Beware The Sleeping Giant:

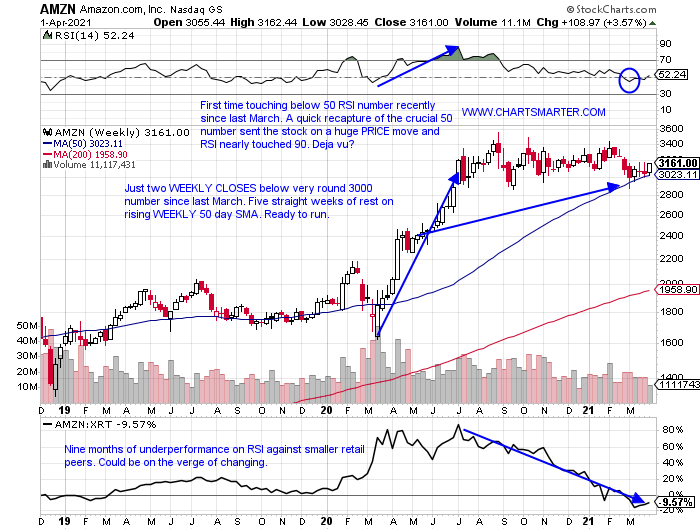

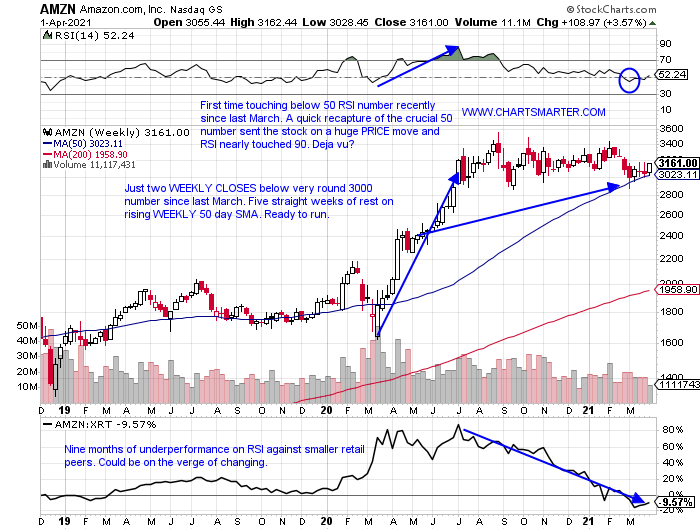

- Sometimes you have to zoom out a bit to see what really is happening. The chart below could be an excellent example. This is a WEEKLY chart, and if one was to look at its daily chart, it trades pretty wide and loose hallmark bearish traits. But on the chart below one can see that AMZN has had a chance to breathe the last nine months as the WEEKLY 50 day SMA has caught up in PRICE. This is a line that it had not come into contact with in over one year. As always one can look at the situation with whichever bias they choose, but I am getting more constructive on the giant. If one looked at the glass half empty they would say the stock is lower 6 of the last 8 weeks, and still in correction mode down 11% from most recent all-time highs. Bullish bias would be the case that the bears have been unable to penetrate the name below the very round 3000 number. One can see the range between roughly 3000-3400 on a CLOSING basis, and something tells me this "runway" of 400 handles, will simply give the stock the takeoff toward the 4000 figure later in 2021.

Two Verbs:

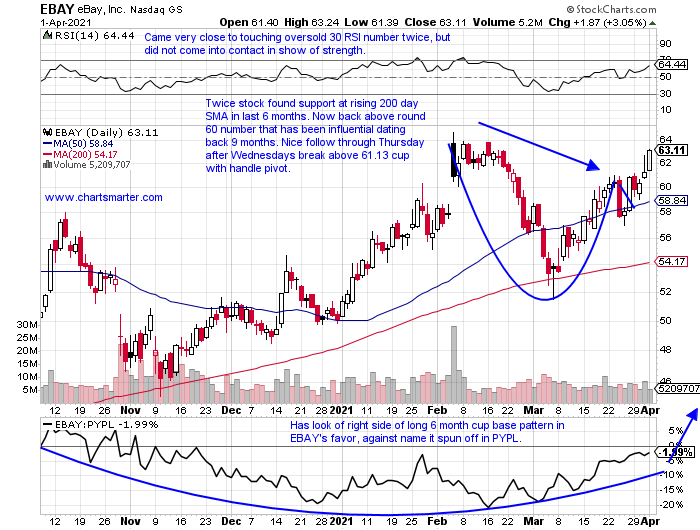

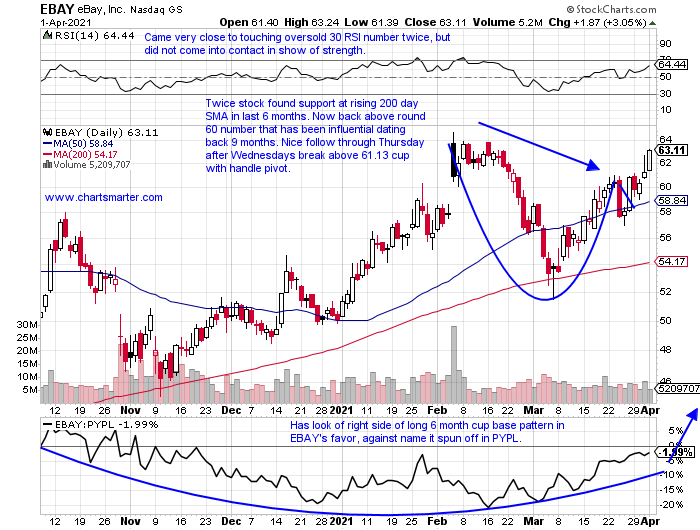

- They say a stock that becomes a verb has made it. Perhaps shareholders of ZM may feel differently with the name now 45% off most recent 52-week highs. UBER is also a verb and its chart's complexion is improving, as is TWTR's. In Tuesdays Consumer Note we discussed how a former parent is trying to show that old dogs can still teach the little one's tricks, as MCD is trying to outclass CMG presently. Well, two more verbs are fighting on the ratio chart below the PRICE chart, in EBAY and its former spinoff PYPL. EBAY is looking better than PYPL at the moment, and PRICE action suggests EBAY will stay that way for the near future. It is conquering the round 60 number, a familiar foe, and is now on a 4-week winning streak, with the last 3 higher by a combined 13%, and all three CLOSING at highs for the WEEKLY range. There is a good chance that the 60 number is firm support going forward. Enter near 62.

Recent Examples:

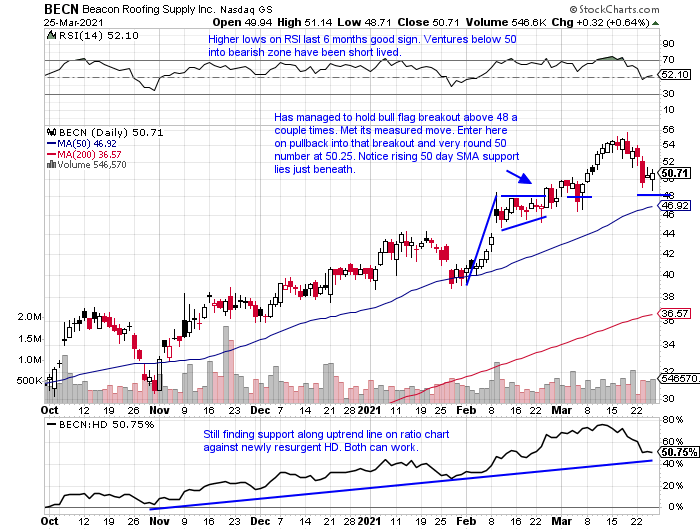

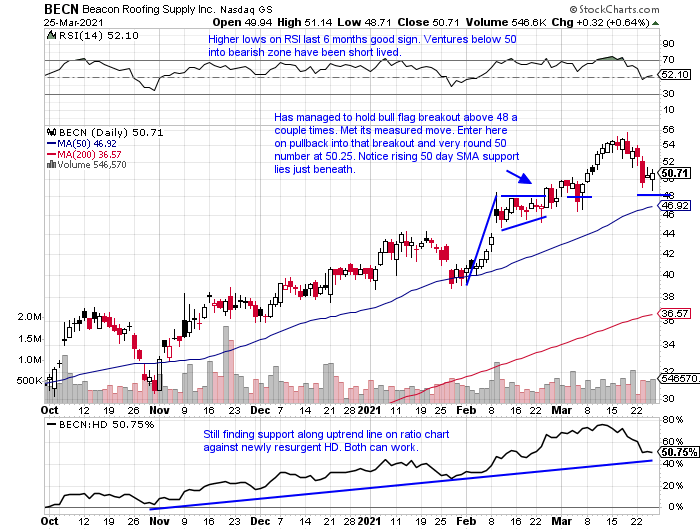

- The home improvement space has seen a big "improvement" on their charts. HD has gone vertical advancing 17 of the last 20 sessions traveling from 246-309. LOW has basically traded in sympathy with that move, and both sit right at their most recent 52-week highs. FND is battling with the very round par number, and RH is doing the same with the 600 figure. Below is yet another play in the space with the chart of BECN, and how it appeared in our 3/26 Consumer Note. This week the stock recorded its fourth consecutive WEEKLY CLOSE above the very round 50 number, a level it last touched almost 3 years ago. The chart trades very taut and has made a strong move from 12 last March. Look for this name to receive support at its upward sloping 50 day SMA in the coming months. Stick with leaders.

Special Situations:

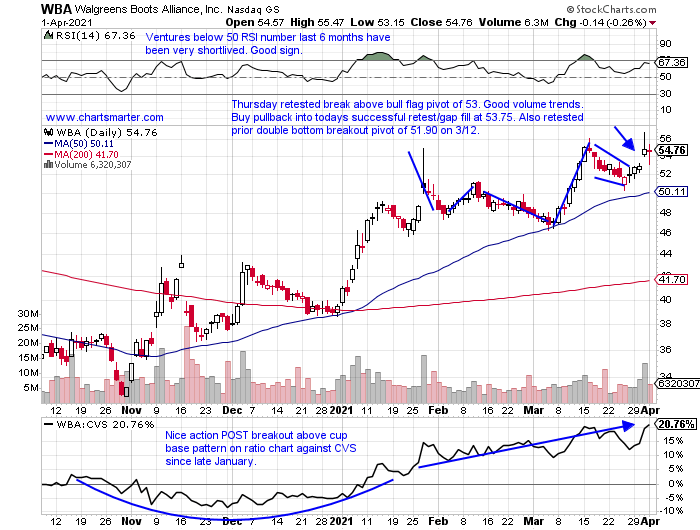

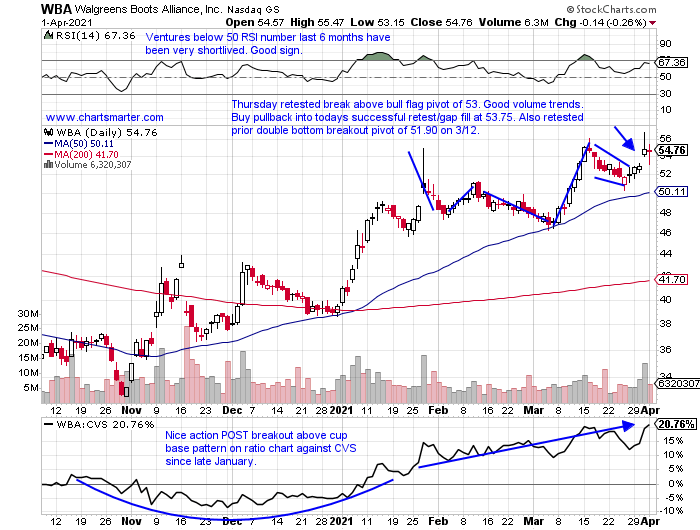

- Retail pharmacy play higher by 37% YTD and 27% over last one year period. Dividend yield of 3.4%.

- Just 3% off most recent 52 week highs, and rose more than 5% this week (peer CVS fell more than 2%). Higher just 11 of the last 22 weeks, but 7 of those gainers jumped at least 6%.

- Three straight positive earnings reactions up 3.6, 5.2 and 4.8% on 3/31, 1/7 and 10/15/20 (prior 3 all fell by 7.8, 6.3 and 5.8% on 7/9, 4/2 and 1/8/20).

- Enter on pullback into bull flag breakout.

- Entry WBA 53.75. Stop 49.75.

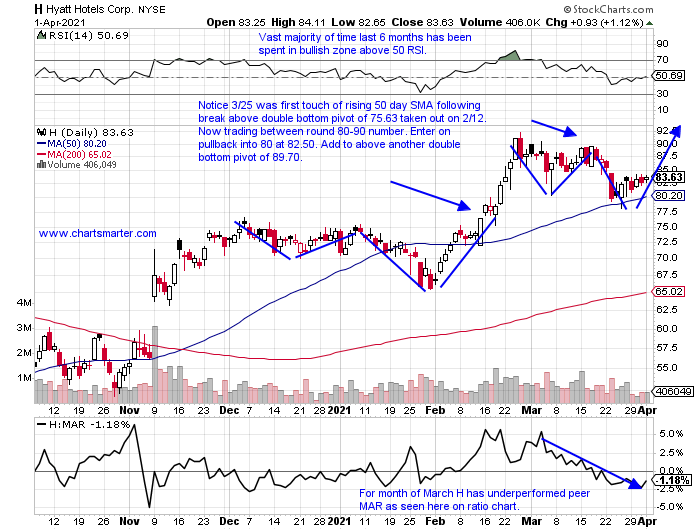

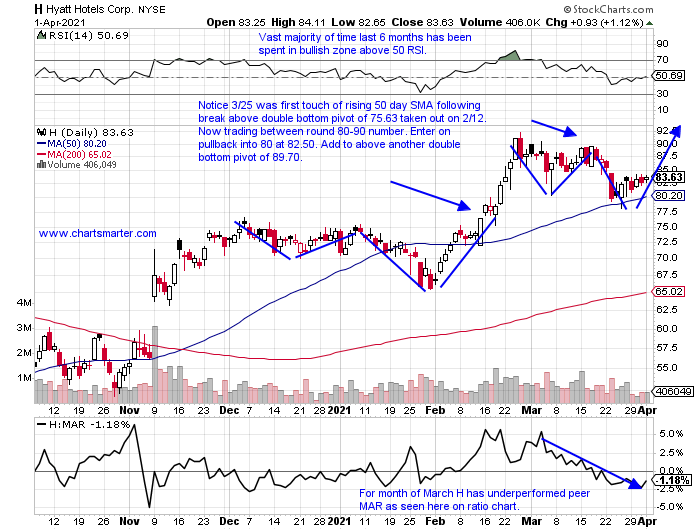

- Hotel name higher by 13% YTD and 92% over the last one year period.

- Now 9% off most recent 52 week highs, and has gained ground 7 of the last 9 weeks starting with a strong 4 week winning streak weeks ending between 2/5-26 that rose by a combined 30%.

- Three straight positive earnings reactions up .1, 19.8 and 6.3% on 2/18, 11/6 and 8/10/20, after loss of 5.9% on 5/11/20.

- Enter on pullback into round number.

- Entry H 82.50. Stop 79.

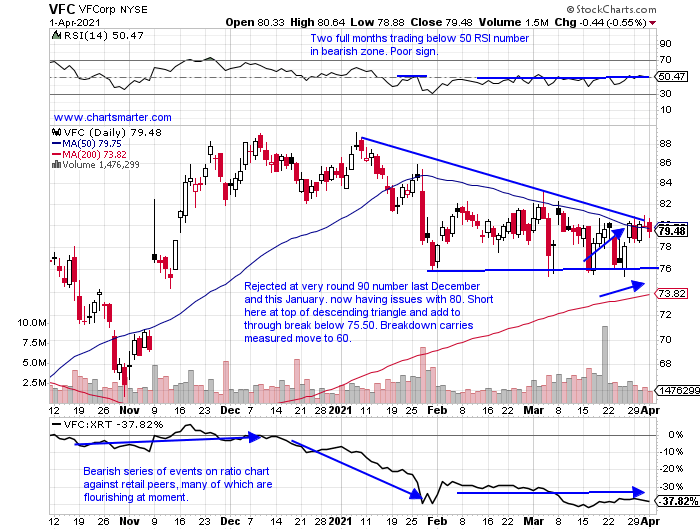

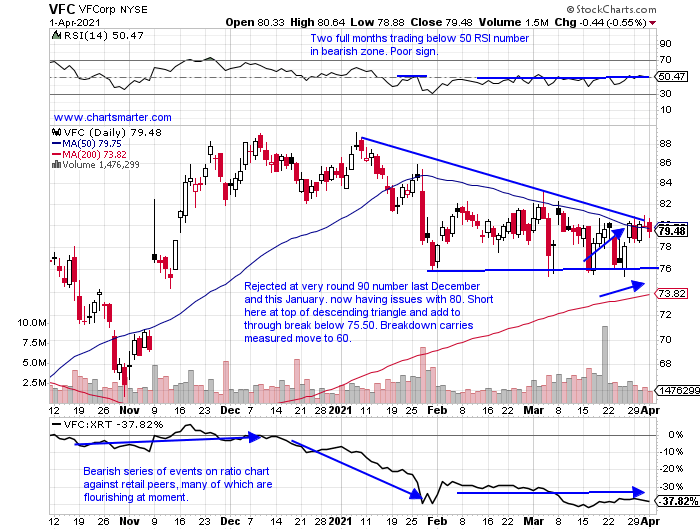

- Specialty retail name lower by 7% YTD and higher by 63% over last one year period. Dividend yield of 2.5%.

- Now lower by 12% off most recent 52 week highs (XLY down just 1% from its yearly peak), and down 10 of the last 15 weeks, with last 8 all CLOSING tight within just 1.77 of each other.

- FIVE straight negative earnings reactions, off 7, 2.5, .2, 6.3 and 9.7% on 1/27, 10/16, 7/31, 5/15 and 1/23/20.

- Enter short into top of bearish descending triangle.

- Entry VFC here. Buy stop 81.

Good luck.

Entry summaries:

Buy pullback into bull flag breakout WBA 53.75. Stop 49.75.

Buy pullback into round number H 82.50. Stop 79.

Short into resistance at top of bearish descending triangle VFC here. Buy stop 81.

This article requires a Chartsmarter membership. Please click here to join.

Beware The Sleeping Giant:

- Sometimes you have to zoom out a bit to see what really is happening. The chart below could be an excellent example. This is a WEEKLY chart, and if one was to look at its daily chart, it trades pretty wide and loose hallmark bearish traits. But on the chart below one can see that AMZN has had a chance to breathe the last nine months as the WEEKLY 50 day SMA has caught up in PRICE. This is a line that it had not come into contact with in over one year. As always one can look at the situation with whichever bias they choose, but I am getting more constructive on the giant. If one looked at the glass half empty they would say the stock is lower 6 of the last 8 weeks, and still in correction mode down 11% from most recent all-time highs. Bullish bias would be the case that the bears have been unable to penetrate the name below the very round 3000 number. One can see the range between roughly 3000-3400 on a CLOSING basis, and something tells me this "runway" of 400 handles, will simply give the stock the takeoff toward the 4000 figure later in 2021.

Two Verbs:

- They say a stock that becomes a verb has made it. Perhaps shareholders of ZM may feel differently with the name now 45% off most recent 52-week highs. UBER is also a verb and its chart's complexion is improving, as is TWTR's. In Tuesdays Consumer Note we discussed how a former parent is trying to show that old dogs can still teach the little one's tricks, as MCD is trying to outclass CMG presently. Well, two more verbs are fighting on the ratio chart below the PRICE chart, in EBAY and its former spinoff PYPL. EBAY is looking better than PYPL at the moment, and PRICE action suggests EBAY will stay that way for the near future. It is conquering the round 60 number, a familiar foe, and is now on a 4-week winning streak, with the last 3 higher by a combined 13%, and all three CLOSING at highs for the WEEKLY range. There is a good chance that the 60 number is firm support going forward. Enter near 62.

Recent Examples:

- The home improvement space has seen a big "improvement" on their charts. HD has gone vertical advancing 17 of the last 20 sessions traveling from 246-309. LOW has basically traded in sympathy with that move, and both sit right at their most recent 52-week highs. FND is battling with the very round par number, and RH is doing the same with the 600 figure. Below is yet another play in the space with the chart of BECN, and how it appeared in our 3/26 Consumer Note. This week the stock recorded its fourth consecutive WEEKLY CLOSE above the very round 50 number, a level it last touched almost 3 years ago. The chart trades very taut and has made a strong move from 12 last March. Look for this name to receive support at its upward sloping 50 day SMA in the coming months. Stick with leaders.

Special Situations:

- Retail pharmacy play higher by 37% YTD and 27% over last one year period. Dividend yield of 3.4%.

- Just 3% off most recent 52 week highs, and rose more than 5% this week (peer CVS fell more than 2%). Higher just 11 of the last 22 weeks, but 7 of those gainers jumped at least 6%.

- Three straight positive earnings reactions up 3.6, 5.2 and 4.8% on 3/31, 1/7 and 10/15/20 (prior 3 all fell by 7.8, 6.3 and 5.8% on 7/9, 4/2 and 1/8/20).

- Enter on pullback into bull flag breakout.

- Entry WBA 53.75. Stop 49.75.

- Hotel name higher by 13% YTD and 92% over the last one year period.

- Now 9% off most recent 52 week highs, and has gained ground 7 of the last 9 weeks starting with a strong 4 week winning streak weeks ending between 2/5-26 that rose by a combined 30%.

- Three straight positive earnings reactions up .1, 19.8 and 6.3% on 2/18, 11/6 and 8/10/20, after loss of 5.9% on 5/11/20.

- Enter on pullback into round number.

- Entry H 82.50. Stop 79.

- Specialty retail name lower by 7% YTD and higher by 63% over last one year period. Dividend yield of 2.5%.

- Now lower by 12% off most recent 52 week highs (XLY down just 1% from its yearly peak), and down 10 of the last 15 weeks, with last 8 all CLOSING tight within just 1.77 of each other.

- FIVE straight negative earnings reactions, off 7, 2.5, .2, 6.3 and 9.7% on 1/27, 10/16, 7/31, 5/15 and 1/23/20.

- Enter short into top of bearish descending triangle.

- Entry VFC here. Buy stop 81.

Good luck.

Entry summaries:

Buy pullback into bull flag breakout WBA 53.75. Stop 49.75.

Buy pullback into round number H 82.50. Stop 79.

Short into resistance at top of bearish descending triangle VFC here. Buy stop 81.