Taking Different Routes:

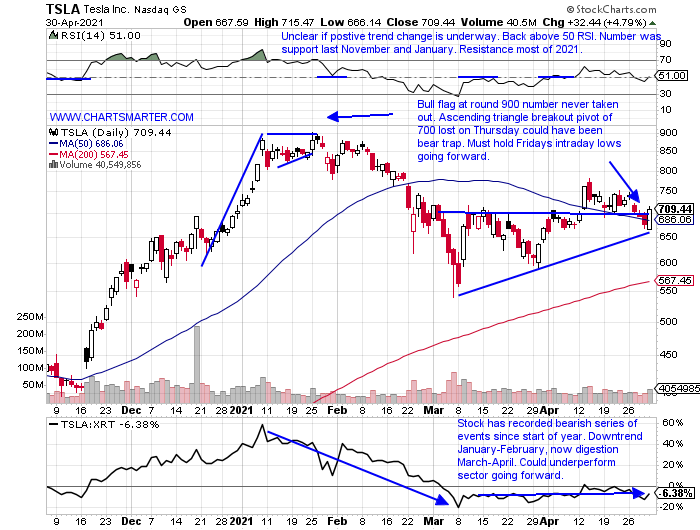

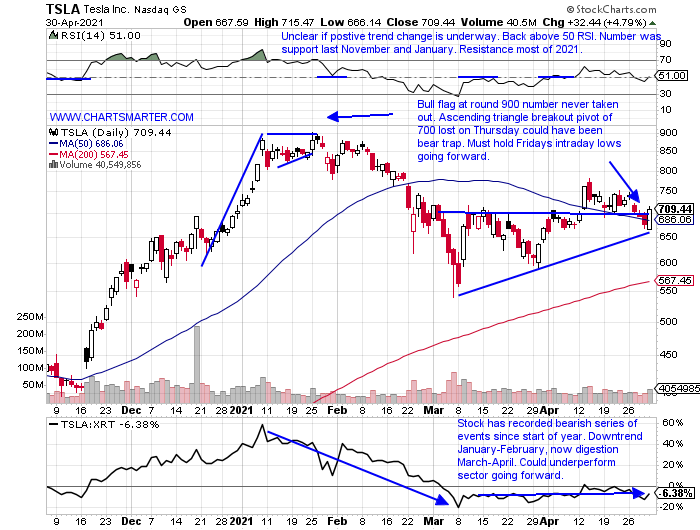

- The top two holdings in the XLY veered off in different directions on Friday. The end of the week displayed some interesting action within the top-heavy retail ETF. AMZN and TSLA are the only double-digit percentage components in the fund and the former recorded an ugly intraday reversal with a bearish engulfing candle on Friday. It CLOSED nearly 90 handles, off highs for the session. This is a rather myopic look, but the chart below of TSLA refused to give any ground and CLOSED near highs for the daily range on a depressing tape. Notice it was another higher low and a bullish engulfing candle that CLOSED above both its 50 day SMA and a prior break above a bullish ascending triangle pivot of 700. The last time it went on a powerful price run following a bullish engulfing candle at the round 600 number on 3/30. Make no mistake about it AMZN is the better acting stock at the moment, just 2% off all-time highs. TSLA is still in bear market mode off 21% from a peak made in late January. With TSLA however, you now have a clearer stop to play against, the devilish 666 figure, Friday's intraday low.

Pool Party:

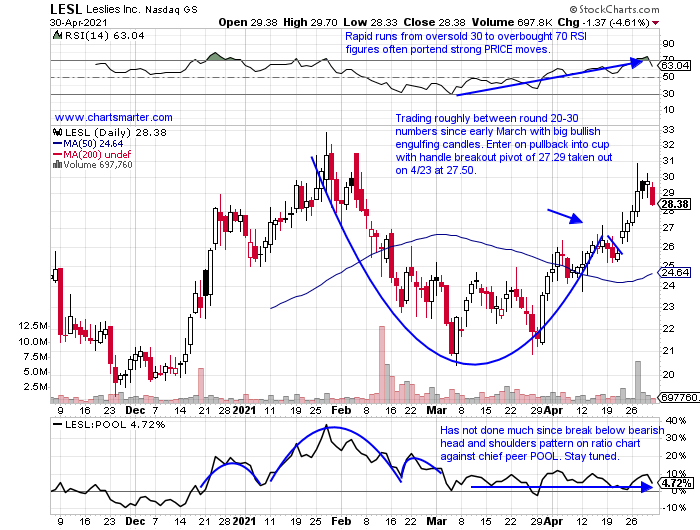

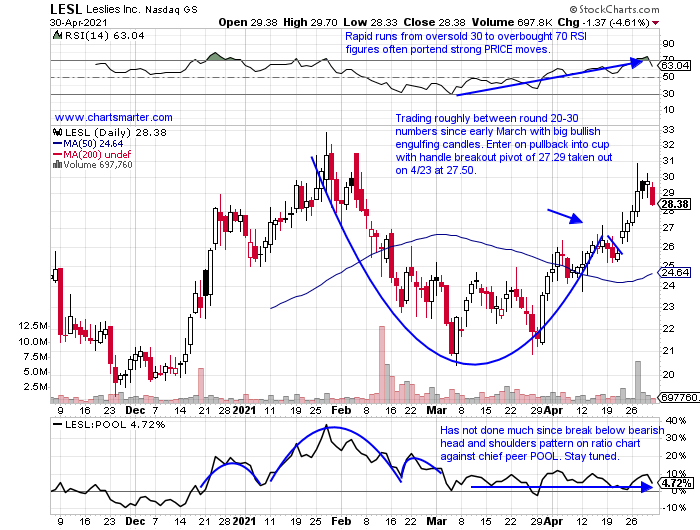

- The home improvement plays have been on a surge recently. Two of the biggest names in the space in HD and LOW, are diverging slightly with HD now just 2% off its most recent 52-week highs while LOW is now 6% off its own recent peak (HD recorded a 6-week winning streak between weeks ending 3/12-4/16 that ran higher by nearly 80 handles top to bottom). FND ended a 7-week winning streak of its own this week. RH is now fading a bit from the round 700 number, where it broke above a bull flag. Looking at a couple of other names in the arena below in POOL and LESL, show the 2 major players in the pool space (unless AMZN looks to get involved, of course, that is a stab at humor). Below is the chart of LESL, a recent new issue that does REPORT earnings on 5/5 after the close next week. It received an indirect boost when POOL reported numbers on 4/22 jumping more than 6%. LESL rose more than 4% that day, and it will have proving to do on its own merit next Wednesday. Friday snapped a 7 session winning streak, losing more than 4%. Cannon Ball anyone?

Recent Examples:

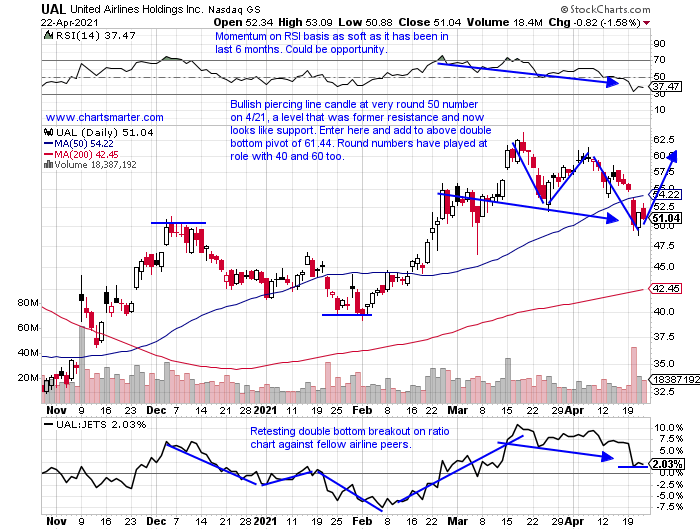

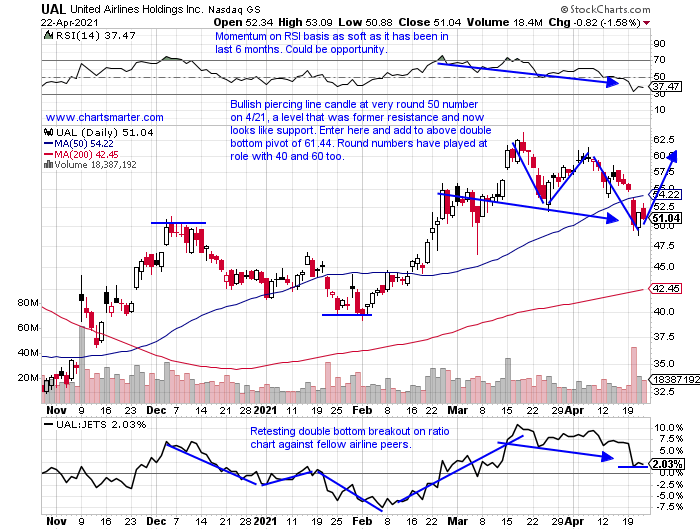

- As much as many detest the incessant "reopening" phrase, it is a good reminder to stick with things that are working. Remember trends tend to persist, more likely than they are to reverse. The cruise lines have been acting well, and I will have my eyes on NCLH as it fights to stay above the round 30 number within a symmetrical triangle. SEAS is breaking above a long bull flag, and even RICK is behaving itself as it carves out a bullish ascending triangle. Not sure how their establishments have been open in the last year! NDLS broke powerfully above a double bottom pivot of 10.90 on Thursday and Friday followed through robustly on a soft tape. Airlines have been a solid group, and below is the chart of UAL, and how it appeared in our 4/23 Consumer Sector Note. It has acted well since putting in a bullish piercing line candle at the very round 50 number on 4/21. The stock is now flirting with recouping its 50 day SMA, and IF that occurs it puts the add-on double bottom pivot of 61.44 in focus. Fasten your seat belts, the flight may be ready for take-off, pun intended.

Special Situations:

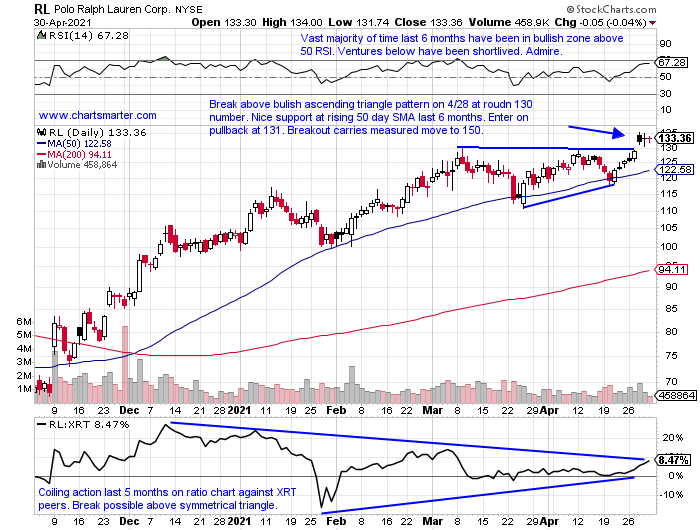

- Retail play higher by 28% YTD and 80% over last one year period.

- Just 2% off most recent 52-week highs, and advanced 19 of last 26 weeks. Solid volume trends as well with last week of distribution the week ending 10/30/20.

- Three straight negative earnings reactions off 5, 4.4, and .6% on 10/29, 8/4, and 5/27/20 (rose 2.5% on 2/4).

- Enter on pullback into ascending triangle breakout.

- Entry RL 131. Stop 125.

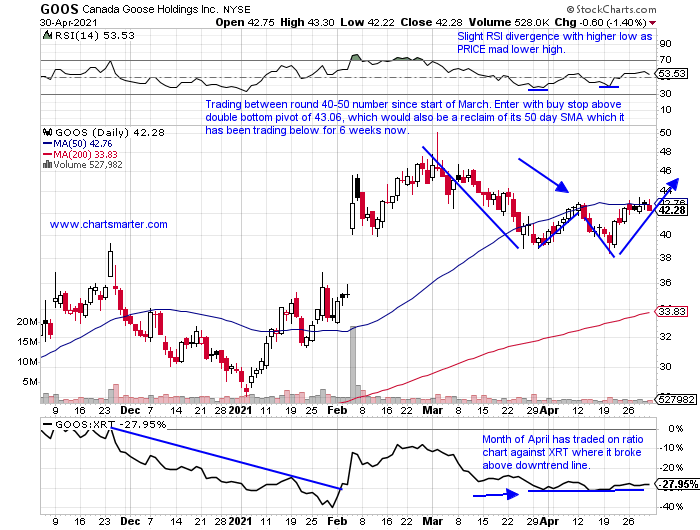

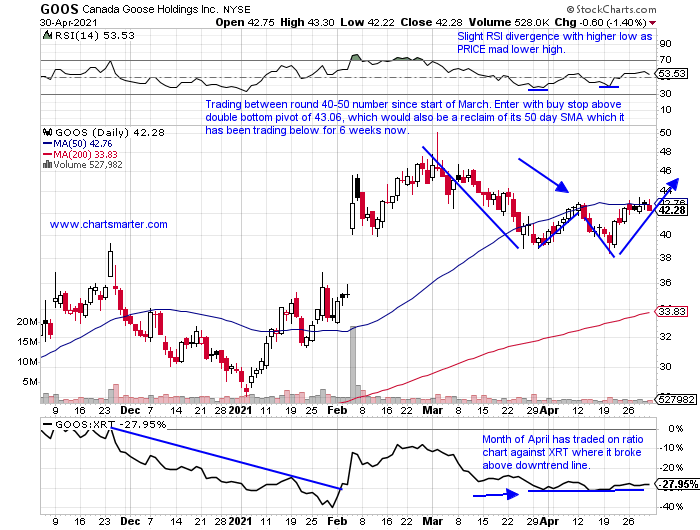

- Canadian retail play higher by 44% YTD and 72% over last one year period.

- No back to back WEEKLY gains since January. Five weeks ending between 3/26-4/23 all were below 40 intraweek, but all of them CLOSED above 40. Good wall of support there.

- Earnings mostly higher with gains of 22, .4, and 17.7% on 2/4, 11/5, and 6/3/20 (fell 5.2% on 8/11/20).

- Enter with buy stop above double-bottom base.

- Entry GOOS 43.06. Stop 41.

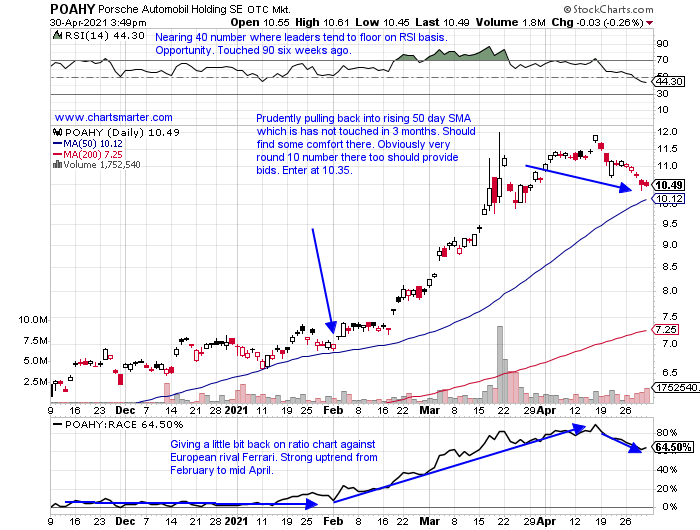

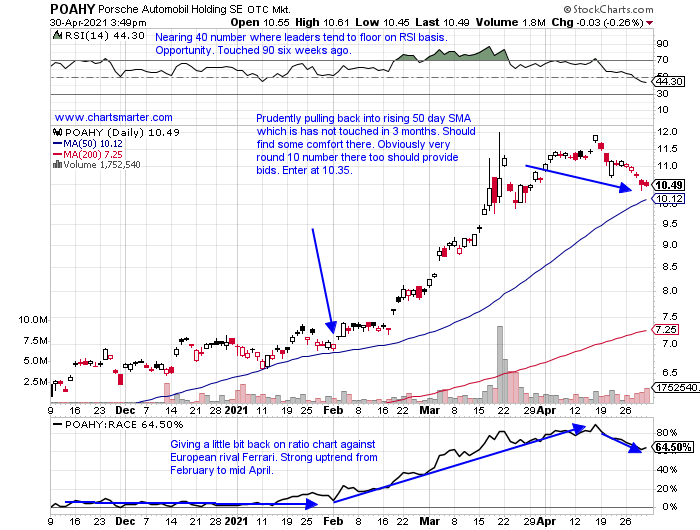

- German auto play higher by 50% YTD and lower by 12% from most recent 52 week highs. Dividend yield of 2.5%.

- Name has doubled since October lows, and this week recorded first back-to-back WEEKLY losses since first 2 weeks of 2021. Prior consecutive WEEKLY declines were last September to show how strong momentum has been.

- Earnings mixed with smaller gains of 2.4 and 2% on 11/10 and 8/10/20, and drops of 10.7 and 6.8% on 3/23 and 5/12/20.

- Buy pullback into very round number.

- Entry POAHY 10.35. Stop 9.70.

Good luck.

Entry summaries:

Buy pullback into ascending triangle breakout RL 131. Stop 125.

Buy stop above double bottom pivot GOOS 43.06. Stop 41.

Buy pullback into very round number POAHY 10.35. Stop 9.70.

This article requires a Chartsmarter membership. Please click here to join.

Taking Different Routes:

- The top two holdings in the XLY veered off in different directions on Friday. The end of the week displayed some interesting action within the top-heavy retail ETF. AMZN and TSLA are the only double-digit percentage components in the fund and the former recorded an ugly intraday reversal with a bearish engulfing candle on Friday. It CLOSED nearly 90 handles, off highs for the session. This is a rather myopic look, but the chart below of TSLA refused to give any ground and CLOSED near highs for the daily range on a depressing tape. Notice it was another higher low and a bullish engulfing candle that CLOSED above both its 50 day SMA and a prior break above a bullish ascending triangle pivot of 700. The last time it went on a powerful price run following a bullish engulfing candle at the round 600 number on 3/30. Make no mistake about it AMZN is the better acting stock at the moment, just 2% off all-time highs. TSLA is still in bear market mode off 21% from a peak made in late January. With TSLA however, you now have a clearer stop to play against, the devilish 666 figure, Friday's intraday low.

Pool Party:

- The home improvement plays have been on a surge recently. Two of the biggest names in the space in HD and LOW, are diverging slightly with HD now just 2% off its most recent 52-week highs while LOW is now 6% off its own recent peak (HD recorded a 6-week winning streak between weeks ending 3/12-4/16 that ran higher by nearly 80 handles top to bottom). FND ended a 7-week winning streak of its own this week. RH is now fading a bit from the round 700 number, where it broke above a bull flag. Looking at a couple of other names in the arena below in POOL and LESL, show the 2 major players in the pool space (unless AMZN looks to get involved, of course, that is a stab at humor). Below is the chart of LESL, a recent new issue that does REPORT earnings on 5/5 after the close next week. It received an indirect boost when POOL reported numbers on 4/22 jumping more than 6%. LESL rose more than 4% that day, and it will have proving to do on its own merit next Wednesday. Friday snapped a 7 session winning streak, losing more than 4%. Cannon Ball anyone?

Recent Examples:

- As much as many detest the incessant "reopening" phrase, it is a good reminder to stick with things that are working. Remember trends tend to persist, more likely than they are to reverse. The cruise lines have been acting well, and I will have my eyes on NCLH as it fights to stay above the round 30 number within a symmetrical triangle. SEAS is breaking above a long bull flag, and even RICK is behaving itself as it carves out a bullish ascending triangle. Not sure how their establishments have been open in the last year! NDLS broke powerfully above a double bottom pivot of 10.90 on Thursday and Friday followed through robustly on a soft tape. Airlines have been a solid group, and below is the chart of UAL, and how it appeared in our 4/23 Consumer Sector Note. It has acted well since putting in a bullish piercing line candle at the very round 50 number on 4/21. The stock is now flirting with recouping its 50 day SMA, and IF that occurs it puts the add-on double bottom pivot of 61.44 in focus. Fasten your seat belts, the flight may be ready for take-off, pun intended.

Special Situations:

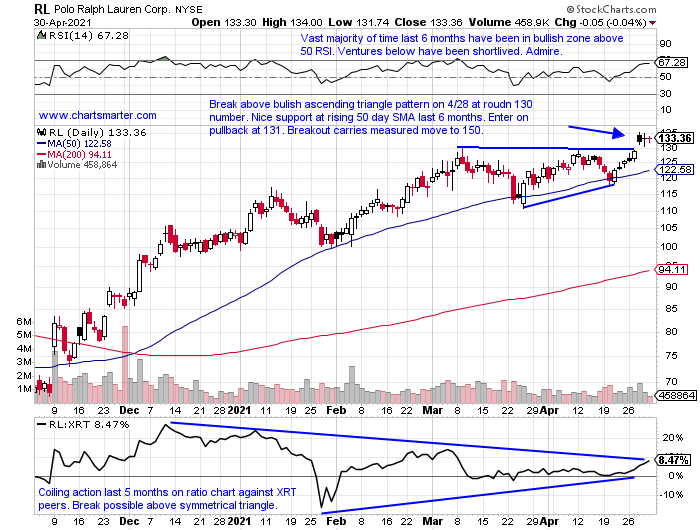

- Retail play higher by 28% YTD and 80% over last one year period.

- Just 2% off most recent 52-week highs, and advanced 19 of last 26 weeks. Solid volume trends as well with last week of distribution the week ending 10/30/20.

- Three straight negative earnings reactions off 5, 4.4, and .6% on 10/29, 8/4, and 5/27/20 (rose 2.5% on 2/4).

- Enter on pullback into ascending triangle breakout.

- Entry RL 131. Stop 125.

- Canadian retail play higher by 44% YTD and 72% over last one year period.

- No back to back WEEKLY gains since January. Five weeks ending between 3/26-4/23 all were below 40 intraweek, but all of them CLOSED above 40. Good wall of support there.

- Earnings mostly higher with gains of 22, .4, and 17.7% on 2/4, 11/5, and 6/3/20 (fell 5.2% on 8/11/20).

- Enter with buy stop above double-bottom base.

- Entry GOOS 43.06. Stop 41.

- German auto play higher by 50% YTD and lower by 12% from most recent 52 week highs. Dividend yield of 2.5%.

- Name has doubled since October lows, and this week recorded first back-to-back WEEKLY losses since first 2 weeks of 2021. Prior consecutive WEEKLY declines were last September to show how strong momentum has been.

- Earnings mixed with smaller gains of 2.4 and 2% on 11/10 and 8/10/20, and drops of 10.7 and 6.8% on 3/23 and 5/12/20.

- Buy pullback into very round number.

- Entry POAHY 10.35. Stop 9.70.

Good luck.

Entry summaries:

Buy pullback into ascending triangle breakout RL 131. Stop 125.

Buy stop above double bottom pivot GOOS 43.06. Stop 41.

Buy pullback into very round number POAHY 10.35. Stop 9.70.