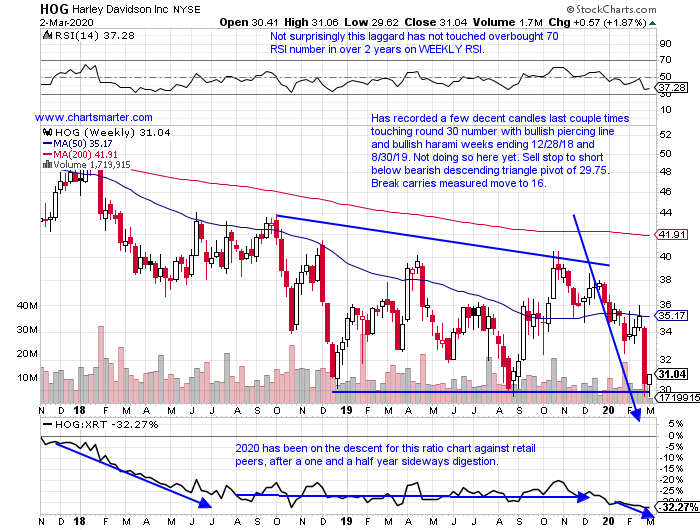

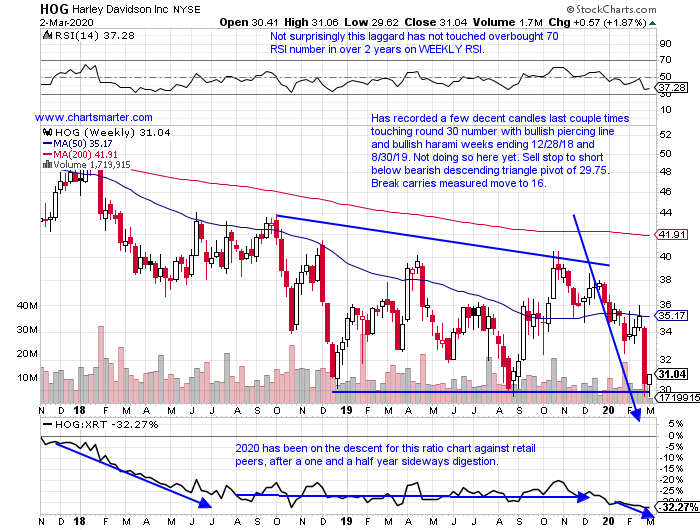

- One could have thrown a dart at a wall with a short strategy the last couple weeks and been successful. However just like in a bull market, leaders will outperform dramatically, and that where stock picking comes into play. It works the same on the short side, meaning if one finds a name that was weak during a powerful uptrend, one can most likely put their foot on the accelerator once the market turns southward. Below could be a good example of that with the chart of HOG, and how it appeared in our 3/3 Consumer Note. This week it recorded its second straight 13% plus decline, CLOSING right at lows for the weekly range. If one were to look backwards on the chart, they would see it has been in a downtrend for 3 years and now sits 37% off most recent 52 week highs. The stock is trading at levels not seen in nearly a decade, and the likelihood of a strong turnaround soon is small.

Special Situations:

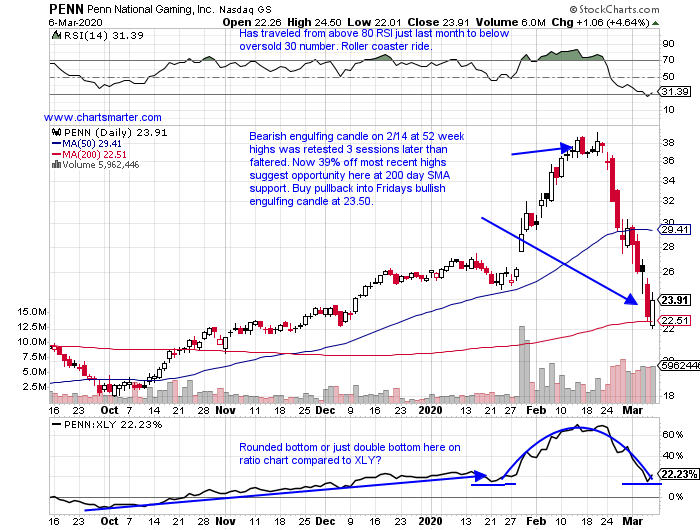

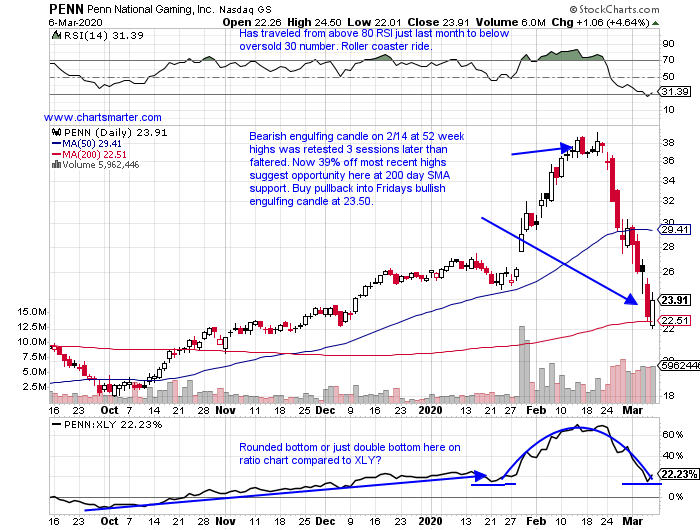

- Casino/gaming play lower by 6% YTD and higher by 3% over last one year period.

- Back to back nearly 20% weekly drops, not a typo. Prior to that stock more than doubled however during 18 of 21 week winning streak weeks ending 10/4/19-2/21.

- Most recent earnings reaction jumped 8.1% on 2/6, but prior FOUR all fell by 2.4, 2.1, 4.7 and .3% on 10/31, 8/1, 5/2 and 2/7/19.

- Buy pullback into bullish piercing line/200 day SMA.

- Entry PENN 23.50. Stop 22.

- Casual diner play down 9% YTD and higher by 29% over last one year period. Dividend yield of 1.6%.

- Higher 19 of last 29 weeks, and now real follow through lower this week, after prior week fell nearly 17%. Advanced 19 of last 29 weeks rising 68.7% from top to bottom in time frame.

- Recent earnings drop of 8.7% on 2/26 (China store closings related) was preceded by FOUR straight gains of 6.9, 2.4, 1.6 and 2.3% on 11/6, 8/7, 5/8 and 2/27/19.

- Enter on pullback into Fridays bullish piercing line candle/200 day SMA support.

- Entry PZZA 56.75. Stop 54.

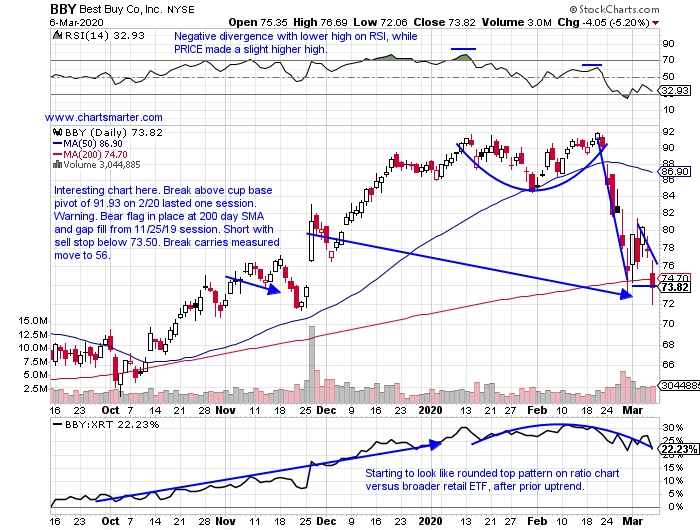

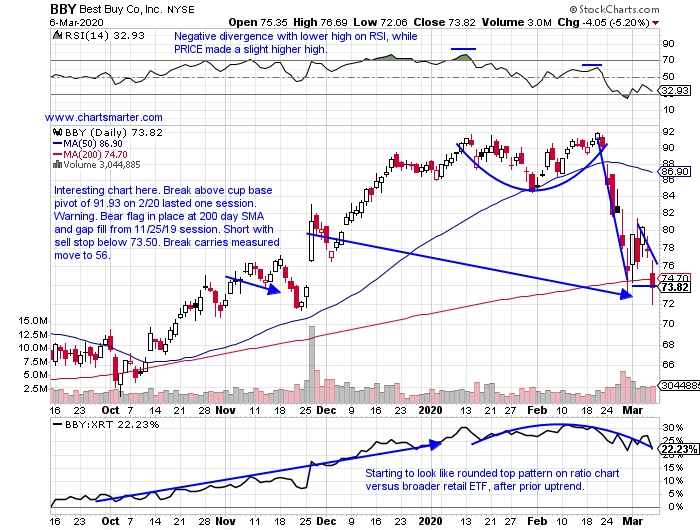

- Consumer electronics giant lower by 16% YTD and higher by 10% over last one year period. Dividend yield of 3%.

- Now 20% off most recent 52 week highs, and fell another 2.4% this week, after prior weeks 16.2% slump.

- Earnings mostly lower with big gains of 9.9 and 14.1% on 11/26 and 2/27, and losses of 4.7, 8 and 4.8% on 2/27, 8/29 and 5/23.

- Sell stop to short below bear flag. Break carries measured move to 56.

- Entry BBY 73.50. Buy stop 77.40.

Good luck.

Entry summaries:

Buy pullback into recent bullish piercing line candle PENN 23.50. Stop 22.

Buy pullback into recent bullish piercing line candle PZZA 56.75. Stop 54.

Sell stop to short below bear flag BBY 73.50. Buy stop 77.40.

This article requires a Chartsmarter membership. Please click here to join.

Cabin Fever?

- With the incessant chatter about the coronavirus, some have come up with their own "at home, indoor" names that they think will be shielded from the markets fragility. NFLX is one of those mentioned, just 6% off most recent all time highs, but has recorded three straight WEEKLY spinning top candles in the very round 400 number vicinity. When the herd gathers in numbers, sometimes it pays to monitor what is being overlooked on the other side. Perhaps when names in the "outdoor" arena look like they are possibly bottoming, with some kind of catalyst (remember we are not buying blindly), the tide is beginning to turn. No one rings a bell at the top, or bottom, but candlestick markers can help identify good risk/reward scenarios. Below is the current chart of WGO, that produced solid earnings reactions, rising 5 of last 6 times up 7.8, 13.2, 3.7, 13.6 and 4.6% on 12/20, 10/23, 6/19, 12/19/18 and 10/17/18. Friday gave market participants a glimmer of hope on the long side with a bullish counterattack candle at 200 day SMA support. Honor your stops though, as this market is merciless.

Uncomfortable Shareholders:

- Talk about coming public at almost the worst time possible. This name thought it could benefit from the decent behavior from established stocks like TPX and SNBR (Tempur Sealy has traded in a quick 30 handle range between the round 70-100 numbers in the last 4 weeks). Below is the chart of Casper, a name that has now been trading for one month, and for the most part, one many believe probably should not have come public at all. It forcefully slashed its IPO price range to $12 to $13, from $17 to $19. The stock has been cut in half from its intraday high, the first day it began trading on 2/6. Between 2/10-24 it briefly found some cushion, pun intended, at the very round 10 number, but that figure was sliced like a punctured waterbed, and now sports a bear flag formation. On its WEEKLY chart, every one of the 5 has CLOSED at or in the lower half of the weekly range.

Recent Examples:

- One could have thrown a dart at a wall with a short strategy the last couple weeks and been successful. However just like in a bull market, leaders will outperform dramatically, and that where stock picking comes into play. It works the same on the short side, meaning if one finds a name that was weak during a powerful uptrend, one can most likely put their foot on the accelerator once the market turns southward. Below could be a good example of that with the chart of HOG, and how it appeared in our 3/3 Consumer Note. This week it recorded its second straight 13% plus decline, CLOSING right at lows for the weekly range. If one were to look backwards on the chart, they would see it has been in a downtrend for 3 years and now sits 37% off most recent 52 week highs. The stock is trading at levels not seen in nearly a decade, and the likelihood of a strong turnaround soon is small.

Special Situations:

- Casino/gaming play lower by 6% YTD and higher by 3% over last one year period.

- Back to back nearly 20% weekly drops, not a typo. Prior to that stock more than doubled however during 18 of 21 week winning streak weeks ending 10/4/19-2/21.

- Most recent earnings reaction jumped 8.1% on 2/6, but prior FOUR all fell by 2.4, 2.1, 4.7 and .3% on 10/31, 8/1, 5/2 and 2/7/19.

- Buy pullback into bullish piercing line/200 day SMA.

- Entry PENN 23.50. Stop 22.

- Casual diner play down 9% YTD and higher by 29% over last one year period. Dividend yield of 1.6%.

- Higher 19 of last 29 weeks, and now real follow through lower this week, after prior week fell nearly 17%. Advanced 19 of last 29 weeks rising 68.7% from top to bottom in time frame.

- Recent earnings drop of 8.7% on 2/26 (China store closings related) was preceded by FOUR straight gains of 6.9, 2.4, 1.6 and 2.3% on 11/6, 8/7, 5/8 and 2/27/19.

- Enter on pullback into Fridays bullish piercing line candle/200 day SMA support.

- Entry PZZA 56.75. Stop 54.

- Consumer electronics giant lower by 16% YTD and higher by 10% over last one year period. Dividend yield of 3%.

- Now 20% off most recent 52 week highs, and fell another 2.4% this week, after prior weeks 16.2% slump.

- Earnings mostly lower with big gains of 9.9 and 14.1% on 11/26 and 2/27, and losses of 4.7, 8 and 4.8% on 2/27, 8/29 and 5/23.

- Sell stop to short below bear flag. Break carries measured move to 56.

- Entry BBY 73.50. Buy stop 77.40.

Good luck.

Entry summaries:

Buy pullback into recent bullish piercing line candle PENN 23.50. Stop 22.

Buy pullback into recent bullish piercing line candle PZZA 56.75. Stop 54.

Sell stop to short below bear flag BBY 73.50. Buy stop 77.40.