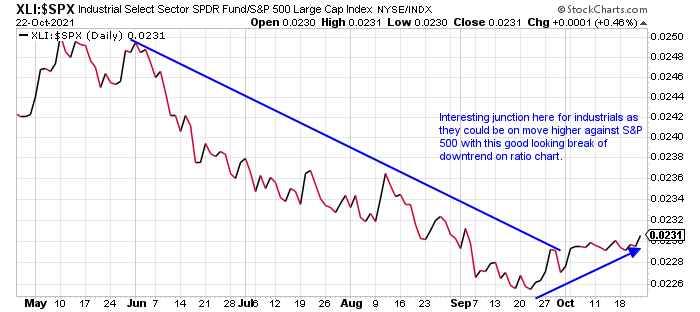

Relative Performance:

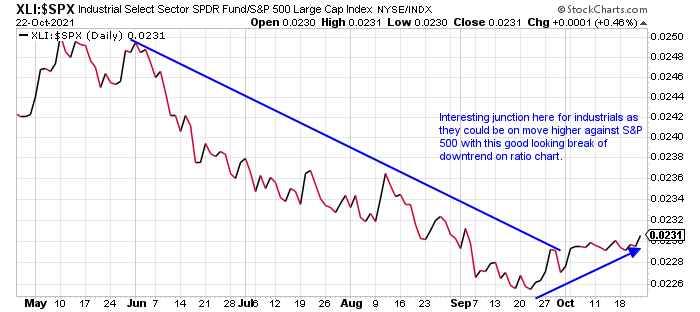

- Group which has been on a slippery, steady downtrend between June-September has recorded a potentially good looking bullish reversal. Over that last week, the transports have really led the charge and that could be saying an economy on the mend. The truckers,, railroads and delivery services all have done most of the heavy recent lifting. UPS looking attractive, back above 200 number, just 7% off most recent 52 week highs while FDX is 27% off its own, not a typo.

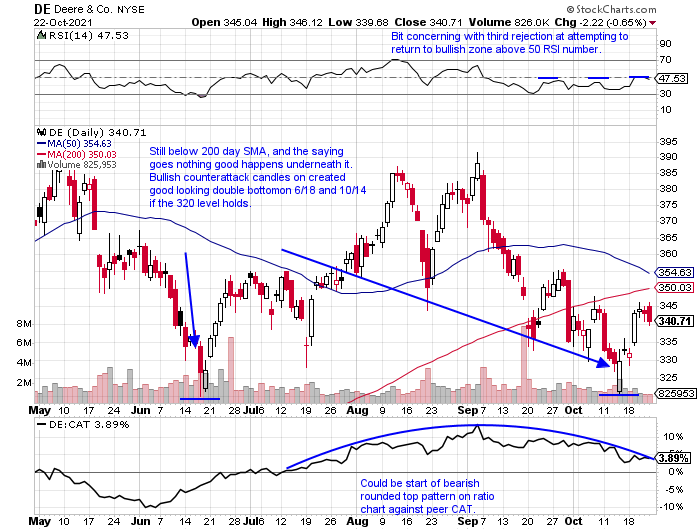

Individual Names:

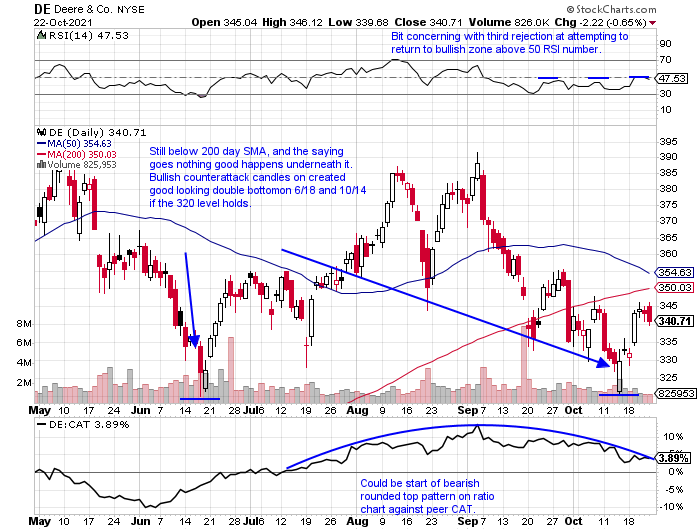

- Deere looks slightly better than CAT with a double bottom to play against. DE is now 15% off most recent 52 week highs, while CAT is 19% off its own and dealing with very round 200 number, which doubles as 50 day SMA resistance. DE on the WEEKLY chart has the look of sideways action where CAT is still declining, both after monster moves into this March.

- All three major waste peers are trading right at 52-week highs, in WM RSG and WCN. WM, however, sports the best dividend yield of the trifecta, and has gained 39% YTD, the same as RSG. WM and RSG have separated themselves over last 3 weeks each advancing by a combined 10% while WCN rose 6.3%.

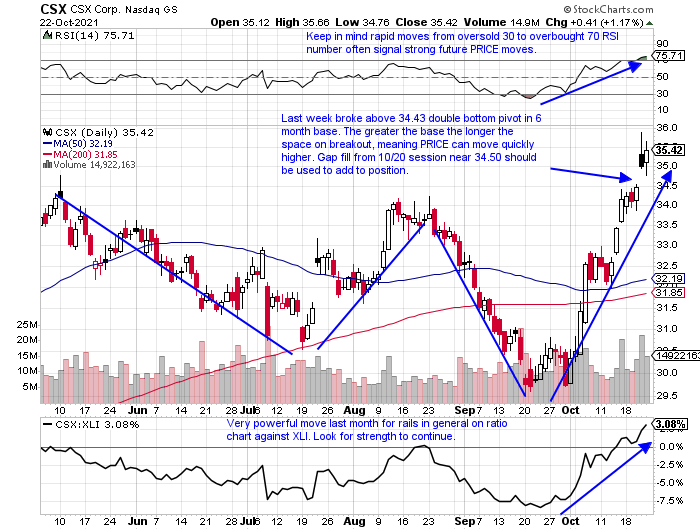

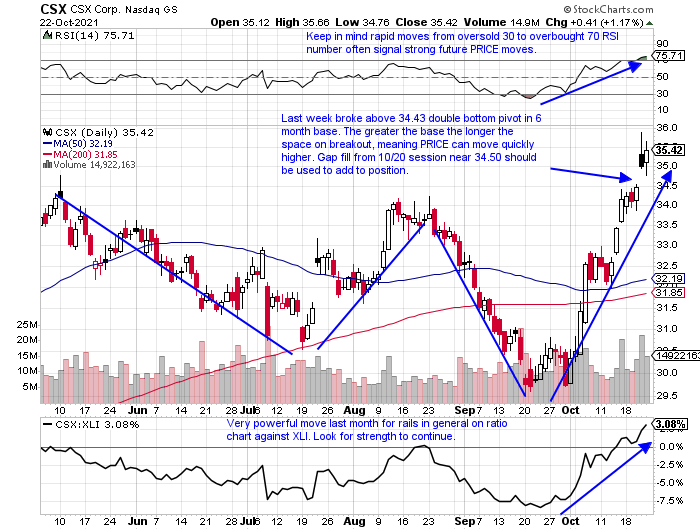

- Rails continue to show force. Below is CSX which has gained a combined 16% the last 3 weeks after the 3 weeks ending between 9/17-10/1 all CLOSED within just .11 of each other and just above 30 number. CNI jumped over 10% for the week and the group remains in focus with the pursuit of KSU.

This article requires a Chartsmarter membership. Please click here to join.

Relative Performance:

- Group which has been on a slippery, steady downtrend between June-September has recorded a potentially good looking bullish reversal. Over that last week, the transports have really led the charge and that could be saying an economy on the mend. The truckers,, railroads and delivery services all have done most of the heavy recent lifting. UPS looking attractive, back above 200 number, just 7% off most recent 52 week highs while FDX is 27% off its own, not a typo.

Individual Names:

- Deere looks slightly better than CAT with a double bottom to play against. DE is now 15% off most recent 52 week highs, while CAT is 19% off its own and dealing with very round 200 number, which doubles as 50 day SMA resistance. DE on the WEEKLY chart has the look of sideways action where CAT is still declining, both after monster moves into this March.

- All three major waste peers are trading right at 52-week highs, in WM RSG and WCN. WM, however, sports the best dividend yield of the trifecta, and has gained 39% YTD, the same as RSG. WM and RSG have separated themselves over last 3 weeks each advancing by a combined 10% while WCN rose 6.3%.

- Rails continue to show force. Below is CSX which has gained a combined 16% the last 3 weeks after the 3 weeks ending between 9/17-10/1 all CLOSED within just .11 of each other and just above 30 number. CNI jumped over 10% for the week and the group remains in focus with the pursuit of KSU.